Generic Brochure - Cyprus Investment Promotion Agency

... to become an energy hub in the Eastern Mediterranean. This development has attracted worldwide interest and significant investments from leading international energy giants, such as Noble Energy, Delek, Total, ENI and KOGAS, as well as renowned international providers operating in the oil and gas ...

... to become an energy hub in the Eastern Mediterranean. This development has attracted worldwide interest and significant investments from leading international energy giants, such as Noble Energy, Delek, Total, ENI and KOGAS, as well as renowned international providers operating in the oil and gas ...

GOVERNMENT SHAREHOLDING AND FINANCIAL HEALTH OF

... the activities of stockholders and from other companies” (Dyckman et al., 2014, p. 28). When the government is a shareholder, the separation of activities may be not so clear in practice. Several studies have shown that it is common for government agents and political groups to use equity holdings t ...

... the activities of stockholders and from other companies” (Dyckman et al., 2014, p. 28). When the government is a shareholder, the separation of activities may be not so clear in practice. Several studies have shown that it is common for government agents and political groups to use equity holdings t ...

wiiw FDI Database – detailed description (June 2015)

... The concepts of direct investor and direct investment enterprise remain broadly unchanged compared with BPM5. Under ‘Direct investor in direct investment enterprises’, the reporting economy of the direct investor records the assets of the direct investor. The reporting economy of the direct investme ...

... The concepts of direct investor and direct investment enterprise remain broadly unchanged compared with BPM5. Under ‘Direct investor in direct investment enterprises’, the reporting economy of the direct investor records the assets of the direct investor. The reporting economy of the direct investme ...

Fund Summary Sheet TMLS Singapore Cash Fund

... Investment in the Underlying Fund is generally designed to produce returns over the long-term and is not suitable for short-term speculation. Investors should not expect to obtain short-term gains from such investment although money market Funds may be suitable for short-term investment. 2. Fund Spe ...

... Investment in the Underlying Fund is generally designed to produce returns over the long-term and is not suitable for short-term speculation. Investors should not expect to obtain short-term gains from such investment although money market Funds may be suitable for short-term investment. 2. Fund Spe ...

Robbing Peter to Pay Paul: Ponzi Schemes Throughout History

... to the confusion of his accountants. This provided him liquidity and the ability to pay consistently high dividends, usually 20–25%, even on his failed ventures. (One of Kreuger’s unsuccessful endeavors included a try at the film industry, which he loved. He is credited with discovering Greta Garbo, ...

... to the confusion of his accountants. This provided him liquidity and the ability to pay consistently high dividends, usually 20–25%, even on his failed ventures. (One of Kreuger’s unsuccessful endeavors included a try at the film industry, which he loved. He is credited with discovering Greta Garbo, ...

Financial Accounting and Accounting Standards

... Governments are required only to report the major funds in separate columns, but have flexibility to report more funds separately if desired. Individual governmental funds and proprietary funds are major funds if the total assets, liabilities, revenues, or expenditure/expenses of that individual fun ...

... Governments are required only to report the major funds in separate columns, but have flexibility to report more funds separately if desired. Individual governmental funds and proprietary funds are major funds if the total assets, liabilities, revenues, or expenditure/expenses of that individual fun ...

Investor Preferences and Demand for Active Management

... index options. In addition, since investments by U.S. open-end equity mutual funds account for a significant part of stock market capitalization, we expect that our index option-based risk preference estimates are representative of the risk attitude of the average mutual fund investor.7 Using flows ...

... index options. In addition, since investments by U.S. open-end equity mutual funds account for a significant part of stock market capitalization, we expect that our index option-based risk preference estimates are representative of the risk attitude of the average mutual fund investor.7 Using flows ...

CRA Investment Fund Audited Financial Statements

... generally accepted in the United States of America requires management to make estimates and assumptions that affect the amount reported in the combined financial statements and accompanying notes. Actual results could differ from those estimates. A material estimate that is partially susceptible to ...

... generally accepted in the United States of America requires management to make estimates and assumptions that affect the amount reported in the combined financial statements and accompanying notes. Actual results could differ from those estimates. A material estimate that is partially susceptible to ...

The Economic Analysis of Real Option Value

... cash-flow-based intrinsic valuation of that security’s price. That is, the intrinsic valuation of the security (based on a discounted cash flow valuation analysis) may simply not support the apparently excessive public stock price of that security. In such instances, some market analysts have argued ...

... cash-flow-based intrinsic valuation of that security’s price. That is, the intrinsic valuation of the security (based on a discounted cash flow valuation analysis) may simply not support the apparently excessive public stock price of that security. In such instances, some market analysts have argued ...

University and College Union

... We note that the UUK proposed changes are “designed to create a structure for USS which is sustainable and affordable over the long term” and that the employers are willing to increase their contributions under the new design. However, an important factor in the UUK proposals is the introduction of ...

... We note that the UUK proposed changes are “designed to create a structure for USS which is sustainable and affordable over the long term” and that the employers are willing to increase their contributions under the new design. However, an important factor in the UUK proposals is the introduction of ...

The Impact of Non-Transparency on Foreign Direct Investment

... Let us start by considering the question of transparency in economic policy-making of governments. The lack of transparency has for us five different origins. First, economic policy – making will be seen as non-transparent if it is subject to corruption and bribery . By definition, bribery involves ...

... Let us start by considering the question of transparency in economic policy-making of governments. The lack of transparency has for us five different origins. First, economic policy – making will be seen as non-transparent if it is subject to corruption and bribery . By definition, bribery involves ...

Form Disclosure Letter for Placement Agents

... The Placement Agent hereby confirms and represents that none of the Placement Agent and its covered associates as defined in SEC Rule 206(4)-5(f)(2) has made, coordinated or solicited any Political Contribution to the Treasurer or any incumbent, nominee, candidate or successful candidate for such el ...

... The Placement Agent hereby confirms and represents that none of the Placement Agent and its covered associates as defined in SEC Rule 206(4)-5(f)(2) has made, coordinated or solicited any Political Contribution to the Treasurer or any incumbent, nominee, candidate or successful candidate for such el ...

FINN 1003 Your Money and Credit

... exercises. The course will be available in the spring, summer, and fall. The course is nondegree credit for business majors. Course Objective: The primary objective of this course is to teach students about personal finance in theory and in practice. Personal finance topics covered will include pers ...

... exercises. The course will be available in the spring, summer, and fall. The course is nondegree credit for business majors. Course Objective: The primary objective of this course is to teach students about personal finance in theory and in practice. Personal finance topics covered will include pers ...

Infrastructure - Debt and Equity Investments for UK Insurers

... will work alongside partners with the aim of delivering at least £25 billion of investment in UK infrastructure in the next five years. Suitable projects will include, but not be limited to those included in the National Infrastructure Plan 2013 and can include major infrastructure projects led by p ...

... will work alongside partners with the aim of delivering at least £25 billion of investment in UK infrastructure in the next five years. Suitable projects will include, but not be limited to those included in the National Infrastructure Plan 2013 and can include major infrastructure projects led by p ...

AAA Video Games EIS Fund

... 2. Investment Objective The Fund aims to invest in a portfolio of Companies with the objective of maximising potential returns while managing risk for Investors. The Fund will target specific platforms within the video games sector, namely businesses focusing on the development of premium digital t ...

... 2. Investment Objective The Fund aims to invest in a portfolio of Companies with the objective of maximising potential returns while managing risk for Investors. The Fund will target specific platforms within the video games sector, namely businesses focusing on the development of premium digital t ...

Reducing the Fear of Inflation with TIPS

... The underlying value of a TIPS bond is its principal grows at the same rate that prices rise. When the principal grows, interest payments also grow since interest payments are a fixed percentage of principal. At maturity – TIPS are issued in 5-, 10- and 20-year maturities – if inflation has occurred ...

... The underlying value of a TIPS bond is its principal grows at the same rate that prices rise. When the principal grows, interest payments also grow since interest payments are a fixed percentage of principal. At maturity – TIPS are issued in 5-, 10- and 20-year maturities – if inflation has occurred ...

Factor Risk Model

... computational burden. All estimation is based on weekly returns. It should be noted that one could in practice introduce any kind of distributional assumption. However the computational burden would rise since estimation of the parameters would have to be done through some nonclosed form of Maximum ...

... computational burden. All estimation is based on weekly returns. It should be noted that one could in practice introduce any kind of distributional assumption. However the computational burden would rise since estimation of the parameters would have to be done through some nonclosed form of Maximum ...

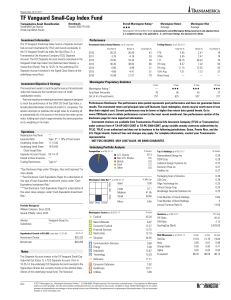

TF Vanguard Small-Cap Index Fund

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

2015 Preqin Sovereign Wealth Fund Review: Exclusive Extract

... Where other institutional investors hold more stringent liquidity requirements in comparison with the multi-generational mission of sovereign wealth funds, potential investments in highly illiquid asset classes and strategies are more feasible, the longer the investment horizon. Sovereign wealth fun ...

... Where other institutional investors hold more stringent liquidity requirements in comparison with the multi-generational mission of sovereign wealth funds, potential investments in highly illiquid asset classes and strategies are more feasible, the longer the investment horizon. Sovereign wealth fun ...

Real Estate and Unconventional Securities under the Arkansas

... The promoter could retain control with his contribution accounting for only a small portion of the entire venture. The risk of loss in case of whole or partial failure of the venture would fall squarely on the investors. As can be seen in each of these illustrations, the investors are risking their ...

... The promoter could retain control with his contribution accounting for only a small portion of the entire venture. The risk of loss in case of whole or partial failure of the venture would fall squarely on the investors. As can be seen in each of these illustrations, the investors are risking their ...

URL Address

... their old ages. The accelerating aging of the Japanese society made the social security system no longer completely reliable. As a complement to the insufficient public support, the Japanese securities industry is expected to support living standards of the Japanese households in the future by offer ...

... their old ages. The accelerating aging of the Japanese society made the social security system no longer completely reliable. As a complement to the insufficient public support, the Japanese securities industry is expected to support living standards of the Japanese households in the future by offer ...

Document

... fall in investment. The govt borrows to finance its deficit, leaving less funds available for investment. This is called crowding out. Recall from the preceding chapter: Investment is important for long-run economic growth. Hence, budget deficits reduce the economy’s growth rate and future stand ...

... fall in investment. The govt borrows to finance its deficit, leaving less funds available for investment. This is called crowding out. Recall from the preceding chapter: Investment is important for long-run economic growth. Hence, budget deficits reduce the economy’s growth rate and future stand ...

the role of gender in entrepreneur-investor relationships: a signaling

... the venture. Signals are the information sent from the signaler to the receiver to communicate information which otherwise is unobservable for the receiver, in this case information about venture quality. Signals may be strong or weak, more or less honest and reliable, and vary in their correlation ...

... the venture. Signals are the information sent from the signaler to the receiver to communicate information which otherwise is unobservable for the receiver, in this case information about venture quality. Signals may be strong or weak, more or less honest and reliable, and vary in their correlation ...

Risk and Return: The Portfolio Theory The crux of portfolio theory

... broken down into two sources: - Firm specific risk (only faced by that firm), - Market wide risk (affects all investments). • Firm-specific risk can be reduced, if not eliminated, by increasing the number of investments in your portfolio (i.e. by being diversified). Market wide risk cannot. • On eco ...

... broken down into two sources: - Firm specific risk (only faced by that firm), - Market wide risk (affects all investments). • Firm-specific risk can be reduced, if not eliminated, by increasing the number of investments in your portfolio (i.e. by being diversified). Market wide risk cannot. • On eco ...

Balanced Income Portfolio Interim Management Report of Fund

... securities, certain derivative products (including futures and forwards) and the execution of portfolio transactions. Brokerage business may be allocated by the Portfolio Advisor and any portfolio sub-advisors to CIBC World Markets Inc. (CIBC WM) and CIBC World Markets Corp., each a subsidiary of CI ...

... securities, certain derivative products (including futures and forwards) and the execution of portfolio transactions. Brokerage business may be allocated by the Portfolio Advisor and any portfolio sub-advisors to CIBC World Markets Inc. (CIBC WM) and CIBC World Markets Corp., each a subsidiary of CI ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.