Net assets. Net assets represent the basis for the investors` required

... Cost of capital. The required rate of return on net assets, and hence the cost of capital, is derived from the minimum rates of return that investors expect on their invested capital. The cost of capital of the Group and the industrial divisions comprises the cost of equity as well as the costs of d ...

... Cost of capital. The required rate of return on net assets, and hence the cost of capital, is derived from the minimum rates of return that investors expect on their invested capital. The cost of capital of the Group and the industrial divisions comprises the cost of equity as well as the costs of d ...

Ch6_6exam

... Compute the Asset Turnover Ratio which is Total Revenue divided by Total Assets. What does this value mean? How do you interpret it? ...

... Compute the Asset Turnover Ratio which is Total Revenue divided by Total Assets. What does this value mean? How do you interpret it? ...

here - HLNDV

... Types of capital expenditure budgets: Replacement - examples • To replace equipment at the end of useful life. • To improve productivity. • To improve quality or because it is required by regulation. New – examples • Expanded service. • Improve safety conditions. • Reduce operating expenses. • Impr ...

... Types of capital expenditure budgets: Replacement - examples • To replace equipment at the end of useful life. • To improve productivity. • To improve quality or because it is required by regulation. New – examples • Expanded service. • Improve safety conditions. • Reduce operating expenses. • Impr ...

Components of a Business Balance Sheet

... A business Balance Sheet has 3 components: assets, liabilities, and net worth or equity. The Balance Sheet is like a scale. Assets and liabilities (business debts) are by themselves normally out of balance until you add the business’s net worth. Assets minus Liabilities always = Net Worth or Equity ...

... A business Balance Sheet has 3 components: assets, liabilities, and net worth or equity. The Balance Sheet is like a scale. Assets and liabilities (business debts) are by themselves normally out of balance until you add the business’s net worth. Assets minus Liabilities always = Net Worth or Equity ...

Introduction to Financial Management

... Firm D wants to expand its business. Currently the firm has D/V of 40%. The cost of the firm’s equity is 14.6%, the risk free rate is 8% and the debt is risk-free. Suppose that the firm wants to finance the expansion project by issuing $20 million of risk-free perpetual debt and $80 millions of equi ...

... Firm D wants to expand its business. Currently the firm has D/V of 40%. The cost of the firm’s equity is 14.6%, the risk free rate is 8% and the debt is risk-free. Suppose that the firm wants to finance the expansion project by issuing $20 million of risk-free perpetual debt and $80 millions of equi ...

APF VI Definitions - Department of Treasury and Finance

... 50 years from its manufacture, construction or creation. In some cases, asset groups that include components or items with lives less than 50 years will also be included. Long-term benefits means employee benefits (other than post-employment benefits and termination benefits) which do not fall due w ...

... 50 years from its manufacture, construction or creation. In some cases, asset groups that include components or items with lives less than 50 years will also be included. Long-term benefits means employee benefits (other than post-employment benefits and termination benefits) which do not fall due w ...

VALUATION

... i. The balance sheet is restated from historical cost to market value ii. A valuation analysis is performed for the fixed, financial, other assets, and liabilities iii. The aggregate value of the assets is “netted” against the estimated value of existing and potential liabilities to estimate the val ...

... i. The balance sheet is restated from historical cost to market value ii. A valuation analysis is performed for the fixed, financial, other assets, and liabilities iii. The aggregate value of the assets is “netted” against the estimated value of existing and potential liabilities to estimate the val ...

maximizing the financial value of ip assets

... IP strategies and portfolios. • Conduct periodic searches of the competitive IP landscape to gain detailed legal and business information relating to competitor products and IP assets. This information can be used to assess the expected value of your IP portfolio and to determine whether new techno ...

... IP strategies and portfolios. • Conduct periodic searches of the competitive IP landscape to gain detailed legal and business information relating to competitor products and IP assets. This information can be used to assess the expected value of your IP portfolio and to determine whether new techno ...

Individual Items to Note (1040)

... Preparer Number - The preparer number has been converted from ProSystem FX. Therefore, preparer names should be set up with the same number in ProSeries. Number of Assets - The conversion program converts a maximum of 2500 assets. Date of Birth - Verify date of birth in Client Information and Depend ...

... Preparer Number - The preparer number has been converted from ProSystem FX. Therefore, preparer names should be set up with the same number in ProSeries. Number of Assets - The conversion program converts a maximum of 2500 assets. Date of Birth - Verify date of birth in Client Information and Depend ...

2001 Midterm (with answers)

... Market comparables are easy to calculate and provide useful benchmarks in assessing DCF-based valuation methods. Market comparables assume that industry averages are equivalent to the firm to be evaluated. There can be substantial differences due to products sold, cost structure, required future inv ...

... Market comparables are easy to calculate and provide useful benchmarks in assessing DCF-based valuation methods. Market comparables assume that industry averages are equivalent to the firm to be evaluated. There can be substantial differences due to products sold, cost structure, required future inv ...

CHAPTER 10 Capital assets

... During an asset’s life, its usefulness may decline because of usage or obsolescence. Amortization is the process of allocating to expense the cost of a capital asset over its useful life. Amortization is designed to match expenses with revenues in accordance with the matching principle. Recognition ...

... During an asset’s life, its usefulness may decline because of usage or obsolescence. Amortization is the process of allocating to expense the cost of a capital asset over its useful life. Amortization is designed to match expenses with revenues in accordance with the matching principle. Recognition ...

Off-Balance Sheet Financing Off-balance sheet

... • A short term quick solution that can bring cash and help the company meet its short term obligations. • The fees are usually based on the credit worthiness of the company’s accounts receivable (the company’s clients) and not on the credit worthiness of the company itself. • The transaction is not ...

... • A short term quick solution that can bring cash and help the company meet its short term obligations. • The fees are usually based on the credit worthiness of the company’s accounts receivable (the company’s clients) and not on the credit worthiness of the company itself. • The transaction is not ...

download

... subtracting the adjustment columns from the trial balance columns. 3. After closing entries have been journalized and posted, all temporary accounts in the ledger should have zero balances. 4. The Dividends account is a permanent account whose balance is carried forward to the next accounting period ...

... subtracting the adjustment columns from the trial balance columns. 3. After closing entries have been journalized and posted, all temporary accounts in the ledger should have zero balances. 4. The Dividends account is a permanent account whose balance is carried forward to the next accounting period ...

Principles of Managerial Finance by Lawrence Gitman

... e. A $ 300 outlay for an office machine. f. An outlay of $ 1700 fr a new machine tool. g. An outlay of $ 241000 for a new building. h. An outlay of $ 1800 for a marketing research report. 2. Covol Industries is developing the relevant cash flows associated with the proposed replacement of an existin ...

... e. A $ 300 outlay for an office machine. f. An outlay of $ 1700 fr a new machine tool. g. An outlay of $ 241000 for a new building. h. An outlay of $ 1800 for a marketing research report. 2. Covol Industries is developing the relevant cash flows associated with the proposed replacement of an existin ...

The valuation of specialised operational assets

... the valuation of a business, however, when it becomes necessary to determine the value of the individual assets used to generate those cash flows, valuers typically consider that either a market comparison or cost approach should be applied. This is because income-based valuation approaches, such as ...

... the valuation of a business, however, when it becomes necessary to determine the value of the individual assets used to generate those cash flows, valuers typically consider that either a market comparison or cost approach should be applied. This is because income-based valuation approaches, such as ...

Financial Statements

... This presentation was prepared exclusively for the benefit and use of the members of Western Capital Markets (“WCM”) for the purpose of teaching and discussing financial and investment matters. This presentation is proprietary to WCM . The information and any analyses contained in this presentation ...

... This presentation was prepared exclusively for the benefit and use of the members of Western Capital Markets (“WCM”) for the purpose of teaching and discussing financial and investment matters. This presentation is proprietary to WCM . The information and any analyses contained in this presentation ...

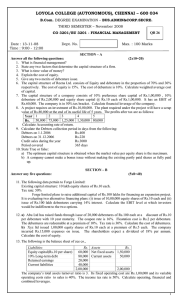

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 5. Give any two merits of debenture issue. 6. The capital structure of Reena Ltd. consists of Equity and debenture in the proportion of 70% and 30% respectively. The cost of equity is 15%. The cost of debenture is 10%. Calculate weighted average cost of capital. 7. The capital structure of a company ...

... 5. Give any two merits of debenture issue. 6. The capital structure of Reena Ltd. consists of Equity and debenture in the proportion of 70% and 30% respectively. The cost of equity is 15%. The cost of debenture is 10%. Calculate weighted average cost of capital. 7. The capital structure of a company ...

Creative Exit Strategies

... – Small Business Administration (SBA) requires valuation if the business is sold to a family member, regardless of the size of loan – SBA requires non‐family transactions with loan value above $250,000 to have a certified valuation – Do not use financial recast, financial statements or perform a ...

... – Small Business Administration (SBA) requires valuation if the business is sold to a family member, regardless of the size of loan – SBA requires non‐family transactions with loan value above $250,000 to have a certified valuation – Do not use financial recast, financial statements or perform a ...

Chapter 15: Financial Statements and Year

... The resulting balance in Income Summary, which is the net income or loss for the period, is transferred to the owner’s capital account. ...

... The resulting balance in Income Summary, which is the net income or loss for the period, is transferred to the owner’s capital account. ...

Accounts

... One to whom money is owed Double-entry accounting The system by which each business transaction is recorded in at least two accounts and the accounting equation is kept in balance Equity The value of a right or claim to or financial interest in an asset or group of assets Expenses The costs that rel ...

... One to whom money is owed Double-entry accounting The system by which each business transaction is recorded in at least two accounts and the accounting equation is kept in balance Equity The value of a right or claim to or financial interest in an asset or group of assets Expenses The costs that rel ...

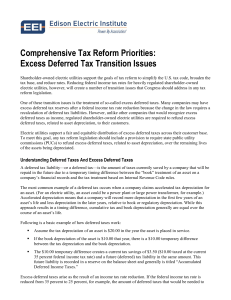

Excess Deferred Tax Transition Issues

... When a tax rate reduction creates excess deferred taxes, all companies must account for the excess. A nonregulated company generally would recognize the excess deferred taxes as income for financial statement purposes. However, an electric utility must refund the excess deferred taxes to ratepayers, ...

... When a tax rate reduction creates excess deferred taxes, all companies must account for the excess. A nonregulated company generally would recognize the excess deferred taxes as income for financial statement purposes. However, an electric utility must refund the excess deferred taxes to ratepayers, ...

Paper - Careers Portal

... dividend due and a final dividend on Ordinary shares to bring that total dividend up to 7c per share. Provide for Debenture Interest due, Investment Interest due, Auditors fees €9,500, Directors fees €50,000 and Corporation tax €87,000. Depreciation is to be provided for on Buildings at a rate of 2% ...

... dividend due and a final dividend on Ordinary shares to bring that total dividend up to 7c per share. Provide for Debenture Interest due, Investment Interest due, Auditors fees €9,500, Directors fees €50,000 and Corporation tax €87,000. Depreciation is to be provided for on Buildings at a rate of 2% ...

download

... The cost of goods that were sold to produce revenue Retailer Manufacturer Beginning Inventory Beginning Inventory + Purchases + Cost of goods sold Manufactured ...

... The cost of goods that were sold to produce revenue Retailer Manufacturer Beginning Inventory Beginning Inventory + Purchases + Cost of goods sold Manufactured ...

Solution 1.10.

... conditions attached and that the grants will be received [IAS 20.7]. The reporting entity should have fulfilled all conditions attached to the grant. Grants that require the recipient to purchase, construct, or otherwise acquire long-lived assets, including intangible assets, should be recognised ei ...

... conditions attached and that the grants will be received [IAS 20.7]. The reporting entity should have fulfilled all conditions attached to the grant. Grants that require the recipient to purchase, construct, or otherwise acquire long-lived assets, including intangible assets, should be recognised ei ...

Depreciation

In accountancy, depreciation refers to two aspects of the same concept: the decrease in value of assets (fair value depreciation), and the allocation of the cost of assets to periods in which the assets are used (depreciation with the matching principle).A method of reallocating the cost of a tangible asset over its useful life span of it being in motion. Businesses depreciate long-term assets for both tax and accounting purposes.The former affects the balance sheet of a business or entity, and the latter affects the net income that they report. Generally the cost is allocated, as depreciation expense, among the periods in which the asset is expected to be used. This expense is recognized by businesses for financial reporting and tax purposes. Methods of computing depreciation, and the periods over which assets are depreciated, may vary between asset types within the same business and may vary for tax purposes. These may be specified by law or accounting standards, which may vary by country. There are several standard methods of computing depreciation expense, including fixed percentage, straight line, and declining balance methods. Depreciation expense generally begins when the asset is placed in service. For example, a depreciation expense of 100 per year for 5 years may be recognized for an asset costing 500.