NORTH CENTRAL FARM MANAGEMENT EXTENSION COMMITTEE

... Two general types of lease plans are available, and are distinguishable mostly by how they are treated for income tax purposes. A true (or operating) lease calls for a series of regular payments, usually annual or semiannual, for a period of years. At the end of the lease period the operator can ch ...

... Two general types of lease plans are available, and are distinguishable mostly by how they are treated for income tax purposes. A true (or operating) lease calls for a series of regular payments, usually annual or semiannual, for a period of years. At the end of the lease period the operator can ch ...

Valuing intangibles companies

... An intellectual capital approach to valuation differs significantly from traditional accounting approaches. In the world of accounting, there are tangible assets and transaction-based prices. In the world of intellectual capital there are two sources of value: innovations (IC) and complementary busi ...

... An intellectual capital approach to valuation differs significantly from traditional accounting approaches. In the world of accounting, there are tangible assets and transaction-based prices. In the world of intellectual capital there are two sources of value: innovations (IC) and complementary busi ...

Produced non-financial assets

... The non-financial transactions of the KTA correspond to the non-financial transaction accounts of the SNA. • Thus, the sub-total of uses-side minus sub-total of resources side of the KTA gives the balance of real transactions - net lending / borrowing. • The financial account of the SNA corresponds ...

... The non-financial transactions of the KTA correspond to the non-financial transaction accounts of the SNA. • Thus, the sub-total of uses-side minus sub-total of resources side of the KTA gives the balance of real transactions - net lending / borrowing. • The financial account of the SNA corresponds ...

DOC - Investor Relations

... Financial Results for the Quarter Ended September 30, 2015 Discussing financial results for the quarter, Chief Financial Officer Bill Wagner reported that the Company generated normalized FFO of $7.7 million or $0.20 per diluted common share, and normalized FAD of $8.7 million or $0.22 per diluted c ...

... Financial Results for the Quarter Ended September 30, 2015 Discussing financial results for the quarter, Chief Financial Officer Bill Wagner reported that the Company generated normalized FFO of $7.7 million or $0.20 per diluted common share, and normalized FAD of $8.7 million or $0.22 per diluted c ...

the balance sheet balance sheet is a financial statement showing a

... For current assets, market value and book value might be somewhat similar because current assets are bought and converted into cash over a relatively short span of time. In other circumstances, the two values might differ quite a bit. Moreover, for fixed assets, it would be purely a coincidence if t ...

... For current assets, market value and book value might be somewhat similar because current assets are bought and converted into cash over a relatively short span of time. In other circumstances, the two values might differ quite a bit. Moreover, for fixed assets, it would be purely a coincidence if t ...

FREE Sample Here - College Test bank

... How much is too much? Who is worth more, Ray Irani or Tiger Woods? The simplest answer is that there is a market for executives just as there is for all types of labor. Executive compensation is the price that clears the market. The same is true for athletes and performers. Having said that, one asp ...

... How much is too much? Who is worth more, Ray Irani or Tiger Woods? The simplest answer is that there is a market for executives just as there is for all types of labor. Executive compensation is the price that clears the market. The same is true for athletes and performers. Having said that, one asp ...

Accounting for Endowment Funds Held at Community Foundations

... value per share (or its equivalent) at the measurement date but the investment may be redeemable with the investee at a future date (for example, investments subject to a lockup or gate or investments whose redemption period does not coincide with the measurement date), the reporting entity shall co ...

... value per share (or its equivalent) at the measurement date but the investment may be redeemable with the investee at a future date (for example, investments subject to a lockup or gate or investments whose redemption period does not coincide with the measurement date), the reporting entity shall co ...

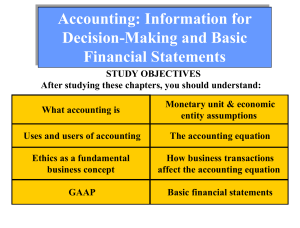

Chp 2 Slides 02_Ch_2_Slides

... Assets that a company expects to convert to cash or use up within one year or the operating cycle, ...

... Assets that a company expects to convert to cash or use up within one year or the operating cycle, ...

Implications of Implementation of IAS 41 about Agriculture on

... In measuring biological asset, other assets element should not be included in the component being measured. Land, building, infrastructure that are on the forest or plantation should be measured separately with plant asset. If the measurement is conducted together, so that for reporting purpose the ...

... In measuring biological asset, other assets element should not be included in the component being measured. Land, building, infrastructure that are on the forest or plantation should be measured separately with plant asset. If the measurement is conducted together, so that for reporting purpose the ...

ACCOUNTING 201 - Everett Community College

... agreed to pay the balance in 30 days. The journal entry to record this transaction would include a debit to an asset account for $1,000, a credit to a liability account for $500. Which of the following would be the correct way to complete the recording of the ...

... agreed to pay the balance in 30 days. The journal entry to record this transaction would include a debit to an asset account for $1,000, a credit to a liability account for $500. Which of the following would be the correct way to complete the recording of the ...

BMA 607 - Assignment 1

... 29. Which of the following transactions will cause both the left and right side of the equation to increase? A. We collect cash from a customer who owed us money B. We pay a supplier for inventory we previously bought on account C. We borrow money from the bank D. We purchase equipment for cash 30. ...

... 29. Which of the following transactions will cause both the left and right side of the equation to increase? A. We collect cash from a customer who owed us money B. We pay a supplier for inventory we previously bought on account C. We borrow money from the bank D. We purchase equipment for cash 30. ...

Calculating ROI for an RFID Asset Tracking System

... Example 1: An automotive supplies manufacturer loses 3% of finished parts inventory each year. This results in a periodic need to rush manufacturing and expedite shipments. Number of Items 50,000 / year ...

... Example 1: An automotive supplies manufacturer loses 3% of finished parts inventory each year. This results in a periodic need to rush manufacturing and expedite shipments. Number of Items 50,000 / year ...

Financial Statements for the period ending November

... parties, and are recorded at cost less accumulated amortization and accumulated impairment losses. Initial acquisition cost is based on the fair value of the consideration paid or payable, and will be amortized on a straight-line basis over the estimated useful life of the underlying technologies wi ...

... parties, and are recorded at cost less accumulated amortization and accumulated impairment losses. Initial acquisition cost is based on the fair value of the consideration paid or payable, and will be amortized on a straight-line basis over the estimated useful life of the underlying technologies wi ...

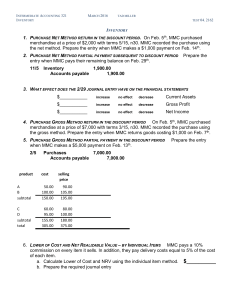

2162 Final ch 8-9 Inventory

... 11. DOLLAR VALUE LIFO REDUCTION OF A PRIOR LAYER On Jan. 1, 2014 MMC adopted dollarvalue LIFO. The inventory value on that date was $300. The inventory value on 12/31/14 was $371 at year-end costs; and the value on 12/31/15 was $374 at year-end costs. The cost index was 1.06 for 2014 and 1.10 for 2 ...

... 11. DOLLAR VALUE LIFO REDUCTION OF A PRIOR LAYER On Jan. 1, 2014 MMC adopted dollarvalue LIFO. The inventory value on that date was $300. The inventory value on 12/31/14 was $371 at year-end costs; and the value on 12/31/15 was $374 at year-end costs. The cost index was 1.06 for 2014 and 1.10 for 2 ...

Measurement of GDP by final expenditure

... transfer in kind, financial leasing, natural growth of cultivated assets and major repairs of produced assets; Disposals can be in terms of sale, barter, capital transfer in kind, financial lease. Exceptional losses, such as those due to natural disasters (fire, drought, etc.) are not recorded as di ...

... transfer in kind, financial leasing, natural growth of cultivated assets and major repairs of produced assets; Disposals can be in terms of sale, barter, capital transfer in kind, financial lease. Exceptional losses, such as those due to natural disasters (fire, drought, etc.) are not recorded as di ...

ACNT1303cplassessment

... 3. If total liabilities are $3,000 and total assets are $10,000, owner's equity must be: a) $7,000. b) $3,000. c) $10,000. d) $13,000. 4. Bob purchased a new Ford vehicle for the company on account. The transaction will: a) increase Vehicle; increase Capital. b) decrease Cash; increase Accounts Paya ...

... 3. If total liabilities are $3,000 and total assets are $10,000, owner's equity must be: a) $7,000. b) $3,000. c) $10,000. d) $13,000. 4. Bob purchased a new Ford vehicle for the company on account. The transaction will: a) increase Vehicle; increase Capital. b) decrease Cash; increase Accounts Paya ...

Accounting Summaries

... - Matching of costs with revenues: expenses direct association with costs incurred in generating associated income on st of compr income - Depreciation or amortisation:expenses spread over several financial periods where benefits also spread over periods Measurement of elements of financial statemen ...

... - Matching of costs with revenues: expenses direct association with costs incurred in generating associated income on st of compr income - Depreciation or amortisation:expenses spread over several financial periods where benefits also spread over periods Measurement of elements of financial statemen ...

Budget to Save—The Balance Sheet

... the board. Answers will vary but might include: •• Wealth is lots of money. •• Wealth is having nice/expensive things. Guide the discussion to the idea that simply having “things” or money does not make you wealthy if those things are accompanied by debt. Tell students that these lessons will examin ...

... the board. Answers will vary but might include: •• Wealth is lots of money. •• Wealth is having nice/expensive things. Guide the discussion to the idea that simply having “things” or money does not make you wealthy if those things are accompanied by debt. Tell students that these lessons will examin ...

Chapter 1 - Testbankster.com

... company concept approaches to the reporting of subsidiary assets and liabilities in the consolidated financial statements on the date of the acquisition. 12. Contrast the consolidated effects of the parent company concept and the economic entity con-cept concept in terms of: (a)The treatment of nonc ...

... company concept approaches to the reporting of subsidiary assets and liabilities in the consolidated financial statements on the date of the acquisition. 12. Contrast the consolidated effects of the parent company concept and the economic entity con-cept concept in terms of: (a)The treatment of nonc ...

Introduction to Business Combinations and the Conceptual Framework

... approaches to the reporting of subsidiary assets and liabilities in the consolidated financial statements on the date of the acquisition. 12. Contrast the consolidated effects of the parent company concept and the economic entity con-cept concept in terms of: (a)The treatment of noncontrolling inter ...

... approaches to the reporting of subsidiary assets and liabilities in the consolidated financial statements on the date of the acquisition. 12. Contrast the consolidated effects of the parent company concept and the economic entity con-cept concept in terms of: (a)The treatment of noncontrolling inter ...

PART I - BrainMass

... ____12. The Retained Earnings column had a beginning total of $30,000 and an ending total of $50,000. If $10,000 of dividends were paid during the period, net income must have been a. $20,000. b. $40,000. c. $10,000. d. $30,000. ...

... ____12. The Retained Earnings column had a beginning total of $30,000 and an ending total of $50,000. If $10,000 of dividends were paid during the period, net income must have been a. $20,000. b. $40,000. c. $10,000. d. $30,000. ...

Euronav NV (Form: 6-K, Received: 01/27/2017 16:07:39)

... ) Regulation from 2020 limiting the maximum sulphur content in fuel oil will help to increase pressure to scrap over time. There are 267 VLCCs in total (38% of current fleet) that will be at least 15 years old by 2020. This ageing profile will encourage a more rational medium-term behavior as owners ...

... ) Regulation from 2020 limiting the maximum sulphur content in fuel oil will help to increase pressure to scrap over time. There are 267 VLCCs in total (38% of current fleet) that will be at least 15 years old by 2020. This ageing profile will encourage a more rational medium-term behavior as owners ...

Chapter 3 Sample Problems

... Journalize the adjusting entry needed on December 31 for each situation. Use the letters to label the journal entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. On October 1, a business collected $6,000 rent in advance, debiting Cash ...

... Journalize the adjusting entry needed on December 31 for each situation. Use the letters to label the journal entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. On October 1, a business collected $6,000 rent in advance, debiting Cash ...

Depreciation

In accountancy, depreciation refers to two aspects of the same concept: the decrease in value of assets (fair value depreciation), and the allocation of the cost of assets to periods in which the assets are used (depreciation with the matching principle).A method of reallocating the cost of a tangible asset over its useful life span of it being in motion. Businesses depreciate long-term assets for both tax and accounting purposes.The former affects the balance sheet of a business or entity, and the latter affects the net income that they report. Generally the cost is allocated, as depreciation expense, among the periods in which the asset is expected to be used. This expense is recognized by businesses for financial reporting and tax purposes. Methods of computing depreciation, and the periods over which assets are depreciated, may vary between asset types within the same business and may vary for tax purposes. These may be specified by law or accounting standards, which may vary by country. There are several standard methods of computing depreciation expense, including fixed percentage, straight line, and declining balance methods. Depreciation expense generally begins when the asset is placed in service. For example, a depreciation expense of 100 per year for 5 years may be recognized for an asset costing 500.