THE CENTRAL BANK OF THE RUSSIAN FEDERATION DEPUTY

... Depositaries of Joint-stock Investment Funds, Unit Investment Funds and Non-Government Pension Funds, approved by FCSM Resolution No. 04-3/ps of 10 February 2004, “On the Regulation of the Specialized Depositaries of Joint-stock Investment Funds, Unit Investment Funds, and Non-Government Pension Fun ...

... Depositaries of Joint-stock Investment Funds, Unit Investment Funds and Non-Government Pension Funds, approved by FCSM Resolution No. 04-3/ps of 10 February 2004, “On the Regulation of the Specialized Depositaries of Joint-stock Investment Funds, Unit Investment Funds, and Non-Government Pension Fun ...

All findings, interpretations, and conclusions of this presentation

... Initial Market Value of Corporate Equity ...

... Initial Market Value of Corporate Equity ...

iShares Morningstar Mid

... Diversification may not protect against market risk or loss of principal. Shares of iShares Funds are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Index returns are for illustrative purposes only. Index performa ...

... Diversification may not protect against market risk or loss of principal. Shares of iShares Funds are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Index returns are for illustrative purposes only. Index performa ...

Investments in Stocks and Bonds of Other Companies

... • Cash received from the sale of investment inflow from an investing activity equal to amount of original investment • Interest received - inflows from operating activities ...

... • Cash received from the sale of investment inflow from an investing activity equal to amount of original investment • Interest received - inflows from operating activities ...

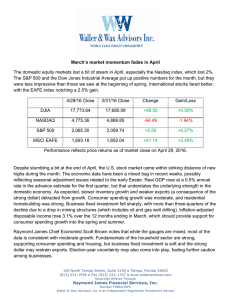

March`s market momentum fades in April The domestic equity

... Despite stumbling a bit at the end of April, the U.S. stock market came within striking distance of new highs during the month. The economic data have been a mixed bag in recent weeks, possibly reflecting seasonal adjustment issues related to the early Easter. Real GDP rose at a 0.5% annual rate in ...

... Despite stumbling a bit at the end of April, the U.S. stock market came within striking distance of new highs during the month. The economic data have been a mixed bag in recent weeks, possibly reflecting seasonal adjustment issues related to the early Easter. Real GDP rose at a 0.5% annual rate in ...

Behavioral Finance

... of narrow framing Narrow frame of evaluation Limited set of metrics in evaluating investments Myopic behavior even though investment is longterm Obsessive about price changes in a particular ...

... of narrow framing Narrow frame of evaluation Limited set of metrics in evaluating investments Myopic behavior even though investment is longterm Obsessive about price changes in a particular ...

ITEM

... List of main types of investments in the investment funds hold by the insurance undertaking. In this template the report is made by asset category, according to splits defined by cells A1 to A6 (example: EEA equity in local currency held in Life portfolio, for unit-linked fund) Distinction between l ...

... List of main types of investments in the investment funds hold by the insurance undertaking. In this template the report is made by asset category, according to splits defined by cells A1 to A6 (example: EEA equity in local currency held in Life portfolio, for unit-linked fund) Distinction between l ...

“Lost” Decade 2000 – 2009

... markets. Investors should consider their ability to continue investing during periods of falling prices. • Diversification and asset allocation does not ensure a profit or protect against loss. • Target date funds are mutual funds that periodically rebalance or modify the asset mix (stocks, bonds, a ...

... markets. Investors should consider their ability to continue investing during periods of falling prices. • Diversification and asset allocation does not ensure a profit or protect against loss. • Target date funds are mutual funds that periodically rebalance or modify the asset mix (stocks, bonds, a ...

D J AVID

... Created forecasting templates to project the Income Statements of 12 of AMCH’s subsidiary companies (used by the respective VP’s to make more diligent financial decisions) Conducted an internal audit of Heat Surge LLC (a subsidiary of AMCH) Learned methods of financial reporting and developed ...

... Created forecasting templates to project the Income Statements of 12 of AMCH’s subsidiary companies (used by the respective VP’s to make more diligent financial decisions) Conducted an internal audit of Heat Surge LLC (a subsidiary of AMCH) Learned methods of financial reporting and developed ...

liquidity of investments

... local authority or town parish council will automatically be Specified Investments. For the prudent management of its treasury balances, maintaining sufficient levels of security and liquidity, the Council will use: • Deposits with banks, building societies, local authorities or other public authori ...

... local authority or town parish council will automatically be Specified Investments. For the prudent management of its treasury balances, maintaining sufficient levels of security and liquidity, the Council will use: • Deposits with banks, building societies, local authorities or other public authori ...

Structuring Private Funds to Profit from the Oil Price Decline

... debt investor is interested in taking control of the company, such investor may use the bankruptcy proceedings as a way to trade its debt for equity in the plan of reorganization. See “Liquidity for Post-Reorganization Securities Under Section 1145 of the Bankruptcy Code,” The Hedge Fund Law Report, ...

... debt investor is interested in taking control of the company, such investor may use the bankruptcy proceedings as a way to trade its debt for equity in the plan of reorganization. See “Liquidity for Post-Reorganization Securities Under Section 1145 of the Bankruptcy Code,” The Hedge Fund Law Report, ...

US Based Silicon Valley - Department of Information Technology

... US Based Silicon Valley to invest USD 300 million in IT and ESDM sector in Odisha. A team of global IT (information technology) investors led by Ajit Monancha with other member as Prakash Aggarwal, Arif Maskatia and Sanjeev Shriya from Silicon Valley visited the state 10th July 2014 to explore the i ...

... US Based Silicon Valley to invest USD 300 million in IT and ESDM sector in Odisha. A team of global IT (information technology) investors led by Ajit Monancha with other member as Prakash Aggarwal, Arif Maskatia and Sanjeev Shriya from Silicon Valley visited the state 10th July 2014 to explore the i ...

MIDYEAR UPDATE: Do Municipal Bonds Make Sense for You?

... investment objectives, financial situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security, financial instrument, or strategy. Before acting on any information in this material, you should consider whether it is suitable for your part ...

... investment objectives, financial situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security, financial instrument, or strategy. Before acting on any information in this material, you should consider whether it is suitable for your part ...

North America Enhanced Index Fund G (AIF)

... The assets are invested mainly in an enhanced index fund managed by State Street Global Advisors, whose assets are mainly invested in the equities and equity-linked securities of North American companies. The fund is a non-UCITS fund, whose assets can be less diversified than in an ordinary mutual f ...

... The assets are invested mainly in an enhanced index fund managed by State Street Global Advisors, whose assets are mainly invested in the equities and equity-linked securities of North American companies. The fund is a non-UCITS fund, whose assets can be less diversified than in an ordinary mutual f ...

The Word from Hansard - Alliance Partnership

... Spain - Spanish unemployment climbed to a record high in the third quarter as a deepening recession left one in four workers jobless, adding pressure on Prime Minister Mariano Rajoy to seek a second European bailout. Unemployment, the second highest in the E.U. after Greece, rose to 25.02% from 24.6 ...

... Spain - Spanish unemployment climbed to a record high in the third quarter as a deepening recession left one in four workers jobless, adding pressure on Prime Minister Mariano Rajoy to seek a second European bailout. Unemployment, the second highest in the E.U. after Greece, rose to 25.02% from 24.6 ...

INVESTMENT focuS - Castanea Partners

... INVESTMENT focus Castanea Partners is principally focused on investing in high-engagement consumer brands and marketing services companies that enable such brands to connect most successfully with target customers. We also seek to invest in select business-to-business must-have information service p ...

... INVESTMENT focus Castanea Partners is principally focused on investing in high-engagement consumer brands and marketing services companies that enable such brands to connect most successfully with target customers. We also seek to invest in select business-to-business must-have information service p ...

Paradox of Wealth - Helm Investment Management

... cyclically adjusted price earnings (CAPE) ratio used by Robert Shiller, who was awarded a share of the Nobel Prize for Economics earlier this year. The CAPE measures the current price of a stock or an index such as the S&P 500 against the earnings-per-share averaged over the most recent 10 years. Sh ...

... cyclically adjusted price earnings (CAPE) ratio used by Robert Shiller, who was awarded a share of the Nobel Prize for Economics earlier this year. The CAPE measures the current price of a stock or an index such as the S&P 500 against the earnings-per-share averaged over the most recent 10 years. Sh ...

Willis Owen | Industry Insight | Article Print |Investment grade bonds

... This article was written by John Pattullo, Co-Head of Strategic Fixed Income at Henderson Global Investors prior to today’s reduction in the UK’s interest rate: A few months ago I remarked to Jenna, my co-manager, how boring credit (corporate bond) markets were. Be wary of what you wish for, I hear ...

... This article was written by John Pattullo, Co-Head of Strategic Fixed Income at Henderson Global Investors prior to today’s reduction in the UK’s interest rate: A few months ago I remarked to Jenna, my co-manager, how boring credit (corporate bond) markets were. Be wary of what you wish for, I hear ...

Actis Content - Rural Finance and Investment Learning Centre

... Price controls; subsistence farmer competition; land / political issues ...

... Price controls; subsistence farmer competition; land / political issues ...

April 17, 2017 - Portfolio Advisory Council

... world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions - the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additi ...

... world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions - the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additi ...

HSBC Global Asset Management

... The material contained herein is for information only and does not constitute investment advice or a recommendation to any reader of this material to buy or sell investments. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such di ...

... The material contained herein is for information only and does not constitute investment advice or a recommendation to any reader of this material to buy or sell investments. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such di ...

July 24, 2016 - Stearns Financial Group

... Bespoke research notes that “In all the previous times when the S&P 500 has made a new alltime high, following at least 52 weeks below the old high water mark, the average return over the next 12 months has been 12.28% (median +12.30%) with an average pullback of 5.48% (median 2.73%).” Those who are ...

... Bespoke research notes that “In all the previous times when the S&P 500 has made a new alltime high, following at least 52 weeks below the old high water mark, the average return over the next 12 months has been 12.28% (median +12.30%) with an average pullback of 5.48% (median 2.73%).” Those who are ...

Introduction to Investing In Renewable Energy here

... Disclaimer No investment strategy can guarantee against loss in adverse market conditions, or against Global Warming in periods of rising atmospheric greenhouse gasses. ...

... Disclaimer No investment strategy can guarantee against loss in adverse market conditions, or against Global Warming in periods of rising atmospheric greenhouse gasses. ...

T. Rowe Price Large Cap Growth Portfolio

... before investing. The investment objectives, risks and policies of the investment options, as well as other information about the investment options, are described in their respective prospectuses. Please read the prospectuses and consider this information carefully before investing. Product availab ...

... before investing. The investment objectives, risks and policies of the investment options, as well as other information about the investment options, are described in their respective prospectuses. Please read the prospectuses and consider this information carefully before investing. Product availab ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.