On Profiling the Superior IT Portfolio Characteristics

... How is it possible to derive the superior IT investment portfolio? One main identified research objective in IT portfolio management (ITPM) is to manage a set of IT assets, similar to manage a financial portfolio to attain the superior return and risk. Among various IT assets, the investment in IT p ...

... How is it possible to derive the superior IT investment portfolio? One main identified research objective in IT portfolio management (ITPM) is to manage a set of IT assets, similar to manage a financial portfolio to attain the superior return and risk. Among various IT assets, the investment in IT p ...

guest slides - WordPress.com

... they had term sheets for their Series A round, I declined -- mainly because the pre-money valuation was 4x larger than the terms we offered them a few months prior and 2x larger than any other investment we had made. Big mistake. FaceBook My brother-in-law called me up to tell me he had some friends ...

... they had term sheets for their Series A round, I declined -- mainly because the pre-money valuation was 4x larger than the terms we offered them a few months prior and 2x larger than any other investment we had made. Big mistake. FaceBook My brother-in-law called me up to tell me he had some friends ...

Investing in shares - Bridges. Financial advice makes a difference

... and manage those shares yourself (unless this is done for you by your financial adviser). ...

... and manage those shares yourself (unless this is done for you by your financial adviser). ...

view - Ferguson Wellman

... single biggest source of demand for U.S. stocks since the financial crisis, providing a “... vital pillar of demand at a time when domestic pension funds and foreign investors have largely been selling.” He further notes that U.S. companies bought back $644 billion of their own shares in 2016, a new ...

... single biggest source of demand for U.S. stocks since the financial crisis, providing a “... vital pillar of demand at a time when domestic pension funds and foreign investors have largely been selling.” He further notes that U.S. companies bought back $644 billion of their own shares in 2016, a new ...

NAV | KWD 1.05938 (As of 29-Nov-16)

... Boubyan KD Money Market Fund Ministry of Commerce License Number: (2011/66) 30 November 2016 ...

... Boubyan KD Money Market Fund Ministry of Commerce License Number: (2011/66) 30 November 2016 ...

CUBIC 2016 Class 6 Personal Finance Day 4

... strategies (taxes, commissions, etc) • This area of research and its results are extremely “contentious” and controversial ...

... strategies (taxes, commissions, etc) • This area of research and its results are extremely “contentious” and controversial ...

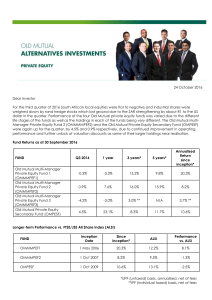

24 October 2016 Dear Investor For the third quarter of 2016 South

... for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has made four cash distribution to date. As investors have had the benefit of receiving cash proceeds from the fund, we believe it more appropriate to calculate the since-inception returns for OMMMPEF1 ...

... for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has made four cash distribution to date. As investors have had the benefit of receiving cash proceeds from the fund, we believe it more appropriate to calculate the since-inception returns for OMMMPEF1 ...

Investment Consultant Ext 100712

... Investment Consultants Mercer is a global leader in investment consulting and fiduciary management and provides investment related services to a wide range of clients including pension funds, insurers and private banks. The firm also has a significant global presence in human resource consulting and ...

... Investment Consultants Mercer is a global leader in investment consulting and fiduciary management and provides investment related services to a wide range of clients including pension funds, insurers and private banks. The firm also has a significant global presence in human resource consulting and ...

SVLS Fact sheet FEB AW - International Biotechnology Trust plc

... Past performance is not necessarily a guide to future performance and may not be repeated. The value of investments, and the income from them, may go down as well as up, and is not guaranteed, and investors may not get back the full amount invested. Exchange rate changes may cause the value of overs ...

... Past performance is not necessarily a guide to future performance and may not be repeated. The value of investments, and the income from them, may go down as well as up, and is not guaranteed, and investors may not get back the full amount invested. Exchange rate changes may cause the value of overs ...

Rajiv Gandhi Equity Savings Scheme

... associated and vital. The purpose of this lesson is to clarify the basics of the concept so that readers at large can relate and thereby take more interest in the product / concept. In a nutshell, Professor Simply Simple lessons should be seen from the perspective of it being a primer on financial c ...

... associated and vital. The purpose of this lesson is to clarify the basics of the concept so that readers at large can relate and thereby take more interest in the product / concept. In a nutshell, Professor Simply Simple lessons should be seen from the perspective of it being a primer on financial c ...

Pyramid and Ponzi schemes

... Pyramid schemes get their name from their triangularly-shaped corporate structure and can be promoted under any number of business names. While it is common for a product or service to be represented in the scheme, the sale of this product or service is a secondary factor in the generation of return ...

... Pyramid schemes get their name from their triangularly-shaped corporate structure and can be promoted under any number of business names. While it is common for a product or service to be represented in the scheme, the sale of this product or service is a secondary factor in the generation of return ...

20-Year Portfolio Performance Examining the past 20 years

... Examining the past 20 years of hypothetical portfolio returns can provide historical insight into the performance characteristics of portfolios with various stock and bond allocations. This image illustrates the hypothetical growth of a $1 investment in five different portfolios over the past 20 yea ...

... Examining the past 20 years of hypothetical portfolio returns can provide historical insight into the performance characteristics of portfolios with various stock and bond allocations. This image illustrates the hypothetical growth of a $1 investment in five different portfolios over the past 20 yea ...

Dollar Cost Averaging – A sound investment strategy to help you

... strategy to remove this speculation and focus on a longer term investment plan. ...

... strategy to remove this speculation and focus on a longer term investment plan. ...

American Funds Bond Fund

... before investing. The investment objectives, risks and policies of the investment options, as well as other information about the investment options, are described in their respective prospectuses. Please read the prospectuses and consider this information carefully before investing. Product availab ...

... before investing. The investment objectives, risks and policies of the investment options, as well as other information about the investment options, are described in their respective prospectuses. Please read the prospectuses and consider this information carefully before investing. Product availab ...

Ten Highly Effective Habits of Successful Angel Investing

... Members for Analysis Engage VCs in Due Diligence Review Engage Relevant Strategic Investors ...

... Members for Analysis Engage VCs in Due Diligence Review Engage Relevant Strategic Investors ...

I-45 Investments - Town of Cardston

... principal by mitigating credit risk and interest rate risk. In order to mitigate risk, the Town of Cardston only invests in the securities which are authorized investments as defined and described by sections 250 (1) and (2) of the Municipal Government Act (MGA) RSA 2000 Chapter M-26 (a copy of whic ...

... principal by mitigating credit risk and interest rate risk. In order to mitigate risk, the Town of Cardston only invests in the securities which are authorized investments as defined and described by sections 250 (1) and (2) of the Municipal Government Act (MGA) RSA 2000 Chapter M-26 (a copy of whic ...

File: ch01, Chapter 1: The Nature of Investments

... as arranging the sale of new securities to institutional investors. A security analyst, or investment analyst, may assist investment bankers or portfolio managers by providing a valuation of a company and its securities. Stockbrokers, or financial advisors, primarily sell stocks, bonds and funds to ...

... as arranging the sale of new securities to institutional investors. A security analyst, or investment analyst, may assist investment bankers or portfolio managers by providing a valuation of a company and its securities. Stockbrokers, or financial advisors, primarily sell stocks, bonds and funds to ...

LionGlobal Asia Bond Fund

... The investment objective of the Fund is to provide total return of capital growth and income over the medium to long-term, through an actively managed portfolio of bonds, high quality interest rate securities, convertible bonds, real estate investment trusts (“REITs”), business trusts and other rela ...

... The investment objective of the Fund is to provide total return of capital growth and income over the medium to long-term, through an actively managed portfolio of bonds, high quality interest rate securities, convertible bonds, real estate investment trusts (“REITs”), business trusts and other rela ...

New firm brings KKR funds to smaller Canadian investors

... in KKR's asset classes, such as private equity, energy, infrastructure and real estate, through a Canadian domiciled fund. Until recent years, global infrastructure and private equity investments were primarily restricted to large institutions, such as pension funds and sovereign wealth funds. But t ...

... in KKR's asset classes, such as private equity, energy, infrastructure and real estate, through a Canadian domiciled fund. Until recent years, global infrastructure and private equity investments were primarily restricted to large institutions, such as pension funds and sovereign wealth funds. But t ...

Investment Policy Beaufort County Open Land Trust (BCOLT

... concentration, exposure to extreme economic conditions and market volatility). Individually managed portfolios shall be monitored and reviewed by the Finance Committee periodically, but not less frequently than every six months, and such results shall be evaluated by the board annually, at a minimum ...

... concentration, exposure to extreme economic conditions and market volatility). Individually managed portfolios shall be monitored and reviewed by the Finance Committee periodically, but not less frequently than every six months, and such results shall be evaluated by the board annually, at a minimum ...

GAME PLAN - 7Twelve Portfolio

... They’ve been replaced by 401(k) and IRA plans that shift the burden of building and managing a retirement nest egg to the employee. And most of us are woefully unprepared to handle this responsibility. ...

... They’ve been replaced by 401(k) and IRA plans that shift the burden of building and managing a retirement nest egg to the employee. And most of us are woefully unprepared to handle this responsibility. ...

BT Smaller Companies Fund

... Performance returns are calculated net of ICR (Management Fees) and pre tax. Past performance is not a reliable indicator of future performance, the value of your investment can go up and down. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Tota ...

... Performance returns are calculated net of ICR (Management Fees) and pre tax. Past performance is not a reliable indicator of future performance, the value of your investment can go up and down. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Tota ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.