Franklin Quotential Balanced Income Portfolio Series A

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

LargeCap Growth Fund II (J) as of 03/31/2017

... Investors should carefully consider a fund’s investment objectives, risks, charges, and expenses prior to investing. A prospectus, or summary prospectus if available, containing this and other information can be obtained by contacting a financial professional, visiting principalfunds.com, or calling ...

... Investors should carefully consider a fund’s investment objectives, risks, charges, and expenses prior to investing. A prospectus, or summary prospectus if available, containing this and other information can be obtained by contacting a financial professional, visiting principalfunds.com, or calling ...

NVIT Large Cap Growth Fund — Class I

... NVIT Large Cap Growth Fund — Class I Investment Strategy from investment’s prospectus The investment seeks long-term capital growth. The fund invests at least 80% of its net assets in common stocks issued by large-cap companies, utilizing a growth style of investing. It seeks companies whose earning ...

... NVIT Large Cap Growth Fund — Class I Investment Strategy from investment’s prospectus The investment seeks long-term capital growth. The fund invests at least 80% of its net assets in common stocks issued by large-cap companies, utilizing a growth style of investing. It seeks companies whose earning ...

MBS Total Return Fund

... (1) Year To Date (2) The 30 Day SEC Yield is a standardized yield which is calculated based on a 30-day period ending on the last day of the previous month. It is computed by dividing the net investment income per share earned during the period by the maximum offering price per share on the last day ...

... (1) Year To Date (2) The 30 Day SEC Yield is a standardized yield which is calculated based on a 30-day period ending on the last day of the previous month. It is computed by dividing the net investment income per share earned during the period by the maximum offering price per share on the last day ...

Exploiting Inefficiencies Across Asset Classes, Globally

... This article seeks to highlight the benefits of looking outside a rigid benchmark-constrained approach, to access the broadest possible opportunity set in our universe. At any given point in time, compelling value can be found in selected CEF subsectors and we believe institutional investors, high n ...

... This article seeks to highlight the benefits of looking outside a rigid benchmark-constrained approach, to access the broadest possible opportunity set in our universe. At any given point in time, compelling value can be found in selected CEF subsectors and we believe institutional investors, high n ...

Nuveen Small Cap Value Fund

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund's investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility t ...

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund's investment objectives will be achieved. Prices of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility t ...

Putnam New Flag Euro High Yield Fund

... recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions at net asset value (NAV), and reflects fund operating expenses, such as management ...

... recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions at net asset value (NAV), and reflects fund operating expenses, such as management ...

When Selecting Stocks, He Knows No Boundaries

... mostly absent in the industry. He thought that mutual funds that had to adhere to certain categories, such as value or small-cap, were limited in what they could do for investors. The Encompass Fund is designed to be agile. Mr. Gissen and Mr. Berol can take it wherever they believe the market is fer ...

... mostly absent in the industry. He thought that mutual funds that had to adhere to certain categories, such as value or small-cap, were limited in what they could do for investors. The Encompass Fund is designed to be agile. Mr. Gissen and Mr. Berol can take it wherever they believe the market is fer ...

Q1: What is your reading of the state of Indian economy

... build-out will ensure that the domestic manufacturing sector does well on a multi-year basis. Tax collection numbers are quite buoyant. While the economy is unlikely to grow at the 9% pace seen in the recent past, we believe that GDP growth is likely to be at around 8% for FY09 which is quite robust ...

... build-out will ensure that the domestic manufacturing sector does well on a multi-year basis. Tax collection numbers are quite buoyant. While the economy is unlikely to grow at the 9% pace seen in the recent past, we believe that GDP growth is likely to be at around 8% for FY09 which is quite robust ...

Mutual Fund Distributions of Tax-Exempt Interest and Capital Gains

... This release relates to the taxation of dividends and capital gains that taxpayers receive from investing in sales of mutual funds, which in turn invest in state and local obligations. What follows is a brief explanation of the federal law on the taxation of mutual funds and an explanation of Maryla ...

... This release relates to the taxation of dividends and capital gains that taxpayers receive from investing in sales of mutual funds, which in turn invest in state and local obligations. What follows is a brief explanation of the federal law on the taxation of mutual funds and an explanation of Maryla ...

Fund Performance - 13D Activist Fund

... could subject the Fund to greater risks including, currency fluctuation, economic conditions, and different governmental and accounting standards. There is neither a front end load nor a deferred sales charge for the 13D Activist Fund I Class Shares. The A Class shares are subject to a maximum front ...

... could subject the Fund to greater risks including, currency fluctuation, economic conditions, and different governmental and accounting standards. There is neither a front end load nor a deferred sales charge for the 13D Activist Fund I Class Shares. The A Class shares are subject to a maximum front ...

Key Investor Information AMP Capital Global Listed Infrastructure

... > This indicator is based on historical data and may not be a reliable indicator of the future risk profile of the Fund. > This risk category shown is not a target or a guarantee and may change over time. > The lowest category does not mean risk free. > The risk indicator for this Fund is set as 6 b ...

... > This indicator is based on historical data and may not be a reliable indicator of the future risk profile of the Fund. > This risk category shown is not a target or a guarantee and may change over time. > The lowest category does not mean risk free. > The risk indicator for this Fund is set as 6 b ...

Fixed Interest Fund - Irish Life Corporate Business

... This fund should broadly follow the long-term changes in annuity Style prices due to interest rates, i.e. if long-term interest rates fall, the value of this fund will increase to roughly compensate for the rise Size in annuity prices. Long-term interest rates are just one of the main factors that d ...

... This fund should broadly follow the long-term changes in annuity Style prices due to interest rates, i.e. if long-term interest rates fall, the value of this fund will increase to roughly compensate for the rise Size in annuity prices. Long-term interest rates are just one of the main factors that d ...

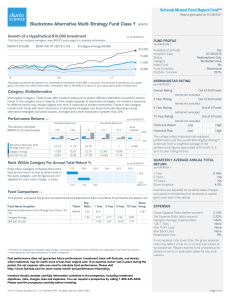

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... Morningstar, Inc., has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933. Mutual Fund OneSource® funds have no loads and generally have no transaction fees. Funds appearing on the Mutual Fund OneSource® Select List are chosen based on a formula that c ...

... Morningstar, Inc., has not granted consent for it to be considered or deemed an "expert" under the Securities Act of 1933. Mutual Fund OneSource® funds have no loads and generally have no transaction fees. Funds appearing on the Mutual Fund OneSource® Select List are chosen based on a formula that c ...

pax small cap fund

... Small Cap Core Funds Average is a total return performance average of the mutual funds tracked by Lipper, Inc. that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a threeyear weighted basis) below Lipper’s USDE small-cap ceiling. Small ...

... Small Cap Core Funds Average is a total return performance average of the mutual funds tracked by Lipper, Inc. that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a threeyear weighted basis) below Lipper’s USDE small-cap ceiling. Small ...

Stable Value Fund

... Are there any limitations on contributions, withdrawals, or transfers from my plan’s stable value option? Generally, there are no limitations on contributions to or withdrawals from the Fund as a result of retirement, death, disability, unforeseen hardship, separation from service, or attainment of ...

... Are there any limitations on contributions, withdrawals, or transfers from my plan’s stable value option? Generally, there are no limitations on contributions to or withdrawals from the Fund as a result of retirement, death, disability, unforeseen hardship, separation from service, or attainment of ...

Guidelines for Transfers of Registered Plans

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

... Chartered banks will endeavour to process transfers of deposit type registered plans in a maximum of seven (7) business days normally and twelve (12) business days during peak time (February 15 - March 31) from the date the bank receives the complete and accurate documentation (whether at the branch ...

Richmond ETF update

... such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the impl ...

... such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the impl ...

Emerging Markets Equity Corporate Class

... Assante Wealth Management’s 800 advisors in more than 300 locations across Canada have exclusive access to the customized United Financial brand of solutions, Evolution Private Managed Accounts and Optima Strategy, managed by CI Investments Inc. For high net worth clients with ...

... Assante Wealth Management’s 800 advisors in more than 300 locations across Canada have exclusive access to the customized United Financial brand of solutions, Evolution Private Managed Accounts and Optima Strategy, managed by CI Investments Inc. For high net worth clients with ...

Stocks and Investment - The Independent School

... • Bond mutual funds – Bond mutual funds are funds which invest a majority of their assets in bonds of specific types of companies or institutions – These funds generally have a specific objective, i.e. “corporate,” “government”, “municipals,” “growth,”, etc. which relates to the types of bonds the m ...

... • Bond mutual funds – Bond mutual funds are funds which invest a majority of their assets in bonds of specific types of companies or institutions – These funds generally have a specific objective, i.e. “corporate,” “government”, “municipals,” “growth,”, etc. which relates to the types of bonds the m ...

TA Aegon US Government Securities

... Alpha is a coefficient measuring the portion of a fund’s return arising from specific (non-market) risk. Beta illustrates a fund’s sensitivity to price movements in relation to a benchmark index. R-Squared is a statistical measure that represents the percentage of a fund’s movements that can be expl ...

... Alpha is a coefficient measuring the portion of a fund’s return arising from specific (non-market) risk. Beta illustrates a fund’s sensitivity to price movements in relation to a benchmark index. R-Squared is a statistical measure that represents the percentage of a fund’s movements that can be expl ...

Invesco High Yield Municipal Fund fact sheet

... Class Y shares are available only to certain investors. See the prospectus for more information. Asset allocation/diversification does not guarantee a profit or eliminate the risk of loss. Income may be subject to state and local taxes. There is no guarantee that the fund’s income will be exempt fro ...

... Class Y shares are available only to certain investors. See the prospectus for more information. Asset allocation/diversification does not guarantee a profit or eliminate the risk of loss. Income may be subject to state and local taxes. There is no guarantee that the fund’s income will be exempt fro ...

Five-Year Ranking: Pimco Leads 10

... do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods shown. Absent ...

... do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods shown. Absent ...

Wells Fargo Funds to merge certain funds

... This is not an offer to sell or a solicitation of an offer to buy shares of any investment company, nor is it a solicitation of any proxy. Additional information and where to find it In connection with the proposed transactions, in March, the merging funds will file a preliminary prospectus/proxy s ...

... This is not an offer to sell or a solicitation of an offer to buy shares of any investment company, nor is it a solicitation of any proxy. Additional information and where to find it In connection with the proposed transactions, in March, the merging funds will file a preliminary prospectus/proxy s ...

Call: June 19, 2015 AFFIDAVIT SAMPLE Contact Person

... 4. - The fund has at least 20% of the target fund size in hard commitments from investors, as included in the table below. Portfolio contributions, as well as any other non-monetary contributions, will not be considered valid for this purpose. Commitments must be represented by a signed letter of in ...

... 4. - The fund has at least 20% of the target fund size in hard commitments from investors, as included in the table below. Portfolio contributions, as well as any other non-monetary contributions, will not be considered valid for this purpose. Commitments must be represented by a signed letter of in ...