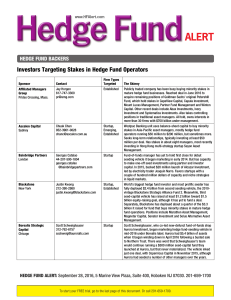

Hedge Fund Backers

... that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill Asset Management with $400 million, on condition that it raised at ...

... that seeks to acquire stakes in new and emerging alternativeinvestment businesses including hedge fund managers and commodity-trading advisors. In 2014, reached deal with former SAC Capital executive Sol Kumin to seed his Folger Hill Asset Management with $400 million, on condition that it raised at ...

Powerpoint Chapter 6 - The Business

... • This is the percent of plant and equipment that is actually being used at any given time • You won’t invest if you have a lot of unused capacity – During recessions, why build more when you are not using all of what you have ...

... • This is the percent of plant and equipment that is actually being used at any given time • You won’t invest if you have a lot of unused capacity – During recessions, why build more when you are not using all of what you have ...

4212201 WFA Hedge Fund Guide

... funds and funds of hedge funds. The list is not exhaustive. Particular hedge funds may involve other risks that will be disclosed in the official offering documents or in any supplement to those documents for the individual products. Unregistered investments — While many hedge fund managers register ...

... funds and funds of hedge funds. The list is not exhaustive. Particular hedge funds may involve other risks that will be disclosed in the official offering documents or in any supplement to those documents for the individual products. Unregistered investments — While many hedge fund managers register ...

complete course brochure - Institute for Financial Analysts

... to pay for their employees to participate in the program. Many investors include the CFA charter in the criteria they use to select the firms and individuals who manage their financial assets. Earning the CFA demonstrates mastery of a broad range of practical portfolio management and ...

... to pay for their employees to participate in the program. Many investors include the CFA charter in the criteria they use to select the firms and individuals who manage their financial assets. Earning the CFA demonstrates mastery of a broad range of practical portfolio management and ...

MFSA Guidance Note for Shariah Compliant Funds

... any leverage restrictions; where applicable, the possible distribution of income to third parties who are not fund investors, such as charities, and the nature of such income and the criteria for determing when this can be done, to whom and a maximum permitted limit on such distributions together wi ...

... any leverage restrictions; where applicable, the possible distribution of income to third parties who are not fund investors, such as charities, and the nature of such income and the criteria for determing when this can be done, to whom and a maximum permitted limit on such distributions together wi ...

Emerging Markets – Income Opportunities

... inclusion should not be interpreted as a recommendation to buy or sell. J.P. Morgan Asset Management may or may not positions on behalf of its clients in any or all of the aforementioned securities. ...

... inclusion should not be interpreted as a recommendation to buy or sell. J.P. Morgan Asset Management may or may not positions on behalf of its clients in any or all of the aforementioned securities. ...

Guidance Note 1/05 - Central Bank of Ireland

... whether this is for hedging or investment purposes; - A statement as to whether the UCITS is actively or passively managed. (If the UCITS adopts a tactical asset allocation strategy with high frequency portfolio adjustments, this should be disclosed); - An indication of the strategy to be followed i ...

... whether this is for hedging or investment purposes; - A statement as to whether the UCITS is actively or passively managed. (If the UCITS adopts a tactical asset allocation strategy with high frequency portfolio adjustments, this should be disclosed); - An indication of the strategy to be followed i ...

East African Community Common Market Protocol

... securities triggered a 307% year-on-year surge on the Dar Stock Exchange. Allowing foreign investment in government securities also created new opportunities e.g. NSSF Uganda’s purchase of $19.5m of Tanzanian treasury bills, a transaction previously disallowed. Other market indicators, such as marke ...

... securities triggered a 307% year-on-year surge on the Dar Stock Exchange. Allowing foreign investment in government securities also created new opportunities e.g. NSSF Uganda’s purchase of $19.5m of Tanzanian treasury bills, a transaction previously disallowed. Other market indicators, such as marke ...

Audited Financial Statements June 30, 2010

... accounting used by most private-sector companies. Revenues are recorded when earned and expenses are recorded when a liability is incurred, regardless of the timing of the related cash flows. The Statement of Net Assets (Exhibit A) answers the question, “How is our financial health at the end of the ...

... accounting used by most private-sector companies. Revenues are recorded when earned and expenses are recorded when a liability is incurred, regardless of the timing of the related cash flows. The Statement of Net Assets (Exhibit A) answers the question, “How is our financial health at the end of the ...

The Return of Inflation…and Growth?

... for U.S. ETFs Heather Apperson Investment Strategist for ETF Investment Strategy & Insights ...

... for U.S. ETFs Heather Apperson Investment Strategist for ETF Investment Strategy & Insights ...

Who Holds Municipal Bonds?

... billion. That figure included data for 116 hedge funds in North America. Other fixed income could be mixed into that number. On the other hand, certain large debtfocused hedge funds were excluded from the count. These investments have likely grown since 2013, given the various distressed issuers (no ...

... billion. That figure included data for 116 hedge funds in North America. Other fixed income could be mixed into that number. On the other hand, certain large debtfocused hedge funds were excluded from the count. These investments have likely grown since 2013, given the various distressed issuers (no ...

The Adequacy of Investment Choices Offered By 401(k) Plans Edwin

... likely to be the bulk of their financial assets, so that plan offerings are likely to severely restrict the portfolios they can hold. What choices should a corporation offer to plan participants? For those participants for whom 401(k) investments are their sole financial assets, the corporation shou ...

... likely to be the bulk of their financial assets, so that plan offerings are likely to severely restrict the portfolios they can hold. What choices should a corporation offer to plan participants? For those participants for whom 401(k) investments are their sole financial assets, the corporation shou ...

A lifecycle investment solution

... investment thinking for them, ensuring that the investment strategy and asset mix is appropriate for employees depending on their age and risk profile. ...

... investment thinking for them, ensuring that the investment strategy and asset mix is appropriate for employees depending on their age and risk profile. ...

The Changing Chemistry Between Hedge Funds and Investors

... more than HNWIs, who see return enhancement as a greater driver for hedge fund investment. Increasingly, the drive for yield in the era of low interest rates is leading institutional firms into more diverse strategies, so investing in hedge funds has become relatively mainstream. For fund managers, ...

... more than HNWIs, who see return enhancement as a greater driver for hedge fund investment. Increasingly, the drive for yield in the era of low interest rates is leading institutional firms into more diverse strategies, so investing in hedge funds has become relatively mainstream. For fund managers, ...

Angel Investing: Changing Strategies During Volatile Times Jeffrey

... rates for investment proposals were estimated to be 16.4% (Sorheim and Landstrom (2001)). In an earlier study of UK angels, yield rates were determined to be 6% (Mason and Harrison (1994)), although this estimate was based on a sample of only 35 investments by a small group of angels. The only study ...

... rates for investment proposals were estimated to be 16.4% (Sorheim and Landstrom (2001)). In an earlier study of UK angels, yield rates were determined to be 6% (Mason and Harrison (1994)), although this estimate was based on a sample of only 35 investments by a small group of angels. The only study ...

Wave 6 - BetterInvesting

... Despite the fact that many shareholders have not made changes to their portfolios, they are lukewarm in their overall view of the market. Fewer than half of shareholders (45%) believe it’s a good time for new investors to get involved in the stock market, down from 50% in February 2005 and a hig ...

... Despite the fact that many shareholders have not made changes to their portfolios, they are lukewarm in their overall view of the market. Fewer than half of shareholders (45%) believe it’s a good time for new investors to get involved in the stock market, down from 50% in February 2005 and a hig ...

Title Is Times New Roman 28 Pt., Line Spacing .9 Lines

... Sweden, Switzerland, the United Kingdom and the United States. An investment cannot be made directly in a market index. ...

... Sweden, Switzerland, the United Kingdom and the United States. An investment cannot be made directly in a market index. ...

Does Foreign Direct Investment Affect Industrial Workers? Evidence

... To improve the performance of the industrial sector in general and raise its indicators of employment, in particular, Saudi government takes active efforts to attract foreign direct investment. This is based on the ability of this kind of investment to affect positively through its role in construct ...

... To improve the performance of the industrial sector in general and raise its indicators of employment, in particular, Saudi government takes active efforts to attract foreign direct investment. This is based on the ability of this kind of investment to affect positively through its role in construct ...

PCA Faces Suit Linked to CalPERS Bribery Scandal

... Instead, the lawsuit claims former CalPERS CIO Joe Dear, who began his tenure in 2009, allegedly “harbored a deep-seated animus towards Baez.” Baez further claimed the pension was discriminating against him for being Latino. Dear “wanted [Baez] out of Centinela, or at the very least wanted to be see ...

... Instead, the lawsuit claims former CalPERS CIO Joe Dear, who began his tenure in 2009, allegedly “harbored a deep-seated animus towards Baez.” Baez further claimed the pension was discriminating against him for being Latino. Dear “wanted [Baez] out of Centinela, or at the very least wanted to be see ...

U.S. Corporate Pension Liability Hedging Views at 6/30/2015.

... than otherwise would be the case but these have now ended. As economic recovery is better established, there will be less urgency from the Federal Reserve to manipulate bond yields lower. The Federal Reserve is anxious about excesses in risky asset markets and its communication is already turnin ...

... than otherwise would be the case but these have now ended. As economic recovery is better established, there will be less urgency from the Federal Reserve to manipulate bond yields lower. The Federal Reserve is anxious about excesses in risky asset markets and its communication is already turnin ...

Motives for FDI and inter-state investments in USA

... • Inward investment is driven by access to markets, labor skills and increasingly to access technology/innovation rather than incentives. Indeed, quality of life is often higher ranked than incentives by investors • The country level evidence clearly shows that FDI performance is influenced by corpo ...

... • Inward investment is driven by access to markets, labor skills and increasingly to access technology/innovation rather than incentives. Indeed, quality of life is often higher ranked than incentives by investors • The country level evidence clearly shows that FDI performance is influenced by corpo ...

Exploring intentions towards human, social, and financial capital

... Previous research has extensively focused on the role of formal investors as venture capitalists in the entrepreneurial process (de Bettignies and Brander, 2007). Still, in an environment of high uncertainty such as the one experienced during the financial crisis, attracting venture capital is a suc ...

... Previous research has extensively focused on the role of formal investors as venture capitalists in the entrepreneurial process (de Bettignies and Brander, 2007). Still, in an environment of high uncertainty such as the one experienced during the financial crisis, attracting venture capital is a suc ...

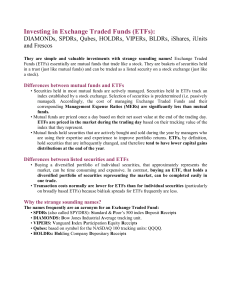

Investing in Exchange Traded Funds (ETFs):

... • Many ETFs have listed options and LEAPS. • ETFs are marginable. • ETFs can be shorted. They are exempt from the “up tick” rule in the U.S. and the “last trade” rule in Canada. • ETFs are sponsored by well-known financial institutions. Barclays Global Investors is the sponsor of Canada’s actively t ...

... • Many ETFs have listed options and LEAPS. • ETFs are marginable. • ETFs can be shorted. They are exempt from the “up tick” rule in the U.S. and the “last trade” rule in Canada. • ETFs are sponsored by well-known financial institutions. Barclays Global Investors is the sponsor of Canada’s actively t ...

Living Annuity 3.4MB

... 2. Past performance is used to show the effect of the fee differential on the longevity of retirement income on two contracts having the same underlying terms and returns but different fee structures. It does not guarantee that your retirement savings will last the same length of time as illustrated ...

... 2. Past performance is used to show the effect of the fee differential on the longevity of retirement income on two contracts having the same underlying terms and returns but different fee structures. It does not guarantee that your retirement savings will last the same length of time as illustrated ...

Cornerstone Investor

... is an investment company incorporated under the PRC Company Law and headquartered in Beijing. CIC is operated on a commercial basis, seeking long-term, risk-adjusted financial returns. Restrictions on the Cornerstone Investor’s Investment The Cornerstone Investor has agreed that, without the prior w ...

... is an investment company incorporated under the PRC Company Law and headquartered in Beijing. CIC is operated on a commercial basis, seeking long-term, risk-adjusted financial returns. Restrictions on the Cornerstone Investor’s Investment The Cornerstone Investor has agreed that, without the prior w ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.