Liquidity Management Policy Summary

... investments via a pooled arrangement in which the underlying assets from each diversified option are invested collectively across the various asset classes. The allocation to these asset classes within each option is the main determinant of the overall risk and return characteristics, including an o ...

... investments via a pooled arrangement in which the underlying assets from each diversified option are invested collectively across the various asset classes. The allocation to these asset classes within each option is the main determinant of the overall risk and return characteristics, including an o ...

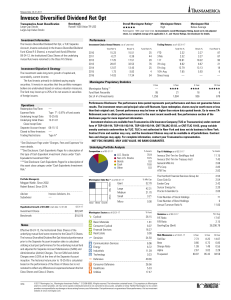

Invesco Diversified Dividend Ret Opt

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

... other than the Transamerica Stable Value investment choice(s), is subject to market risk. Principal value and investment return will fluctuate, so that an investor's shares, when redeemed, may be worth more or less than the original investment. Current performance may be lower or higher than the per ...

Portfolio rebalancing is the process of bringing the different asset

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

Chapter 6.

... investor, a direct investment enterprise, and a fellow enterprise (defined in paragraph 6.17(c)) in its relationships to other enterprises. c. Definitions of control and influence—definitions of immediate and indirect relationships 6.12 Control or influence may be achieved directly by owning equity ...

... investor, a direct investment enterprise, and a fellow enterprise (defined in paragraph 6.17(c)) in its relationships to other enterprises. c. Definitions of control and influence—definitions of immediate and indirect relationships 6.12 Control or influence may be achieved directly by owning equity ...

“ЗАТВЕРДЖЕНО”

... 5.2. The Fund's net asset value does not include the value of securities, the issuance registration of which has been cancelled in accordance with the procedure established by legislature. 5.3. In calculating net asset value of the Fund, the market value of Fund’s securities. Market value of the Fun ...

... 5.2. The Fund's net asset value does not include the value of securities, the issuance registration of which has been cancelled in accordance with the procedure established by legislature. 5.3. In calculating net asset value of the Fund, the market value of Fund’s securities. Market value of the Fun ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... 2.1 Theoretical Background There are several theories that exist in an attempt to rationalize the decisions for MNC to invest in a foreign market they range from Vernon‟s (1966) economic theories, to the internationalization theories posited by Rugman (1981). However, Dunning (1988, 1993) is notable ...

... 2.1 Theoretical Background There are several theories that exist in an attempt to rationalize the decisions for MNC to invest in a foreign market they range from Vernon‟s (1966) economic theories, to the internationalization theories posited by Rugman (1981). However, Dunning (1988, 1993) is notable ...

Present Values, Investment Returns and Discount Rates

... retrospectively as a measurement of portfolio performance. In contrast, the return in formula (1.2) is used prospectively to calculate the future value of the portfolio, and it may or may not be certain. When a portfolio contains risky assets, the portfolio return is uncertain by definition. Most in ...

... retrospectively as a measurement of portfolio performance. In contrast, the return in formula (1.2) is used prospectively to calculate the future value of the portfolio, and it may or may not be certain. When a portfolio contains risky assets, the portfolio return is uncertain by definition. Most in ...

Determinants of Minority Shareholder Rights in the Thai Banking Sector

... corporate governance practices, and inefficient management of cash flows and financial performance (Claessens & Fan 2002; La Porta, R et al. 1998; Shleifer & Vishny 1997). Minority shareholder rights expropriation occurred when family ownership directed cash to their own benefit, inefficient project ...

... corporate governance practices, and inefficient management of cash flows and financial performance (Claessens & Fan 2002; La Porta, R et al. 1998; Shleifer & Vishny 1997). Minority shareholder rights expropriation occurred when family ownership directed cash to their own benefit, inefficient project ...

Ingrid`s PowerPoint presentation

... “The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.” Warren Buffett ...

... “The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.” Warren Buffett ...

834KB - Future of Financial Advice

... In 2007, a definition of ‘sophisticated investor’ was introduced to Chapter 7 of the Corporations Act (s761GA). This new section mirrors s708(10) and aims to apply the same tests that apply to securities and debentures in Chapter 6D of the Corporations Act. This provides a more consistent approach f ...

... In 2007, a definition of ‘sophisticated investor’ was introduced to Chapter 7 of the Corporations Act (s761GA). This new section mirrors s708(10) and aims to apply the same tests that apply to securities and debentures in Chapter 6D of the Corporations Act. This provides a more consistent approach f ...

Probability Return on large company common stocks

... Long-Term Corporate Bonds Long-Term U.S. Government Bonds U.S. Treasury Bills ...

... Long-Term Corporate Bonds Long-Term U.S. Government Bonds U.S. Treasury Bills ...

your retirement plan is on the move

... Target date funds allow you to make a single choice for your total plan account based on the approximate year in which you plan to start withdrawing assets (typically during retirement). To choose this option, you must allocate 100% of your account balance to a single target date fund. The date in a ...

... Target date funds allow you to make a single choice for your total plan account based on the approximate year in which you plan to start withdrawing assets (typically during retirement). To choose this option, you must allocate 100% of your account balance to a single target date fund. The date in a ...

Sample Endowment Fund policy

... inquire as to any current holdings affected by this restriction and determine an appropriate strategy for divesting the affected holdings within a reasonable time frame. Portfolio Diversification: The investment objectives should be achieved through a diversified portfolio, which may include but it ...

... inquire as to any current holdings affected by this restriction and determine an appropriate strategy for divesting the affected holdings within a reasonable time frame. Portfolio Diversification: The investment objectives should be achieved through a diversified portfolio, which may include but it ...

Islamic Insurance takaful

... cooperation, mutuality and shared responsibility among participants who have agreed to share defined losses to be paid out of defined assets. Takaful is Islamic insurance based on the principle of mutual assistance and protection of assets and property. It implies an agreement among a group of mem ...

... cooperation, mutuality and shared responsibility among participants who have agreed to share defined losses to be paid out of defined assets. Takaful is Islamic insurance based on the principle of mutual assistance and protection of assets and property. It implies an agreement among a group of mem ...

Uncertainty and Consumer Behavior

... 5. Why do people often want to insure fully against uncertain situations even when the premium paid exceeds the expected value of the loss being insured against? Risk averse people have declining marginal utility, and this means that the pain of a loss increases at an increasing rate as the size of ...

... 5. Why do people often want to insure fully against uncertain situations even when the premium paid exceeds the expected value of the loss being insured against? Risk averse people have declining marginal utility, and this means that the pain of a loss increases at an increasing rate as the size of ...

Careers in Mathematics Actuaries` Careers

... • Valuation Actuaries: Insurance companies put aside what they need to pay future claims and expenses. • Pricing Actuaries: Pricing actuaries are responsible for determining how much money a company is likely to make on a product. A product can be life insurance, an annuity, and so forth. ...

... • Valuation Actuaries: Insurance companies put aside what they need to pay future claims and expenses. • Pricing Actuaries: Pricing actuaries are responsible for determining how much money a company is likely to make on a product. A product can be life insurance, an annuity, and so forth. ...

`Parsing the Reality and Promise of Gulf

... that time, exports from GCC to Asia increased 55%, to US$174bn.10 Despite a history of trade between Northeast Asia and the GCC, direct financial investments between these regions have developed relatively slowly. For each Northeast Asian country this situation is the result of a different set of ci ...

... that time, exports from GCC to Asia increased 55%, to US$174bn.10 Despite a history of trade between Northeast Asia and the GCC, direct financial investments between these regions have developed relatively slowly. For each Northeast Asian country this situation is the result of a different set of ci ...

Impact of Foreign Institutional Investors

... markets have come in age where there were significant developments in the last 15 years make the markets at par with the developed markets. Bohra, N. Singh and Dutt, Akash. (2011)3, studied the behavioral pattern of FII in India and figure out the reasons for indifferent responses of BSE Sensex due ...

... markets have come in age where there were significant developments in the last 15 years make the markets at par with the developed markets. Bohra, N. Singh and Dutt, Akash. (2011)3, studied the behavioral pattern of FII in India and figure out the reasons for indifferent responses of BSE Sensex due ...

What every Ghanaian employee should know about the

... well, who can contribute up to a maximum of 35% of their gross salaries into ...

... well, who can contribute up to a maximum of 35% of their gross salaries into ...

Does Social Enterprise Understand Social Need?

... more able to later gather traction to become more potent macro alternatives. These are the routes that social entrepreneurs and their community-based social enterprises strive to provide. Social entrepreneurship was manifested primarily at community level; As such, it was positioned as closer to the ...

... more able to later gather traction to become more potent macro alternatives. These are the routes that social entrepreneurs and their community-based social enterprises strive to provide. Social entrepreneurship was manifested primarily at community level; As such, it was positioned as closer to the ...

Savings and Retirement

... The Equitable Life Family of Segregated funds Pivotal Select Estate Class is an enhanced segregated fund offering for investors wishing to protect their investment, while maintaining the growth potential of the markets. Investors can choose from a diverse selection of investment funds from a variet ...

... The Equitable Life Family of Segregated funds Pivotal Select Estate Class is an enhanced segregated fund offering for investors wishing to protect their investment, while maintaining the growth potential of the markets. Investors can choose from a diverse selection of investment funds from a variet ...

recent trends in world saving and investment patterns1

... since 1994, the other east Asia region since 1998, the oil producers in the Middle East plus Russia since 1999, and Latin America since 2003. Indeed, in contrast to most of the period under review here, by 2004 the Eastern Europe and former Soviet Union (excluding Russia) region was the only develop ...

... since 1994, the other east Asia region since 1998, the oil producers in the Middle East plus Russia since 1999, and Latin America since 2003. Indeed, in contrast to most of the period under review here, by 2004 the Eastern Europe and former Soviet Union (excluding Russia) region was the only develop ...

Endowment Policy

... In fiscal years where the three years’ trailing average market values multiplied by the four percent spending rate, plus the assessed fees of one and three quarters percent, exceeds the earnings available for distribution, the shortfall in available earnings may cause a partial distribution in th ...

... In fiscal years where the three years’ trailing average market values multiplied by the four percent spending rate, plus the assessed fees of one and three quarters percent, exceeds the earnings available for distribution, the shortfall in available earnings may cause a partial distribution in th ...

Accounting for Investments (AS 13) and

... payable for theFinancial year,Audit the excess should be treated31 Autonomous Bodies AS 13 and AS 15 Session 1.7 as a pre-payment. ...

... payable for theFinancial year,Audit the excess should be treated31 Autonomous Bodies AS 13 and AS 15 Session 1.7 as a pre-payment. ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.