Frequently Asked Questions on Rajiv Gandhi Equity Savings

... With an objective to encourage flow of savings of the small investors in domestic capital market, the Government of India announced a scheme named Rajiv Gandhi Equity Savings Scheme, 2012 (RGESS). 2) What benefits does RGESS offer to small investors? Under RGESS, a new section 80CCG has been introdu ...

... With an objective to encourage flow of savings of the small investors in domestic capital market, the Government of India announced a scheme named Rajiv Gandhi Equity Savings Scheme, 2012 (RGESS). 2) What benefits does RGESS offer to small investors? Under RGESS, a new section 80CCG has been introdu ...

direct foreign investments and the lack of positive effects on the

... Based on the analysis of more than 4,000 companies they concluded that the net effect of FDI is quite small. Babic, Pufnik and Stuck (2001) found the legal basis for discrimination of small towards large enterprises, and foreign towards domestic. After conducting empirical analysis, Sisek (2005) con ...

... Based on the analysis of more than 4,000 companies they concluded that the net effect of FDI is quite small. Babic, Pufnik and Stuck (2001) found the legal basis for discrimination of small towards large enterprises, and foreign towards domestic. After conducting empirical analysis, Sisek (2005) con ...

CIMB Clicks User Guide - PMB Investment Berhad

... CIMB Clicks User Guide 2 Methods via: I. Clicks CASA (with CIMB A/C) II. Clicks Shoppe(without CIMB A/C) ...

... CIMB Clicks User Guide 2 Methods via: I. Clicks CASA (with CIMB A/C) II. Clicks Shoppe(without CIMB A/C) ...

MiFID II Appointment of tied agents

... investment firm on whose behalf it acts, promotes investment and/or ancillary services to clients or provides the services of either receiving and transmitting instructions or orders, placing financial instruments or providing investment advice on financial instruments. The rules regarding the appoi ...

... investment firm on whose behalf it acts, promotes investment and/or ancillary services to clients or provides the services of either receiving and transmitting instructions or orders, placing financial instruments or providing investment advice on financial instruments. The rules regarding the appoi ...

Revenue Sharing Fund Families

... per employee per fund family per year). Morgan Stanley’s non-cash compensation policies set conditions for each of these types of payments, and do not permit any gifts or entertainment conditioned on achieving any sales target. Administrative Service Fees Morgan Stanley and/or its affiliates receive ...

... per employee per fund family per year). Morgan Stanley’s non-cash compensation policies set conditions for each of these types of payments, and do not permit any gifts or entertainment conditioned on achieving any sales target. Administrative Service Fees Morgan Stanley and/or its affiliates receive ...

Investors` Rights: The Evolutionary Process of Investment Treaties

... Concerning direct investment and the WTO framework, the Ministers stated, "[h]aving regard to the existing WTO provision on matters related to investment and competition policy and the built-in agenda in these areas, including under the TRIM agreement, and on the understanding that the work undertak ...

... Concerning direct investment and the WTO framework, the Ministers stated, "[h]aving regard to the existing WTO provision on matters related to investment and competition policy and the built-in agenda in these areas, including under the TRIM agreement, and on the understanding that the work undertak ...

AON CORP (Form: 11-K, Received: 07/01/1996 00

... Money Market Fund - Invested principally in shares of the Money Market Portfolio of the Series Funds. The portfolio invests in various types of good quality money market securities including certificates of deposit, commercial paper, U.S. Treasury and Agency securities and other similar instruments. ...

... Money Market Fund - Invested principally in shares of the Money Market Portfolio of the Series Funds. The portfolio invests in various types of good quality money market securities including certificates of deposit, commercial paper, U.S. Treasury and Agency securities and other similar instruments. ...

Public online consultation on investor protection in TTIP

... investment protection standards. It ensures that investors and investments are protected against treatment by the host country which, even if not expropriatory or discriminatory, is still unacceptable because it is arbitrary, unfair, abusive, etc. Approach in most investment agreements The FET stand ...

... investment protection standards. It ensures that investors and investments are protected against treatment by the host country which, even if not expropriatory or discriminatory, is still unacceptable because it is arbitrary, unfair, abusive, etc. Approach in most investment agreements The FET stand ...

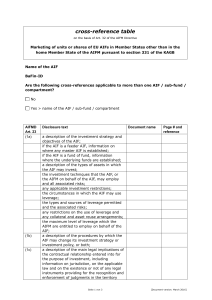

cross-reference table on the basis of Art. 32 of the AIFM Directive

... the identity of each delegate; any conflicts of interest that may arise from such delegations; a description of the AIF’s valuation procedure and of the pricing methodology for valuing assets, including the methods used in valuing hard-to-value assets in accordance with Article 19; a description of ...

... the identity of each delegate; any conflicts of interest that may arise from such delegations; a description of the AIF’s valuation procedure and of the pricing methodology for valuing assets, including the methods used in valuing hard-to-value assets in accordance with Article 19; a description of ...

Investment is a key component in economic development and has... the main objectives of countries in pursuing regional economic integration.... CHAPTER 4. STIMULATING INVESTMENT

... describes trade blocs’ policies towards investment and then asks whether the arguments advanced for their having positive effects are justified. Section 4.1 explores explicit policies towards investment. In early RIAs this was almost always activist and interventionist, co-opting regional integratio ...

... describes trade blocs’ policies towards investment and then asks whether the arguments advanced for their having positive effects are justified. Section 4.1 explores explicit policies towards investment. In early RIAs this was almost always activist and interventionist, co-opting regional integratio ...

CHAPTER Capital Market Theory: An Overview Chapter Outline 9.1

... The 20.1-percent standard deviation we found for stock returns from 1926 through 1999 can now be interpreted in the following way: if stock returns are approximately normally distributed, the probability that a yearly return will fall within 20.1 percent of the mean of 13.3 percent will be approxima ...

... The 20.1-percent standard deviation we found for stock returns from 1926 through 1999 can now be interpreted in the following way: if stock returns are approximately normally distributed, the probability that a yearly return will fall within 20.1 percent of the mean of 13.3 percent will be approxima ...

Chap009vid

... Normal Distribution The 20.1-percent standard deviation we found for stock returns from 1926 through 1999 can now be interpreted in the following way: if stock returns are approximately normally distributed, the probability that a yearly return will fall within 20.1 percent of the mean of 13.3 perce ...

... Normal Distribution The 20.1-percent standard deviation we found for stock returns from 1926 through 1999 can now be interpreted in the following way: if stock returns are approximately normally distributed, the probability that a yearly return will fall within 20.1 percent of the mean of 13.3 perce ...

commentary - Jones Day

... tection to the wider category of “investments” defined in that country’s bilateral investment treaties with non-NAFTA states, as a consequence of the “most favored nation” clause contained in NAFTA Article 1103 (which states that, “each Party shall accord to investors of another Party treatment no l ...

... tection to the wider category of “investments” defined in that country’s bilateral investment treaties with non-NAFTA states, as a consequence of the “most favored nation” clause contained in NAFTA Article 1103 (which states that, “each Party shall accord to investors of another Party treatment no l ...

For What IT`s Worth: Insights into the True Business Value of IT

... these frameworks a common understanding arises that IT can make a business more efficient, more effective, more flexible and/or more innovative. These four ‘sources of value’ identify the way IT creates value for an organization. The four terms mentioned summarize the development of the value of IT ...

... these frameworks a common understanding arises that IT can make a business more efficient, more effective, more flexible and/or more innovative. These four ‘sources of value’ identify the way IT creates value for an organization. The four terms mentioned summarize the development of the value of IT ...

Can the Investment Court System (ICS) save TTIP and CETA?

... features in more than 3,500 international trade agreements (to around half of which EU Member States are signatories). However, since both the US and the EU are generally not considered as countries where the rule of law is particularly weak, and since both ...

... features in more than 3,500 international trade agreements (to around half of which EU Member States are signatories). However, since both the US and the EU are generally not considered as countries where the rule of law is particularly weak, and since both ...

Statement of Guidance on Corporate Governance for Mutual Funds

... The Authority expects the oversight, direction and management of a regulated mutual fund, as defined by the Mutual Funds Law (2013 revision) to be conducted in a fit and proper manner. The purpose of this Statement of Guidance (‘Statement of Guidance’) is to provide the governing body of a regulated ...

... The Authority expects the oversight, direction and management of a regulated mutual fund, as defined by the Mutual Funds Law (2013 revision) to be conducted in a fit and proper manner. The purpose of this Statement of Guidance (‘Statement of Guidance’) is to provide the governing body of a regulated ...

Mapping the UK financial system

... formed by the transactions illustrated in Figure 1A. For each agent, a blue oval positioned above it shows a liability, whereas an orange oval beneath it shows an asset. More generally, a financial asset can always be matched to a financial liability of someone else. The black arrows point in the op ...

... formed by the transactions illustrated in Figure 1A. For each agent, a blue oval positioned above it shows a liability, whereas an orange oval beneath it shows an asset. More generally, a financial asset can always be matched to a financial liability of someone else. The black arrows point in the op ...

The Future Shape of EU Investment Agreements

... ‘conclusion of tariff and trade agreements relating to trade in goods and services, and the commercial aspects of intellectual property, foreign direct investment’, can be read as supporting a limiting interpretation if one understands that ‘foreign direct investment’ is the other subject-matter ‘th ...

... ‘conclusion of tariff and trade agreements relating to trade in goods and services, and the commercial aspects of intellectual property, foreign direct investment’, can be read as supporting a limiting interpretation if one understands that ‘foreign direct investment’ is the other subject-matter ‘th ...

How important is dividend yield?

... Find the annual dividend per share. This figure represents the sum of money paid to shareholders of a corporation from earnings. Find the price per share of your stock. Use a calculator to determine the annual yield calculation by taking the annual dividend per share and dividing it by the stock’s p ...

... Find the annual dividend per share. This figure represents the sum of money paid to shareholders of a corporation from earnings. Find the price per share of your stock. Use a calculator to determine the annual yield calculation by taking the annual dividend per share and dividing it by the stock’s p ...

capital budgeting practices: evidence from sri lankan listed companies

... technique. Each significance of preference as a percentage to total number of respondents is given under parenthesis. The last column of the table indicates the number of responses on techniques that were ranked as Important or Very Important. According to the data gathered by the survey, majority o ...

... technique. Each significance of preference as a percentage to total number of respondents is given under parenthesis. The last column of the table indicates the number of responses on techniques that were ranked as Important or Very Important. According to the data gathered by the survey, majority o ...

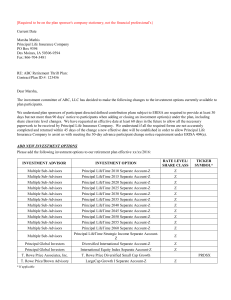

IDRT

... We are aware of the optional fiduciary protection made available by the Pension Protection Act for some investment mapping situations. If we choose to take advantage of this protection, we understand we must meet these requirements: Participant balances are redirected (i.e. mapped) to investment o ...

... We are aware of the optional fiduciary protection made available by the Pension Protection Act for some investment mapping situations. If we choose to take advantage of this protection, we understand we must meet these requirements: Participant balances are redirected (i.e. mapped) to investment o ...

The Case for Dividend Growers in Volatile Markets

... increased their dividend for at least 20 consecutive years (see sidebar on index methodology). While the hurdle for index inclusion is 20 straight years of rising dividends, the index average is 35 years. Additionally, there are eight constituents with over 53 consecutive years of dividend increases ...

... increased their dividend for at least 20 consecutive years (see sidebar on index methodology). While the hurdle for index inclusion is 20 straight years of rising dividends, the index average is 35 years. Additionally, there are eight constituents with over 53 consecutive years of dividend increases ...

Bankrate Content to be Included in Bob Brinker Web Sites NEW

... The program is nationally broadcast live from 4pm to 7pm Eastern time on Saturdays and Sundays. Bob answers investment questions from around the country and discusses current issues on the radio program. In addition to hosting Moneytalk, Bob Brinker publishes Marketimer, his monthly investment newsl ...

... The program is nationally broadcast live from 4pm to 7pm Eastern time on Saturdays and Sundays. Bob answers investment questions from around the country and discusses current issues on the radio program. In addition to hosting Moneytalk, Bob Brinker publishes Marketimer, his monthly investment newsl ...

agenda for a new strategy of equity financing by the islamic

... accept government guarantees for its operations. It shares full project risks with its partners. It plays an important catalytic role in mobilizing additional project funding from other investors, either through co-financing, or through syndication, underwriting and guarantees. In addition to projec ...

... accept government guarantees for its operations. It shares full project risks with its partners. It plays an important catalytic role in mobilizing additional project funding from other investors, either through co-financing, or through syndication, underwriting and guarantees. In addition to projec ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.