LionGlobal Asia Bond Fund

... insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the Fund is not guaranteed and the value of units in the Fund and the income accruing to the units, if any, may rise or fall. Past performance, ...

... insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the Fund is not guaranteed and the value of units in the Fund and the income accruing to the units, if any, may rise or fall. Past performance, ...

Active Management can help make these kinds of market declines

... of the potentially lower MERs. For information on the fees and performance of other series of the IA Clarington funds presented, please visit www.iaclarington.com or call 1-800-530-0204. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investment ...

... of the potentially lower MERs. For information on the fees and performance of other series of the IA Clarington funds presented, please visit www.iaclarington.com or call 1-800-530-0204. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investment ...

Slajd 1

... Source: (MERIT) and the Joint Research Centre (Institute for the Protection and Security of the Citizen) of the European Commission ...

... Source: (MERIT) and the Joint Research Centre (Institute for the Protection and Security of the Citizen) of the European Commission ...

What does the Fund invest in? FUND PERFORMANCE REPORT

... What does the Fund invest in? Fund Objective: The Sun Life Grepa (SLG) MyFuture Fund is offered as a fund option exclusive to Sun Grepa Power Builder 1, 5 and 10, which are investment-linked life insurance products regulated by the Insurance Commission. The SLG MyFuture Fund is a target date fund th ...

... What does the Fund invest in? Fund Objective: The Sun Life Grepa (SLG) MyFuture Fund is offered as a fund option exclusive to Sun Grepa Power Builder 1, 5 and 10, which are investment-linked life insurance products regulated by the Insurance Commission. The SLG MyFuture Fund is a target date fund th ...

Dynamic Power Canadian Growth Fund Series A

... amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult their financial advisor before makin ...

... amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult their financial advisor before makin ...

Diapositive 1 - Goldman Sachs

... Please see Additional Notes. All performance and holdings data as at 28-February-17. * We identify two broad categories of funds to help investors think about how to construct their overall investment portfolio. We describe the following as “Core”: (A) Equity funds with a global investment remit or ...

... Please see Additional Notes. All performance and holdings data as at 28-February-17. * We identify two broad categories of funds to help investors think about how to construct their overall investment portfolio. We describe the following as “Core”: (A) Equity funds with a global investment remit or ...

Answers to Chapter 1 Questions

... as liabilities while investing in risky, nontradable, and often illiquid loans as assets. As long as an FI is sufficiently large, to gain from diversification and monitoring on the asset side of its balance sheet, its financial claims (it issues as liabilities) are likely to be viewed as liquid and ...

... as liabilities while investing in risky, nontradable, and often illiquid loans as assets. As long as an FI is sufficiently large, to gain from diversification and monitoring on the asset side of its balance sheet, its financial claims (it issues as liabilities) are likely to be viewed as liquid and ...

deep value fund

... Mutual fund investing involves risk; principal loss is possible. The Carbon Beach Deep Value Fund invests in smaller companies, which involve additional risk such as limited liquidity and greater volatility. Event driven investments carry the risk that expected events or transactions may not occur a ...

... Mutual fund investing involves risk; principal loss is possible. The Carbon Beach Deep Value Fund invests in smaller companies, which involve additional risk such as limited liquidity and greater volatility. Event driven investments carry the risk that expected events or transactions may not occur a ...

What does the Fund invest in? FUND PERFORMANCE REPORT

... Invest wisely. Share values and yields may fluctuate thus fund performance is not guaranteed and investment returns may differ from the original amount invested. Past performance is not indicative of and does not represent future returns. Read product materials carefully. Important information about ...

... Invest wisely. Share values and yields may fluctuate thus fund performance is not guaranteed and investment returns may differ from the original amount invested. Past performance is not indicative of and does not represent future returns. Read product materials carefully. Important information about ...

Neuberger Berman NVIT Socially Responsible Fund

... Neuberger Berman NVIT Socially Responsible Fund — Class I Investment Strategy from investment’s prospectus The investment seeks long-term growth of capital by investing primarily in securities of companies that meet the fund's financial criteria and social policy. The fund invests primarily in equit ...

... Neuberger Berman NVIT Socially Responsible Fund — Class I Investment Strategy from investment’s prospectus The investment seeks long-term growth of capital by investing primarily in securities of companies that meet the fund's financial criteria and social policy. The fund invests primarily in equit ...

Nigerian earnings growth contributes to Sustainable Capital`s

... Based on 2012 estimated company earnings, dividends and book value, he believes the price earnings, price-to-book and dividend yield of companies are at the same levels or lower than in 2011, before the recent stockmarket rally, which supports Sustainable Capital’s value-based approach to investing. ...

... Based on 2012 estimated company earnings, dividends and book value, he believes the price earnings, price-to-book and dividend yield of companies are at the same levels or lower than in 2011, before the recent stockmarket rally, which supports Sustainable Capital’s value-based approach to investing. ...

Dynamic Global Value Fund Series G

... amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult their financial advisor before makin ...

... amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfolio size, income, investment knowledge and attitude toward price fluctuations. Investors should consult their financial advisor before makin ...

Socially Responsive Investment Fund

... criteria described above and that are not involved in industries which are considered strategically important to keeping repressive regimes in place. Community Development The Fund will seek out opportunities to invest in local businesses and organizations that improve the quality of life for low an ...

... criteria described above and that are not involved in industries which are considered strategically important to keeping repressive regimes in place. Community Development The Fund will seek out opportunities to invest in local businesses and organizations that improve the quality of life for low an ...

SEBI (Venture Capital Funds) Regulations, 1996

... AIF shall have a minimum corpus of Rs 20 crore The fund or any of its scheme shall not have more than 1,000 investors AIF shall not accept investment of value less than Rs. 1 cr from an investor Not to invest more than 25% of funds in one investee company AIFs shall not invest in associate ...

... AIF shall have a minimum corpus of Rs 20 crore The fund or any of its scheme shall not have more than 1,000 investors AIF shall not accept investment of value less than Rs. 1 cr from an investor Not to invest more than 25% of funds in one investee company AIFs shall not invest in associate ...

STATE OF WISCONSIN INVESTMENT BOARD PORTFOLIO

... STATE OF WISCONSIN INVESTMENT BOARD PORTFOLIO PERFORMANCE WITH BENCHMARKS PERIODS ENDING 6/30/16 ANNUALIZED RETURNS (%) ...

... STATE OF WISCONSIN INVESTMENT BOARD PORTFOLIO PERFORMANCE WITH BENCHMARKS PERIODS ENDING 6/30/16 ANNUALIZED RETURNS (%) ...

Strong first year for Smartfund 80% Protected

... “We believe that Smartfund 80% Protected is ideal for clients who are reluctant to take risks with their investments, such as investors approaching or in retirement. Smartfund 80% Protected offers an alternative to low-risk investments that may not deliver a client’s financial objectives in the cur ...

... “We believe that Smartfund 80% Protected is ideal for clients who are reluctant to take risks with their investments, such as investors approaching or in retirement. Smartfund 80% Protected offers an alternative to low-risk investments that may not deliver a client’s financial objectives in the cur ...

Pension Fund Management Private Client Investment Portfolios

... Datvest offers managed investment portfolio services and focuses on property based investments, fixed income investments and equity based investments. We are targeted at individuals and institutions who intend to have their own portfolios were they can track the fixed income investments placed on th ...

... Datvest offers managed investment portfolio services and focuses on property based investments, fixed income investments and equity based investments. We are targeted at individuals and institutions who intend to have their own portfolios were they can track the fixed income investments placed on th ...

Summary of Investments

... investments with NCMF. MHCO assets invested with NCMF are diversified between the Stock Fund and the Income Fund currently at a ratio of 72.6% stock and 27.4% fixed income, as of March 31, 2016, with the total current value of MHCO owned investments at $20,300,402.55. The investment ratio fluctuates ...

... investments with NCMF. MHCO assets invested with NCMF are diversified between the Stock Fund and the Income Fund currently at a ratio of 72.6% stock and 27.4% fixed income, as of March 31, 2016, with the total current value of MHCO owned investments at $20,300,402.55. The investment ratio fluctuates ...

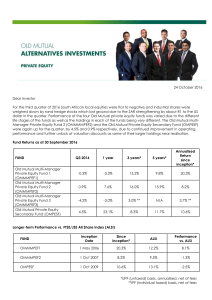

24 October 2016 Dear Investor For the third quarter of 2016 South

... OMMMPEF1 has made four cash distribution to date. As investors have had the benefit of receiving cash proceeds from the fund, we believe it more appropriate to calculate the since-inception returns for OMMMPEF1 on an internal rate of return (IRR) or money-weighted basis (all other performance calcul ...

... OMMMPEF1 has made four cash distribution to date. As investors have had the benefit of receiving cash proceeds from the fund, we believe it more appropriate to calculate the since-inception returns for OMMMPEF1 on an internal rate of return (IRR) or money-weighted basis (all other performance calcul ...

tom steinert-threlkeld

... Investors pull out of his PIMCO Total Return Fund for first time. $5 billion redeemed from the world’s largest mutual fund in ...

... Investors pull out of his PIMCO Total Return Fund for first time. $5 billion redeemed from the world’s largest mutual fund in ...