Chapter 13

... positive alpha is a positive-NPV investment opportunity, and investors should flock to invest in such strategies. ...

... positive alpha is a positive-NPV investment opportunity, and investors should flock to invest in such strategies. ...

Chapter 8 - Mississippi State University, College of Business

... Since equity earns a much higher return but with higher risk, it would be nice if we could invest and earn a high return but reduce the risk associated with such investments ...

... Since equity earns a much higher return but with higher risk, it would be nice if we could invest and earn a high return but reduce the risk associated with such investments ...

Report on the analysis of existing and potential investment

... flows, would have to be significantly expanded to address needs for additional investment and financial flows. National policies can assist in shifting investments and financial flows made by private and public investors into more climate-friendly alternatives and optimize the use of available funds ...

... flows, would have to be significantly expanded to address needs for additional investment and financial flows. National policies can assist in shifting investments and financial flows made by private and public investors into more climate-friendly alternatives and optimize the use of available funds ...

The relative asset pricing model

... firm bias investing or background risk, and Section 6 highlights the behavior of liability-aware investors to demonstrate that these investors adopt Three Fund Separation, forecasted by such a model. This section also discusses some opportunities for CIOs of funds to improve investment processes, an ...

... firm bias investing or background risk, and Section 6 highlights the behavior of liability-aware investors to demonstrate that these investors adopt Three Fund Separation, forecasted by such a model. This section also discusses some opportunities for CIOs of funds to improve investment processes, an ...

PDF

... only then will this year’s investments (i = 0) enter this year’s capital stock (at the end of the year) with a weight of 1. On the other hand, if we want the stock that is determining this year’s production there are essentially 2 possibilities, beginning year stocks and mid year stocks. For beginni ...

... only then will this year’s investments (i = 0) enter this year’s capital stock (at the end of the year) with a weight of 1. On the other hand, if we want the stock that is determining this year’s production there are essentially 2 possibilities, beginning year stocks and mid year stocks. For beginni ...

Cash Is KIng, and There`s no heIr To The Throne

... Cash Is King, And T here ’ s N o Heir T o T he T hrone Perhaps above all, cash is intuitive. A colleague once attended a presentation by Richemont in which the Chairman said, when questioned by an analyst about his ROCE/WACC5 spread and what it meant for value creation, «I measure value creation by ...

... Cash Is King, And T here ’ s N o Heir T o T he T hrone Perhaps above all, cash is intuitive. A colleague once attended a presentation by Richemont in which the Chairman said, when questioned by an analyst about his ROCE/WACC5 spread and what it meant for value creation, «I measure value creation by ...

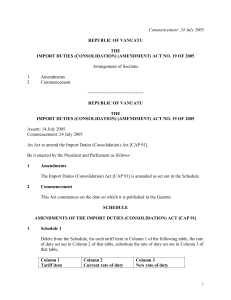

republic of vanuatu

... that the Director of Fisheries is satisfied (based on information not available to him or her when giving advice under subclause (3)) that the capital investment in Vanuatu has been (or will be) less than a total of VT1 billion during the prescribed period and the further period, paragraphs (2)(a), ...

... that the Director of Fisheries is satisfied (based on information not available to him or her when giving advice under subclause (3)) that the capital investment in Vanuatu has been (or will be) less than a total of VT1 billion during the prescribed period and the further period, paragraphs (2)(a), ...

overhead - 23 Portfolio, Risk Stationarity

... Portfolio and Bid Analysis Models • Many business decisions can be couched in a portfolio analysis framework • A portfolio analysis refers to comparing investment alternatives • A portfolio can represent any set of risky alternatives the decision maker considers • For example an insurance purchase ...

... Portfolio and Bid Analysis Models • Many business decisions can be couched in a portfolio analysis framework • A portfolio analysis refers to comparing investment alternatives • A portfolio can represent any set of risky alternatives the decision maker considers • For example an insurance purchase ...

SunAmerica Dynamic Allocation Portfolio Summary

... and short-term investments (the “Overlay Component”). The Fund-of-Funds Component will allocate approximately 50% to 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securitie ...

... and short-term investments (the “Overlay Component”). The Fund-of-Funds Component will allocate approximately 50% to 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securitie ...

Investment Embracing Sharia Principles

... representation or warranties about the correctness or the suitability of any products or service that appear nor the soundness of any general advice offered. Oasis shall not be responsible and disclaims all liability for any loss, liability, damage (whether direct, indirect, special or consequential ...

... representation or warranties about the correctness or the suitability of any products or service that appear nor the soundness of any general advice offered. Oasis shall not be responsible and disclaims all liability for any loss, liability, damage (whether direct, indirect, special or consequential ...

Macro Trading and Investment Strategies. Macroeconomic Arbitrage in Brochure

... - Causes of macroeconomic mispricings in markets; tackling secondary macroeconomic variables in trades - The importance of technical timing in macro arbitrage - Volatility of macro arbitrage strategies versus volatility of relative-value strategies - Mispricing opportunities due to the effect of the ...

... - Causes of macroeconomic mispricings in markets; tackling secondary macroeconomic variables in trades - The importance of technical timing in macro arbitrage - Volatility of macro arbitrage strategies versus volatility of relative-value strategies - Mispricing opportunities due to the effect of the ...

Retirement Plan Enrollment Booklet

... You should carefully consider the investment objectives, risks, charges and expenses of the investment options offered under the retirement plan before investing. Smallcompany (small cap) investing involves specific risks not necessarily encountered in large-company investing, such as increased vola ...

... You should carefully consider the investment objectives, risks, charges and expenses of the investment options offered under the retirement plan before investing. Smallcompany (small cap) investing involves specific risks not necessarily encountered in large-company investing, such as increased vola ...

Chp 10 Slides File

... a. There is strong evidence that, on average, IPOs of firms perform poorly over a period of a year or longer. b. From a long-term perspective, many IPOs are overpriced at the time of the issue. c. This weak performance may be partially attributed to irrational valuations at the time of the IPO, whic ...

... a. There is strong evidence that, on average, IPOs of firms perform poorly over a period of a year or longer. b. From a long-term perspective, many IPOs are overpriced at the time of the issue. c. This weak performance may be partially attributed to irrational valuations at the time of the IPO, whic ...

Reproductive investment when mate quality varies: differential

... a female has at a given time to allocate towards reproduction or somatic maintenance. We assume females may facultatively allocate energetic resources towards offspring production at a given reproductive attempt and that these decisions may optimally maximize the expected lifetime reproductive succe ...

... a female has at a given time to allocate towards reproduction or somatic maintenance. We assume females may facultatively allocate energetic resources towards offspring production at a given reproductive attempt and that these decisions may optimally maximize the expected lifetime reproductive succe ...

Investments and mortgages supplement

... Terms in this form These Notes use the following terms: 'you' refers to the person(s) signing the form on behalf of the applicant firm; 'the applicant firm' refers to the firm applying for authorisation; ‘the FCA' ,'we', ‘us’ or 'our' refers to the Financial Conduct Authority; FSMA refers to ...

... Terms in this form These Notes use the following terms: 'you' refers to the person(s) signing the form on behalf of the applicant firm; 'the applicant firm' refers to the firm applying for authorisation; ‘the FCA' ,'we', ‘us’ or 'our' refers to the Financial Conduct Authority; FSMA refers to ...

Rajiv Gandhi Equity Savings Scheme

... ____________________ depository participant but I have not traded in any equity shares or derivatives in this account. (c) I have a joint demat account no _________________ in ____________________ depository participant but I am not the first account holder. I hereby declare that I have read and und ...

... ____________________ depository participant but I have not traded in any equity shares or derivatives in this account. (c) I have a joint demat account no _________________ in ____________________ depository participant but I am not the first account holder. I hereby declare that I have read and und ...

Currency Investor Roundtable

... currencies become more widely accepted as an asset class is there likely to be significantly increased interest for active overlay strategies that can deliver modest returns and if so, do you see regional variations in demand for these? KS: The difficulty with overlay strategies is that their perfor ...

... currencies become more widely accepted as an asset class is there likely to be significantly increased interest for active overlay strategies that can deliver modest returns and if so, do you see regional variations in demand for these? KS: The difficulty with overlay strategies is that their perfor ...

Lifetime ISA (LISA)

... Lifetime ISA (LISA) From 6th April 2017, adults under the age of 40 (up to the day of their 40th birthday) can open a LISA. Once open, you are able to pay in up to £4,000 each tax year up to the age of 50. The government will add a 25% bonus to these contributions at the end of the tax year, so thos ...

... Lifetime ISA (LISA) From 6th April 2017, adults under the age of 40 (up to the day of their 40th birthday) can open a LISA. Once open, you are able to pay in up to £4,000 each tax year up to the age of 50. The government will add a 25% bonus to these contributions at the end of the tax year, so thos ...

In Whose Best Interest?

... are currently required to act as fiduciaries. Moreover, even among Americans who already work with a financial advisor, two in five (41 percent) were “not sure” if their advisor was a fiduciary or not. This means that many unsuspecting Americans are at risk of placing their hard-earned retirement sa ...

... are currently required to act as fiduciaries. Moreover, even among Americans who already work with a financial advisor, two in five (41 percent) were “not sure” if their advisor was a fiduciary or not. This means that many unsuspecting Americans are at risk of placing their hard-earned retirement sa ...

Medicine Hat-based financial advisor fined $70000 for

... IIROC is the national self-regulatory organization which oversees all investment dealers and their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while supporting healthy ...

... IIROC is the national self-regulatory organization which oversees all investment dealers and their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while supporting healthy ...

Hedge Fund Risk and Return Modeling

... • General problem: model risk and return for portfolios of hedge fund investments. • Hedge fund returns have unique properties that present interesting challenges for modeling. © Eric Zivot 2011 ...

... • General problem: model risk and return for portfolios of hedge fund investments. • Hedge fund returns have unique properties that present interesting challenges for modeling. © Eric Zivot 2011 ...

Quantitative Investment Analysis by Richard A. DeFusco/ CFA

... • Although it might seem reasonable for the variance of a portfolio to be the weighted average of the variances of the securities in the portfolio, this is incorrect. • Portfolio variance consists of the variances of the individual securities, but must also consist of a factor that measures the inte ...

... • Although it might seem reasonable for the variance of a portfolio to be the weighted average of the variances of the securities in the portfolio, this is incorrect. • Portfolio variance consists of the variances of the individual securities, but must also consist of a factor that measures the inte ...

Quantitative Investment Analysis by Richard A. DeFusco/ CFA

... • Although it might seem reasonable for the variance of a portfolio to be the weighted average of the variances of the securities in the portfolio, this is incorrect. • Portfolio variance consists of the variances of the individual securities, but must also consist of a factor that measures the inte ...

... • Although it might seem reasonable for the variance of a portfolio to be the weighted average of the variances of the securities in the portfolio, this is incorrect. • Portfolio variance consists of the variances of the individual securities, but must also consist of a factor that measures the inte ...

Chapter 8

... Since equity earns a much higher return but with higher risk, it would be nice if we could invest and earn a high return but reduce the risk associated with such investments ...

... Since equity earns a much higher return but with higher risk, it would be nice if we could invest and earn a high return but reduce the risk associated with such investments ...

Strategy enhancement - nab asset management

... Ruffer aims to construct portfolios delivering above inflation returns over 5 to 7 years, while limiting the risk of negative nominal returns in any 12 month period. Ruffer does this through their deep understanding of the fundamental drivers of the global investment environment and also the lessons ...

... Ruffer aims to construct portfolios delivering above inflation returns over 5 to 7 years, while limiting the risk of negative nominal returns in any 12 month period. Ruffer does this through their deep understanding of the fundamental drivers of the global investment environment and also the lessons ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.