Chapter 36

... • Dependence on foreign exchange markets • Occasional intervention • In support of managed float • Concerns with managed float ...

... • Dependence on foreign exchange markets • Occasional intervention • In support of managed float • Concerns with managed float ...

International Trade

... another specialization concentration on what one can do best import the other goods it needs • Japan - electronics • Cuba - sugar ...

... another specialization concentration on what one can do best import the other goods it needs • Japan - electronics • Cuba - sugar ...

Post WWI Development

... Second period of gold standard • 1925-1931, most countries re-adopted gold standard • During 1924 – stabilization of exchange rates even in countries that suffered hyperinflations, but, namely between sterling and dollar – positive strong correlation between relative prices (both in UK and USA) and ...

... Second period of gold standard • 1925-1931, most countries re-adopted gold standard • During 1924 – stabilization of exchange rates even in countries that suffered hyperinflations, but, namely between sterling and dollar – positive strong correlation between relative prices (both in UK and USA) and ...

Balance of payments

... When the U.S. is in an expansion, it tends to stimulate other economies ...

... When the U.S. is in an expansion, it tends to stimulate other economies ...

The United Kingdom & the EU (the Single Currency)

... • The gain in competitiveness of the EMU group would, other things being equal, be equivalent to a loss of competitiveness among the countries outside. Then, it will lead to : • Higher risk premium on interest rates • Greater exchange rate volatility Lower rates of investment and growth Higher u ...

... • The gain in competitiveness of the EMU group would, other things being equal, be equivalent to a loss of competitiveness among the countries outside. Then, it will lead to : • Higher risk premium on interest rates • Greater exchange rate volatility Lower rates of investment and growth Higher u ...

Introduction to International Finance

... range in terms of gold and each other. Increasing fluctuations in currency values became realized as speculators sold short weak currencies. The US adopted a modified gold standard in 1934. During WWII and its chaotic aftermath the US dollar was the only major trading currency that continued t ...

... range in terms of gold and each other. Increasing fluctuations in currency values became realized as speculators sold short weak currencies. The US adopted a modified gold standard in 1934. During WWII and its chaotic aftermath the US dollar was the only major trading currency that continued t ...

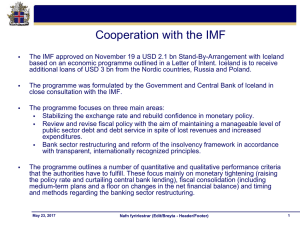

DAGSKRÁ

... The fall of the banking sector and subsequent currency market guidelines issued by the Central Bank (CB) caused the currency market to being initially divided into a domestic (on-shore) and a foreign (off-shore) currency markets. ...

... The fall of the banking sector and subsequent currency market guidelines issued by the Central Bank (CB) caused the currency market to being initially divided into a domestic (on-shore) and a foreign (off-shore) currency markets. ...

The New US-Asian Dollar Bloc

... to notice when the dollar was rising and the pricing advantages lay on Europe’s side. Italian economic and finance ministers have appealed for help to the European Union and the ECB, while ECB President Jean-Claude Trichet has hinted at the possibility of a cut in European interest rates and even di ...

... to notice when the dollar was rising and the pricing advantages lay on Europe’s side. Italian economic and finance ministers have appealed for help to the European Union and the ECB, while ECB President Jean-Claude Trichet has hinted at the possibility of a cut in European interest rates and even di ...

Nature of Money

... US payments deficit financed by printing more dollars Because of Vietnam War, deficit spending increased producing more dollars Supply of dollars raised world’s money supply and led to inflation throughout the ...

... US payments deficit financed by printing more dollars Because of Vietnam War, deficit spending increased producing more dollars Supply of dollars raised world’s money supply and led to inflation throughout the ...

The Euro`s Fundamental Flaws

... single currency meant that the individual member countries lost the ability to control monetary policy and interest rates in order to respond to national economic conditions. It also meant that each country’s exchange rate could no longer respond to the cumulative effects of differences in productiv ...

... single currency meant that the individual member countries lost the ability to control monetary policy and interest rates in order to respond to national economic conditions. It also meant that each country’s exchange rate could no longer respond to the cumulative effects of differences in productiv ...

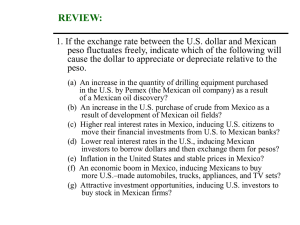

Fixed Rate System: Preview of Results

... – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen ...

... – Your currency depreciates – Your exports become more attractive – Your export industries aren’t hurt as badly as they would otherwise be – Your country’s terms of trade worsen ...

Chapter 08 - Canvas (canvas.park.edu)

... • Price of gold has risen from 1200 A.D. through today. • Traders carried bullion, gold + silver coins till late 19th C. • 1717, Sir Isaac Newton put England on the gold standard based on British currency, pound sterling. • Britain converted gold currency until 1914 and WWI, except during Napoleo ...

... • Price of gold has risen from 1200 A.D. through today. • Traders carried bullion, gold + silver coins till late 19th C. • 1717, Sir Isaac Newton put England on the gold standard based on British currency, pound sterling. • Britain converted gold currency until 1914 and WWI, except during Napoleo ...

Comparative Politics of Developing Countries

... the resulting shortage of liquidity could pull the world economy into a contractionary spiral, leading to instability. Excessive U.S. deficits would erode confidence in the value of the U.S. dollar. Hence, it would no longer be accepted as the world's reserve currency. The fixed exchange rate system ...

... the resulting shortage of liquidity could pull the world economy into a contractionary spiral, leading to instability. Excessive U.S. deficits would erode confidence in the value of the U.S. dollar. Hence, it would no longer be accepted as the world's reserve currency. The fixed exchange rate system ...

International Monetary System

... Bad (abundant) money drives good (scarce) money out of circulation. ...

... Bad (abundant) money drives good (scarce) money out of circulation. ...

The Globalization of International Relations

... • In most industrialized countries, politicians know they cannot trust themselves with… • To enforce self-discipline and enhance public trust in the value of money, these decisions are… – Limit the amount of money printed and not allowing high inflation. – In the U.S., the central bank is called the ...

... • In most industrialized countries, politicians know they cannot trust themselves with… • To enforce self-discipline and enhance public trust in the value of money, these decisions are… – Limit the amount of money printed and not allowing high inflation. – In the U.S., the central bank is called the ...

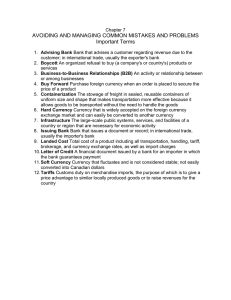

AVOIDING AND MANAGING COMMON MISTAKES AND PROBLEMS Important Terms

... uniform size and shape that makes transportation more effective because it allows goods to be transported without the need to handle the goods 6. Hard Currency Currency that is widely accepted on the foreign currency exchange market and can easily be converted to another currency 7. Infrastructure T ...

... uniform size and shape that makes transportation more effective because it allows goods to be transported without the need to handle the goods 6. Hard Currency Currency that is widely accepted on the foreign currency exchange market and can easily be converted to another currency 7. Infrastructure T ...

History of the European Union

... was a six-nation international organisation ( France, West Germany, Belgium, Netherlands, Luxembourg, Italy) foundation of democratic countries of Europe during the Cold War period first meeting on 9 May 1950 ( known as Europe Day) create a common market for coal and steel (for coal opened on 10 Feb ...

... was a six-nation international organisation ( France, West Germany, Belgium, Netherlands, Luxembourg, Italy) foundation of democratic countries of Europe during the Cold War period first meeting on 9 May 1950 ( known as Europe Day) create a common market for coal and steel (for coal opened on 10 Feb ...

Global Macro Investment For Presentation at Yale U. October 22

... • At least 95% FX professionals are technical trend followers; • On average, they make a little bit money; • FX economists have not performed better than the stock analysts; like the stock analysts, they are entertainers for the investment community. When it comes to predicting future spot exchange ...

... • At least 95% FX professionals are technical trend followers; • On average, they make a little bit money; • FX economists have not performed better than the stock analysts; like the stock analysts, they are entertainers for the investment community. When it comes to predicting future spot exchange ...

Lecture Slides Chapter 15

... 1) response to crises of Great Depression when floating exchange rates had been unsuccessful 2) Bretton Woods created a semi-fixed system known as adjustable pegged exchange rates 3) currencies values tied to each other 4) nations to use fiscal and monetary policies first to address balance of payme ...

... 1) response to crises of Great Depression when floating exchange rates had been unsuccessful 2) Bretton Woods created a semi-fixed system known as adjustable pegged exchange rates 3) currencies values tied to each other 4) nations to use fiscal and monetary policies first to address balance of payme ...

The Greenspan Legacy of Hyperinflation

... can only be temporary, it doesn’t cancel winter, it just delays it. In a healthy economic expansion demand comes from high consumption. In an artificial boom created by inflation and hyper-inflation consumption falls but is more than offset by hoarding such that composite demand increases. But this ...

... can only be temporary, it doesn’t cancel winter, it just delays it. In a healthy economic expansion demand comes from high consumption. In an artificial boom created by inflation and hyper-inflation consumption falls but is more than offset by hoarding such that composite demand increases. But this ...

International Finance and the Foreign Exchange

... 3. causes currency depreciation and a trade surplus ...

... 3. causes currency depreciation and a trade surplus ...

First phase of World War II

... USA: war effort in industry coordinated by War Production Board (1942), subordinated with other defense agencies in 1943 to Office of War Mobilization (James Byrnes) great success (industrial output growing yearly by 15%, rising capacities of technologically most advanced industry, GDP more than dou ...

... USA: war effort in industry coordinated by War Production Board (1942), subordinated with other defense agencies in 1943 to Office of War Mobilization (James Byrnes) great success (industrial output growing yearly by 15%, rising capacities of technologically most advanced industry, GDP more than dou ...

The international monetary system

... condemned the US for its quantitative easing policies, claiming that their real purpose was to devalue the dollar (see for instance, Evenett 2010 on this site). In our recent report (Dadush and Eidelman 2011) we argue that the international monetary system has performed well during an extraordinaril ...

... condemned the US for its quantitative easing policies, claiming that their real purpose was to devalue the dollar (see for instance, Evenett 2010 on this site). In our recent report (Dadush and Eidelman 2011) we argue that the international monetary system has performed well during an extraordinaril ...

PPT

... The US government and many economists recommend increased exchange rate flexibility. China revalued the RMB from 8.28 to 8.11 yuan per USD on July 22, 2005. The currency has been on managed float ever since. What kind of exchange rate system would be most appropriate for China? ...

... The US government and many economists recommend increased exchange rate flexibility. China revalued the RMB from 8.28 to 8.11 yuan per USD on July 22, 2005. The currency has been on managed float ever since. What kind of exchange rate system would be most appropriate for China? ...