SCHEDULE 13G Amendment No. 0 PIEDMONT OFFICE RLTY TR

... Hamilton, Bermuda, and various foreign-based subsidiaries provide investment advisory and management services to a number of non-U.S. investment companies and certain institutional investors. FIL, which is a qualified institution under section 240.13d-1(b)(1)(ii), is the beneficial owner of 3,894,80 ...

... Hamilton, Bermuda, and various foreign-based subsidiaries provide investment advisory and management services to a number of non-U.S. investment companies and certain institutional investors. FIL, which is a qualified institution under section 240.13d-1(b)(1)(ii), is the beneficial owner of 3,894,80 ...

THE TRUTH ABOUT THE DIFFERENCE BETWEEN

... With the rise of Exchange Traded Funds (ETFs), comparisons have been made with unit trusts as to which provides the optimal vehicle for retail investors. The reality, however, is that unit trusts and ETFs are two very different investment products and are not necessarily competitors in the retail in ...

... With the rise of Exchange Traded Funds (ETFs), comparisons have been made with unit trusts as to which provides the optimal vehicle for retail investors. The reality, however, is that unit trusts and ETFs are two very different investment products and are not necessarily competitors in the retail in ...

IBEW-NECA Stable Value Fund

... All material presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This is not to be construed as an offer to buy or sell any financial instruments and should not be relied upon as the sole factor in an investment making decision. As with all inve ...

... All material presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. This is not to be construed as an offer to buy or sell any financial instruments and should not be relied upon as the sole factor in an investment making decision. As with all inve ...

THE TRUTH ABOUT THE DIFFERENCE BETWEEN UNIT TRUSTS

... With the rise of Exchange Traded Funds (ETFs), comparisons have been made with unit trusts as to which provides the optimal vehicle for retail investors. The reality, however, is that unit trusts and ETFs are two very different investment products and are not necessarily competitors in the retail in ...

... With the rise of Exchange Traded Funds (ETFs), comparisons have been made with unit trusts as to which provides the optimal vehicle for retail investors. The reality, however, is that unit trusts and ETFs are two very different investment products and are not necessarily competitors in the retail in ...

Investment Account Tracking

... Perhaps you’ve had a brokerage account or a retirement fund as a benefit from an offfarm job, but haven’t used Quicken for any records associated with your investments. Maybe you have had some experience with mutual funds and decided now that you want to add individual stocks to your investment port ...

... Perhaps you’ve had a brokerage account or a retirement fund as a benefit from an offfarm job, but haven’t used Quicken for any records associated with your investments. Maybe you have had some experience with mutual funds and decided now that you want to add individual stocks to your investment port ...

Are Funds of Funds Simply Multi-Strategy

... in the summer of 2006. When Amaranth suffered a severe drawdown, it was reportedly managing over $9 billion in assets. Given the fact that all of the multi-strategy managers included in the Agarwal and Kale study collectively managed $34 billion in assets as of 2004, it is likely that this event wou ...

... in the summer of 2006. When Amaranth suffered a severe drawdown, it was reportedly managing over $9 billion in assets. Given the fact that all of the multi-strategy managers included in the Agarwal and Kale study collectively managed $34 billion in assets as of 2004, it is likely that this event wou ...

financial letter

... Remember, you have time on your side. Invest often—even if it’s only small amounts—and take advantage of long-term returns and the compound growth they offer. Get yourself started if you want to make sure you have some retirement revenue, no one is going to do it for you. Indicators point to signs t ...

... Remember, you have time on your side. Invest often—even if it’s only small amounts—and take advantage of long-term returns and the compound growth they offer. Get yourself started if you want to make sure you have some retirement revenue, no one is going to do it for you. Indicators point to signs t ...

Market Turmoil and Destabilizing Speculation Supplementary Material

... involve a set of fund and portfolio characteristics. The fund characteristics are yield, size, an indicator variable for institutional fund, weighted average portfolio maturity, pre-shock exposure to the euro area, and net asset ‡ow. For instance, large funds are often thought to be more involved in ...

... involve a set of fund and portfolio characteristics. The fund characteristics are yield, size, an indicator variable for institutional fund, weighted average portfolio maturity, pre-shock exposure to the euro area, and net asset ‡ow. For instance, large funds are often thought to be more involved in ...

Costs of Eliminating Discretionary Broker Voting on Uncontested

... to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for example, have a duty of care requirement to monitor corporate actions and vote client proxies in many instances. Fiduciaries to private pension plans—typically plan sponsors—are subject ...

... to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for example, have a duty of care requirement to monitor corporate actions and vote client proxies in many instances. Fiduciaries to private pension plans—typically plan sponsors—are subject ...

Meetup Outreach Speaker Topics

... you through how to get the most out of them, including: IBD’s Research Tables: Our next-generation stock tables featuring highlights of the top stocks in the top sectors. Base Reader: Identifies stocks that could be setting up for a major price move. IBD Industry Themes: Analyzes which sectors ...

... you through how to get the most out of them, including: IBD’s Research Tables: Our next-generation stock tables featuring highlights of the top stocks in the top sectors. Base Reader: Identifies stocks that could be setting up for a major price move. IBD Industry Themes: Analyzes which sectors ...

Enron Episode - Buy, buy, buy

... Securities lawyer Jacob Zamansky blames the analysts. "Analysts, according to industry standards, are supposed to be objective, unbiased in doing their research," Zamansky says. "They've done a great disservice to the public." Even today, with the company mired in bankruptcy and scandal and its ...

... Securities lawyer Jacob Zamansky blames the analysts. "Analysts, according to industry standards, are supposed to be objective, unbiased in doing their research," Zamansky says. "They've done a great disservice to the public." Even today, with the company mired in bankruptcy and scandal and its ...

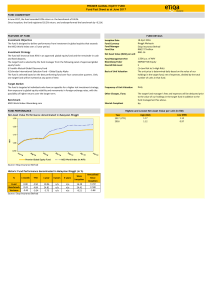

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... The policyholders should consider the following potential risks when investing in a fund: 1 Market Risk - The risk of losses in the value of an investment fund, due to factors that affect the overall performance of financial markets. These factors could be the current situation or future outlook, an ...

... The policyholders should consider the following potential risks when investing in a fund: 1 Market Risk - The risk of losses in the value of an investment fund, due to factors that affect the overall performance of financial markets. These factors could be the current situation or future outlook, an ...

REPORT TO SECURITYHOLDERS

... Approval of inter-fund trading for purchasing and selling securities between the Funds and other investment funds or managed accounts managed by the manager or affiliates of the manager; and approval of trading in securities of associated issuers, related issuers and substantial securityholders. Thi ...

... Approval of inter-fund trading for purchasing and selling securities between the Funds and other investment funds or managed accounts managed by the manager or affiliates of the manager; and approval of trading in securities of associated issuers, related issuers and substantial securityholders. Thi ...

CAPM is CRAP, or, The Dead Parrot lives

... harder to actually make money than ivory tower theorists claim. One can even imagine some academic heretics documenting rapid short-term stock market responses to new arrival in event studies, and arguing that security return predictability results from rational premia for bearing risk. Would the ol ...

... harder to actually make money than ivory tower theorists claim. One can even imagine some academic heretics documenting rapid short-term stock market responses to new arrival in event studies, and arguing that security return predictability results from rational premia for bearing risk. Would the ol ...

Fidelity Value (FDVLX)

... Nicholas Kaiser, CFA is the lead manager of this fund and has been actively managing its assets worth $634.3 million since the fund’s inception in 1994. Mr. Kaiser managed the fund’s best performing year in 1999 which returned an impressive 99.88%. However, in 2002, the Amana Growth Fund’s return wa ...

... Nicholas Kaiser, CFA is the lead manager of this fund and has been actively managing its assets worth $634.3 million since the fund’s inception in 1994. Mr. Kaiser managed the fund’s best performing year in 1999 which returned an impressive 99.88%. However, in 2002, the Amana Growth Fund’s return wa ...

File: ch06 Multiple Choice 1. While certain investors look for income

... from common stocks, than other investments. Given this history, why would anyone choose other investments? a) Everyone wants to increase their cumulative wealth as much as possible. b) Treasury and corporate bonds are better protection against inflation. c) Common stocks have a higher chance of losi ...

... from common stocks, than other investments. Given this history, why would anyone choose other investments? a) Everyone wants to increase their cumulative wealth as much as possible. b) Treasury and corporate bonds are better protection against inflation. c) Common stocks have a higher chance of losi ...

FACTORS AFFECTING PORTFOLIO INVESTMENT IN PAKISTAN

... of interest as well as the positive reception of the value of the instruments. Most of the studies emphasized on the positive aspects of foreign capital on economic growth. Foreign capital improves the process of economic growth by filling the gap between savings and investment. Foreign capital flow ...

... of interest as well as the positive reception of the value of the instruments. Most of the studies emphasized on the positive aspects of foreign capital on economic growth. Foreign capital improves the process of economic growth by filling the gap between savings and investment. Foreign capital flow ...

Are private investors willing to pay for sustainable

... vance of financial versus non-financial motives of investors for SRI. Most of these studies (e.g. Nilsson, 2008, Bauer and Smeets, 2015, Wins and Zwergel, 2016, Gutsche et al., 2016, Riedl and Smeets, 2016) consider perceived risk and returns of SRI besides several indicators for social values and ...

... vance of financial versus non-financial motives of investors for SRI. Most of these studies (e.g. Nilsson, 2008, Bauer and Smeets, 2015, Wins and Zwergel, 2016, Gutsche et al., 2016, Riedl and Smeets, 2016) consider perceived risk and returns of SRI besides several indicators for social values and ...

EDHEC and EuroPerformance release the Alpha League Table 2007 for the UK

... performance adjusted for the risks that were actually taken) for all of the asset management firm’s active “equity” management. The asset management firm must be registered with the regulatory authorities and must have at least six equity funds analysed, marketed and managed in the country studied. ...

... performance adjusted for the risks that were actually taken) for all of the asset management firm’s active “equity” management. The asset management firm must be registered with the regulatory authorities and must have at least six equity funds analysed, marketed and managed in the country studied. ...

The injustice of inequality

... regulatory schemes. Sonin (2002) examines the effect of the subversion of institutions by Russian oligarchs in the 1990s on the country’s transition. Do (2002) examines the consequences of inequality for the evolution of institutions. We specifically focus on the effects of unequal distribution of ec ...

... regulatory schemes. Sonin (2002) examines the effect of the subversion of institutions by Russian oligarchs in the 1990s on the country’s transition. Do (2002) examines the consequences of inequality for the evolution of institutions. We specifically focus on the effects of unequal distribution of ec ...

Stifel to Acquire Ziegler Lotsoff Capital Management

... ST. LOUIS, October 16, 2013 – Stifel Financial Corp. (NYSE: SF) today announced that it has entered into an agreement to acquire Ziegler Lotsoff Capital Management, LLC (“ZLCM”) a Chicago and Milwaukee-based asset management business. The acquisition will bring new asset management strategies and ca ...

... ST. LOUIS, October 16, 2013 – Stifel Financial Corp. (NYSE: SF) today announced that it has entered into an agreement to acquire Ziegler Lotsoff Capital Management, LLC (“ZLCM”) a Chicago and Milwaukee-based asset management business. The acquisition will bring new asset management strategies and ca ...

Guide to listing on AIM for Indian companies

... provides one of the best platforms for expanding Indian companies seeking international investment. AIM is the world’s leading market for smaller international companies. Currently approximately 1110 companies are traded on AIM with a market capitalisation of over £58 billion (including, as at Augus ...

... provides one of the best platforms for expanding Indian companies seeking international investment. AIM is the world’s leading market for smaller international companies. Currently approximately 1110 companies are traded on AIM with a market capitalisation of over £58 billion (including, as at Augus ...

ExamView - Quiz # 6.tst

... a. both the equilibrium interest rate and the equilibrium quantity of loanable funds to fall. b. both the equilibrium interest rate and the equilibrium quantity of loanable funds to rise. c. the equilibrium interest rate to rise and the equilibrium quantity of loanable funds to fall. d. the equilibr ...

... a. both the equilibrium interest rate and the equilibrium quantity of loanable funds to fall. b. both the equilibrium interest rate and the equilibrium quantity of loanable funds to rise. c. the equilibrium interest rate to rise and the equilibrium quantity of loanable funds to fall. d. the equilibr ...

High-performing credit specialist pVe keeps a wary eye on

... With bank prop trading having dwindled dramatically in recent years, the opportunity set for hedge funds has become much richer and less competitive – with fund managers are also in a much stronger position as suppliers of market liquidity and flows. “The bank proprietary function has largely been d ...

... With bank prop trading having dwindled dramatically in recent years, the opportunity set for hedge funds has become much richer and less competitive – with fund managers are also in a much stronger position as suppliers of market liquidity and flows. “The bank proprietary function has largely been d ...

Equity for Rural America: From Wall Street to Main Street

... together they manage less than $300 million. The long-term nature of private equity investing appears not to be compatible with public investors’ shorter term investment horizons. Two other types of private equity organizations are SBICs owned by bank holding companies and venture capital subsidiari ...

... together they manage less than $300 million. The long-term nature of private equity investing appears not to be compatible with public investors’ shorter term investment horizons. Two other types of private equity organizations are SBICs owned by bank holding companies and venture capital subsidiari ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.