Russell Continental European Equity Fund

... The fund benchmark is the FTSE World Europe ex-UK Index. A Multi-Manager fund, suitable for institutional investors. Actively managed fund with 100% equity content. Aims for consistent performance with lower levels of risk. Managed from the point of view of a European institutional investor. Investm ...

... The fund benchmark is the FTSE World Europe ex-UK Index. A Multi-Manager fund, suitable for institutional investors. Actively managed fund with 100% equity content. Aims for consistent performance with lower levels of risk. Managed from the point of view of a European institutional investor. Investm ...

Comment on a National Securities Regulator

... What has been completely overlooked in all the battling over the issue of a national securities regulator is how the dealers and persons who actually distribute and trade in securities on behalf of retail, corporate and institutional investors are regulated. The community of investment and mutual fu ...

... What has been completely overlooked in all the battling over the issue of a national securities regulator is how the dealers and persons who actually distribute and trade in securities on behalf of retail, corporate and institutional investors are regulated. The community of investment and mutual fu ...

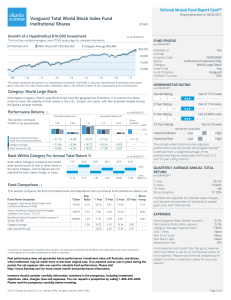

Vanguard Total World Stock Index Fund Institutional Shares

... Morningstar, Inc., has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933. Mutual Fund OneSource® funds have no loads and generally have no transaction fees. Funds appearing on the Mutual Fund OneSource® Select List are chosen based on a formula that c ...

... Morningstar, Inc., has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933. Mutual Fund OneSource® funds have no loads and generally have no transaction fees. Funds appearing on the Mutual Fund OneSource® Select List are chosen based on a formula that c ...

Asia Investment Grade Bond Fund

... The fund is a sub-fund of Nomura Funds Ireland plc, which is authorised by the Central Bank of Ireland as an open-ended umbrella investment company with variable capital and segregated liability between its sub-funds, established as an undertaking for Collective Investment in Transferable Securities ...

... The fund is a sub-fund of Nomura Funds Ireland plc, which is authorised by the Central Bank of Ireland as an open-ended umbrella investment company with variable capital and segregated liability between its sub-funds, established as an undertaking for Collective Investment in Transferable Securities ...

CIT Investment Discl..

... The Funds may be an appropriate investment for investors seeking professional management of their retirement account assets. Fund Investments and Risks of Investing in the Funds Under normal market conditions, each Fund invests primarily in US and foreign stocks, bonds, private investment funds and ...

... The Funds may be an appropriate investment for investors seeking professional management of their retirement account assets. Fund Investments and Risks of Investing in the Funds Under normal market conditions, each Fund invests primarily in US and foreign stocks, bonds, private investment funds and ...

American Funds Bond Fund

... Variable annuities are long-term investments designed for retirement purposes. MetLife Variable life insurance and annuity products have limitations, exclusions, charges, termination provisions and terms for keeping them in force. There is no guarantee that any of the variable investments options in ...

... Variable annuities are long-term investments designed for retirement purposes. MetLife Variable life insurance and annuity products have limitations, exclusions, charges, termination provisions and terms for keeping them in force. There is no guarantee that any of the variable investments options in ...

05 HF LCG MAY 2009

... presentation incomplete without accompanying footnotes as shown at www.dsmcapital.com (c) Total return including dividends. (d) The fund is registered with the AFM for public distribution in the Netherlands (e) Share Class C is German tax registered from 4/1/08. (f) Share Class U has UK Distributor ...

... presentation incomplete without accompanying footnotes as shown at www.dsmcapital.com (c) Total return including dividends. (d) The fund is registered with the AFM for public distribution in the Netherlands (e) Share Class C is German tax registered from 4/1/08. (f) Share Class U has UK Distributor ...

Sales Aid

... the UK Financial Services Conduct of Business Sourcebook. All or most of the protection provided by the UK regulatory system does not apply to investments in the Company and compensation will not be available under the UK Financial Services Compensation Scheme. An investment in the Company entails r ...

... the UK Financial Services Conduct of Business Sourcebook. All or most of the protection provided by the UK regulatory system does not apply to investments in the Company and compensation will not be available under the UK Financial Services Compensation Scheme. An investment in the Company entails r ...

Columbia Limited Duration Credit Fund

... and yield. These risks may be heightened for longer maturity and duration securities. Non-investment-grade securities (high-yield or junk bonds) are volatile and carry more risk to principal and income than investment-grade securities. Prepayment and extension risk exists because a loan, bond or oth ...

... and yield. These risks may be heightened for longer maturity and duration securities. Non-investment-grade securities (high-yield or junk bonds) are volatile and carry more risk to principal and income than investment-grade securities. Prepayment and extension risk exists because a loan, bond or oth ...

Do Presidential Elections Impact the Market?

... An investment in FlexShares is subject to investment risk, including the possible loss of principal amount invested. Funds’ returns may not match the returns of their respective Indexes. The Funds may invest in emerging and foreign markets, derivatives and concentrated sectors. In addition, the Fund ...

... An investment in FlexShares is subject to investment risk, including the possible loss of principal amount invested. Funds’ returns may not match the returns of their respective Indexes. The Funds may invest in emerging and foreign markets, derivatives and concentrated sectors. In addition, the Fund ...

A Dynamic Blend of Global Stocks and Bonds

... On the equity side, the fund seeks stocks priced below their intrinsic value, with dividend yield also an important criterion. On the fixed income side, the fund identifies opportunities based on fundamental analysis of interest rates, exchange rates and yield spreads. ...

... On the equity side, the fund seeks stocks priced below their intrinsic value, with dividend yield also an important criterion. On the fixed income side, the fund identifies opportunities based on fundamental analysis of interest rates, exchange rates and yield spreads. ...

March 2015 AULIEN S.C.A., Sicav

... The latest GDP figures have shown a US economy slowing down (from approx. 4% in Q3 to around 2.5% in Q4 while Europe’s growth is accelerating (so far modestly) with encouraging figures once again from Germany. The consensus believes these trends will continue during 2015 with Europe benefitting from ...

... The latest GDP figures have shown a US economy slowing down (from approx. 4% in Q3 to around 2.5% in Q4 while Europe’s growth is accelerating (so far modestly) with encouraging figures once again from Germany. The consensus believes these trends will continue during 2015 with Europe benefitting from ...

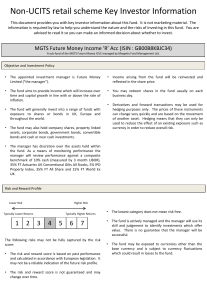

Document

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

Telegraph fund focus

... Should you invest - and what are the alternatives? Mark Slater deserves credit for his stock selection over the years, according to Ben Willis of Whitechurch Securities, but the MFM SlaterGrowth fund must be considered a long-term hold. Mr Slater can invest in smaller companies and firms listed on t ...

... Should you invest - and what are the alternatives? Mark Slater deserves credit for his stock selection over the years, according to Ben Willis of Whitechurch Securities, but the MFM SlaterGrowth fund must be considered a long-term hold. Mr Slater can invest in smaller companies and firms listed on t ...

1 climate assets fund quarterly update - q1 2017

... investment. Please refer to the Prospectus and Key Investor Information documents for further details, available free of charge from the Authorised Corporate Director (‘ACD’) Thesis Unit Trust Management Ltd, Exchange Building, St John's Street, Chichester, West Sussex, PO19 1UP. These documents are ...

... investment. Please refer to the Prospectus and Key Investor Information documents for further details, available free of charge from the Authorised Corporate Director (‘ACD’) Thesis Unit Trust Management Ltd, Exchange Building, St John's Street, Chichester, West Sussex, PO19 1UP. These documents are ...

Al Beit Al Mali Fund Al-Beit Al Mali Fund

... in the MSCI Emerging Market Index, with an increase in China’s weight causing a decline in other country weights. Also, important to note that the market’s -4.8% decline on the last trading day was driven by some last minute aggressive selling. Most of this was reversed on the following day. Looking ...

... in the MSCI Emerging Market Index, with an increase in China’s weight causing a decline in other country weights. Also, important to note that the market’s -4.8% decline on the last trading day was driven by some last minute aggressive selling. Most of this was reversed on the following day. Looking ...

Absa Multi Managed Bond Fund - Absa | Wealth And Investment

... Collective Investment Schemes (CIS) are generally medium to long-term investments. The value of participatory interests may go down as well as up and past performance is not necessarily a guide to future performance. Fluctuations or movements in exchange rates may cause the value of underlying inter ...

... Collective Investment Schemes (CIS) are generally medium to long-term investments. The value of participatory interests may go down as well as up and past performance is not necessarily a guide to future performance. Fluctuations or movements in exchange rates may cause the value of underlying inter ...

Canadian Responsible Investment Mutual Funds Risk / Return

... and should not be relied upon as providing, legal, accounting, tax, financial, investment or other advice, or a solicitation to buy or sell any securities. Economic and market conditions are subject to change. The information was obtained from sources believed to be reliable, but is not guaranteed t ...

... and should not be relied upon as providing, legal, accounting, tax, financial, investment or other advice, or a solicitation to buy or sell any securities. Economic and market conditions are subject to change. The information was obtained from sources believed to be reliable, but is not guaranteed t ...

Vanguard Developed All-Cap ex North America Equity Index Pooled

... This document is for informational purposes only regarding the Vanguard Index Pooled Funds. It is not a recommendation or solicitation to buy, hold or sell any security, including any securities of the funds. The information is not investment advice, nor is it tailored to the needs or circumstances ...

... This document is for informational purposes only regarding the Vanguard Index Pooled Funds. It is not a recommendation or solicitation to buy, hold or sell any security, including any securities of the funds. The information is not investment advice, nor is it tailored to the needs or circumstances ...

continued from cover - Association Reserves

... Select individual securities that have maturities of one to five years. Structure these maturities so that an approximately equal proportion comes due every month. With matured funds, consistently purchase securities at the long end of the maturity range. The Board may reduce the longest maturity as ...

... Select individual securities that have maturities of one to five years. Structure these maturities so that an approximately equal proportion comes due every month. With matured funds, consistently purchase securities at the long end of the maturity range. The Board may reduce the longest maturity as ...

Enhanced practice management

... of a mutual fund’s underperformance versus common market indexes. ...

... of a mutual fund’s underperformance versus common market indexes. ...

PIMCO VIT Income Portfolio — Advisor Class

... PIMCO VIT Income Portfolio — Advisor Class Investment Strategy from investment’s prospectus The investment seeks to maximize current income; long-term capital appreciation is a secondary objective. The portfolio seeks to achieve its investment objectives by investing under normal circumstances at le ...

... PIMCO VIT Income Portfolio — Advisor Class Investment Strategy from investment’s prospectus The investment seeks to maximize current income; long-term capital appreciation is a secondary objective. The portfolio seeks to achieve its investment objectives by investing under normal circumstances at le ...

Impact Portfolio - RSF Social Finance

... The Impact Portfolio invests in institutional-quality funds and asset managers that generate competitive risk adjusted returns through investments that directly address global challenges in the areas of climate change, resource depletion, poverty, disease and illness, and corporate responsibility. T ...

... The Impact Portfolio invests in institutional-quality funds and asset managers that generate competitive risk adjusted returns through investments that directly address global challenges in the areas of climate change, resource depletion, poverty, disease and illness, and corporate responsibility. T ...

Key Investor Information Franklin Global Aggregate Investment

... Credit risk: the risk of loss arising from default that may occur if an issuer fails to make principal or interest payments when due. This risk is higher if the Fund holds low-rated, non-investment-grade securities. Currency risk: the risk of loss arising from exchange-rate fluctuations or due to ex ...

... Credit risk: the risk of loss arising from default that may occur if an issuer fails to make principal or interest payments when due. This risk is higher if the Fund holds low-rated, non-investment-grade securities. Currency risk: the risk of loss arising from exchange-rate fluctuations or due to ex ...

Saving and Investing on a Shoestring: Finding Money to Save

... Debra Pankow, Ph.D., family economics specialist, and Marina Serdiouk, graduate student ...

... Debra Pankow, Ph.D., family economics specialist, and Marina Serdiouk, graduate student ...