Problem Set #2: Monetary System and Inflation

... – If the Fed drops newly minted $100 bills from a helicopter, then this will increase the monetary base and the money supply. If any of the currency ends up in the bank, then there will be a further increase in the money supply. If people end up holding more currency relative to deposits, then the ...

... – If the Fed drops newly minted $100 bills from a helicopter, then this will increase the monetary base and the money supply. If any of the currency ends up in the bank, then there will be a further increase in the money supply. If people end up holding more currency relative to deposits, then the ...

How Can Commodity Producers Make Fiscal & Monetary Policy

... • It is hard to argue with IT when defined broadly: “choose a long run goal for inflation & be transparent.” • But something more specific is implied. – The narrow definition of IT would have central bank governors commit each year to a goal for the CPI, and then put 100% weight on achieving that ob ...

... • It is hard to argue with IT when defined broadly: “choose a long run goal for inflation & be transparent.” • But something more specific is implied. – The narrow definition of IT would have central bank governors commit each year to a goal for the CPI, and then put 100% weight on achieving that ob ...

U.S. M P I W

... periods of obvious impact coincided with the oil shocks, the huge dollar appreciation and LDC debt crisis of the 1980s, and the more recent Mexican and Asian financial crises and their economic consequences. The pattern is also highly countercyclical, naturally enough, with net exports having a posi ...

... periods of obvious impact coincided with the oil shocks, the huge dollar appreciation and LDC debt crisis of the 1980s, and the more recent Mexican and Asian financial crises and their economic consequences. The pattern is also highly countercyclical, naturally enough, with net exports having a posi ...

Financial Crises and Money Demand in Jamaica

... interest rates, the floating of the exchange rate and the opening of international financial flows. As shown in graph 1 & 2 and discussed below these reforms produced a period of steady growth in the M2 : GDP ratio and positive real interest rates, both indicative of financial deepening (Lynch,1996) ...

... interest rates, the floating of the exchange rate and the opening of international financial flows. As shown in graph 1 & 2 and discussed below these reforms produced a period of steady growth in the M2 : GDP ratio and positive real interest rates, both indicative of financial deepening (Lynch,1996) ...

belloc mmi08 6675559 en

... part of the economy, there is no need to model the money market. Perfect international capital mobility is assumed: the real interest rate is driven by the portfolio equilibrium condition or real interest parity condition, possibly with a risk premium. The system is assumed to be self-equilibrating ...

... part of the economy, there is no need to model the money market. Perfect international capital mobility is assumed: the real interest rate is driven by the portfolio equilibrium condition or real interest parity condition, possibly with a risk premium. The system is assumed to be self-equilibrating ...

CHAPTER OVERVIEW

... immediately. It could create instability, so Fed rarely changes it (last time was 1992). 5. Table 16.2 illustrates the effect of different reserve ratios on money creation potential. D. The third tool is the discount rate, which is the interest rate that the Fed charges to commercial banks that borr ...

... immediately. It could create instability, so Fed rarely changes it (last time was 1992). 5. Table 16.2 illustrates the effect of different reserve ratios on money creation potential. D. The third tool is the discount rate, which is the interest rate that the Fed charges to commercial banks that borr ...

Exchange Rate Movements and Economic Activity

... ¼ to ½ percentage point in the two to three years following a permanent 10 per cent depreciation. At an industry level, unsurprisingly, output in the trade-exposed mining and manufacturing industries is most affected, as well as in business services, which often benefit from activity in these indus ...

... ¼ to ½ percentage point in the two to three years following a permanent 10 per cent depreciation. At an industry level, unsurprisingly, output in the trade-exposed mining and manufacturing industries is most affected, as well as in business services, which often benefit from activity in these indus ...

- ANU Repository

... investment are low and investment is minimal. But economic reforms and opening up to international trade changes this situation. The process involves putting in place sound macroeconomic policies, to provide a guarantee of stability. This reduces the risk premium on investment.3 Furthermore, the pro ...

... investment are low and investment is minimal. But economic reforms and opening up to international trade changes this situation. The process involves putting in place sound macroeconomic policies, to provide a guarantee of stability. This reduces the risk premium on investment.3 Furthermore, the pro ...

Exchange Rate Forecasting, Order Flow and Macroeconomic

... The feeble link between exchange rates and fundamentals, in the short, medium, and to a certain extent the long run, has given rise to ‘the exchange rate disconnect’puzzle (Obstfeld and Rogo¤, 2000). The Meese and Rogo¤ (1983) results on exchange rate forecasting using macroeconomic models, that …rs ...

... The feeble link between exchange rates and fundamentals, in the short, medium, and to a certain extent the long run, has given rise to ‘the exchange rate disconnect’puzzle (Obstfeld and Rogo¤, 2000). The Meese and Rogo¤ (1983) results on exchange rate forecasting using macroeconomic models, that …rs ...

mmi05 razin 225761 en

... panel of 100 low and middle-income countries. Findings indicate that the effects of exchange rate regimes, and liberalization regimes, on macroeconomic performance go through two distinct channels: a direct channel via the real side of the economy, and an indirect channel via the financial side, whi ...

... panel of 100 low and middle-income countries. Findings indicate that the effects of exchange rate regimes, and liberalization regimes, on macroeconomic performance go through two distinct channels: a direct channel via the real side of the economy, and an indirect channel via the financial side, whi ...

Essays on currency intervention, with particular reference to

... Most major currencies are free floating vis-à-vis other currencies, except renminbi. 3 There might possibly be some gains or losses from currency intervention in the foreign exchange market. For example, Gylfason and Schmid (1983) show that devaluation has positive output effects in a study of ten c ...

... Most major currencies are free floating vis-à-vis other currencies, except renminbi. 3 There might possibly be some gains or losses from currency intervention in the foreign exchange market. For example, Gylfason and Schmid (1983) show that devaluation has positive output effects in a study of ten c ...

Forecasting of Exchange Rate Disertation

... However, most of these studies are much more theoretical only and may not be of much usefulness in the prediction of the future exchange rate in the international markets. The variables used to deduce the conclusion in much of the studies have a constant equation with an identified coefficient, thus ...

... However, most of these studies are much more theoretical only and may not be of much usefulness in the prediction of the future exchange rate in the international markets. The variables used to deduce the conclusion in much of the studies have a constant equation with an identified coefficient, thus ...

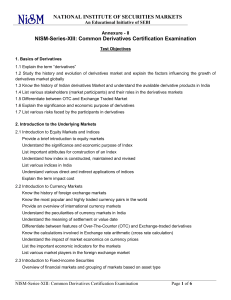

National Institute of Securities Markets

... Explain the importance of debt market for the economic development of a country and know the relative size of debt and equity markets globally and in India 2.4 Introduction to “Interest Rate” Understand the concept of interest rate and interest rate as rent on money Explain the importance of risk-fr ...

... Explain the importance of debt market for the economic development of a country and know the relative size of debt and equity markets globally and in India 2.4 Introduction to “Interest Rate” Understand the concept of interest rate and interest rate as rent on money Explain the importance of risk-fr ...

NBER WORKING PAPER SERIES THE CHOICE OF MONETARY INSTRUMENT UNDER UNCERTAINTY

... Thisimplies that the only Nash equilibrium is the M — M policy combination. For any other policy combination the policy maker setting the interest rate would ...

... Thisimplies that the only Nash equilibrium is the M — M policy combination. For any other policy combination the policy maker setting the interest rate would ...

Unit 9 Capital Account Convertibility: Benefits, Costs and Challenges

... transactions with the objective of achieving the traditional benefits of CAC identified in the literature. Since most developing countries still have some kind of restrictions on capital account transactions, capital account openness is a matter of degree.2 In terms of theory, one of the primary aim ...

... transactions with the objective of achieving the traditional benefits of CAC identified in the literature. Since most developing countries still have some kind of restrictions on capital account transactions, capital account openness is a matter of degree.2 In terms of theory, one of the primary aim ...

Indonesian Macro Policy through Two Crises CAMA Working Paper

... underlay its first decade of stagnation (Horiuchi 1998, Tyers 2012). The considerable effect of this switch on the value of the Yen, illustrated in Figure 2, proved important in Southeast Asia because Thailand and Indonesia, in particular, had received extensive foreign direct investment (FDI) from ...

... underlay its first decade of stagnation (Horiuchi 1998, Tyers 2012). The considerable effect of this switch on the value of the Yen, illustrated in Figure 2, proved important in Southeast Asia because Thailand and Indonesia, in particular, had received extensive foreign direct investment (FDI) from ...

PDF

... equal and opposite flows tell us nothing about causation: that is, whether the capital inflow occurred because it was required to balance the current account deficit or, alternatively, whether the current account deficit was the result of the capital inflow. A common view is that a low US propensity ...

... equal and opposite flows tell us nothing about causation: that is, whether the capital inflow occurred because it was required to balance the current account deficit or, alternatively, whether the current account deficit was the result of the capital inflow. A common view is that a low US propensity ...

Lecture 13 - Har Wai Mun

... • Another question: Now, Malaysia has de-peg the Ringgit against the US$ (now under a managed float system). General opinion think that the Ringgit will appreciate. • Who will benefit if the Ringgit really appreciate? ...

... • Another question: Now, Malaysia has de-peg the Ringgit against the US$ (now under a managed float system). General opinion think that the Ringgit will appreciate. • Who will benefit if the Ringgit really appreciate? ...

Econometric Analysis of Money Demand in Serbia

... The demand for money function creates a background to review the effectiveness of monetary policies, as an important issue in terms of the overall macroeconomic stability. Money demand is an important indicator of growth of a particular economy. The increasing money demand mostly indicates a countr ...

... The demand for money function creates a background to review the effectiveness of monetary policies, as an important issue in terms of the overall macroeconomic stability. Money demand is an important indicator of growth of a particular economy. The increasing money demand mostly indicates a countr ...

MONEY PAPERS

... Why does the author think the central had this role? 3- What is the Real Bill Doctrine? 4- Does the current model of the Fed give a particular role to the variable “monetary growth” for the determination of inflation? What does Meltzer think about that? 5- For the author, are interest rates good ind ...

... Why does the author think the central had this role? 3- What is the Real Bill Doctrine? 4- Does the current model of the Fed give a particular role to the variable “monetary growth” for the determination of inflation? What does Meltzer think about that? 5- For the author, are interest rates good ind ...

Purchasing power parity

... costs, the law of one price states that identical goods sold in competitive markets should cost the same everywhere when prices are expressed in terms of the same currency The convergence of prices over time is called ...

... costs, the law of one price states that identical goods sold in competitive markets should cost the same everywhere when prices are expressed in terms of the same currency The convergence of prices over time is called ...

The Academy of Economic Studies The Faculty of Finance

... single equation relationship between real exchange rate and its fundamentals. it is quite simple to implement from the econometrical point of view by using different cointegration techniques. this approach does not need complex theoretical framework, for example multi-country models, two-country mod ...

... single equation relationship between real exchange rate and its fundamentals. it is quite simple to implement from the econometrical point of view by using different cointegration techniques. this approach does not need complex theoretical framework, for example multi-country models, two-country mod ...

Exchange Control Liberalization, Measures and Their Economic

... Foreign exchange generally means foreign currency. Foreign currency may also be defined to include assets denominated in foreign currencies. Foreign assets that can be used to serve the functions of a foreign money, i.e., a medium of international payments/exchange, medium of deferred payments for i ...

... Foreign exchange generally means foreign currency. Foreign currency may also be defined to include assets denominated in foreign currencies. Foreign assets that can be used to serve the functions of a foreign money, i.e., a medium of international payments/exchange, medium of deferred payments for i ...

Internationalization of Renminbi: What does the Evidence Suggest?

... not to say that today‘s monetary lingua franca the USD will be replaced by the RMB or any other currency anytime time soon but its dominant position may erode over time (Eichengreen, 2011 and Wall Street Journal, 2011). That said there are a number of internal and external factors requiring China to ...

... not to say that today‘s monetary lingua franca the USD will be replaced by the RMB or any other currency anytime time soon but its dominant position may erode over time (Eichengreen, 2011 and Wall Street Journal, 2011). That said there are a number of internal and external factors requiring China to ...