Global Governance and The Bretton Woods System

... USA emerged from the WWII as the world’s predominant military and economic power and dictated some key outcomes. The USA’s priorities in relation to Bretton Woods were twofold: First, having massively increased its industrial output through rearmament and the expansion of exports before and during t ...

... USA emerged from the WWII as the world’s predominant military and economic power and dictated some key outcomes. The USA’s priorities in relation to Bretton Woods were twofold: First, having massively increased its industrial output through rearmament and the expansion of exports before and during t ...

European Monetary System

... authorities agreed to exchange gold for its own currency with other CBs, upon demand, at the fixed price of $35/ounce. For the other currencies there was an official convertibility (between CBs) and a market convertibility (for the public); these currencies could be indirectly converted in gold th ...

... authorities agreed to exchange gold for its own currency with other CBs, upon demand, at the fixed price of $35/ounce. For the other currencies there was an official convertibility (between CBs) and a market convertibility (for the public); these currencies could be indirectly converted in gold th ...

EXCHANGE RATES

... A currency transaction tax (CTT) A CTT would be collected from dealers in international 1... markets, by financial clearing and settlement systems. The 2... was designed to slow down 3........ across borders, to make monetary 4...... more effective, and to prevent or manage exchange rate 5...... . ...

... A currency transaction tax (CTT) A CTT would be collected from dealers in international 1... markets, by financial clearing and settlement systems. The 2... was designed to slow down 3........ across borders, to make monetary 4...... more effective, and to prevent or manage exchange rate 5...... . ...

International Monetary System

... and the exchange rate among currencies was determined by either their gold or silver content. Gresham’s law - exchange ratio between two metals was officially fixed, therefore only more abundant metal was used, driving the more scarce metal out of circulation ...

... and the exchange rate among currencies was determined by either their gold or silver content. Gresham’s law - exchange ratio between two metals was officially fixed, therefore only more abundant metal was used, driving the more scarce metal out of circulation ...

single global currency

... These short-run fluctuations have little to do with the true value of work or wealth in the U.S., Europe, or elsewhere. With a single global currency, such fluctuations would be eliminated, and the value of assets around the world would increase as the risk of currency fluctuations disappears. When ...

... These short-run fluctuations have little to do with the true value of work or wealth in the U.S., Europe, or elsewhere. With a single global currency, such fluctuations would be eliminated, and the value of assets around the world would increase as the risk of currency fluctuations disappears. When ...

FX GCR 5_2_02.qxd

... ➤ Previews of key data releases and central bank announcements. ➤ Commentary is distributed twice daily: ◆ New York Open ◆ London Open ...

... ➤ Previews of key data releases and central bank announcements. ➤ Commentary is distributed twice daily: ◆ New York Open ◆ London Open ...

International Trade is trade among the nations of the

... • C: Quotas: Limit on the quantity of a particular good during a certain period of time. • Embargoes: A government order that restricts commerce or exchange with a specified country. An embargo is usually created as a result of unfavorable political or economic circumstances between nations. The res ...

... • C: Quotas: Limit on the quantity of a particular good during a certain period of time. • Embargoes: A government order that restricts commerce or exchange with a specified country. An embargo is usually created as a result of unfavorable political or economic circumstances between nations. The res ...

Key Concepts: Graphs and Formulas to KNOW: *Production

... those that represent purchases of assets. 11) current account deficit: Situation that occurs when spending for goods and services that flows out of the country exceeds spending that flows in. 12) current account surplus: Situation that occurs when spending flowing in for the purchase of goods and se ...

... those that represent purchases of assets. 11) current account deficit: Situation that occurs when spending for goods and services that flows out of the country exceeds spending that flows in. 12) current account surplus: Situation that occurs when spending flowing in for the purchase of goods and se ...

chapter 29

... Countries with higher relative GDPs demand more foreign currency, causing their own currencies to depreciate. 6. Purchasing power parity says that the exchange rate between two countries should adjust until the average price of goods is approximately the same in the two countries. Exchange rates mig ...

... Countries with higher relative GDPs demand more foreign currency, causing their own currencies to depreciate. 6. Purchasing power parity says that the exchange rate between two countries should adjust until the average price of goods is approximately the same in the two countries. Exchange rates mig ...

Open economies in PK stock-flow consistent models: Applying the

... difficult for them to manage their monetary policy; but the above analysis strongly suggests that they are mistaken. Mainstream authors would say that the UK (or Chinese) central bank of our model is “sterilizing” foreign reserves, by selling domestic Treasury bills on the open market. In a way, it ...

... difficult for them to manage their monetary policy; but the above analysis strongly suggests that they are mistaken. Mainstream authors would say that the UK (or Chinese) central bank of our model is “sterilizing” foreign reserves, by selling domestic Treasury bills on the open market. In a way, it ...

UNCTAD N° 5, December 2008

... will be particularly affected because of their vulnerability to declining exports, falling commodity prices, and negative wealth effects stemming from currency mismatches. But the world seems not to have learned the lessons from previous financial crises: that traditional adjustment packages can be ...

... will be particularly affected because of their vulnerability to declining exports, falling commodity prices, and negative wealth effects stemming from currency mismatches. But the world seems not to have learned the lessons from previous financial crises: that traditional adjustment packages can be ...

20150817 - Rand Refinery

... year before its yuan (or renminbi) currency is given world-reserve status via inclusion in the IMF’s SDR basket. The Chinese government wants the IMF to include the yuan in the basket of currencies that comprise the IMF’s reserve assets that are known as special drawing rights. By doing so the yuan ...

... year before its yuan (or renminbi) currency is given world-reserve status via inclusion in the IMF’s SDR basket. The Chinese government wants the IMF to include the yuan in the basket of currencies that comprise the IMF’s reserve assets that are known as special drawing rights. By doing so the yuan ...

FREE Sample Here

... structural trade problems. More recently, it has attempted to help countries, like Russia and other former Soviet republics, Brazil, Indonesia, and South Korea, to resolve financial crises. 11. Special Drawing Rights.What are Special Drawing Rights? The Special Drawing Right (SDR) is an internationa ...

... structural trade problems. More recently, it has attempted to help countries, like Russia and other former Soviet republics, Brazil, Indonesia, and South Korea, to resolve financial crises. 11. Special Drawing Rights.What are Special Drawing Rights? The Special Drawing Right (SDR) is an internationa ...

The Meiji Restoration

... • Several of the Ministry of Finance (MOF) leaders had spent time in the US working for a bank in New Hampshire • 1870 Hirobumi Ito (who later became Prime Minister) visited the US to study national banking • Recommended that Japan do the same • No central bank, but a series of national banks that c ...

... • Several of the Ministry of Finance (MOF) leaders had spent time in the US working for a bank in New Hampshire • 1870 Hirobumi Ito (who later became Prime Minister) visited the US to study national banking • Recommended that Japan do the same • No central bank, but a series of national banks that c ...

Foreign Exchange (FX) Market

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

Angola update – the case of dollar supply

... authorities have been acting very firmly to hasten the reduction of the US currency use internally for payment purposes (for instance, through legislation to mandate oil companies to use local banks and to make most of their operations in kwanzas). However, there are some high value items such as re ...

... authorities have been acting very firmly to hasten the reduction of the US currency use internally for payment purposes (for instance, through legislation to mandate oil companies to use local banks and to make most of their operations in kwanzas). However, there are some high value items such as re ...

`Storm clouds over the EMS`, from La Libre Belgique (29-30

... countries would have invested more in our industrial restructuring projects rather than buying gold or making very short-term dollar deposits. Therefore, the lack of an energy policy can only prolong the current mess. European countries do not react in the same way to global shocks, for both politic ...

... countries would have invested more in our industrial restructuring projects rather than buying gold or making very short-term dollar deposits. Therefore, the lack of an energy policy can only prolong the current mess. European countries do not react in the same way to global shocks, for both politic ...

Module Exchange Rates and Macroeconomic Policy

... fixed exchange rate regime • Why open-economy considerations affect macroeconomic policy under floating exchange rates ...

... fixed exchange rate regime • Why open-economy considerations affect macroeconomic policy under floating exchange rates ...

Alternatives to the dictatorship of international finance

... The disruptive and destructive role of the present system of international finance in many countries of the South - and in some countries of the North as well – is obvious and needs no specific demonstration or proof. They often appear as the result of the insuperable economic and political power of ...

... The disruptive and destructive role of the present system of international finance in many countries of the South - and in some countries of the North as well – is obvious and needs no specific demonstration or proof. They often appear as the result of the insuperable economic and political power of ...

INTERNATIONAL MONETARY INSTITUTIONS Read and translate

... A movement in the exchange rate may benefit an individual in one of his roles but leave him worse off in another. The individual as a consumer may have a different view of and a different interest in what happens in the international monetary sphere from that of the individual as a worker. Business ...

... A movement in the exchange rate may benefit an individual in one of his roles but leave him worse off in another. The individual as a consumer may have a different view of and a different interest in what happens in the international monetary sphere from that of the individual as a worker. Business ...

Int Fin Sys - Glendale Community College

... (Obvious but important point) • People trade currencies for two primary reasons • To buy and sell goods and services • To buy and sell financial assets ...

... (Obvious but important point) • People trade currencies for two primary reasons • To buy and sell goods and services • To buy and sell financial assets ...

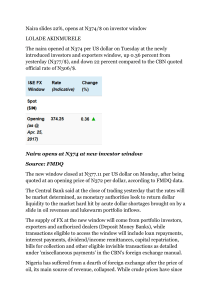

Naira opens at N374 at new investor window Source

... The Central Bank said at the close of trading yesterday that the rates will be market determined, as monetary authorities look to return dollar liquidity to the market hard hit by acute dollar shortages brought on by a slide in oil revenues and lukewarm portfolio inflows. The supply of FX at the new ...

... The Central Bank said at the close of trading yesterday that the rates will be market determined, as monetary authorities look to return dollar liquidity to the market hard hit by acute dollar shortages brought on by a slide in oil revenues and lukewarm portfolio inflows. The supply of FX at the new ...

The main qualities of an orthodox currency board are

... rate like a central bank. The peg with the foreign currency tends to keep interest rates and inflation very closely aligned to those in the country against whose currency the peg is fixed. ...

... rate like a central bank. The peg with the foreign currency tends to keep interest rates and inflation very closely aligned to those in the country against whose currency the peg is fixed. ...