EFFECTS OF EXCHANGE RATE VOLATILITY ON OUTPUTS IN

... Many economies of the world are basically interested in measures that can guarantee them a viable and robust economic statues. These quest is more pronounced among the less developed countries (LDCs) than the developed countries (DCs) of the world. To achieve this noble objective, developing economi ...

... Many economies of the world are basically interested in measures that can guarantee them a viable and robust economic statues. These quest is more pronounced among the less developed countries (LDCs) than the developed countries (DCs) of the world. To achieve this noble objective, developing economi ...

real exchange rate

... • According to the theory of purchasing-power parity, a unit of currency should buy the same quantity of goods in all countries. • The nominal exchange rate between the currencies of two countries should reflect the countries’ price levels in those countries. ...

... • According to the theory of purchasing-power parity, a unit of currency should buy the same quantity of goods in all countries. • The nominal exchange rate between the currencies of two countries should reflect the countries’ price levels in those countries. ...

RMB - Charles Mo and Company

... recent recession, dropping by about one-third from late 2008 to early 2010. In 2010, gradual appreciation occurred again. The current exchange rate now stands at about 6.0 yuan per dollar, ...

... recent recession, dropping by about one-third from late 2008 to early 2010. In 2010, gradual appreciation occurred again. The current exchange rate now stands at about 6.0 yuan per dollar, ...

International Portfolio Investment

... The correlation of the U.S. stock market with the Canadian stock market is 72%. The correlation of the U.S. stock market with the Japanese stock market is 31%. A U.S. investor would get more diversification from investments in Japan than Canada. ...

... The correlation of the U.S. stock market with the Canadian stock market is 72%. The correlation of the U.S. stock market with the Japanese stock market is 31%. A U.S. investor would get more diversification from investments in Japan than Canada. ...

XIA MENG Brandeis University International Business School Phone

... Exchange Rates and Commodity Prices ---- An Analysis and Trading Strategy on G10 Currencies, Joint paper with Ritirupa Samanta There is a dual relationship between commodity prices and exchange rates. On the one hand, commodity prices can be used to construct a proxy of a country’s terms of trade, w ...

... Exchange Rates and Commodity Prices ---- An Analysis and Trading Strategy on G10 Currencies, Joint paper with Ritirupa Samanta There is a dual relationship between commodity prices and exchange rates. On the one hand, commodity prices can be used to construct a proxy of a country’s terms of trade, w ...

Foreign Exchange Benchmarks - Foreign Exchange Professionals

... by the Financial Stability Board (FSB). The FSB’s membership includes more than 60 global financial regulatory agencies, including major central banks, the U.S. Federal Reserve, Securities and Exchange Commission, and Treasury Department. The FXBG study resulted in several recommendations to improve ...

... by the Financial Stability Board (FSB). The FSB’s membership includes more than 60 global financial regulatory agencies, including major central banks, the U.S. Federal Reserve, Securities and Exchange Commission, and Treasury Department. The FXBG study resulted in several recommendations to improve ...

Management & Engineering Contents lists available at SEI

... 1 Literature Review and Summary From interest rate parity to sticky price monetary approach (Dornbusch, 1976), interest rate and exchange rate is always the focus of macroeconomic models. Though most macroeconomic models agree that exchange rate is affected by basic economic variables including inte ...

... 1 Literature Review and Summary From interest rate parity to sticky price monetary approach (Dornbusch, 1976), interest rate and exchange rate is always the focus of macroeconomic models. Though most macroeconomic models agree that exchange rate is affected by basic economic variables including inte ...

fixed exchange rates

... The fixed-exchange-rate regime that applied to most advanced countries from World War II until the early 1970s was called the Bretton Woods Under this system, the participating countries established narrow bands within which they pegged the nominal exchange rate, ε, between their currency and the U. ...

... The fixed-exchange-rate regime that applied to most advanced countries from World War II until the early 1970s was called the Bretton Woods Under this system, the participating countries established narrow bands within which they pegged the nominal exchange rate, ε, between their currency and the U. ...

Word Document

... The federal funds rate is the primary target for monetary policy from the Federal Reserve. It is not set directly – rather, it is indirectly manipulated using other policy tools. Since 1995 the Federal Reserve explicitly announces a federal funds rate target at each FOMC meeting. The federal f ...

... The federal funds rate is the primary target for monetary policy from the Federal Reserve. It is not set directly – rather, it is indirectly manipulated using other policy tools. Since 1995 the Federal Reserve explicitly announces a federal funds rate target at each FOMC meeting. The federal f ...

Click to add title

... Forward is the market’s best guess as to what the spot will be in 90 days so if the market is right, you’re only out the bid/ask spread. If the market is wrong, hedging could be good or bad! If £ appreciates (takes more $’s to buy a £), hedging would have been better, if it depreciates (takes fewer ...

... Forward is the market’s best guess as to what the spot will be in 90 days so if the market is right, you’re only out the bid/ask spread. If the market is wrong, hedging could be good or bad! If £ appreciates (takes more $’s to buy a £), hedging would have been better, if it depreciates (takes fewer ...

Chapter # 6

... Step2. the fall in i leads to exchange rate depreciation to e1 in order that expected appreciation from B’ to A’ would offset the expected interest loss from holding domestic currency rather than foreign bonds. Step3. depreciation shifts ISXM to ISXMe1 which raises y further (B to C) in the RHS ...

... Step2. the fall in i leads to exchange rate depreciation to e1 in order that expected appreciation from B’ to A’ would offset the expected interest loss from holding domestic currency rather than foreign bonds. Step3. depreciation shifts ISXM to ISXMe1 which raises y further (B to C) in the RHS ...

Iceland: a nation in the kreppa

... in the long run. In terms of merchandise trade, 78 per cent of exports went to countries in the EEA in 2007, while they were the source of 65 per cent of imports. Most of this was due to the importing of goods and services financed by debt; for example the importing of materials and capital goods to ...

... in the long run. In terms of merchandise trade, 78 per cent of exports went to countries in the EEA in 2007, while they were the source of 65 per cent of imports. Most of this was due to the importing of goods and services financed by debt; for example the importing of materials and capital goods to ...

WP 80 de Paula et al Online

... Monetary policy through interest rate management can have a significant impact on the level of economic activity by influencing private agents’ portfolio composition in favor of both an increase in production (using current productive capacity) and the acquisition of capital goods. According to the ...

... Monetary policy through interest rate management can have a significant impact on the level of economic activity by influencing private agents’ portfolio composition in favor of both an increase in production (using current productive capacity) and the acquisition of capital goods. According to the ...

Chapter 24A

... Companies that do business internationally are exposed to exchange rate risk The more volatile the exchange rates, the more difficult it is to predict the firm’s cash flows in its domestic currency If a firm can manage its exchange rate risk, it can reduce the volatility of its foreign earnings ...

... Companies that do business internationally are exposed to exchange rate risk The more volatile the exchange rates, the more difficult it is to predict the firm’s cash flows in its domestic currency If a firm can manage its exchange rate risk, it can reduce the volatility of its foreign earnings ...

NBER WORKING PAPER SERIES FINANCIAL POLICY AND SPECULATIVE ARGENTINA 1979-1981

... This paper is part of the World Bank Research Project, Liberalization with Stabilization in the Southern Cone (RPO672-85). Helpful discussions with Chris Harris, John Huizinga, Graciela Kaminsky, and seminar participants at Columbia University, the International Monetary Fund and the University of C ...

... This paper is part of the World Bank Research Project, Liberalization with Stabilization in the Southern Cone (RPO672-85). Helpful discussions with Chris Harris, John Huizinga, Graciela Kaminsky, and seminar participants at Columbia University, the International Monetary Fund and the University of C ...

Barry Eichengreen, Does the Federal Reserve Care About the Rest

... The traditional constraint in which a central bank needs to hold interest rates high to attract capital inflows and defend the exchange rate then reemerged with a vengeance late in 1931. In a shock to financial markets, Britain departed from the gold standard on September 21, 1931. The dollar weaken ...

... The traditional constraint in which a central bank needs to hold interest rates high to attract capital inflows and defend the exchange rate then reemerged with a vengeance late in 1931. In a shock to financial markets, Britain departed from the gold standard on September 21, 1931. The dollar weaken ...

econviews Argentina The

... Little room for monetary policy but the central bank can affect the amount of bank credit. Floating exchange rates: room for monetary policy, the main question is how effective can it be when dollarization is significant. ...

... Little room for monetary policy but the central bank can affect the amount of bank credit. Floating exchange rates: room for monetary policy, the main question is how effective can it be when dollarization is significant. ...

ch21_5e

... The case for devaluation is that, in a fixed exchange rate regime, a devaluation (an increase in the nominal exchange rate) leads to a real depreciation (an increase in the real exchange rate), and thus to an increase in output. A devaluation of the right size can return an economy in recession back ...

... The case for devaluation is that, in a fixed exchange rate regime, a devaluation (an increase in the nominal exchange rate) leads to a real depreciation (an increase in the real exchange rate), and thus to an increase in output. A devaluation of the right size can return an economy in recession back ...

One Country, One Currency? Dollarization and the Case for

... to resist the attack, borrowers saw a significant widening of the spread between interest rates on dollar liabilities and on otherwise comparable peso-denominated liabilities. As the dollarization option began to be discussed widely, additional candidates were proposed, particularly Mexico and Cana ...

... to resist the attack, borrowers saw a significant widening of the spread between interest rates on dollar liabilities and on otherwise comparable peso-denominated liabilities. As the dollarization option began to be discussed widely, additional candidates were proposed, particularly Mexico and Cana ...

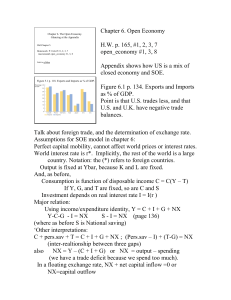

Exchange rates

... Talk about foreign trade, and the determination of exchange rate. Assumptions for SOE model in chapter 6: Perfect capital mobility, cannot affect world prices or interest rates. World interest rate is r*. Implicitly, the rest of the world is a large country. Notation: the (*) refers to foreign count ...

... Talk about foreign trade, and the determination of exchange rate. Assumptions for SOE model in chapter 6: Perfect capital mobility, cannot affect world prices or interest rates. World interest rate is r*. Implicitly, the rest of the world is a large country. Notation: the (*) refers to foreign count ...

New currency hedging possibilities in Cambodia`s

... below six percent beyond 2016. Overall macroeconomic stability, combined with continuously growing foreign exchange reserves of the National Bank of Cambodia which stand at almost 5.8 months of imports at the end of 2012, provide sufficient grounds for making a de-facto peg of the riel to the dollar ...

... below six percent beyond 2016. Overall macroeconomic stability, combined with continuously growing foreign exchange reserves of the National Bank of Cambodia which stand at almost 5.8 months of imports at the end of 2012, provide sufficient grounds for making a de-facto peg of the riel to the dollar ...

STUDY GUIDE FINAL ECO41 FALL 2011 UDAYAN ROY The final

... Which of the following is accurate? a. As the left panel of the figure above shows, an increase in the supply of money reduces the interest rate, provided the price level and the real GNP are unchanged. b. As the right panel of the figure above shows, an increase in the supply of money raises the in ...

... Which of the following is accurate? a. As the left panel of the figure above shows, an increase in the supply of money reduces the interest rate, provided the price level and the real GNP are unchanged. b. As the right panel of the figure above shows, an increase in the supply of money raises the in ...

Document

... the foreign entity’s financial statements are presented as they would have been had the U.S. dollar been used to record the transactions in the local currency as they occurred ...

... the foreign entity’s financial statements are presented as they would have been had the U.S. dollar been used to record the transactions in the local currency as they occurred ...