KSCVX Cusip Change 12 31 07

... In an effort to enhance operating efficiency and product offerings, the Keeley Funds implemented the following changes to their family of funds effective December 31, 2007. 1 - The Keeley Small Cap Value Fund, Inc. was merged into a newly created series of the Keeley Funds, Inc., the KEELEY Small Ca ...

... In an effort to enhance operating efficiency and product offerings, the Keeley Funds implemented the following changes to their family of funds effective December 31, 2007. 1 - The Keeley Small Cap Value Fund, Inc. was merged into a newly created series of the Keeley Funds, Inc., the KEELEY Small Ca ...

Factsheet Total Emerging Markets Fund Class I USD

... †† For each fund with a 3-year history, a Morningstar Rating® is calculated based on risk-adjusted returns that account for variations in a fund’s monthly performance (including sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding consistent performan ...

... †† For each fund with a 3-year history, a Morningstar Rating® is calculated based on risk-adjusted returns that account for variations in a fund’s monthly performance (including sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding consistent performan ...

Choosing an International Fund, Part 2

... A few years ago, style wasn't an issue for foreign-stock funds. Most funds bought reasonably priced stocks of the world's largest companies. After all, international-investing pioneers such as Sir John Templeton and the managers at Scudder had profited for decades on such strategies. In the 1990s, t ...

... A few years ago, style wasn't an issue for foreign-stock funds. Most funds bought reasonably priced stocks of the world's largest companies. After all, international-investing pioneers such as Sir John Templeton and the managers at Scudder had profited for decades on such strategies. In the 1990s, t ...

CIS Schroder Recovery Pension

... The scheme's investment objective is to achieve capital growth for investors through investment in companies that have suffered a setback. The fund invests primarily in UK quoted shares. The investments are selected from those companies that have suffered a severe setback in terms of profits or shar ...

... The scheme's investment objective is to achieve capital growth for investors through investment in companies that have suffered a setback. The fund invests primarily in UK quoted shares. The investments are selected from those companies that have suffered a severe setback in terms of profits or shar ...

Commonwealth Global Fund

... of the portfolios for the Australia/New Zealand Fund, the Africa Fund, the Japan Fund, the Global Fund and the Real Estate Securities Fund. Additionally, Mr. Scharar is President and Director of FCA Corp and has primarily worked in this capacity since 1975. Mr. Scharar received his AA degree from Po ...

... of the portfolios for the Australia/New Zealand Fund, the Africa Fund, the Japan Fund, the Global Fund and the Real Estate Securities Fund. Additionally, Mr. Scharar is President and Director of FCA Corp and has primarily worked in this capacity since 1975. Mr. Scharar received his AA degree from Po ...

TEMPLETON GLOBAL SMALLER COMPANIES FUND

... currency fluctuations. Performance figures above are for A(Ydis) shares, except where only A(acc) shares are available, then A(acc) performance is shown. 2. Chart Performance figures are rebased to 100 at beginning of time period. 3. The portfolio manager for the Fund reserves the right to withhold ...

... currency fluctuations. Performance figures above are for A(Ydis) shares, except where only A(acc) shares are available, then A(acc) performance is shown. 2. Chart Performance figures are rebased to 100 at beginning of time period. 3. The portfolio manager for the Fund reserves the right to withhold ...

SEC amends Rule 2a-7 to eliminate dependency on NRSRO ratings

... references to credit ratings issued by nationally recognized statistical rating organizations (NRSROs). The SEC adopted these amendments (NRSRO Amendments) in response to a Dodd-Frank Wall Street Reform and Consumer Protection Act mandate that the SEC end reliance on NRSRO ratings in its rules. Rule ...

... references to credit ratings issued by nationally recognized statistical rating organizations (NRSROs). The SEC adopted these amendments (NRSRO Amendments) in response to a Dodd-Frank Wall Street Reform and Consumer Protection Act mandate that the SEC end reliance on NRSRO ratings in its rules. Rule ...

Hedge against Rising Interest Rates with QAI

... The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be ...

... The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be ...

Activity 2:

... elaborating the strategy for the venture capital funds creation. BIC Bratislava has presented the Israeli experience of the Venture capital industry creation, the experience of the Latvian Ministry of Economy with the VC funds creation and the own results coming out of the ESTER project, e.g. the de ...

... elaborating the strategy for the venture capital funds creation. BIC Bratislava has presented the Israeli experience of the Venture capital industry creation, the experience of the Latvian Ministry of Economy with the VC funds creation and the own results coming out of the ESTER project, e.g. the de ...

05 HF DGHM ACV MAY 2011

... AT&T INC COM JPMORGAN CHASE & CO COM ALEXANDRIA REAL ESTATE EQ INC COM FRANKLIN RES INC COM ...

... AT&T INC COM JPMORGAN CHASE & CO COM ALEXANDRIA REAL ESTATE EQ INC COM FRANKLIN RES INC COM ...

Federated Mid-Cap Index Fund

... comprise the mid-level stock capitalization sector of the United States equity market. The fund normally invests its assets primarily in common stocks included in the Standard & Poor's MidCap 400 Index. It may invest in derivatives contracts (such as, for example, futures contracts, option contracts ...

... comprise the mid-level stock capitalization sector of the United States equity market. The fund normally invests its assets primarily in common stocks included in the Standard & Poor's MidCap 400 Index. It may invest in derivatives contracts (such as, for example, futures contracts, option contracts ...

Perkins Mid Cap Value Fund (Class S)

... Perkins Mid Cap Value Fund (Class S) As of December 31, 2015 Category: Mid-Cap Value Some mid-cap value funds focus on medium-size companies while others land here because they own a mix of small-, mid-, and large-cap stocks. All look for stocks that are less expensive or growing more slowly than th ...

... Perkins Mid Cap Value Fund (Class S) As of December 31, 2015 Category: Mid-Cap Value Some mid-cap value funds focus on medium-size companies while others land here because they own a mix of small-, mid-, and large-cap stocks. All look for stocks that are less expensive or growing more slowly than th ...

Hedge Fund Vs Mutual Fund

... already rich. Hedge funds are open only to 'accredited investors' defined as those with net worth of more than $1.5 million, or income in excess of $200,000 in each of the past two years. The good ones demand $1 million or more of investment. ...

... already rich. Hedge funds are open only to 'accredited investors' defined as those with net worth of more than $1.5 million, or income in excess of $200,000 in each of the past two years. The good ones demand $1 million or more of investment. ...

OrbiMed Advisors Offers `One-Stop Shop` for Health

... larger venture funds and a series of specialized pools aimed at Asia, Israel and credit/royalty investments. The New York firm’s newest partnership, which closed in December with $950 million in limited partner and $25 million in general partner commitments, respectively, surpasses a $900.5 million ...

... larger venture funds and a series of specialized pools aimed at Asia, Israel and credit/royalty investments. The New York firm’s newest partnership, which closed in December with $950 million in limited partner and $25 million in general partner commitments, respectively, surpasses a $900.5 million ...

Click to download Firth AVF September 2014

... democracy demonstrations and continued political difficulties on its economy which is of most interest. While stocks listed in Hong Kong are a large proportion of the portfolio, Hong Kong domestic demand, as measured by sales, probably accounts only for about 7% of our fund. The Hong Kong economy is ...

... democracy demonstrations and continued political difficulties on its economy which is of most interest. While stocks listed in Hong Kong are a large proportion of the portfolio, Hong Kong domestic demand, as measured by sales, probably accounts only for about 7% of our fund. The Hong Kong economy is ...

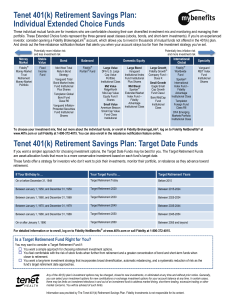

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... You may want to consider a Target Retirement Fund if: You want a simple approach for choosing retirement investment options. You feel comfortable with the risk of stock funds when further from retirement and a greater concentration of bond and short-term funds when closer to retirement. You wa ...

... You may want to consider a Target Retirement Fund if: You want a simple approach for choosing retirement investment options. You feel comfortable with the risk of stock funds when further from retirement and a greater concentration of bond and short-term funds when closer to retirement. You wa ...

FT One of the few active operators

... “Provided that it is a core asset that ticks all those boxes, the thought of falling values is not stopping them from buying now.” The ambitions of the open-ended funds are not limited to London. CB Richard Ellis research estimates that the funds collectively have €22bn to spend on property. The Asi ...

... “Provided that it is a core asset that ticks all those boxes, the thought of falling values is not stopping them from buying now.” The ambitions of the open-ended funds are not limited to London. CB Richard Ellis research estimates that the funds collectively have €22bn to spend on property. The Asi ...

Chapter 18

... Investment Objectives and Policies Portfolio (or “Investment Holdings”) Management Fees and Expenses ...

... Investment Objectives and Policies Portfolio (or “Investment Holdings”) Management Fees and Expenses ...

Overview Presentation

... This document is for information purposes only and does not constitute a solicitation to buy or sell securities. The information in this report is confidential. It is not to be reproduced or distributed to any other person except to the client’s professional advisers. While information used in this ...

... This document is for information purposes only and does not constitute a solicitation to buy or sell securities. The information in this report is confidential. It is not to be reproduced or distributed to any other person except to the client’s professional advisers. While information used in this ...

BT Smaller Companies Fund

... Performance returns are calculated net of ICR (Management Fees) and pre tax. Past performance is not a reliable indicator of future performance, the value of your investment can go up and down. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Tota ...

... Performance returns are calculated net of ICR (Management Fees) and pre tax. Past performance is not a reliable indicator of future performance, the value of your investment can go up and down. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Tota ...