DEPARTMENT OF ECONOMICS WORKING

... The concept of a contractionary devaluation is not new or limited to small states.Calvo(1981), for example, argues that a devaluation puts downward pressure on consumption, and if consumption falls below income, there is a deterioration in the fiscal deficit and further pressure to devalue and a wo ...

... The concept of a contractionary devaluation is not new or limited to small states.Calvo(1981), for example, argues that a devaluation puts downward pressure on consumption, and if consumption falls below income, there is a deterioration in the fiscal deficit and further pressure to devalue and a wo ...

Topic 1: Introduction to Economics 1 (The Price System)

... combinations of r and Y that satisfy equilibrium in the goods market, and the LM curve provides the combinations of r and Y that satisfy equilibrium in the money market. The short-run equilibrium on the economy is the point at which the IS curve and the LM curve cross. So in the short-run both the g ...

... combinations of r and Y that satisfy equilibrium in the goods market, and the LM curve provides the combinations of r and Y that satisfy equilibrium in the money market. The short-run equilibrium on the economy is the point at which the IS curve and the LM curve cross. So in the short-run both the g ...

ANSWERS TO SELECTED QUESTIONS AND PROBLEMS

... expected return has fallen relative to Microsoft stock; (d) more, because it has become less risky relative to stocks; (e) less, because its expected return has fallen. 4. (a) More, because they have become more liquid; (b) more, because their expected return has risen relative to stocks; (c) less, ...

... expected return has fallen relative to Microsoft stock; (d) more, because it has become less risky relative to stocks; (e) less, because its expected return has fallen. 4. (a) More, because they have become more liquid; (b) more, because their expected return has risen relative to stocks; (c) less, ...

2004 m

... and personal independencies. Discuss with reference to the Maastricht Treaty and ESCB/ECB protocol; Why and how ECB is different from the other central banks in the world? - Paul De Grauwe, 151-173. -The ECB’s relations with European Union institutions and bodies: trends and prospects, ECB Monthly b ...

... and personal independencies. Discuss with reference to the Maastricht Treaty and ESCB/ECB protocol; Why and how ECB is different from the other central banks in the world? - Paul De Grauwe, 151-173. -The ECB’s relations with European Union institutions and bodies: trends and prospects, ECB Monthly b ...

vsi10 cbc Lamla 13320745 en

... Market participants use the interest rate decision as well as the communication of the central bank to infer the future path of monetary policy. Very recent studies like Ehrmann und Fratzscher (2009) and Brand et al. (2006) explore the importance of the press conference relative to the announced int ...

... Market participants use the interest rate decision as well as the communication of the central bank to infer the future path of monetary policy. Very recent studies like Ehrmann und Fratzscher (2009) and Brand et al. (2006) explore the importance of the press conference relative to the announced int ...

The theory of flexible exchange rate regimes and macroeconomic

... context of exchange rate determinations. ...

... context of exchange rate determinations. ...

On the Rand: Determinants of the South African Exchange Rate

... Is the rand a commodity currency, like the Australian and Canadian dollar are said to be (to pick two floaters)? That is, is it a currency that appreciates when prices of the mineral products that it produces are strong on world markets and depreciates when they are weak? In other respects, does ...

... Is the rand a commodity currency, like the Australian and Canadian dollar are said to be (to pick two floaters)? That is, is it a currency that appreciates when prices of the mineral products that it produces are strong on world markets and depreciates when they are weak? In other respects, does ...

Exchange Rate Policy

... Gum Arabic Production and Marketing in Nigeria: Didier and Chidume (2004), reported that before 1970 there were only five countries producing gum arabic in Africa; namely, Senegal, Nigeria, Sudan, Mali and Mauritania. Gum arabic (Acacia species), has been an integral part of some people in these co ...

... Gum Arabic Production and Marketing in Nigeria: Didier and Chidume (2004), reported that before 1970 there were only five countries producing gum arabic in Africa; namely, Senegal, Nigeria, Sudan, Mali and Mauritania. Gum arabic (Acacia species), has been an integral part of some people in these co ...

Official PDF , 23 pages

... rate expected to prevail in the next period. In this relation the small-country assumption makes R* exogenous, and the relation between R and S thus depends on how Se+1 responds to changes in R. Indeed, one of the main functions of traditional exchange rate models is to supply the structure require ...

... rate expected to prevail in the next period. In this relation the small-country assumption makes R* exogenous, and the relation between R and S thus depends on how Se+1 responds to changes in R. Indeed, one of the main functions of traditional exchange rate models is to supply the structure require ...

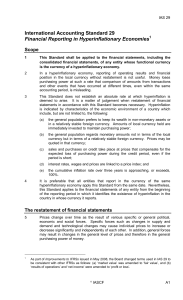

International Accounting Standard 29

... In a period of inflation, an entity holding an excess of monetary assets over monetary liabilities loses purchasing power and an entity with an excess of monetary liabilities over monetary assets gains purchasing power to the extent the assets and liabilities are not linked to a price level. This ga ...

... In a period of inflation, an entity holding an excess of monetary assets over monetary liabilities loses purchasing power and an entity with an excess of monetary liabilities over monetary assets gains purchasing power to the extent the assets and liabilities are not linked to a price level. This ga ...

Tight Money in a Post-Crisis Defense of the Exchange Rate: What

... rate expected to prevail in the next period. In this relation the small-country assumption makes R* exogenous, and the relation between R and S thus depends on how Se+1 responds to changes in R. Indeed, one of the main functions of traditional exchange rate models is to supply the structure require ...

... rate expected to prevail in the next period. In this relation the small-country assumption makes R* exogenous, and the relation between R and S thus depends on how Se+1 responds to changes in R. Indeed, one of the main functions of traditional exchange rate models is to supply the structure require ...

S03141_en.pdf

... it was one of the main reasons of the process of deterioration that led to debt default in 1988 and hyperinflation in 1989. The Act establishing the Convertibility Plan (in March 1991) fixed the exchange rate at the value of 10,000 australes per dollar,1 and tried to give credibility to this rate in ...

... it was one of the main reasons of the process of deterioration that led to debt default in 1988 and hyperinflation in 1989. The Act establishing the Convertibility Plan (in March 1991) fixed the exchange rate at the value of 10,000 australes per dollar,1 and tried to give credibility to this rate in ...

Proceedings of World Business and Social Science Research Conference

... than USD151,627 million in 2012, even though it had experienced a decreasing value on the last decade. On the import side, China import from Japan took a percentage of 21.27% out of total in 2012 and make China to be one of the biggest importers for Japan. However, in 2005, China’s government revalu ...

... than USD151,627 million in 2012, even though it had experienced a decreasing value on the last decade. On the import side, China import from Japan took a percentage of 21.27% out of total in 2012 and make China to be one of the biggest importers for Japan. However, in 2005, China’s government revalu ...

The role of the chinese dollar peg for macroeconomic

... because (as in the case of China) domestic financial markets are shallow and fragmented and the currency is not convertible, the yuan is not accepted for international lending. Second, (as in the case of the Japanese yen) due to network externalities international capital markets have been pre-empte ...

... because (as in the case of China) domestic financial markets are shallow and fragmented and the currency is not convertible, the yuan is not accepted for international lending. Second, (as in the case of the Japanese yen) due to network externalities international capital markets have been pre-empte ...

Carl E.

... inflation. The wedge will also be affected by any reserve requirement that forces banks to hold non-interest bearing reserves. Further effects ...

... inflation. The wedge will also be affected by any reserve requirement that forces banks to hold non-interest bearing reserves. Further effects ...

NBER TECHNICAL WORKING PAPERS SERIES FINANCIAL INTERMEDIATION AND MONETARY

... distinguishing between lending and borrowing interest rates and by introducing banks' required reserves. Second, we distinguish between monetary injections via lump—sum transfers to individuals and those via ...

... distinguishing between lending and borrowing interest rates and by introducing banks' required reserves. Second, we distinguish between monetary injections via lump—sum transfers to individuals and those via ...

Impact of Interest Rate, Inflation and Money Supply

... First section gives introduction and provides some basic information about the background of the study, while second section reviews the relevant literature. In the third section, data sources and methodology have been presented. The results have been described in details in the fourth section. In t ...

... First section gives introduction and provides some basic information about the background of the study, while second section reviews the relevant literature. In the third section, data sources and methodology have been presented. The results have been described in details in the fourth section. In t ...

Document

... • LM Curve and Fig. 15.3 (cont.) – With the stock of money fixed, income must rise to increase the demand for money. • Therefore, the interest rate and income combinations are positively related. The curve summarizing this positive relationship between I and Q is the LM curve, because at each point ...

... • LM Curve and Fig. 15.3 (cont.) – With the stock of money fixed, income must rise to increase the demand for money. • Therefore, the interest rate and income combinations are positively related. The curve summarizing this positive relationship between I and Q is the LM curve, because at each point ...

NBER WORKING PAPER SERIES ASPECTS OF THE OPTIMAL MANAGEMENT OF EXCHANGE RATES

... equation (14) suggests that the monetary authority possesses two instruments for the attainment of its policy goals: a '' policy--the optimal intervention index and an policy--the optimal stock of money at the beginning of each period. The general optimization procedure would then solve simultaneous ...

... equation (14) suggests that the monetary authority possesses two instruments for the attainment of its policy goals: a '' policy--the optimal intervention index and an policy--the optimal stock of money at the beginning of each period. The general optimization procedure would then solve simultaneous ...

NBER WORKING PAPER SERIES RISK, UNCERTAINTY AND EXCHANGE RATES Robert J. Hodrick

... which is a real barter model. Ciovannini (1987) works in a simple version of Svensson's (1985b) model, which modified the timing of transactions in the monetary model of Lucas (1982). ...

... which is a real barter model. Ciovannini (1987) works in a simple version of Svensson's (1985b) model, which modified the timing of transactions in the monetary model of Lucas (1982). ...

The Real Fed Funds Rate

... This activity introduces the concept of the real fed funds rate using a short video clip from the Chair the Fed Video Q&A. Following the video clip, students will work in pairs to play one round of Chair the Fed, record their game data, and then complete an analysis of their game data to evaluate th ...

... This activity introduces the concept of the real fed funds rate using a short video clip from the Chair the Fed Video Q&A. Following the video clip, students will work in pairs to play one round of Chair the Fed, record their game data, and then complete an analysis of their game data to evaluate th ...

Lecture 4 Conduct of Monetary Policy: Goals, Instruments, and Targets

... willing to lend to financial institutions for overnight. The lower limit of the band is the rate, which the central bank pays to the overnight depositors. One can immediately see that these operating bands put limit on the actual overnight rate. No financial institution will borrow overnight fund f ...

... willing to lend to financial institutions for overnight. The lower limit of the band is the rate, which the central bank pays to the overnight depositors. One can immediately see that these operating bands put limit on the actual overnight rate. No financial institution will borrow overnight fund f ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... If the aggregate elasticity of demand for imports is less than unity, an increase in the average tariff rate increases government revenues and savings at a given level of government expenditures. Purchases of export certificates which carry import entitlement, while they add to the local currency co ...

... If the aggregate elasticity of demand for imports is less than unity, an increase in the average tariff rate increases government revenues and savings at a given level of government expenditures. Purchases of export certificates which carry import entitlement, while they add to the local currency co ...