Dear Akin - Les Leba.

... mechanism for determining the appropriate value of the naira. In the first place, the CBN has never condescended to explain why it continues to change the monthly dollar revenue at less than N110=$1 so that the states and local governments who are paid the resultant naira sum are forced to buy back ...

... mechanism for determining the appropriate value of the naira. In the first place, the CBN has never condescended to explain why it continues to change the monthly dollar revenue at less than N110=$1 so that the states and local governments who are paid the resultant naira sum are forced to buy back ...

ch13-1

... Money as a Unit of Account • Money is used as a common denominator to measure the relative values of goods and services. • Without money, we would have to measure the value of goods and services in terms of other goods and services. • Money is a useful unit of account only if its value relative to ...

... Money as a Unit of Account • Money is used as a common denominator to measure the relative values of goods and services. • Without money, we would have to measure the value of goods and services in terms of other goods and services. • Money is a useful unit of account only if its value relative to ...

ECON 8423-001 International Finance

... What are the effects of changes in exchange rates (or the shocks that caused them)? What causes changes in the balance of trade (and current account)? What are the allocative or distributional effects of alternative exchange-rate systems? Under what conditions can we rank (or even compare) exchange- ...

... What are the effects of changes in exchange rates (or the shocks that caused them)? What causes changes in the balance of trade (and current account)? What are the allocative or distributional effects of alternative exchange-rate systems? Under what conditions can we rank (or even compare) exchange- ...

PDF Download

... and the reasons for the new issuance. As monetary and fiscal authorities do not strictly target longterm interest rates, new issuance of long-term debt instruments reduces their price in domestic currency, increasing their yield. This drop in domestic debt prices may be sufficient to make internatio ...

... and the reasons for the new issuance. As monetary and fiscal authorities do not strictly target longterm interest rates, new issuance of long-term debt instruments reduces their price in domestic currency, increasing their yield. This drop in domestic debt prices may be sufficient to make internatio ...

Federal Reserve

... – Increases can cause serious liquidity problems for banks. – Continually fluctuating reserve requirements create uncertainty for banks and make liquidity management more difficult. ...

... – Increases can cause serious liquidity problems for banks. – Continually fluctuating reserve requirements create uncertainty for banks and make liquidity management more difficult. ...

Cuban Monetary Policy: Response to the Global Crisis

... markets, the agricultural and the informal, make up the remaining percentage of total CPI, each representing about 30%. This CPI calculation does not include prices in convertible peso markets. After the triple-digit inflation of the early 1990s, monetary policy has managed to maintain a singledigit ...

... markets, the agricultural and the informal, make up the remaining percentage of total CPI, each representing about 30%. This CPI calculation does not include prices in convertible peso markets. After the triple-digit inflation of the early 1990s, monetary policy has managed to maintain a singledigit ...

Currency Induced Credit Risk Management Guidelines

... of the real sector) are mostly denominated in foreign currencies, or where assets and liabilities are denominated in the domestic currency, but indexed to another, generally convertible, currency, such as the US dollar or euro (hereinafter: currency clause). The main reason for an almost general acc ...

... of the real sector) are mostly denominated in foreign currencies, or where assets and liabilities are denominated in the domestic currency, but indexed to another, generally convertible, currency, such as the US dollar or euro (hereinafter: currency clause). The main reason for an almost general acc ...

The Dollar-Euro Exchange Rate and the Limits to

... fundamentals would matter in exactly the same way for more than 30 years, or that they could fully prespecify how this relationship might have changed over time. It is thus not surprising that academic economists have found that their models forecast exchange rates no better than flipping a coin do ...

... fundamentals would matter in exactly the same way for more than 30 years, or that they could fully prespecify how this relationship might have changed over time. It is thus not surprising that academic economists have found that their models forecast exchange rates no better than flipping a coin do ...

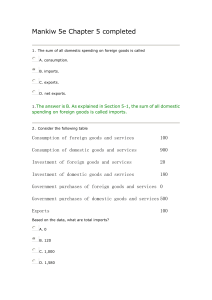

Mankiw 5e Chapter 5 completed

... interest rate it faces is given by the world interest rate, since its financial markets are too small to influence it. ...

... interest rate it faces is given by the world interest rate, since its financial markets are too small to influence it. ...

The Dynamic Adjustment of a Transition Economy in the Early

... stages of transformation. In particular, by allowing the use of foreign currency holdings for domestic transactions - some currency substitution is permitted, while ...

... stages of transformation. In particular, by allowing the use of foreign currency holdings for domestic transactions - some currency substitution is permitted, while ...

INTRODUCTION DOLLARS, DEFICITS, AND TRADE James A. Dorn

... rate stability, Yeager favors the former. Abandoning floating exchange rates would not solve the fundamental problem confronting every national economy, namely, the absurdity of a fiat money system in which the future purchasing power of money is unknown. Without solving this problem, it makes littl ...

... rate stability, Yeager favors the former. Abandoning floating exchange rates would not solve the fundamental problem confronting every national economy, namely, the absurdity of a fiat money system in which the future purchasing power of money is unknown. Without solving this problem, it makes littl ...

Exchange Rates, the Balance of Payments, and Trade

... 18. Which of the following combinations is plausible, as it relates to a nation's balance of payments? A) current account = $ + 40 billion; capital account = $ + 20 billion; official reserves account = $ - 50 billion. B) current account - $ + 50 billion; capital account = $ - 20 billion; official re ...

... 18. Which of the following combinations is plausible, as it relates to a nation's balance of payments? A) current account = $ + 40 billion; capital account = $ + 20 billion; official reserves account = $ - 50 billion. B) current account - $ + 50 billion; capital account = $ - 20 billion; official re ...

Ratib

... As mentioned earlier, the Marshall-Lerner condition states that given the price elasticities of both the exports and imports of a country are somewhat high, currency depreciation will lead to a current account surplus. However, this may not always be the case if the goods traded are price inelastic. ...

... As mentioned earlier, the Marshall-Lerner condition states that given the price elasticities of both the exports and imports of a country are somewhat high, currency depreciation will lead to a current account surplus. However, this may not always be the case if the goods traded are price inelastic. ...

The Balance of Payments Tells Us the Truth

... within the European Monetary System – it is the central bank that ultimately has to absorb the surplus of foreign exchange deriving from the current account surplus and private net capital exports. In a system of flexible exchange rates it is primarily the domestic banking system that acquires short ...

... within the European Monetary System – it is the central bank that ultimately has to absorb the surplus of foreign exchange deriving from the current account surplus and private net capital exports. In a system of flexible exchange rates it is primarily the domestic banking system that acquires short ...

the determination of exchange rates

... From the breakup of the former Soviet Union in 1991 on, the Russian government had difficulty managing its finances. By spending more than it was collecting in revenues, Russia faced persistent budget deficits financed by issuing short-term treasury bills and printing rubles. By late 1997, the combi ...

... From the breakup of the former Soviet Union in 1991 on, the Russian government had difficulty managing its finances. By spending more than it was collecting in revenues, Russia faced persistent budget deficits financed by issuing short-term treasury bills and printing rubles. By late 1997, the combi ...

Open Economy Macroeconomics

... • Suppose that trade is initially balanced. A rise in productivity increases investment demand • In a closed economy, interest rates would rise • In an open economy, the trade deficit would increase. In the case, the deficit increases from zero to -$15,000 • Do interest rates rise at all? ...

... • Suppose that trade is initially balanced. A rise in productivity increases investment demand • In a closed economy, interest rates would rise • In an open economy, the trade deficit would increase. In the case, the deficit increases from zero to -$15,000 • Do interest rates rise at all? ...

"Alternative Monetary Constitutions and the Quest for Price Stability

... we are aware of has adhered to a commodity standard.3 While many central banks continue to hold stocks of gold, the market value of these stocks bears no relation to the outstanding liabilities of the central banks.4 For part of the post – World War II period, the Bretton Woods system of fixed (but ...

... we are aware of has adhered to a commodity standard.3 While many central banks continue to hold stocks of gold, the market value of these stocks bears no relation to the outstanding liabilities of the central banks.4 For part of the post – World War II period, the Bretton Woods system of fixed (but ...

Chapter 8

... Graphic Analysis of the IFE • The point of the IFE theory is that if a firm periodically tries to capitalize on higher foreign interest rates, it will achieve a yield that is sometimes above and sometimes below the domestic yield. ...

... Graphic Analysis of the IFE • The point of the IFE theory is that if a firm periodically tries to capitalize on higher foreign interest rates, it will achieve a yield that is sometimes above and sometimes below the domestic yield. ...