Intangible Assets - McGraw Hill Higher Education

... When exchanges are recorded at fair value, any gain or loss is recognized for the difference between the fair value and book value of the asset(s) given up. To preclude the possibility of companies engaging in exchanges of appreciated assets solely to be able to recognize gains, fair value can only ...

... When exchanges are recorded at fair value, any gain or loss is recognized for the difference between the fair value and book value of the asset(s) given up. To preclude the possibility of companies engaging in exchanges of appreciated assets solely to be able to recognize gains, fair value can only ...

Chap011

... On January 1, 2009, Matrix, Inc., purchased equipment for $400,000. Matrix expected a residual value $40,000, and a service life of 5 years. Matrix uses the double-declining-balance method to depreciate this type of asset. During 2011, the company switched from double-declining balance to straight-l ...

... On January 1, 2009, Matrix, Inc., purchased equipment for $400,000. Matrix expected a residual value $40,000, and a service life of 5 years. Matrix uses the double-declining-balance method to depreciate this type of asset. During 2011, the company switched from double-declining balance to straight-l ...

problem 6_4a page 255- 256

... The company expects to sell about 10% of its merchandise for cash. Of sales on account. 70% are expected to be collected in full in the month following the sale and the remainder the following month. Depreciation, insurance, and property tax expense represent $25,000 of the estimated monthly manufac ...

... The company expects to sell about 10% of its merchandise for cash. Of sales on account. 70% are expected to be collected in full in the month following the sale and the remainder the following month. Depreciation, insurance, and property tax expense represent $25,000 of the estimated monthly manufac ...

What is the Balance Sheet?

... a given period of time • It shows revenue and expenses of the firm, the effect of interest and tax, and the net income for the period ...

... a given period of time • It shows revenue and expenses of the firm, the effect of interest and tax, and the net income for the period ...

CHAPTER 10 PLANT ASSETS, NATURAL RESOURCES, AND

... excessive, a change should be made. When a change is made, there is no correction of previously recorded depreciation expense. Instead, depreciation expense for current and future years is revised. To determine the new annual depreciation expense, the depreciable cost at the time of the revision ...

... excessive, a change should be made. When a change is made, there is no correction of previously recorded depreciation expense. Instead, depreciation expense for current and future years is revised. To determine the new annual depreciation expense, the depreciable cost at the time of the revision ...

Слайд 1 - Beltelecom

... are recognized in the same period when they have been paid. Expenses are recognized in the period they have been actually incurred regardless of the time of payments (advance or next). ...

... are recognized in the same period when they have been paid. Expenses are recognized in the period they have been actually incurred regardless of the time of payments (advance or next). ...

ppt

... ORGANISATION MAY ACCRUE AFTER FEW YEARS.THESE MAY BE TREATED AS DEFERRED REVENUE EXPENDITURE , CARRIED TO THE BALANCE SHEET , AND WRITTEN OFF TO THE PROFIT & LOSS ACCOUNT OVER A PERIOD OF TIME. ...

... ORGANISATION MAY ACCRUE AFTER FEW YEARS.THESE MAY BE TREATED AS DEFERRED REVENUE EXPENDITURE , CARRIED TO THE BALANCE SHEET , AND WRITTEN OFF TO THE PROFIT & LOSS ACCOUNT OVER A PERIOD OF TIME. ...

FA2: Module 9 Tangible and intangible capital assets

... Acme Incorporated has a management practice of dismantling its equipment at the end of their useful life and selling them for scrap. For new equipment purchased in 20x1 for a cost of $70,000, the anticipated net costs (cost less scrap revenue) are $10,000. The equipment has an estimated useful life ...

... Acme Incorporated has a management practice of dismantling its equipment at the end of their useful life and selling them for scrap. For new equipment purchased in 20x1 for a cost of $70,000, the anticipated net costs (cost less scrap revenue) are $10,000. The equipment has an estimated useful life ...

- Distribly

... years from now you can withdraw $10,000 a year for the next 5 years (periods 11 through 15) plus an additional amount of $20,000 in the last year (period 15)? Assume an interest rate of 6 percent. 9. (Break-even analysis) The Marvel Mfg. Company is considering whether or not to construct a new ...

... years from now you can withdraw $10,000 a year for the next 5 years (periods 11 through 15) plus an additional amount of $20,000 in the last year (period 15)? Assume an interest rate of 6 percent. 9. (Break-even analysis) The Marvel Mfg. Company is considering whether or not to construct a new ...

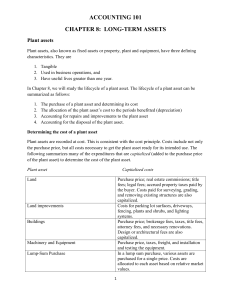

ACCOUNTING I Chapter 15 Reading Guide

... 15-3 ADJUSTING ACCUMULATED DEPRECIATION 14. What is the difference between current assets and plant assets? Cash or assets expected to be exchanged for cash or consumed within a year are current assets. Plant assets are physical assets that will be used for a number of years in the operation of a ...

... 15-3 ADJUSTING ACCUMULATED DEPRECIATION 14. What is the difference between current assets and plant assets? Cash or assets expected to be exchanged for cash or consumed within a year are current assets. Plant assets are physical assets that will be used for a number of years in the operation of a ...

III. Financial Statements

... Depreciation is the process of apportioning the cost of a fixed asset over the period during which it will be used. The portion being used up is reported as depreciation expense on the income statement. In effect, depreciation is the transfer of a portion of an asset’s cost from the balance sheet t ...

... Depreciation is the process of apportioning the cost of a fixed asset over the period during which it will be used. The portion being used up is reported as depreciation expense on the income statement. In effect, depreciation is the transfer of a portion of an asset’s cost from the balance sheet t ...

Fixed Assets, Depreciation, Disposals

... purchased for a single price. Costs are allocated to each asset based on relative market values. ...

... purchased for a single price. Costs are allocated to each asset based on relative market values. ...

Adjustments, Financial Statements, and the Quality of

... • Certain circumstances require adjusting entries to record accounting estimates. • Examples include . . . –Depreciation –Bad debts –Income taxes ...

... • Certain circumstances require adjusting entries to record accounting estimates. • Examples include . . . –Depreciation –Bad debts –Income taxes ...

Sample Problem

... The equipment of Ace Plastics Company has a book value (cost less accumulated depreciation) of $180,000. However, the equipment could not be sold for more than $40,000 today. The company’s owner thinks that the machinery should nevertheless be reported on the balance sheet at $180,000 and depreciat ...

... The equipment of Ace Plastics Company has a book value (cost less accumulated depreciation) of $180,000. However, the equipment could not be sold for more than $40,000 today. The company’s owner thinks that the machinery should nevertheless be reported on the balance sheet at $180,000 and depreciat ...

Depreciation

In accountancy, depreciation refers to two aspects of the same concept: the decrease in value of assets (fair value depreciation), and the allocation of the cost of assets to periods in which the assets are used (depreciation with the matching principle).A method of reallocating the cost of a tangible asset over its useful life span of it being in motion. Businesses depreciate long-term assets for both tax and accounting purposes.The former affects the balance sheet of a business or entity, and the latter affects the net income that they report. Generally the cost is allocated, as depreciation expense, among the periods in which the asset is expected to be used. This expense is recognized by businesses for financial reporting and tax purposes. Methods of computing depreciation, and the periods over which assets are depreciated, may vary between asset types within the same business and may vary for tax purposes. These may be specified by law or accounting standards, which may vary by country. There are several standard methods of computing depreciation expense, including fixed percentage, straight line, and declining balance methods. Depreciation expense generally begins when the asset is placed in service. For example, a depreciation expense of 100 per year for 5 years may be recognized for an asset costing 500.