Regulation 10(5)

... f. Rationale, if any, for the proposed transfer Relevant sub-clause of regulation 10(1)(a) under which the acquirer is exempted from making open offer ...

... f. Rationale, if any, for the proposed transfer Relevant sub-clause of regulation 10(1)(a) under which the acquirer is exempted from making open offer ...

Sale of a business - Should I sell the assets or my shares? Recently

... amortization written off in prior years) and/or as a capital gain. These are the main issues that face the buyer and seller of an unincorporated business. The buying and selling of an incorporated business can be done in two possible ways. 1) Sell the shares of the business, which gives the buyer co ...

... amortization written off in prior years) and/or as a capital gain. These are the main issues that face the buyer and seller of an unincorporated business. The buying and selling of an incorporated business can be done in two possible ways. 1) Sell the shares of the business, which gives the buyer co ...

of 6 CIRCULAR CIR/CFD/POLICYCELL/1/2015 April 13, 2015

... d. In case of competing offers under Regulation 20 of the Takeover Regulations, each acquirer will apply for and use separate Acquisition Windows during the tendering period. If one acquirer chooses to use acquisition window of one Stock Exchange having nationwide trading terminal, it would not be m ...

... d. In case of competing offers under Regulation 20 of the Takeover Regulations, each acquirer will apply for and use separate Acquisition Windows during the tendering period. If one acquirer chooses to use acquisition window of one Stock Exchange having nationwide trading terminal, it would not be m ...

Stocks

... orders placed by investors) • NASDAQ Stock Market- free stock quotes, stock exchange prices, stock market news, and online stock trading tools • AMEX American stock exchange- has about 800 stocks that are generally smaller and less actively traded • Specialists- traders who help to make a market in ...

... orders placed by investors) • NASDAQ Stock Market- free stock quotes, stock exchange prices, stock market news, and online stock trading tools • AMEX American stock exchange- has about 800 stocks that are generally smaller and less actively traded • Specialists- traders who help to make a market in ...

Markets

... • Describe, briefly, the bond and derivatives markets. • Discuss the factors behind rapid change in the securities markets ...

... • Describe, briefly, the bond and derivatives markets. • Discuss the factors behind rapid change in the securities markets ...

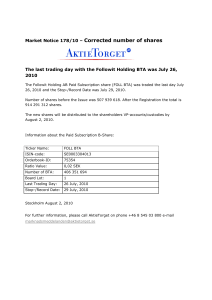

Market Notice 178/10 – Corrected number of shares

... The last trading day with the Followit Holding BTA was July 26, ...

... The last trading day with the Followit Holding BTA was July 26, ...

Chapter 15 - Salem State University

... Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

... Usually securities of other companies Record at fair value of the asset transferred Gain or loss is recognized ...

The Stock Exchange Corner

... with the market. What makes the price of bonds go up and down? Bond prices rise and fall with interest rates, partly on changes in inflation expectations and partly on the supply and demand for credit. What are the benefits of owning bonds? A relatively secure and predictable monetary return in the ...

... with the market. What makes the price of bonds go up and down? Bond prices rise and fall with interest rates, partly on changes in inflation expectations and partly on the supply and demand for credit. What are the benefits of owning bonds? A relatively secure and predictable monetary return in the ...

Operating Instruction nº 54/2017 INITIAL

... 2.- The opening auction shall start at 8:30 p.m. and end at 12:00 p.m., being the starting conditioned to the admission to trading of these shares in at least two Stock Exchanges. Though, if required, its duration could be modified for as long as the situation of the market so warrants. Its extensio ...

... 2.- The opening auction shall start at 8:30 p.m. and end at 12:00 p.m., being the starting conditioned to the admission to trading of these shares in at least two Stock Exchanges. Though, if required, its duration could be modified for as long as the situation of the market so warrants. Its extensio ...

Interest Rate Parity

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

Balancing Public Market Benefits and Burdens for Smaller

... and benefits of being a public company under the SEC’s regulatory regime. Part II describes the OTCBB eligibility rule, Regulation FD, and Sarbanes-Oxley and then discusses how they have added to the regulatory burden on small businesses, such that the costs of being a pubic company often outweigh t ...

... and benefits of being a public company under the SEC’s regulatory regime. Part II describes the OTCBB eligibility rule, Regulation FD, and Sarbanes-Oxley and then discusses how they have added to the regulatory burden on small businesses, such that the costs of being a pubic company often outweigh t ...

short selling regulations

... with a public float capitalisation of not less than HK$20 billion for a period of 20 consecutive trading days commencing from the second day of their listing on the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

... with a public float capitalisation of not less than HK$20 billion for a period of 20 consecutive trading days commencing from the second day of their listing on the Exchange and an aggregate turnover of not less than HK$500 million during such period; and ...

Document

... I am writing in reference to the Portals Roundtable the Securities and Exchange Commission (SEC) held on May 23, 2001. The SEC needs to be careful not to create the impression that it is considering regulation of Internet portals. Internet portals do not fall within the jurisdiction of the SEC. Abse ...

... I am writing in reference to the Portals Roundtable the Securities and Exchange Commission (SEC) held on May 23, 2001. The SEC needs to be careful not to create the impression that it is considering regulation of Internet portals. Internet portals do not fall within the jurisdiction of the SEC. Abse ...

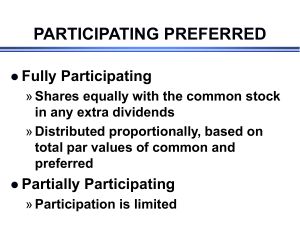

Stock PPT - Issaquah Connect

... Companies who share their profit with investors by paying them for simply owning the stock Dividends are not required ...

... Companies who share their profit with investors by paying them for simply owning the stock Dividends are not required ...

How did the stock market work?

... The stock market was where shares of companies were sold. There were a number of stock markets across America. The largest one was the New York Stock Market situated on Wall Street. ...

... The stock market was where shares of companies were sold. There were a number of stock markets across America. The largest one was the New York Stock Market situated on Wall Street. ...

SEC Form NELET-AF - Securities and Exchange Commission

... Form for Payment of Annual Fees and in the said Annexes is true, correct, current, accurate and complete. The undersigned Associated Persons/Compliance Officers undertake to attend Certification Seminars and take Certification Examinations, for Associated Persons/Compliance Officers, to be administe ...

... Form for Payment of Annual Fees and in the said Annexes is true, correct, current, accurate and complete. The undersigned Associated Persons/Compliance Officers undertake to attend Certification Seminars and take Certification Examinations, for Associated Persons/Compliance Officers, to be administe ...

Securities Law Private University, a private nonprofit educational

... graduate college credit in any of its schools at any time in the future. The shares may also be resold without restric¬tion by the initial purchaser. The offering will be made via the Internet. Will the offering need to be registered with the Securities and Exchange Commission (SEC) under the Securi ...

... graduate college credit in any of its schools at any time in the future. The shares may also be resold without restric¬tion by the initial purchaser. The offering will be made via the Internet. Will the offering need to be registered with the Securities and Exchange Commission (SEC) under the Securi ...

Stocks and the Stock Market

... You make money by selling it for more than what you paid for it You buy stock hoping that the price will increase so they can sell it for a profit ...

... You make money by selling it for more than what you paid for it You buy stock hoping that the price will increase so they can sell it for a profit ...

Warsaw, 3 January 2005

... relating to the Resolution of the Stock Exchange on admitting into stock exchange trade ordinary bearer P, R and O series shares of ComputerLand SA, the Management Board of the Company informs that by virtue of resolution No. 669/04 dated December 29, 2004, the Management Board of the National Depos ...

... relating to the Resolution of the Stock Exchange on admitting into stock exchange trade ordinary bearer P, R and O series shares of ComputerLand SA, the Management Board of the Company informs that by virtue of resolution No. 669/04 dated December 29, 2004, the Management Board of the National Depos ...

TOTAL NUMBER OF SHARES AND VOTING RIGHTS The

... The total number of shares and voting rights of Forthnet S.A. on 13.06.2017, which is the date of the invitation to Ordinary General Meeting of Shareholders to be held on the 5th of July 2017, amounts to one hundred and ten million ninety seven thousand one hundred eighty five (110,097,185). It is n ...

... The total number of shares and voting rights of Forthnet S.A. on 13.06.2017, which is the date of the invitation to Ordinary General Meeting of Shareholders to be held on the 5th of July 2017, amounts to one hundred and ten million ninety seven thousand one hundred eighty five (110,097,185). It is n ...

Chapter 12.2 notes - Effingham County Schools

... • Putting money into different investments, different risk levels, etc. ...

... • Putting money into different investments, different risk levels, etc. ...

PreConf-Session B – Heaney

... Change: To make the form, nature, content etc. of something different from what it is. Regulation and Enforcement are Here to Stay ...

... Change: To make the form, nature, content etc. of something different from what it is. Regulation and Enforcement are Here to Stay ...

Naked short selling

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the security or ensuring that the security can be borrowed, as is conventionally done in a short sale. When the seller does not obtain the shares within the required time frame, the result is known as a ""failure to deliver"". The transaction generally remains open until the shares are acquired by the seller, or the seller's broker settles the trade.Short selling is used to anticipate a price fall, but exposes the seller to the risk of a price rise.In 2008, the SEC banned what it called ""abusive naked short selling"" in the United States, as well as some other jurisdictions, as a method of driving down share prices. Failing to deliver shares is legal under certain circumstances, and naked short selling is not per se illegal. In the United States, naked short selling is covered by various SEC regulations which prohibit the practice.Critics, including Overstock.com's Patrick M. Byrne, have advocated for stricter regulations against naked short selling.In 2005, ""Regulation SHO"" was enacted; requiring that broker-dealers have grounds to believe that shares will be available for a given stock transaction, and requiring that delivery take place within a limited time period.As part of its response to the crisis in the North American markets in 2008, the SEC issued a temporary order restricting short-selling in the shares of 19 financial firms deemed systemically important, by reinforcing the penalties for failing to deliver the shares in time.Effective September 18, 2008, amid claims that aggressive short selling had played a role in the failure of financial giant Lehman Brothers, the SEC extended and expanded the rules to remove exceptions and to cover all companies, including market makers.A 2014 study by researchers at the University of Buffalo, published in the Journal of Financial Economics, found no evidence that failure to deliver stock ""caused price distortions or the failure of financial firms during the 2008 financial crisis"" and that ""greater FTDs lead to higher liquidity and pricing efficiency, and their impact is similar to our estimate of delivered short sales."" Some commentators have contended that despite regulations, naked shorting is widespread and that the SEC regulations are poorly enforced. Its critics have contended that the practice is susceptible to abuse, can be damaging to targeted companies struggling to raise capital, and has led to numerous bankruptcies. However, other commentators have said that the naked shorting issue is a ""devil theory"", not a bona fide market issue and a waste of regulatory resources.