Example #4 - University of Colorado Boulder

... Quantitative Finance and a Minor in Mathematics. The courses required for the certificate and minor provide me with a deeper mathematical and economics background allowing me to apply calculations and understand their interpretation more profoundly. I feel that my determination for success and initi ...

... Quantitative Finance and a Minor in Mathematics. The courses required for the certificate and minor provide me with a deeper mathematical and economics background allowing me to apply calculations and understand their interpretation more profoundly. I feel that my determination for success and initi ...

Financial Markets and Institutions

... justify the common practice of thinking about firms, especially large firms, as being separate entities from their owners. ...

... justify the common practice of thinking about firms, especially large firms, as being separate entities from their owners. ...

New Client Questionnaire

... Existing adviser relationship and role of SJBenen in financial planning (select one) o _____ I am satisfied with my existing adviser, or totally self-directed, and confident I am getting good advice. I am simply looking to make an allocation to an account managed by SJBenen as a percentage of my ove ...

... Existing adviser relationship and role of SJBenen in financial planning (select one) o _____ I am satisfied with my existing adviser, or totally self-directed, and confident I am getting good advice. I am simply looking to make an allocation to an account managed by SJBenen as a percentage of my ove ...

PDF Download

... Europe which, according to the European Central Bank, was again a big net exporter of direct invest- ...

... Europe which, according to the European Central Bank, was again a big net exporter of direct invest- ...

Investment Management Policy

... With a view to alleviate poverty through employment generation, Government of the People’s Republic of Bangladesh has established Palli Karma-Sahayak Foundation (PKSF) under the Company Act 1913(amended in 1994) as “not for Profit” company in 1990.PKSF makes available financial services (Micro-credi ...

... With a view to alleviate poverty through employment generation, Government of the People’s Republic of Bangladesh has established Palli Karma-Sahayak Foundation (PKSF) under the Company Act 1913(amended in 1994) as “not for Profit” company in 1990.PKSF makes available financial services (Micro-credi ...

I. “Active” Small/Mid Cap US Equity (SMID) Should Play Second

... Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker‐dealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or ot ...

... Morgan Stanley Wealth Management is the trade name of Morgan Stanley Smith Barney LLC, a registered broker‐dealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or ot ...

Manager Bio - Natixis Global Asset Management

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. ...

Hedge against Rising Interest Rates with QAI

... Tax-efficient—historically has not paid out short term capital gains ...

... Tax-efficient—historically has not paid out short term capital gains ...

over confidence amongst us

... Schroders commissioned Research Plus Ltd to conduct an independent survey of 20,706 retail investors in 28 countries around the world who intend to invest at least €10,000 (or the equivalent) during the next 12 months. The survey was conducted online between 3rd - 27th March 2015 and these individua ...

... Schroders commissioned Research Plus Ltd to conduct an independent survey of 20,706 retail investors in 28 countries around the world who intend to invest at least €10,000 (or the equivalent) during the next 12 months. The survey was conducted online between 3rd - 27th March 2015 and these individua ...

3Q2015 - Oak Ridge Investments

... greater risks. The Funds may invest in ETFs (Exchange-Traded Funds) and is therefore subject to the same risks as the underlying securities in which the ETF invests as well as entails higher expenses than if invested into the underlying ETF directly. The MSCI EAFE Small Cap Index measures the perfor ...

... greater risks. The Funds may invest in ETFs (Exchange-Traded Funds) and is therefore subject to the same risks as the underlying securities in which the ETF invests as well as entails higher expenses than if invested into the underlying ETF directly. The MSCI EAFE Small Cap Index measures the perfor ...

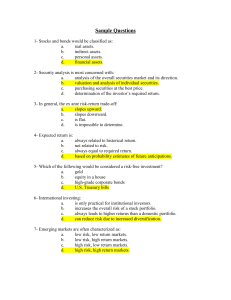

Sample Questions - U of L Class Index

... 17- The measure that allows investors to assess total performance over a stated period of time is the: a. total return. b. cumulative total return. c. cumulative average return. d. total indexed return. 18- Which of the following return measures smoothes out variations in performance? a. total retur ...

... 17- The measure that allows investors to assess total performance over a stated period of time is the: a. total return. b. cumulative total return. c. cumulative average return. d. total indexed return. 18- Which of the following return measures smoothes out variations in performance? a. total retur ...

SEC amends Rule 2a-7 to eliminate dependency on NRSRO ratings

... Rule 2a-7 permits money market funds to invest only in securities that present minimal credit risk to the fund. Historically, these Eligible Securities have been defined in Rule 2a-7 by reference to NRSRO ratings and grouped into two categories: First Tier securities (those that received a short-ter ...

... Rule 2a-7 permits money market funds to invest only in securities that present minimal credit risk to the fund. Historically, these Eligible Securities have been defined in Rule 2a-7 by reference to NRSRO ratings and grouped into two categories: First Tier securities (those that received a short-ter ...

Using Low Volatility Hedge Funds as a Complement to Fixed

... This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The information contained in this document has been compiled by Cidel Asset Management I ...

... This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The information contained in this document has been compiled by Cidel Asset Management I ...

INTRODUCTION TO

... Dividends can now only be paid out of actually realized gains : It will reduce both the quantum of dividends ...

... Dividends can now only be paid out of actually realized gains : It will reduce both the quantum of dividends ...

Slide 1 - Acionista.com.br

... nature and human resources • Investments Vehicles: Fundraising, LP’s and ...

... nature and human resources • Investments Vehicles: Fundraising, LP’s and ...

When Selecting Stocks, He Knows No Boundaries

... breathing challenges are common, it's best to have a medical team along. “We feel that it's essential that we see these projects and get to know both the executives and the employees, including local people,” Mr. Gissen said of his trek up the South American mountain range. “You're not comfortable. ...

... breathing challenges are common, it's best to have a medical team along. “We feel that it's essential that we see these projects and get to know both the executives and the employees, including local people,” Mr. Gissen said of his trek up the South American mountain range. “You're not comfortable. ...

EdgePoint Canadian Growth and Income Portfolio 3rd quarter, 2011

... It’s a friend to investors who know the value of a business and an enemy to those who don’t. Historically, chaotic periods in the market are when we’ve added the most value for you. If volatility doesn’t represent a risk to achieving your long-term goals, what does? We believe it’s two things: The o ...

... It’s a friend to investors who know the value of a business and an enemy to those who don’t. Historically, chaotic periods in the market are when we’ve added the most value for you. If volatility doesn’t represent a risk to achieving your long-term goals, what does? We believe it’s two things: The o ...

Probability of College Football Underdogs Winning Against the

... investment markets. Says Thaler, “each bet has a well-defined termination point at which its value becomes certain.” Alternatively, investment markets do not have an end date which means feedback is littered with noise and more difficult to test for rationality. We can collectively do well as invest ...

... investment markets. Says Thaler, “each bet has a well-defined termination point at which its value becomes certain.” Alternatively, investment markets do not have an end date which means feedback is littered with noise and more difficult to test for rationality. We can collectively do well as invest ...

Chapter03 - U of L Class Index

... standard of living in an economy. Describe how various financial markets are differentiated. Discuss the role that an investment banking house plays in the financial markets. Describe the role that financial intermediaries play in the financial markets, and explain why there are so many different ty ...

... standard of living in an economy. Describe how various financial markets are differentiated. Discuss the role that an investment banking house plays in the financial markets. Describe the role that financial intermediaries play in the financial markets, and explain why there are so many different ty ...

New Investment Guidance from TPR means Responsible

... London, 30th March 2017 – The Pensions Regulator (TPR) today outlined new guidance for trustees of definedbenefit (DB) schemes saying they “need” to pay attention to Environmental, Social and Governance (ESG) factors where they are financially significant. This represents an important step forward f ...

... London, 30th March 2017 – The Pensions Regulator (TPR) today outlined new guidance for trustees of definedbenefit (DB) schemes saying they “need” to pay attention to Environmental, Social and Governance (ESG) factors where they are financially significant. This represents an important step forward f ...

Boston Partners Global Equity Fund (BPGIX)

... The performance data quoted represets past performance and does guarantee future results. Current performance may be lower or higher. Performance data current to the most recent monthend may be obtained at www.boston-partners.com. The investment return and principal value of an investment will fluct ...

... The performance data quoted represets past performance and does guarantee future results. Current performance may be lower or higher. Performance data current to the most recent monthend may be obtained at www.boston-partners.com. The investment return and principal value of an investment will fluct ...

What does teR mean and What is it foR?

... defined expenses deducted from the fund’s portfolio. Investors have a good understanding as to the cost structure of their investments. TER specifically discloses performance fees. Investors are able to compare differently structured investment solutions, e.g. costs related to investing in fun ...

... defined expenses deducted from the fund’s portfolio. Investors have a good understanding as to the cost structure of their investments. TER specifically discloses performance fees. Investors are able to compare differently structured investment solutions, e.g. costs related to investing in fun ...

Fidelity® VIP Growth Portfolio — Service Class 2

... Fidelity® VIP Growth Portfolio — Service Class 2 Investment Strategy from investment’s prospectus The investment seeks to achieve capital appreciation. The fund primarily invests in common stocks. It invests in companies that the adviser believes have above-average growth potential (stocks of these ...

... Fidelity® VIP Growth Portfolio — Service Class 2 Investment Strategy from investment’s prospectus The investment seeks to achieve capital appreciation. The fund primarily invests in common stocks. It invests in companies that the adviser believes have above-average growth potential (stocks of these ...

How Sharpe is Your Fund?

... you know your investment objectives and risk appetite. If you are after high, longterm returns and willing to take a significant amount of risk on your money, then stock market investing is right for you. And since you know little about it, be wise and just hire fund managers to do the “dirty work” ...

... you know your investment objectives and risk appetite. If you are after high, longterm returns and willing to take a significant amount of risk on your money, then stock market investing is right for you. And since you know little about it, be wise and just hire fund managers to do the “dirty work” ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.