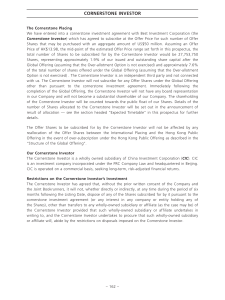

Cornerstone Investor

... is an investment company incorporated under the PRC Company Law and headquartered in Beijing. CIC is operated on a commercial basis, seeking long-term, risk-adjusted financial returns. Restrictions on the Cornerstone Investor’s Investment The Cornerstone Investor has agreed that, without the prior w ...

... is an investment company incorporated under the PRC Company Law and headquartered in Beijing. CIC is operated on a commercial basis, seeking long-term, risk-adjusted financial returns. Restrictions on the Cornerstone Investor’s Investment The Cornerstone Investor has agreed that, without the prior w ...

The Life-Cycle Personal Accounts Proposal for

... independent of the performance of financial markets. While Social Security benefits are subject to political risk and risks about changes in the economy, they historically have not exhibited any of the annual volatility associated with investments in financial markets. The proposed new personal acco ...

... independent of the performance of financial markets. While Social Security benefits are subject to political risk and risks about changes in the economy, they historically have not exhibited any of the annual volatility associated with investments in financial markets. The proposed new personal acco ...

Standard Deviation as a Measure of Risk for a Mutual Fund

... P( x < 0) = .103 = 10.3%. (See other articles in this course for more on the Student’s t-distribution which is used for small samples and other applications.) Why invest in a stock mutual fund? Because it gives you professional management, immediate diversification, and a small expense ratio. In the ...

... P( x < 0) = .103 = 10.3%. (See other articles in this course for more on the Student’s t-distribution which is used for small samples and other applications.) Why invest in a stock mutual fund? Because it gives you professional management, immediate diversification, and a small expense ratio. In the ...

Incorporating Uncertainty into Discounted Cash Flow

... can be assumed to remain constant then the investor’s utility from various gambles can be computed. Using Monte Carlo simulations similar to the study mentioned above, the expected utility of an investment can be found by taking the average of thousands of simulation results. This value can then be ...

... can be assumed to remain constant then the investor’s utility from various gambles can be computed. Using Monte Carlo simulations similar to the study mentioned above, the expected utility of an investment can be found by taking the average of thousands of simulation results. This value can then be ...

Chapter 2 - McGraw Hill Higher Education

... The act of borrowing or of issuing new stock simultaneously gives rise to the creation of an equal volume of financial assets. For example, a $10,000 financial asset held by a household that had lent money will be exactly matched by a $10,000 liability of the business firm that had borrowed the ...

... The act of borrowing or of issuing new stock simultaneously gives rise to the creation of an equal volume of financial assets. For example, a $10,000 financial asset held by a household that had lent money will be exactly matched by a $10,000 liability of the business firm that had borrowed the ...

The Essentials of Portfolio Construction

... However, the manager’s returns could be different from the benchmark’s returns. In other words, though the absolute risk — as measured by volatility — may be low, the relative risk could be high. Hint: Use Tracking Error to gain a better understanding of the potential risk relative to the benchmark. ...

... However, the manager’s returns could be different from the benchmark’s returns. In other words, though the absolute risk — as measured by volatility — may be low, the relative risk could be high. Hint: Use Tracking Error to gain a better understanding of the potential risk relative to the benchmark. ...

FINDING THE VALUE OF BDCs - Valuation Research Corporation

... A cornerstone of ASC 820 is the three-level fair value hierarchy. Although types of investments in different BDCs may vary, one thing all public BDCs have in common is that they are required to report quarterly their investments on a fair value basis, and delineate hard-tovalue highly illiquid secur ...

... A cornerstone of ASC 820 is the three-level fair value hierarchy. Although types of investments in different BDCs may vary, one thing all public BDCs have in common is that they are required to report quarterly their investments on a fair value basis, and delineate hard-tovalue highly illiquid secur ...

What are commercial mortgage-backed securities?

... This document is for Qualified Investors in Switzerland, Professional Clients in Continental Europe, Dubai, Guernsey, the Isle of Man, Jersey and the UK; for Institutional Investors only in the United States and Australia; for Professional Investors in Hong Kong; for Qualified Institutional Investor ...

... This document is for Qualified Investors in Switzerland, Professional Clients in Continental Europe, Dubai, Guernsey, the Isle of Man, Jersey and the UK; for Institutional Investors only in the United States and Australia; for Professional Investors in Hong Kong; for Qualified Institutional Investor ...

The Relationship with Other Treaty Standards

... operation of a hazardous industrial waste landfill in Mexico. The Mexican authorities refused, by way of an administrative resolution, an application for renewal of the required operating licence two years after the claimant’s investment. As part of its expropriation claim, the claimant argued that ...

... operation of a hazardous industrial waste landfill in Mexico. The Mexican authorities refused, by way of an administrative resolution, an application for renewal of the required operating licence two years after the claimant’s investment. As part of its expropriation claim, the claimant argued that ...

Mutual fund distributions - Sun Life Global Investments

... a portion of your capital – in other words, you’re getting back the same money you invested in the fund. Why would a mutual fund return your capital? Generally, return of capital distributions occur when a fund’s distribution policy is to pay a monthly distribution at a targeted annualized rate, or ...

... a portion of your capital – in other words, you’re getting back the same money you invested in the fund. Why would a mutual fund return your capital? Generally, return of capital distributions occur when a fund’s distribution policy is to pay a monthly distribution at a targeted annualized rate, or ...

Ch 26 PPT

... • Mutual Funds • A mutual fund is an institution that sells shares to the public and uses the proceeds to buy a portfolio, of various types of stocks, bonds, or both. • Mutual funds allow people with small amounts of money to easily diversify. • There are many funds on the market today. Some are ind ...

... • Mutual Funds • A mutual fund is an institution that sells shares to the public and uses the proceeds to buy a portfolio, of various types of stocks, bonds, or both. • Mutual funds allow people with small amounts of money to easily diversify. • There are many funds on the market today. Some are ind ...

THE CITY UNIVERSITY OF NEW YORK – INVESTMENT POLICY

... diversification through investments in assets and/or investment strategies with attractive expected returns combined with low expected correlations with the traditional equity and fixed income holdings of the portfolio and b) to support the Portfolio through periods of unexpected high inflation thro ...

... diversification through investments in assets and/or investment strategies with attractive expected returns combined with low expected correlations with the traditional equity and fixed income holdings of the portfolio and b) to support the Portfolio through periods of unexpected high inflation thro ...

Week Ahead: All eyes on European leaders, corporate earnings and

... Investors await action from European leaders – The Greek sovereign debt crisis will remain at the forefront of investors’ minds this week. Overnight, Germany’s Angela Merkel and France’s Nicholas Sarkozy met to discuss next steps in averting a regional crisis. Both leaders were tight-lipped on the d ...

... Investors await action from European leaders – The Greek sovereign debt crisis will remain at the forefront of investors’ minds this week. Overnight, Germany’s Angela Merkel and France’s Nicholas Sarkozy met to discuss next steps in averting a regional crisis. Both leaders were tight-lipped on the d ...

PRIVATE EQUITY IN REAL ESTATE

... The capital is provided for medium to long term to enable such businesses to grow and expand. Private equity investors assume the role of active investors and work closely with their portfolio companies in strategy formulation, networking with customers and suppliers, syndicating with other investor ...

... The capital is provided for medium to long term to enable such businesses to grow and expand. Private equity investors assume the role of active investors and work closely with their portfolio companies in strategy formulation, networking with customers and suppliers, syndicating with other investor ...

SAVINGS, INVESTMENT AND CAPITAL FLOWS: AN EMPIRICAL

... by productive activities transformed effectively from the increased domestic resources and the mobilized international resources in the forms of foreign capital inflow and foreign direct investment. The increase in investment enhanced aggregate output and national income, which in turn induce furthe ...

... by productive activities transformed effectively from the increased domestic resources and the mobilized international resources in the forms of foreign capital inflow and foreign direct investment. The increase in investment enhanced aggregate output and national income, which in turn induce furthe ...

Why napkin math may not add up: Arithmetic and geometric means

... combined result will be less than the actual geometric mean for the 60%/40% portfolio.2 ...

... combined result will be less than the actual geometric mean for the 60%/40% portfolio.2 ...

An Austrian Approach to Investing Austrian Student Scholars

... Man should not invest due to only Austrian views or only CFA and CFP analysis. Man must recognize cash flows, financial statements, a stock’s alpha, and its beta. The strict numerical side of investing should be used to find the market price and value of the firm through fundamental analysis. No Aus ...

... Man should not invest due to only Austrian views or only CFA and CFP analysis. Man must recognize cash flows, financial statements, a stock’s alpha, and its beta. The strict numerical side of investing should be used to find the market price and value of the firm through fundamental analysis. No Aus ...

Why napkin math may not add up: Arithmetic and geometric means

... combined result will be less than the actual geometric mean for the 60%/40% portfolio.2 ...

... combined result will be less than the actual geometric mean for the 60%/40% portfolio.2 ...

Dani Rodrik Working Paper No. 2999 1050 POLICY

... investment climate". One important reason is the high degree of uncertainty regarding future policy. High-inflation countries like Argentina or Brazil have by now gone through a large number of failed stabilization programs. Even in countries like Turkey (since 1980) and Mexico (since 1983) which ha ...

... investment climate". One important reason is the high degree of uncertainty regarding future policy. High-inflation countries like Argentina or Brazil have by now gone through a large number of failed stabilization programs. Even in countries like Turkey (since 1980) and Mexico (since 1983) which ha ...

Report 58 - Euro Bonds High Yield Short Term

... The principal object of the composite is to seek long‐term capital gains. It invests mainly in EUR High yield denominated debt with a maturity date not above 4 years. It has no geographic limitation and can invest in the emerging markets. It has no sector restriction and can invest in one or more o ...

... The principal object of the composite is to seek long‐term capital gains. It invests mainly in EUR High yield denominated debt with a maturity date not above 4 years. It has no geographic limitation and can invest in the emerging markets. It has no sector restriction and can invest in one or more o ...

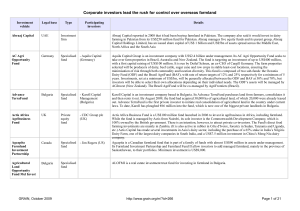

The new farm owners table

... Carlos da Costa Lima, the Secretary of Production and Agro-Energy at the Brazilian Ministry of Agriculture 2003-2007, is a member of the Advisory Board. Roberto Rodrigues, former Brazilian agriculture minister, is a member of the board and his son is the chief operating officer ...

... Carlos da Costa Lima, the Secretary of Production and Agro-Energy at the Brazilian Ministry of Agriculture 2003-2007, is a member of the Advisory Board. Roberto Rodrigues, former Brazilian agriculture minister, is a member of the board and his son is the chief operating officer ...

Title Is Times New Roman 28 Pt., Line Spacing .9 Lines

... services, providing a measure of inflation. The CPI is a fixed quantity price index and a sort of cost-of-living index. The CPI can be used to track changes in prices of all goods and services purchased for consumption by urban households. User fees (such as water and sewer service) and sales and ex ...

... services, providing a measure of inflation. The CPI is a fixed quantity price index and a sort of cost-of-living index. The CPI can be used to track changes in prices of all goods and services purchased for consumption by urban households. User fees (such as water and sewer service) and sales and ex ...

This presentation is for discussion purposes only and is not an

... Rebecca is a proven success as a musical. It has been performed in 6 cities with strong results and is ready to take the Broadway stage, the most lucrative theatre market in the world. ...

... Rebecca is a proven success as a musical. It has been performed in 6 cities with strong results and is ready to take the Broadway stage, the most lucrative theatre market in the world. ...

- CAIA Association

... Suppose you discover an asset that has been losing money since inception (e.g., a mutual fund run by an incompetent manager). Further, you have every reason to believe that the asset will continue to lose money going forward. You wonder how good it would be if you could short this mutual fund. You c ...

... Suppose you discover an asset that has been losing money since inception (e.g., a mutual fund run by an incompetent manager). Further, you have every reason to believe that the asset will continue to lose money going forward. You wonder how good it would be if you could short this mutual fund. You c ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.