Document

... Suppose that the number of buyers and sellers of municipal bonds decreases substantially. The result should be a (an) (a) increase in the prices of municipal bonds. (b) decrease in the prices of municipal bonds. (c) increase in U.S. Treasury bond yields. (d) decrease in the tax rate on municipal bon ...

... Suppose that the number of buyers and sellers of municipal bonds decreases substantially. The result should be a (an) (a) increase in the prices of municipal bonds. (b) decrease in the prices of municipal bonds. (c) increase in U.S. Treasury bond yields. (d) decrease in the tax rate on municipal bon ...

Selling Shares in Quicken

... If you sell your entire holding in a company, specifying lots is irrelevant. Instead, just tick the box ...

... If you sell your entire holding in a company, specifying lots is irrelevant. Instead, just tick the box ...

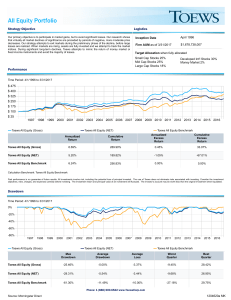

All Equity Portfolio

... sector of the U.S. equity market. Indices are not managed, and investors cannot invest directly in an index. Comparison of the Toews composite to the “market” is for illustrative purposes only. Investors should be aware that the referenced benchmarks may have a different composition, volatility, ris ...

... sector of the U.S. equity market. Indices are not managed, and investors cannot invest directly in an index. Comparison of the Toews composite to the “market” is for illustrative purposes only. Investors should be aware that the referenced benchmarks may have a different composition, volatility, ris ...

Barings Developed and Emerging Markets High Yield Bond

... The Fund will invest at least 70% of its assets in a combination of debt and loan securities (including credit linked securities) of corporations and governments (including any agency of government or central bank) of any member state of the Organisation for Economic Co-operation and Development (“O ...

... The Fund will invest at least 70% of its assets in a combination of debt and loan securities (including credit linked securities) of corporations and governments (including any agency of government or central bank) of any member state of the Organisation for Economic Co-operation and Development (“O ...

ProShares Profile EMDV

... Source: Ned Davis Research, based on an analysis of MSCI Emerging Markets stocks from 1/1/9612/31/16. Growth of a hypothetical $100 in emerging markets countries in the Americas, Europe, the Middle East, Africa and Asia, divided into: Dividend ...

... Source: Ned Davis Research, based on an analysis of MSCI Emerging Markets stocks from 1/1/9612/31/16. Growth of a hypothetical $100 in emerging markets countries in the Americas, Europe, the Middle East, Africa and Asia, divided into: Dividend ...

Financing Against Pledge of Investment Portfolio

... Interest rate on the capital use is calculated in accordance with provisions of section B14 of “ABLV Bank, AS, General Terms of Business” (NOT.001). Bank is entitled to unilaterally amend the financing conditions of the financial instrument included in a particular investment asset category, giving ...

... Interest rate on the capital use is calculated in accordance with provisions of section B14 of “ABLV Bank, AS, General Terms of Business” (NOT.001). Bank is entitled to unilaterally amend the financing conditions of the financial instrument included in a particular investment asset category, giving ...

The Process of Portfolio Management

... Hindsight is an inappropriate perspective for investment decision making • Everything you do as a portfolio manager must be logically justifiable at the time you do it • Everything you do as a portfolio manager must be ...

... Hindsight is an inappropriate perspective for investment decision making • Everything you do as a portfolio manager must be logically justifiable at the time you do it • Everything you do as a portfolio manager must be ...

Comprehensive Standard 3 - University of Louisville

... statements. All financial statements are prepared in accordance with generally accepted accounting standards as set forth by the Governmental Accounting Standards Board (GASB) or the Financial Accounting Standards Board (FASB). The controller’s office uses the standard reporting systems to generate ...

... statements. All financial statements are prepared in accordance with generally accepted accounting standards as set forth by the Governmental Accounting Standards Board (GASB) or the Financial Accounting Standards Board (FASB). The controller’s office uses the standard reporting systems to generate ...

Infrastructure Financing PowerPoint

... A developer may agree to provide land or to construct facilities of the type for which impact fees would be charged. In such cases the developer is entitled to receive a credit or reimbursement equal to the market value of the land or facilities provided which is subtracted from his impact fee bill. ...

... A developer may agree to provide land or to construct facilities of the type for which impact fees would be charged. In such cases the developer is entitled to receive a credit or reimbursement equal to the market value of the land or facilities provided which is subtracted from his impact fee bill. ...

4 Empirical Results. - Econ

... they generate misinformation. Thus the change in information is such that insiders do not change their holdings. Instead they mislead outsiders, resulting in an unanticipated change in the real assets held by outsiders. There is no expansion in the production possibility frontier, but instead an uni ...

... they generate misinformation. Thus the change in information is such that insiders do not change their holdings. Instead they mislead outsiders, resulting in an unanticipated change in the real assets held by outsiders. There is no expansion in the production possibility frontier, but instead an uni ...

Notification under AIFMD - Central Bank of Ireland

... If the AIF takes the form of an umbrella AIF with multiple compartments, AIFMs should only indicate the name of the compartments of the umbrella AIF notified for marketing. AIFMs should not indicate the name of the umbrella AIF. 2 Information on the depositary of the AIF should include the address o ...

... If the AIF takes the form of an umbrella AIF with multiple compartments, AIFMs should only indicate the name of the compartments of the umbrella AIF notified for marketing. AIFMs should not indicate the name of the umbrella AIF. 2 Information on the depositary of the AIF should include the address o ...

No Slide Title

... variety of maturities and payment provisions. At one extreme, the money market refers to fixedincome securities that are short term, highly marketable, and generally of very low risk. In contrast, the fixed income capital market includes long-term securities such as Treasury bonds, as well as bonds ...

... variety of maturities and payment provisions. At one extreme, the money market refers to fixedincome securities that are short term, highly marketable, and generally of very low risk. In contrast, the fixed income capital market includes long-term securities such as Treasury bonds, as well as bonds ...

Tsung Sheng Liu , Polaris Financial Group, Taiwan

... (2) Globalization, liberalization, lead to the new space in new financial products development. (3) Intensively market competition forces the investment trust companies to enhance its product development capability and level of internationalization ...

... (2) Globalization, liberalization, lead to the new space in new financial products development. (3) Intensively market competition forces the investment trust companies to enhance its product development capability and level of internationalization ...

Indexes and benchmarks made clear

... © 2017 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE TMX Global Debt Capital Markets Inc. and FTSE TMX Global Debt Capital Markets Limited (toget ...

... © 2017 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE TMX Global Debt Capital Markets Inc. and FTSE TMX Global Debt Capital Markets Limited (toget ...

Brochure - The Brookdale Group

... markets in the Sunbelt region of the United States. Brookdale seeks to invest in multiple office properties, diversified by geography and tenant profile. Brookdale also seeks investment opportunities where value can be enhanced through intensive asset management. ...

... markets in the Sunbelt region of the United States. Brookdale seeks to invest in multiple office properties, diversified by geography and tenant profile. Brookdale also seeks investment opportunities where value can be enhanced through intensive asset management. ...

Colfax CORP (Form: 11-K, Received: 06/19/2015 16:44:14)

... We have audited the accompanying statements of net assets available for benefits of the Colfax Corporation 401(k) Savings Plan Plus (the Plan) as of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These finan ...

... We have audited the accompanying statements of net assets available for benefits of the Colfax Corporation 401(k) Savings Plan Plus (the Plan) as of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These finan ...

RFP Questionnaire - Meketa Investment Group

... 19. Discuss your policy towards country allocations. Are country allocations targeted or are they a result of other decisions? Please give the minimum and/or maximum country allocation (at market value) you would have for an International Equity portfolio. 20. Describe your firm’s policy towards cur ...

... 19. Discuss your policy towards country allocations. Are country allocations targeted or are they a result of other decisions? Please give the minimum and/or maximum country allocation (at market value) you would have for an International Equity portfolio. 20. Describe your firm’s policy towards cur ...

Brief Summary of GASB 68

... closed period equal to the average remaining service of active and inactive plan members (who have no future service) — a much shorter than typical period. Investment gains and losses must be recognized in pension expense over closed 5-year periods. ...

... closed period equal to the average remaining service of active and inactive plan members (who have no future service) — a much shorter than typical period. Investment gains and losses must be recognized in pension expense over closed 5-year periods. ...

Crowdfunding - North American Securities Administrators Association

... strategy that began as a way for the public to donate small amounts of money, often through social networking websites, to help artists, musicians, filmmakers and other creative people finance their projects. ...

... strategy that began as a way for the public to donate small amounts of money, often through social networking websites, to help artists, musicians, filmmakers and other creative people finance their projects. ...

The Myths and Fallacies about Diversified Portfolios

... Claimants to the Holy Grail of diversification summarily dismiss the extension of this theory to Figure 2 and the conclusion that the most-efficient portfolios are combinations of the risk-free asset and a total market index fund. Their reasons for this dismissal are vague. Some cite the Roll critiq ...

... Claimants to the Holy Grail of diversification summarily dismiss the extension of this theory to Figure 2 and the conclusion that the most-efficient portfolios are combinations of the risk-free asset and a total market index fund. Their reasons for this dismissal are vague. Some cite the Roll critiq ...

U.S. Treasury Department Unveils New Reporting Requirement for

... The U.S. Government imposes a wide range of reporting requirements on U.S.-resident entities with regard to their cross-border transactions. The two largest systems of reporting are those of the Treasury Department and the Commerce Department. The Treasury Department’s forms are part of the Treasury ...

... The U.S. Government imposes a wide range of reporting requirements on U.S.-resident entities with regard to their cross-border transactions. The two largest systems of reporting are those of the Treasury Department and the Commerce Department. The Treasury Department’s forms are part of the Treasury ...

Investments

... available for sale with a previous fair vale of $9,700, and transfers them into the held-to-maturity category when the current market value of the debt securities is $9,500. Investment in Held-to-Maturity Debt ...

... available for sale with a previous fair vale of $9,700, and transfers them into the held-to-maturity category when the current market value of the debt securities is $9,500. Investment in Held-to-Maturity Debt ...

Financial Management: Principles and Applications

... Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 16) Organized security exchanges do not physically occupy space. Answer: FALSE Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 17) Explain how securities markets prov ...

... Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 16) Organized security exchanges do not physically occupy space. Answer: FALSE Diff: 1 Topic: 2.3 The Financial Marketplace: Securities Markets Keywords: stock exchanges 17) Explain how securities markets prov ...

budgetary fund balance

... The General Fund is used to account for and report all financial resources not accounted for and reported in another fund. ...

... The General Fund is used to account for and report all financial resources not accounted for and reported in another fund. ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.