Global Finance and The Crisis of Today

... Germany and US “cash for clunkers” Low interest rate policies ...

... Germany and US “cash for clunkers” Low interest rate policies ...

The fundamentals that have been driving the price of gold are still

... The fundamentals that have been driving the price of gold are still intact. While the recent volatility may prolong a recovery in gold prices, the same underlying fundamentals that have been driving the prices higher, are still in place. These forces include a generally-weak U.S. dollar, a potential ...

... The fundamentals that have been driving the price of gold are still intact. While the recent volatility may prolong a recovery in gold prices, the same underlying fundamentals that have been driving the prices higher, are still in place. These forces include a generally-weak U.S. dollar, a potential ...

Results of World War I

... Federal Deposit Insurance Corporation additional spending in different sectors of economy: Agricultural Adjustment Administration (May 1933 -1936, $ 1.5 bn of expenditures), Federal Emergency Relief Administration (May 1933 - relief payments for unemployed), National Recovery Administration (June 19 ...

... Federal Deposit Insurance Corporation additional spending in different sectors of economy: Agricultural Adjustment Administration (May 1933 -1936, $ 1.5 bn of expenditures), Federal Emergency Relief Administration (May 1933 - relief payments for unemployed), National Recovery Administration (June 19 ...

Exchange Rates - Continental Economics

... both countries have to intervene Asymmetrical: one country fixes and must solely intervene ...

... both countries have to intervene Asymmetrical: one country fixes and must solely intervene ...

Floating exchange rates

... • In an adjustable peg regime, exchange rates are normally fixed, but countries are occasionally allowed to alter their exchange rate. • Under the Bretton Woods system, each country announced a par value for their currency in terms of US dollars – the dollar standard. ...

... • In an adjustable peg regime, exchange rates are normally fixed, but countries are occasionally allowed to alter their exchange rate. • Under the Bretton Woods system, each country announced a par value for their currency in terms of US dollars – the dollar standard. ...

Paraguay_en.pdf

... continued: in September 2008 the ratio of local- to foreign-currency deposits was 1.42, compared with 1.12 in September 2007. The effect was even more pronounced in the area of lending, where the same ratio reached 1.55 in September 2008 as against 1.16 in September 2007. In October, in reaction to ...

... continued: in September 2008 the ratio of local- to foreign-currency deposits was 1.42, compared with 1.12 in September 2007. The effect was even more pronounced in the area of lending, where the same ratio reached 1.55 in September 2008 as against 1.16 in September 2007. In October, in reaction to ...

U.S. M P I W

... measure of openness would be how rapidly and thoroughly any changes in specific prices (adjusted for changes in exchange rates) were transmitted across boundaries. In their interesting study of the influence of international considerations on the Fed’s monetary policy decisions, the authors found th ...

... measure of openness would be how rapidly and thoroughly any changes in specific prices (adjusted for changes in exchange rates) were transmitted across boundaries. In their interesting study of the influence of international considerations on the Fed’s monetary policy decisions, the authors found th ...

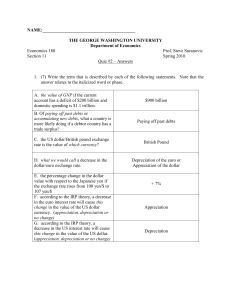

THE GEORGE WASHINGTON UNIVERSITY

... 3. (4) The current dollar/euro exchange rate is 1.35. Suppose you plan to invest $1000 in a simple interest one-year European CD paying an interest rate of 2% per year. A. (3) Calculate the rate of return on this investment if you expect the dollar/euro exchange rate to be 1.25 in one year. Show yo ...

... 3. (4) The current dollar/euro exchange rate is 1.35. Suppose you plan to invest $1000 in a simple interest one-year European CD paying an interest rate of 2% per year. A. (3) Calculate the rate of return on this investment if you expect the dollar/euro exchange rate to be 1.25 in one year. Show yo ...

Chapter 19 Section 1

... A. Primitive- no formal economy B. Transition- people question old ways and change to new system (sudden/yrs) C. Takeoff- after you overcome primitive views, economy grows more rapidly ...

... A. Primitive- no formal economy B. Transition- people question old ways and change to new system (sudden/yrs) C. Takeoff- after you overcome primitive views, economy grows more rapidly ...

chapter four ppoint - MDC Faculty Home Pages

... Legal Environment Three dimensions: U.S. law, international regulations, laws of the countries where they plan to trade. Corruption can be an important issue. International Regulations Friendship, commerce, and navigation treaties between U.S. and other nations. ...

... Legal Environment Three dimensions: U.S. law, international regulations, laws of the countries where they plan to trade. Corruption can be an important issue. International Regulations Friendship, commerce, and navigation treaties between U.S. and other nations. ...

Government Influence on Exchange Rates

... • Some speculators attempt to determine when the central bank is intervening directly, and the extent of the intervention, in order to capitalize on the anticipated results of the intervention effort. ...

... • Some speculators attempt to determine when the central bank is intervening directly, and the extent of the intervention, in order to capitalize on the anticipated results of the intervention effort. ...

Document

... Legal Environment Three dimensions: U.S. law, international regulations, laws of the countries where they plan to trade. Corruption can be an important issue. International Regulations Friendship, commerce, and navigation treaties between U.S. and other nations. ...

... Legal Environment Three dimensions: U.S. law, international regulations, laws of the countries where they plan to trade. Corruption can be an important issue. International Regulations Friendship, commerce, and navigation treaties between U.S. and other nations. ...

PDF Download

... $100.0bn. At some stage, these nations are going to develop sufficient self-confidence that they will reduce their degree of intervention or possibly even stop completely. At some time before the decade is over, some Asian countries will probably move away from using the dollar as the basis for thei ...

... $100.0bn. At some stage, these nations are going to develop sufficient self-confidence that they will reduce their degree of intervention or possibly even stop completely. At some time before the decade is over, some Asian countries will probably move away from using the dollar as the basis for thei ...

Document

... The Economic Historical Context of Integration New Breed of Postwar European Economies Growth economies: export-led growth Government-intervention economies Full-employment goal as priority Welfare state Nationalizations (Britain, France): “public sector economy” Implications ...

... The Economic Historical Context of Integration New Breed of Postwar European Economies Growth economies: export-led growth Government-intervention economies Full-employment goal as priority Welfare state Nationalizations (Britain, France): “public sector economy” Implications ...

Gold Standard

... Fixed and Flexible Exchange Rate System Interest rate differences could influence capital flows: If interest rates in the domestic economy are higher that that of the economy of the anchor currency, it could lead to huge capital flows from the foreign economy to the domestic economy, creating exc ...

... Fixed and Flexible Exchange Rate System Interest rate differences could influence capital flows: If interest rates in the domestic economy are higher that that of the economy of the anchor currency, it could lead to huge capital flows from the foreign economy to the domestic economy, creating exc ...

International Financial Crisis & Single World Currency

... global currency backed by reserves of dollars, yen, euros, and gold. “The benefits from a world currency would be enormous. Prices all over the world would be denominated in the same unit and would be kept equal in different parts of the world to the extent that the law of one price was allowed to w ...

... global currency backed by reserves of dollars, yen, euros, and gold. “The benefits from a world currency would be enormous. Prices all over the world would be denominated in the same unit and would be kept equal in different parts of the world to the extent that the law of one price was allowed to w ...

The price of gold falls below $1600 an ounce.

... relative strength index which is less than 20; strongly suggesting that spot gold is deeply oversold. While, prices of gold have plunged in the short-term, and as I have stated countless times, these sharp price declines do not reflect the real fundamentals which include a European and coming UK, U. ...

... relative strength index which is less than 20; strongly suggesting that spot gold is deeply oversold. While, prices of gold have plunged in the short-term, and as I have stated countless times, these sharp price declines do not reflect the real fundamentals which include a European and coming UK, U. ...

International Monetary System

... If Gold suddenly and unexpectedly became much more valuable than silver, which coins would you spend if you wanted to buy a 20-mark item and which would you keep? ...

... If Gold suddenly and unexpectedly became much more valuable than silver, which coins would you spend if you wanted to buy a 20-mark item and which would you keep? ...

Chapter 2: The International Monetary System

... If Gold suddenly and unexpectedly became much more valuable than silver, which coins would you spend if you wanted to buy a 20-mark item and which would you keep? ...

... If Gold suddenly and unexpectedly became much more valuable than silver, which coins would you spend if you wanted to buy a 20-mark item and which would you keep? ...

“Explorations into Use of the Exchange Rate in Macroeconomic

... Intervention in foreign exchange markets is pervasive among Asian economies. Some economies in the region maintain close pegs to the dollar or to a basket of currencies as the cornerstone of their monetary policies. But even for economies with exchange rate regimes classified as “floating” (albeit n ...

... Intervention in foreign exchange markets is pervasive among Asian economies. Some economies in the region maintain close pegs to the dollar or to a basket of currencies as the cornerstone of their monetary policies. But even for economies with exchange rate regimes classified as “floating” (albeit n ...

Exchange Rate Systems - Mays Business School

... • Some speculators attempt to determine when the central bank is intervening directly, and the extent of the intervention, in order to capitalize on the anticipated results of the intervention effort. ...

... • Some speculators attempt to determine when the central bank is intervening directly, and the extent of the intervention, in order to capitalize on the anticipated results of the intervention effort. ...

Chapter 8.

... Now let us suppose that for some reason demand for TL assets decrease (maybe because FED increases rates). TL loses value in the free forex market below the fixed parity (overvalued). In this case CB buys TL and sells dollars. This reduces money supply and increases the interest rate on TL assets, ...

... Now let us suppose that for some reason demand for TL assets decrease (maybe because FED increases rates). TL loses value in the free forex market below the fixed parity (overvalued). In this case CB buys TL and sells dollars. This reduces money supply and increases the interest rate on TL assets, ...

Hold the Frankincense and Myrrh

... performed a rather neat trick. First, money created by the Bank of Japan and made available at near-zero percent interest will be borrowed by American and European banks in order to keep financial asset prices high and themselves solvent. Second, the 15% fall in the value of the yen can easily be in ...

... performed a rather neat trick. First, money created by the Bank of Japan and made available at near-zero percent interest will be borrowed by American and European banks in order to keep financial asset prices high and themselves solvent. Second, the 15% fall in the value of the yen can easily be in ...