Would a Stock By Any Other Ticker Smell as Sweet? Alex Head

... (Internet America). Southwest Airlines’ choice of LUV as a ticker symbol was related to its efforts to brand itself as an airline “built on love.” Southwest is based at Dallas’ Love Field and has an open-seating policy that reportedly can lead to romance between strangers who sit next to each other. ...

... (Internet America). Southwest Airlines’ choice of LUV as a ticker symbol was related to its efforts to brand itself as an airline “built on love.” Southwest is based at Dallas’ Love Field and has an open-seating policy that reportedly can lead to romance between strangers who sit next to each other. ...

Homeownership and Commercial Real Estate

... investor sentiment and household consumption needs. In contrast, the only goal of investing in commercial real estate is to generate returns and create value. As shown in Table I, home prices appreciated about 6.0 percent per year since 1978. Assuming a conservative aftertax annual cost of carry of ...

... investor sentiment and household consumption needs. In contrast, the only goal of investing in commercial real estate is to generate returns and create value. As shown in Table I, home prices appreciated about 6.0 percent per year since 1978. Assuming a conservative aftertax annual cost of carry of ...

Public Opinion towards Policy Trade-offs: Investigating Attitudes on

... welfare state transformations from an academic as well as from a societal perspective. ...

... welfare state transformations from an academic as well as from a societal perspective. ...

News Release Bats Welcomes New Issuer

... CBOE Holdings, Inc. (BATS: CBOE | NASDAQ: CBOE), owner of the Chicago Board Options Exchange, the Bats exchanges, CBOE Futures Exchange (CFE) and other subsidiaries, is one of the world’s largest exchange holding companies and a leader in providing global investors cutting-edge trading and investmen ...

... CBOE Holdings, Inc. (BATS: CBOE | NASDAQ: CBOE), owner of the Chicago Board Options Exchange, the Bats exchanges, CBOE Futures Exchange (CFE) and other subsidiaries, is one of the world’s largest exchange holding companies and a leader in providing global investors cutting-edge trading and investmen ...

Inverse Indexing

... market will decline over the next quarter. The investor could hedge their portfolio against a decline by buying the Horizons BetaPro S&P/TSX 60™ Inverse ETF to hedge against it. By buying an inverse ETF, the investor can avoid selling stock from their existing portfolio, which may incur a capital ga ...

... market will decline over the next quarter. The investor could hedge their portfolio against a decline by buying the Horizons BetaPro S&P/TSX 60™ Inverse ETF to hedge against it. By buying an inverse ETF, the investor can avoid selling stock from their existing portfolio, which may incur a capital ga ...

The Anatomy of a Stock Market Winner

... This article analyzes characteristics of past stock market winners to see whether they may yield some insights into successful investment strategies. Earlierresearch has isolated a particular attribute (such as P/E or size) and then investigated its associated return behavior; we take the opposite t ...

... This article analyzes characteristics of past stock market winners to see whether they may yield some insights into successful investment strategies. Earlierresearch has isolated a particular attribute (such as P/E or size) and then investigated its associated return behavior; we take the opposite t ...

Select - HSBC Onshore Investment Bond

... It is not designed for non-taxpayers, non-UK residents and short-term (less than 5 years) investors. The value of investments can fall as well as rise and you may not get back what you invested. For some investments this can also happen as a result of exchange rate fluctuations as shares and funds m ...

... It is not designed for non-taxpayers, non-UK residents and short-term (less than 5 years) investors. The value of investments can fall as well as rise and you may not get back what you invested. For some investments this can also happen as a result of exchange rate fluctuations as shares and funds m ...

Automatic Account Rebalancing

... Lock in potential gains by selling funds at higher prices (during a market upturn) ...

... Lock in potential gains by selling funds at higher prices (during a market upturn) ...

a history of ground-breaking research and investment

... used an optimization program that was not commercially available and had problems with managing the turnover. What we liked about Barra Aegis and Barra Optimizer was the ability to manage the turnover in the optimization.” Barra Aegis is an integrated suite of equity investment analysis modules, des ...

... used an optimization program that was not commercially available and had problems with managing the turnover. What we liked about Barra Aegis and Barra Optimizer was the ability to manage the turnover in the optimization.” Barra Aegis is an integrated suite of equity investment analysis modules, des ...

Why Does Everyone Experience Such Different Retirement Income

... becomes increasingly difficult and a post-retirement market drop can be devastating. Actual wealth accumulations and sustainable withdrawal rates will vary substantially among retirees, as these outcomes depend disproportionately on the shorter sequence of returns just before and after the retiremen ...

... becomes increasingly difficult and a post-retirement market drop can be devastating. Actual wealth accumulations and sustainable withdrawal rates will vary substantially among retirees, as these outcomes depend disproportionately on the shorter sequence of returns just before and after the retiremen ...

TD Ameritrade Institutional Puts a Social Spin on Traditional Advisor

... collect and share stories about what it really means to be a fiduciary advisor. Unlike a traditional marketing campaign, real advisors will play a leading role in both providing the content and serving as a distribution channel to get the word out about the benefits of working with an RIA. “Financia ...

... collect and share stories about what it really means to be a fiduciary advisor. Unlike a traditional marketing campaign, real advisors will play a leading role in both providing the content and serving as a distribution channel to get the word out about the benefits of working with an RIA. “Financia ...

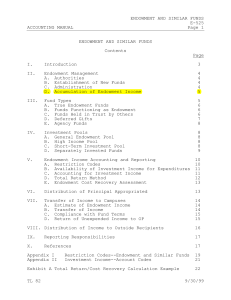

Endowment and Similar Funds

... designated revenue accounts (J-239590-3XXXX). Participation is based on a daily weighted average for the month--which is ascertained from the STIP history file. The total STIP income available for the month is distributed in proportion to the weighted average. Endowment income balances, however, par ...

... designated revenue accounts (J-239590-3XXXX). Participation is based on a daily weighted average for the month--which is ascertained from the STIP history file. The total STIP income available for the month is distributed in proportion to the weighted average. Endowment income balances, however, par ...

Document

... your time at Accelerator participating in the decisions regarding scientific, business, intellectual property, and management aspects of potential start-up companies. The fellow has the opportunity to work and interact with the Accelerator team as well as experienced scientists and investors from th ...

... your time at Accelerator participating in the decisions regarding scientific, business, intellectual property, and management aspects of potential start-up companies. The fellow has the opportunity to work and interact with the Accelerator team as well as experienced scientists and investors from th ...

Introduction Hypothesis Central Limit Theorem Objective Madoff

... In 25 of 156 months when the Madoff Fund was allegedly operating, it could not have achieved its reported results with any combination of stocks. Assuming that Madoff chose to stay out of the market for those 25 months – and for the 34 months when the probability of obtaining his reported results is ...

... In 25 of 156 months when the Madoff Fund was allegedly operating, it could not have achieved its reported results with any combination of stocks. Assuming that Madoff chose to stay out of the market for those 25 months – and for the 34 months when the probability of obtaining his reported results is ...

Spotlight on catastrophe bonds

... exposure to very large risks such as natural disasters. Over this time, ILS as an asset class has also proved to be very attractive to pension funds and other institutional investors. In this paper we discuss the most well known type of ILS, catastrophe bonds (nicknamed ‘cat bonds’). Catastrophe bon ...

... exposure to very large risks such as natural disasters. Over this time, ILS as an asset class has also proved to be very attractive to pension funds and other institutional investors. In this paper we discuss the most well known type of ILS, catastrophe bonds (nicknamed ‘cat bonds’). Catastrophe bon ...

malta 2016 - HFM Global

... alta has been experiencing unprecedented change as it looks to grow its hedge fund and captive industries. This year’s HFMWeek Malta Report aims to uncover the techniques that have propelled Malta into the international finance spotlight. The establishment of some 600 investment funds, with a combin ...

... alta has been experiencing unprecedented change as it looks to grow its hedge fund and captive industries. This year’s HFMWeek Malta Report aims to uncover the techniques that have propelled Malta into the international finance spotlight. The establishment of some 600 investment funds, with a combin ...

note to staff - Towers Watson

... Note Printing Australia Limited (NPA) and the Australian Prudential Regulation Authority. It had almost 2 650 members and $1.29 billion of assets as at 30 June 2016. The OSF is governed by a trust deed and overseen by the OSF Board of Trustees which consists equally of representatives appointed by b ...

... Note Printing Australia Limited (NPA) and the Australian Prudential Regulation Authority. It had almost 2 650 members and $1.29 billion of assets as at 30 June 2016. The OSF is governed by a trust deed and overseen by the OSF Board of Trustees which consists equally of representatives appointed by b ...

The Trading Behavior of Institutions and Individuals in Chinese

... and hence level of sophistication is unlikely to be comparable to that of investors from developed markets. Therefore, does the vast heterogeneity of Chinese individual investors behave like other individual investors from developed markets? In other words, will this mass population of Chinese indiv ...

... and hence level of sophistication is unlikely to be comparable to that of investors from developed markets. Therefore, does the vast heterogeneity of Chinese individual investors behave like other individual investors from developed markets? In other words, will this mass population of Chinese indiv ...

Results

... bles are assessed for various sorts of commodity assets and compared with investment instruments – shares, bonds, and financial market tools. Data used in this analysis show total monthly revenues of individual commodity indices provided by S&P Dow Jones Indices (indices S&P GSCI). Apart from compo ...

... bles are assessed for various sorts of commodity assets and compared with investment instruments – shares, bonds, and financial market tools. Data used in this analysis show total monthly revenues of individual commodity indices provided by S&P Dow Jones Indices (indices S&P GSCI). Apart from compo ...

Code of Best Practices in Advertising Collective Investment

... On 20th January 2006, IMAS circulated a draft of the Code of Best Practices in Advertising Collective Investment Schemes and Investment Linked Life Insurance Policies to members for their comments. The purpose of the Code is to supplement regulations and laws applicable and does not replace any legi ...

... On 20th January 2006, IMAS circulated a draft of the Code of Best Practices in Advertising Collective Investment Schemes and Investment Linked Life Insurance Policies to members for their comments. The purpose of the Code is to supplement regulations and laws applicable and does not replace any legi ...

20`s and 30`s Notes Packet

... 2. Turn and Talk: What are some things that most people cannot pay cash for and have to borrow money in order to purchase the product? ...

... 2. Turn and Talk: What are some things that most people cannot pay cash for and have to borrow money in order to purchase the product? ...

Amendment No 3 dated August 10, 2016 to the Simplified Prospectus

... ee) On page 117, the following paragraph is added after the paragraph beginning with “The fund may use derivative consistent with its investment objective…” under “Investment strategies”: “The fund also uses derivatives to hedge the exposure of its investments denominated in foreign currencies attr ...

... ee) On page 117, the following paragraph is added after the paragraph beginning with “The fund may use derivative consistent with its investment objective…” under “Investment strategies”: “The fund also uses derivatives to hedge the exposure of its investments denominated in foreign currencies attr ...

Trends in Institutional Investor Use of Fixed Income ETFs

... can’t find individual bonds.” – Investment manager ...

... can’t find individual bonds.” – Investment manager ...

Sovereign Wealth Funds in the Pacific Island Countries

... experienced large (though shorter lived) fiscal deficits in recent years. Revenue volatility and sustainability Fiscal revenue in the PICs is highly volatile by international standards, particularly with respect to non-tax revenue (for some countries) and grants (for most countries) (Figure 2 and Ap ...

... experienced large (though shorter lived) fiscal deficits in recent years. Revenue volatility and sustainability Fiscal revenue in the PICs is highly volatile by international standards, particularly with respect to non-tax revenue (for some countries) and grants (for most countries) (Figure 2 and Ap ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.