Chenavari enter into an agreement to acquire BuyWay Personal

... Altamir is a listed private equity company with €500 million in assets under management. The objective of Altamir is to grow its net asset value per share (NAV), and to outperform the most relevant indices (CAC Mid & Small, and LPX Europe). Altamir invests through the funds managed by Apax Partners ...

... Altamir is a listed private equity company with €500 million in assets under management. The objective of Altamir is to grow its net asset value per share (NAV), and to outperform the most relevant indices (CAC Mid & Small, and LPX Europe). Altamir invests through the funds managed by Apax Partners ...

Takeout financing

... Private Equity investments • Domestic resources may not be sufficient to bridge the ...

... Private Equity investments • Domestic resources may not be sufficient to bridge the ...

SL 1971-820 - North Carolina General Assembly

... The General Assembly of North Carolina enacts: Section 1. G.S. 105-130.5 is amended by adding a new subdivision in the proper order at the end of subsection (b), which shall read as follows: "With respect to a shareholder of a regulated investment company, the portion of undistributed capital gains ...

... The General Assembly of North Carolina enacts: Section 1. G.S. 105-130.5 is amended by adding a new subdivision in the proper order at the end of subsection (b), which shall read as follows: "With respect to a shareholder of a regulated investment company, the portion of undistributed capital gains ...

Global Equity Income Fund (Unhedged)

... Ironbark Asset Management (Fund Services) Limited ABN 63 116 232 154 AFSL 298626 (“Ironbark”), is the issuer of units in the Threadneedle Global Equity Income Fund (Unhedged) ARSN 161 086 497 ('the Fund'). Ironbark is the responsible entity of the Fund and has selected Threadneedle International Lim ...

... Ironbark Asset Management (Fund Services) Limited ABN 63 116 232 154 AFSL 298626 (“Ironbark”), is the issuer of units in the Threadneedle Global Equity Income Fund (Unhedged) ARSN 161 086 497 ('the Fund'). Ironbark is the responsible entity of the Fund and has selected Threadneedle International Lim ...

ministry of economy

... Liquefied natural gas (LNG) investments and underground gas storage investments with a minimum amount of 50 million TL ...

... Liquefied natural gas (LNG) investments and underground gas storage investments with a minimum amount of 50 million TL ...

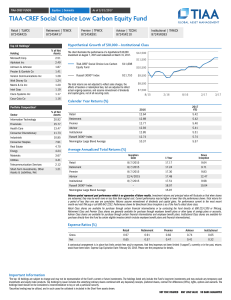

TIAA-CREF Social Choice Low Carbon Equity Fund

... Social Governance (ESG) guidelines. As a result, the universe of investments available to the Fund will be more limited than other funds that do not apply such guidelines. ESG criteria risk is the risk that because the Fund’s ESG criteria exclude securities of certain issuers for nonfinancial reason ...

... Social Governance (ESG) guidelines. As a result, the universe of investments available to the Fund will be more limited than other funds that do not apply such guidelines. ESG criteria risk is the risk that because the Fund’s ESG criteria exclude securities of certain issuers for nonfinancial reason ...

Innovest - Kellogg School of Management

... Innovest has widened its screening services to provide investors and international organizations with a cutting-edge tool for analyzing the policies and performance of countries in relation to international standards. This tool complements Innovest's growing suite of screening services and will be o ...

... Innovest has widened its screening services to provide investors and international organizations with a cutting-edge tool for analyzing the policies and performance of countries in relation to international standards. This tool complements Innovest's growing suite of screening services and will be o ...

Investing in shares - Bridges. Financial advice makes a difference

... dividends. You also have the opportunity to benefit from the potential growth in share price as the company grows, which means your initial investment is growing as well. Generally, a company will list on the stock exchange to raise money for planned activities, such as further expansion of their ma ...

... dividends. You also have the opportunity to benefit from the potential growth in share price as the company grows, which means your initial investment is growing as well. Generally, a company will list on the stock exchange to raise money for planned activities, such as further expansion of their ma ...

Fund Performance - 13D Activist Fund

... performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Fund performance, especially for very short periods of time, should ...

... performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Fund performance, especially for very short periods of time, should ...

RBC High Yield Bond Fund - RBC Global Asset Management

... corporate bonds. Given that central banks are beginning to lean toward tighter monetary policies, we believe that high-yield corporate bonds remain attractive relative to other fixedincome assets. However, it is likely that future returns will be lower than those experienced in the recent past, and ...

... corporate bonds. Given that central banks are beginning to lean toward tighter monetary policies, we believe that high-yield corporate bonds remain attractive relative to other fixedincome assets. However, it is likely that future returns will be lower than those experienced in the recent past, and ...

www.FirstRate.com | Evaluating Performance of Alternative

... instruments. These GIPS real estate provisions require the computation of time-weighted returns and, beginning in 2011, a break out of income returns and capital returns. In addition, moneyweighted returns must be computed for real estate closed-end funds. There are a wide range of global real estat ...

... instruments. These GIPS real estate provisions require the computation of time-weighted returns and, beginning in 2011, a break out of income returns and capital returns. In addition, moneyweighted returns must be computed for real estate closed-end funds. There are a wide range of global real estat ...

PruFund Expected Growth Rates

... The EGR set at each quarter date may be higher, the same or lower than those applying at the start of your investment. In addition, there may be times where the unit price may be adjusted which will impact the growth received. The overall return achieved is affected by the amount of the investment, ...

... The EGR set at each quarter date may be higher, the same or lower than those applying at the start of your investment. In addition, there may be times where the unit price may be adjusted which will impact the growth received. The overall return achieved is affected by the amount of the investment, ...

The Business-Investment Sector

... – If sales are expected to be strong the next few months the business is probably willing to add inventory – If sales outlook is good for the next few years, firms will probably purchase new plant and equipment ...

... – If sales are expected to be strong the next few months the business is probably willing to add inventory – If sales outlook is good for the next few years, firms will probably purchase new plant and equipment ...

Chapter 4

... The planner is not concerned with productivity of an individual firm, but with overall (or average) productivity ...

... The planner is not concerned with productivity of an individual firm, but with overall (or average) productivity ...

Private Real Estate Co-Investing Today

... specific set of portfolio construction goals, co-investments offer a way to allocate capital within the real estate portfolio deliberately, with control and with a greater degree of certainty of outcome. This contrasts with investing in a “blind pool” private real estate fund, where the ultimate por ...

... specific set of portfolio construction goals, co-investments offer a way to allocate capital within the real estate portfolio deliberately, with control and with a greater degree of certainty of outcome. This contrasts with investing in a “blind pool” private real estate fund, where the ultimate por ...

Strategy Highlight - Silvant Capital Management

... estimates are analyzed. For each security the team develops a short- and longterm investment thesis, establishes performance benchmarks, and debates the security’s appropriateness within the overall portfolio. Build portfolio – build a style-consistent portfolio based on fundamental, bottomup stock ...

... estimates are analyzed. For each security the team develops a short- and longterm investment thesis, establishes performance benchmarks, and debates the security’s appropriateness within the overall portfolio. Build portfolio – build a style-consistent portfolio based on fundamental, bottomup stock ...

Strategy sheet

... By signing this document you confirm that you have received and taken note of the investment regulations, correctly answered our questions and selected your strategy. Furthermore you have also taken note of the Discretionary Mandate Agreement from Julius Baer & Co. LTD. You are solely responsible to ...

... By signing this document you confirm that you have received and taken note of the investment regulations, correctly answered our questions and selected your strategy. Furthermore you have also taken note of the Discretionary Mandate Agreement from Julius Baer & Co. LTD. You are solely responsible to ...

Standard Life MyFolio Market Funds

... The funds have a strong asset allocation process, based on risk / return optimisation and combined with a tactical overlay. There is a relatively simple approach across the range, using the core asset allocation as the base then focusing on the underlying fund selections to populate the portfolios. ...

... The funds have a strong asset allocation process, based on risk / return optimisation and combined with a tactical overlay. There is a relatively simple approach across the range, using the core asset allocation as the base then focusing on the underlying fund selections to populate the portfolios. ...

DOC - Europa.eu

... for banks, finalising the delegated acts on the Liquidity Cover Ratio (a liquidity ratio with a one-month horizon) and the Net Stable Funding Ratio (a liquidity ratio with a one-year horizon) – see MEMO/13/690 on Capital Requirements Directive IV; for insurers, finalising the delegated acts unde ...

... for banks, finalising the delegated acts on the Liquidity Cover Ratio (a liquidity ratio with a one-month horizon) and the Net Stable Funding Ratio (a liquidity ratio with a one-year horizon) – see MEMO/13/690 on Capital Requirements Directive IV; for insurers, finalising the delegated acts unde ...

impact investing “supply” failing to meet demand

... The SRI Conference Announces Moskowitz Prize Winner: Study Shows Europe’s Demand for Impact Funds Over Traditional Investments Three Times Higher Than in North America DENVER, CO. AND BERKELEY, CA (November 10, 2016) — The demand for impact investing alternatives is outstripping the available supply ...

... The SRI Conference Announces Moskowitz Prize Winner: Study Shows Europe’s Demand for Impact Funds Over Traditional Investments Three Times Higher Than in North America DENVER, CO. AND BERKELEY, CA (November 10, 2016) — The demand for impact investing alternatives is outstripping the available supply ...

Exploring Investment Options

... • Stocks generally carry more risk than choices with fixed interest because a stockholder’s earnings can go up or down, depending on the company’s fortunes. ...

... • Stocks generally carry more risk than choices with fixed interest because a stockholder’s earnings can go up or down, depending on the company’s fortunes. ...

The case for investing in smaller companies

... change within a company that have not yet been identified by the wider market. With a focus on finding high quality, profitable businesses with significant growth potential, the smaller companies team seek to identify tomorrow’s larger companies today. What do the team look for in a smaller company? ...

... change within a company that have not yet been identified by the wider market. With a focus on finding high quality, profitable businesses with significant growth potential, the smaller companies team seek to identify tomorrow’s larger companies today. What do the team look for in a smaller company? ...

Corporate Superannuation Association

... significant margin above this target, for reasons which include potential disputes over ownership of the surplus. Hence, there is an incentive to fund to an amount very close to 100% VBI at all times. This can constrain the nature of the investments, artificially. Funds invest to match the liability ...

... significant margin above this target, for reasons which include potential disputes over ownership of the surplus. Hence, there is an incentive to fund to an amount very close to 100% VBI at all times. This can constrain the nature of the investments, artificially. Funds invest to match the liability ...