RVM Achieves Ninth “Top Gun” Ranking from Effron

... San Antonio- November 17, 2009 ---Robinson Value Management’s Market Opportunity Composite was recognized again by Informa Investment Solutions (IIS) as one of the “Top Guns” in the 2-star category under IIS’ Plan Sponsor Network (PSN) database. The 2-star category is derived from performance for th ...

... San Antonio- November 17, 2009 ---Robinson Value Management’s Market Opportunity Composite was recognized again by Informa Investment Solutions (IIS) as one of the “Top Guns” in the 2-star category under IIS’ Plan Sponsor Network (PSN) database. The 2-star category is derived from performance for th ...

Debt, Growth & Politics - Robert Ricketts

... For example, “because all the benefits of a good road system are difficult for a private entity to capture without creating inefficiencies (toll or EZ Pay booths on every corner), the government is the natural entity to make decisions about road building and other investments that have widespread ...

... For example, “because all the benefits of a good road system are difficult for a private entity to capture without creating inefficiencies (toll or EZ Pay booths on every corner), the government is the natural entity to make decisions about road building and other investments that have widespread ...

Click to download DSM US LCG JUNE 2010

... presentation incomplete without accompanying footnotes as shown at www.dsmcapital.com. (c) Total return including dividends. (d) The fund is registered with the AFM for public distribution in the Netherlands. (e) Share Class C is German tax registered from 4/1/08. (f) Share Class U has UK Distributo ...

... presentation incomplete without accompanying footnotes as shown at www.dsmcapital.com. (c) Total return including dividends. (d) The fund is registered with the AFM for public distribution in the Netherlands. (e) Share Class C is German tax registered from 4/1/08. (f) Share Class U has UK Distributo ...

getfunddocument?oid=1.9

... can only be made on the basis of its latest prospectus together with the latest audited annual report (and subsequent unaudited semi-annual report, if published), copies of which can be obtained, free of charge, from Schroder Investment Management (Luxembourg) S.A. An investment in the Company entai ...

... can only be made on the basis of its latest prospectus together with the latest audited annual report (and subsequent unaudited semi-annual report, if published), copies of which can be obtained, free of charge, from Schroder Investment Management (Luxembourg) S.A. An investment in the Company entai ...

Prudential Jennison Mid Cap Growth A LW

... Some mid-cap growth portfolios invest in stocks of all sizes, thus leading to a mid-cap profile, but others focus on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. The U.S. mid ...

... Some mid-cap growth portfolios invest in stocks of all sizes, thus leading to a mid-cap profile, but others focus on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. The U.S. mid ...

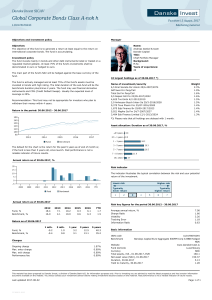

Global Corporate Bonds Class A-nok h

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

investment policy - University of Arkansas at Pine Bluff

... Foundation funds and is responsible for developing appropriate investment policies and asset allocation guidelines. The executive committee has retained investment consultant, Cambridge Associates, to implement investment decisions within these guidelines through a dedicated outsourced CIO who is su ...

... Foundation funds and is responsible for developing appropriate investment policies and asset allocation guidelines. The executive committee has retained investment consultant, Cambridge Associates, to implement investment decisions within these guidelines through a dedicated outsourced CIO who is su ...

Personal Finance for Accountants (U13763)

... regulation specified that advisors were either tied in that they would only sell their products from one company or independent where they would be in a position to choose products across the whole market. ...

... regulation specified that advisors were either tied in that they would only sell their products from one company or independent where they would be in a position to choose products across the whole market. ...

News release - EY`s 2016 study on direct investment in Europe

... building materials. Such investments are frequently made in eastern Europe – nearly one in every two manufacturing jobs created by Swiss companies is in this region, with Poland benefitting the most out of the 13 target countries. Most investment projects launched by Swiss companies are in sales and ...

... building materials. Such investments are frequently made in eastern Europe – nearly one in every two manufacturing jobs created by Swiss companies is in this region, with Poland benefitting the most out of the 13 target countries. Most investment projects launched by Swiss companies are in sales and ...

New York, New York TUESDAY, DECEMBER 8, 2009

... and private wealth management lines of business on matters relating to asset management mandates, product development, securities and banking regulatory compliance, and litigation. He may be reached at 212.536.3905 or [email protected]. Mr. Hoffman has more than 50 years of experience in c ...

... and private wealth management lines of business on matters relating to asset management mandates, product development, securities and banking regulatory compliance, and litigation. He may be reached at 212.536.3905 or [email protected]. Mr. Hoffman has more than 50 years of experience in c ...

About Our Private Investment Benchmarks

... individual fund’s performance because they provide a similar universe for comparison. 8. The Cambridge Associates commentaries talk a lot about comparative size vintages. Why is this important? Because the index is derived by cash flows, the largest funds and largest vintages have the most impact on ...

... individual fund’s performance because they provide a similar universe for comparison. 8. The Cambridge Associates commentaries talk a lot about comparative size vintages. Why is this important? Because the index is derived by cash flows, the largest funds and largest vintages have the most impact on ...

File

... Today we announce the winners for hedge funds and alternatives. By The Editors | 22 April 2010 Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We concl ...

... Today we announce the winners for hedge funds and alternatives. By The Editors | 22 April 2010 Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We concl ...

Investment Terminology and Concepts

... • Voting Rights • Owning shares in Home Depot does not mean you can go help yourself to free home improvement or other building materials! ...

... • Voting Rights • Owning shares in Home Depot does not mean you can go help yourself to free home improvement or other building materials! ...

benefits of alternative investments

... information has been prepared by PTCo. It contains general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial or other adviser, whether the information is suitable for you ...

... information has been prepared by PTCo. It contains general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial or other adviser, whether the information is suitable for you ...

1 climate assets fund quarterly update - q1 2017

... Thesis Unit Trust Management Ltd, Exchange Building, St John's Street, Chichester, West Sussex, PO19 1UP. These documents are only available in English. IMPORTANT INFORMATION This document is for general information purposes only and does not take into account the specific investment objectives, finan ...

... Thesis Unit Trust Management Ltd, Exchange Building, St John's Street, Chichester, West Sussex, PO19 1UP. These documents are only available in English. IMPORTANT INFORMATION This document is for general information purposes only and does not take into account the specific investment objectives, finan ...

SECONDARY MARKET FIRMS The following companies buy and

... REITs, limited partnerships, LLCs and other direct investment programs in the informal Secondary Market. Certain of these firms deal only with licensed securities brokers and therefore do not transact business directly with investors. Partnership Profiles, Inc., the Direct Investment Spectrum, its a ...

... REITs, limited partnerships, LLCs and other direct investment programs in the informal Secondary Market. Certain of these firms deal only with licensed securities brokers and therefore do not transact business directly with investors. Partnership Profiles, Inc., the Direct Investment Spectrum, its a ...

Debt (B) Value of firm (V)

... • Theory stating that firms prefer internal financing, followed by debt issues, and then equity financing • The pecking-order Theory implies: – There is no target D/E ratio. – Profitable firms use less debt. – Companies like financial slack ( cash buildup and low leverage) ...

... • Theory stating that firms prefer internal financing, followed by debt issues, and then equity financing • The pecking-order Theory implies: – There is no target D/E ratio. – Profitable firms use less debt. – Companies like financial slack ( cash buildup and low leverage) ...

Will shares produce highest returns long-term?

... If a company is to grow it needs new capital above that which is self-funding, shareholders have to receive appropriate returns on the capital they have already invested to encourage them to invest more. Economic forces will therefore look to bring the model back into balance. If employees (or execu ...

... If a company is to grow it needs new capital above that which is self-funding, shareholders have to receive appropriate returns on the capital they have already invested to encourage them to invest more. Economic forces will therefore look to bring the model back into balance. If employees (or execu ...

Socially Responsible Investing

... that Jewish law incorporated aspects of investing, and how to invest in an ethical manner. Generations of religious investors followed in this manner, investing in non-violent and peaceful organizations, and avoiding organizations that profit from manufacturing goods that can have detrimental societ ...

... that Jewish law incorporated aspects of investing, and how to invest in an ethical manner. Generations of religious investors followed in this manner, investing in non-violent and peaceful organizations, and avoiding organizations that profit from manufacturing goods that can have detrimental societ ...

Pakistan`s Investment Scenario and Capital Markets

... vehemently assert that growth in Pakistan is consumption led and fuelled by bank credit. If they are right then the latest data available is indeed very intriguing. Gross fixed capital formation during 2005-06 was Rs.1.42 trillion – an increase of 30.7 % over last year. This was over and above an in ...

... vehemently assert that growth in Pakistan is consumption led and fuelled by bank credit. If they are right then the latest data available is indeed very intriguing. Gross fixed capital formation during 2005-06 was Rs.1.42 trillion – an increase of 30.7 % over last year. This was over and above an in ...

1 New contributions of PhD dissertation

... This dissertation has systematized and clarified the theory and practice of efficient investment capital in agricultural development, lessons learned and established an analytical framework for the efficiency of investment capital in agricultural development. The dissertation has identified the tren ...

... This dissertation has systematized and clarified the theory and practice of efficient investment capital in agricultural development, lessons learned and established an analytical framework for the efficiency of investment capital in agricultural development. The dissertation has identified the tren ...

Sources of Growth

... Turning the Sources of Growth into Growth • It is the combination of investing in machines, people, and technological change that plays a central role in the growth of any economy. ...

... Turning the Sources of Growth into Growth • It is the combination of investing in machines, people, and technological change that plays a central role in the growth of any economy. ...

Sequence contains no elements

... or portfolio that is volatile is considered higher risk because its performance may change quickly in either direction at any moment. For the Parallel portfolios we quote the standard deviation over a rolling 3-year period. Property refers primarily to investment in commercial property but may inclu ...

... or portfolio that is volatile is considered higher risk because its performance may change quickly in either direction at any moment. For the Parallel portfolios we quote the standard deviation over a rolling 3-year period. Property refers primarily to investment in commercial property but may inclu ...

Trends in Spanish corporate bond issuance

... this debt in the same currency in which they generate profits. Moreover, to the extent that these companies expect dollar appreciation to continue, their effective borrowing costs may come down, as debt service in dollar terms will get cheaper. The arrival of US issuers to the European market is cer ...

... this debt in the same currency in which they generate profits. Moreover, to the extent that these companies expect dollar appreciation to continue, their effective borrowing costs may come down, as debt service in dollar terms will get cheaper. The arrival of US issuers to the European market is cer ...