I_Ch03

... be sold (bought) immediately when its price falls below (rises above) a limit In other words, investors who send stop-loss (stop-buy) orders will sell (buy) shares equal to or lower (higher) than the specified limit Once the limit is hit, the stop orders become market orders, which will be executed ...

... be sold (bought) immediately when its price falls below (rises above) a limit In other words, investors who send stop-loss (stop-buy) orders will sell (buy) shares equal to or lower (higher) than the specified limit Once the limit is hit, the stop orders become market orders, which will be executed ...

The SEC Claws Back The Case - The Law Offices of Daniel J

... that the information fairly presents the company’s financial condition, that he/she is responsible for establishing and maintaining disclosure controls and internal control over financial reporting, that the controls have been designed to provide reasonable assurance of the reliability of the finan ...

... that the information fairly presents the company’s financial condition, that he/she is responsible for establishing and maintaining disclosure controls and internal control over financial reporting, that the controls have been designed to provide reasonable assurance of the reliability of the finan ...

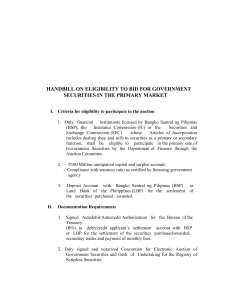

handbill on eligibility to bid for government securities in the primary

... accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside for valuation purposes and reserves for liabilities and defer ...

... accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside for valuation purposes and reserves for liabilities and defer ...

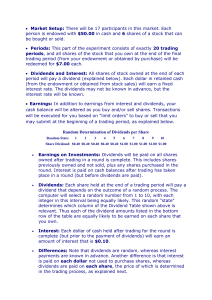

Experimental Instructions

... interest rate. The dividends may not be known in advance, but the interest rate will be known. Earnings: In addition to earnings from interest and dividends, your cash balance will be altered as you buy and/or sell shares. Transactions will be executed for you based on "limit orders" to buy or sel ...

... interest rate. The dividends may not be known in advance, but the interest rate will be known. Earnings: In addition to earnings from interest and dividends, your cash balance will be altered as you buy and/or sell shares. Transactions will be executed for you based on "limit orders" to buy or sel ...

Buyside Traders Want SEC to Press Exchanges and Dark Pools for

... Finally, the traders seek some understanding of the venue’s order matching methodology. Pointedly, they want to know if the venue offers certain players special advantages in the venue. This concern echoes recent criticism from the buyside that some exchange order types may give professional traders ...

... Finally, the traders seek some understanding of the venue’s order matching methodology. Pointedly, they want to know if the venue offers certain players special advantages in the venue. This concern echoes recent criticism from the buyside that some exchange order types may give professional traders ...

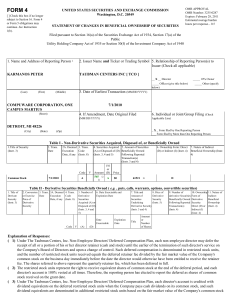

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

The Stock Market

... the information on this page and answer any questions below that pertain to this information. Continue to click next after each section. 1. How did the Colonial Government, during the American Revolution, raise money to fund its wartime operations? ...

... the information on this page and answer any questions below that pertain to this information. Continue to click next after each section. 1. How did the Colonial Government, during the American Revolution, raise money to fund its wartime operations? ...

Chapter 5

... • Legal and social forces— there are legal restrictions and social influences on selling price Must monitor changes and learn from them Monopoly (ex: utility companies) • One company controls market and selling price • Government approves price changes ...

... • Legal and social forces— there are legal restrictions and social influences on selling price Must monitor changes and learn from them Monopoly (ex: utility companies) • One company controls market and selling price • Government approves price changes ...

FREE Sample Here

... 28. Specialists and over-the-counter dealers, sometimes called market makers, buy and sell for their own account. TRUE ...

... 28. Specialists and over-the-counter dealers, sometimes called market makers, buy and sell for their own account. TRUE ...

IIROC `Tips for Traders` CSTA Whistler Friday, August 19 2016

... A dealer is part of a syndicate distributing a new issue at a price of $10.00 per share, and the market is currently $10.00 bid, offered at $10.05. Market stabilization rules are in effect. The dealer receives an unsolicited, institutional client order to sell a block of free trading shares at $10. ...

... A dealer is part of a syndicate distributing a new issue at a price of $10.00 per share, and the market is currently $10.00 bid, offered at $10.05. Market stabilization rules are in effect. The dealer receives an unsolicited, institutional client order to sell a block of free trading shares at $10. ...

Stock Underwriting

... - Now Internet offering (or direct offering) is available ,through which the issuing company bypasses the underwriter and brokerage. - However , the web’s uses will be limited until the legal and regulatory issues are resolved. - Major Wall Street firm think that most corporation still need investme ...

... - Now Internet offering (or direct offering) is available ,through which the issuing company bypasses the underwriter and brokerage. - However , the web’s uses will be limited until the legal and regulatory issues are resolved. - Major Wall Street firm think that most corporation still need investme ...

Stocks

... Where securities are created IPO occurs when a private company sells stocks to the public for the first time. Company needs to file with SEC (Securities Exchange Commission) to go public ...

... Where securities are created IPO occurs when a private company sells stocks to the public for the first time. Company needs to file with SEC (Securities Exchange Commission) to go public ...

Answers to Concepts Review and Critical

... simply easier and less risky to sell from an investment bank’s perspective. The two main reasons are that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securiti ...

... simply easier and less risky to sell from an investment bank’s perspective. The two main reasons are that very large amounts of debt securities can be sold to a relatively small number of buyers, particularly large institutional buyers such as pension funds and insurance companies, and debt securiti ...

CH05

... • A stop order specifies a certain price at which the market order takes effect. The exact price specified in the stop order is not guaranteed and may not be realized. • Limit orders are placed on opposite sides of the current market price of a stock from stop orders. • For example, while a buy limi ...

... • A stop order specifies a certain price at which the market order takes effect. The exact price specified in the stop order is not guaranteed and may not be realized. • Limit orders are placed on opposite sides of the current market price of a stock from stop orders. • For example, while a buy limi ...

How the Stock Market Works

... Hughes Company is entitled to have its stock bought and sold, or traded at the exchange. All trading is done through brokers who are… ...

... Hughes Company is entitled to have its stock bought and sold, or traded at the exchange. All trading is done through brokers who are… ...

“Mini-Tender” Offer

... representing a discount of 4.33% and 4.41%, respectively, to the closing prices of Thomson Reuters shares on the Toronto Stock Exchange and New York Stock Exchange on September 10, 2014, the last trading day before the mini-tender offer was commenced. In addition, the offer is highly conditional. TR ...

... representing a discount of 4.33% and 4.41%, respectively, to the closing prices of Thomson Reuters shares on the Toronto Stock Exchange and New York Stock Exchange on September 10, 2014, the last trading day before the mini-tender offer was commenced. In addition, the offer is highly conditional. TR ...

O novo mercado ea regulamentação

... Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater financial and functional independence The Brazilia ...

... Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater financial and functional independence The Brazilia ...

Information Disclosure and Market Quality

... Although the average quoted depth of NYSE stocks also declined, the post-rule market quality is better than the pre-rule market quality. For the AMEX study sample, the effective and quoted dollar spreads declined by more than 20% while the quoted depth increased by more than 20%. We find significant ...

... Although the average quoted depth of NYSE stocks also declined, the post-rule market quality is better than the pre-rule market quality. For the AMEX study sample, the effective and quoted dollar spreads declined by more than 20% while the quoted depth increased by more than 20%. We find significant ...

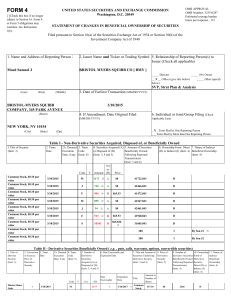

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to $65.86, inclusive. The reporting person undertakes to provide to the SEC staff, the issuer, or a security holder of the issuer, upon request, full informa ...

... ( 5) The price reported reflects the weighted average sales price. The shares were sold in multiple transactions at prices ranging from $65.77 to $65.86, inclusive. The reporting person undertakes to provide to the SEC staff, the issuer, or a security holder of the issuer, upon request, full informa ...

Porezni 3 Forms of Business Organisation in the US

... a company issues shares and puts them on the stock market, we say that it is a publicly listed company and is referred to as a public limited company (plc) ...

... a company issues shares and puts them on the stock market, we say that it is a publicly listed company and is referred to as a public limited company (plc) ...

Self Regulation - Superfinanciera

... Securities exchanges are both business ventures and regulatory bodies; may not enforce rules if detrimental to business ...

... Securities exchanges are both business ventures and regulatory bodies; may not enforce rules if detrimental to business ...

Securities Markets Primary Versus Secondary Markets How

... Commission: Commission: fee paid to broker for making the transaction Spread: Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

... Commission: Commission: fee paid to broker for making the transaction Spread: Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

authorisation to purchase and hold own shares, in accordance with

... the quantity purchased in each transaction must not be less than 250 shares or more than 5,000 shares; 2. to authorise the Board of Directors, in accordance with Art. 2357ter of the Civil Code, to make the shares purchased available for sale - even before purchases as authorised above have been comp ...

... the quantity purchased in each transaction must not be less than 250 shares or more than 5,000 shares; 2. to authorise the Board of Directors, in accordance with Art. 2357ter of the Civil Code, to make the shares purchased available for sale - even before purchases as authorised above have been comp ...

Naked short selling

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the security or ensuring that the security can be borrowed, as is conventionally done in a short sale. When the seller does not obtain the shares within the required time frame, the result is known as a ""failure to deliver"". The transaction generally remains open until the shares are acquired by the seller, or the seller's broker settles the trade.Short selling is used to anticipate a price fall, but exposes the seller to the risk of a price rise.In 2008, the SEC banned what it called ""abusive naked short selling"" in the United States, as well as some other jurisdictions, as a method of driving down share prices. Failing to deliver shares is legal under certain circumstances, and naked short selling is not per se illegal. In the United States, naked short selling is covered by various SEC regulations which prohibit the practice.Critics, including Overstock.com's Patrick M. Byrne, have advocated for stricter regulations against naked short selling.In 2005, ""Regulation SHO"" was enacted; requiring that broker-dealers have grounds to believe that shares will be available for a given stock transaction, and requiring that delivery take place within a limited time period.As part of its response to the crisis in the North American markets in 2008, the SEC issued a temporary order restricting short-selling in the shares of 19 financial firms deemed systemically important, by reinforcing the penalties for failing to deliver the shares in time.Effective September 18, 2008, amid claims that aggressive short selling had played a role in the failure of financial giant Lehman Brothers, the SEC extended and expanded the rules to remove exceptions and to cover all companies, including market makers.A 2014 study by researchers at the University of Buffalo, published in the Journal of Financial Economics, found no evidence that failure to deliver stock ""caused price distortions or the failure of financial firms during the 2008 financial crisis"" and that ""greater FTDs lead to higher liquidity and pricing efficiency, and their impact is similar to our estimate of delivered short sales."" Some commentators have contended that despite regulations, naked shorting is widespread and that the SEC regulations are poorly enforced. Its critics have contended that the practice is susceptible to abuse, can be damaging to targeted companies struggling to raise capital, and has led to numerous bankruptcies. However, other commentators have said that the naked shorting issue is a ""devil theory"", not a bona fide market issue and a waste of regulatory resources.