Chapter15

... • Deposits into a bank are recorded as both assets and liabilities. Deposits that have been received but not lent out are called reserves. • Reserve Ratio: the fraction of deposits that banks hold as reserves • The supply of money in the economy is affected by the amount of deposits that are kept in ...

... • Deposits into a bank are recorded as both assets and liabilities. Deposits that have been received but not lent out are called reserves. • Reserve Ratio: the fraction of deposits that banks hold as reserves • The supply of money in the economy is affected by the amount of deposits that are kept in ...

Estimating a Monetary Policy Rule for India

... both WPI and CPI regressions for the earlier period of 1980q11998q4 is close to 1.13 whereas for the later period of 1999q12008q4, it is around 0.58. Hence, our results indicate that the most recent monetary policy framework has little inertia, and is somewhat less responsive to output gaps than ear ...

... both WPI and CPI regressions for the earlier period of 1980q11998q4 is close to 1.13 whereas for the later period of 1999q12008q4, it is around 0.58. Hence, our results indicate that the most recent monetary policy framework has little inertia, and is somewhat less responsive to output gaps than ear ...

FRBSF E L

... rather than just one or the other. This interaction complicates empirical analysis and illustrates the wellworn dictum that correlation is not causation. However, there have been historical events that caused interest rates to fluctuate away from levels dictated by a central bank’s mandate. These ev ...

... rather than just one or the other. This interaction complicates empirical analysis and illustrates the wellworn dictum that correlation is not causation. However, there have been historical events that caused interest rates to fluctuate away from levels dictated by a central bank’s mandate. These ev ...

A New Currency for the East African Community?

... When fulfilled for a group of regions or countries, the corresponding member economies would most likely be linked by trade in goods and services and also by factor mobility. Such group of countries could therefore be considered as an ideal regional zone, having a single common currency or group of ...

... When fulfilled for a group of regions or countries, the corresponding member economies would most likely be linked by trade in goods and services and also by factor mobility. Such group of countries could therefore be considered as an ideal regional zone, having a single common currency or group of ...

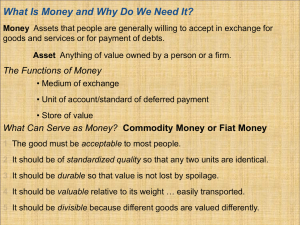

Money

... 1 The good must be acceptable to most people. 2 It should be of standardized quality so that any two units are identical. 3 It should be durable so that value is not lost by spoilage. 4 It should be valuable relative to its weight … easily transported. 5 It should be divisible because different good ...

... 1 The good must be acceptable to most people. 2 It should be of standardized quality so that any two units are identical. 3 It should be durable so that value is not lost by spoilage. 4 It should be valuable relative to its weight … easily transported. 5 It should be divisible because different good ...

Hot Money Flows, Cycles in Primary Commodity Prices, and

... interest to developing countries who may not be direct recipients of the hot money flows. One can usefully identify two sources of price fluctuations: (1) idiosyncratic supply-side shocks—such as a crop failure, a mining strike, or a new major oil discovery, that can certainly move the international ...

... interest to developing countries who may not be direct recipients of the hot money flows. One can usefully identify two sources of price fluctuations: (1) idiosyncratic supply-side shocks—such as a crop failure, a mining strike, or a new major oil discovery, that can certainly move the international ...

People`s Bank of China Boosts the Yuan

... tools: “capital controls” and “sterilized intervention.” Capi tal controls are taxes or restrictions on international transactions in assets like stocks or bonds. For example, Chinese authorities restrict the amount of foreign currency their residents can purchase each year. This helps inhibit spec ...

... tools: “capital controls” and “sterilized intervention.” Capi tal controls are taxes or restrictions on international transactions in assets like stocks or bonds. For example, Chinese authorities restrict the amount of foreign currency their residents can purchase each year. This helps inhibit spec ...

pegging to the dollar and the euro

... expectation of future appreciation. Bubbles are a possibility in any asset market and are especially prevalent in a currency market if there is no anchor to tie down a long-value for the exchange rate. As such, nominal exchange rate stability can help to reduce the possibility of misalignment by pr ...

... expectation of future appreciation. Bubbles are a possibility in any asset market and are especially prevalent in a currency market if there is no anchor to tie down a long-value for the exchange rate. As such, nominal exchange rate stability can help to reduce the possibility of misalignment by pr ...

The Royal Swedish Academy of Sciences has decided to award the

... research on these imbalances had accentuated the effects of relative prices on the flows in foreign trade. Moreover, it had been based on static, real economic models. Inspired by David Humes’s classic mechanism for international price adjustment (the gold-specie flow) which focused on monetary fact ...

... research on these imbalances had accentuated the effects of relative prices on the flows in foreign trade. Moreover, it had been based on static, real economic models. Inspired by David Humes’s classic mechanism for international price adjustment (the gold-specie flow) which focused on monetary fact ...

The Royal Swedish Academy of Sciences has decided to award... Robert A. Mundell

... research on these imbalances had accentuated the effects of relative prices on the flows in foreign trade. Moreover, it had been based on static, real economic models. Inspired by David Humes’s classic mechanism for international price adjustment (the gold-specie flow) which focused on monetary fact ...

... research on these imbalances had accentuated the effects of relative prices on the flows in foreign trade. Moreover, it had been based on static, real economic models. Inspired by David Humes’s classic mechanism for international price adjustment (the gold-specie flow) which focused on monetary fact ...

NBER WORKING PAPER SERIES SUBSTITUTION: INTRODUCING AN INDEXED CURRENCY Federico Sturzenegger

... Substituting (27) and (28) into the budget constraint (and using conditions analogous to (7) for government transfers in each currency) gives y = c as before. I again normalize in ...

... Substituting (27) and (28) into the budget constraint (and using conditions analogous to (7) for government transfers in each currency) gives y = c as before. I again normalize in ...

Lecture Board Notes

... 5) Avoid speculative bubbles that afflict floating. (If variability were all from fundamental real exchange rate risk, and no bubbles, then fixing the nominal exchange rate would mean it would just pop up in prices instead.) ...

... 5) Avoid speculative bubbles that afflict floating. (If variability were all from fundamental real exchange rate risk, and no bubbles, then fixing the nominal exchange rate would mean it would just pop up in prices instead.) ...

NBER WORKING PAPERS SERIES THE FRANC ZONE IN AFRICA

... leads to an activist, discretionary stance. The exchange rate has to be managed flexibly: the authorities need to respond to external shocks (such as terms of trade changes) or domestic price shocks by undertaking the requisite combination of expenditure-switching (i.e., exchange rate) and expenditu ...

... leads to an activist, discretionary stance. The exchange rate has to be managed flexibly: the authorities need to respond to external shocks (such as terms of trade changes) or domestic price shocks by undertaking the requisite combination of expenditure-switching (i.e., exchange rate) and expenditu ...

when the dollar overtook the pound

... largest in terms of output and trade. By such measures, Japan should be number 2, ahead of Germany. Alarmist fears of the early 1990s, notwithstanding, it was never very likely that Japan, a country with half the population and far less land area or natural resources, would surpass the United States ...

... largest in terms of output and trade. By such measures, Japan should be number 2, ahead of Germany. Alarmist fears of the early 1990s, notwithstanding, it was never very likely that Japan, a country with half the population and far less land area or natural resources, would surpass the United States ...

Slide 1

... economy, interest rate arbitrage is a source of instability So, global (i.e., not only national) capital account regulations may be necessary to manage persistent incentives to interest-rate ...

... economy, interest rate arbitrage is a source of instability So, global (i.e., not only national) capital account regulations may be necessary to manage persistent incentives to interest-rate ...

spot exchange rate

... of another: EYTL/USD = 1.34 YTL/dollar Foreign exchange market—the financial market where exchange rates are determined Spot transaction—immediate (two-day) exchange of bank deposits at spot exchange ...

... of another: EYTL/USD = 1.34 YTL/dollar Foreign exchange market—the financial market where exchange rates are determined Spot transaction—immediate (two-day) exchange of bank deposits at spot exchange ...

T F E O

... The Liquidity Trap and the Domestic Bond Market In its most general sense, a liquidity trap is a situation where the central bank can expand the monetary base indefinitely without affecting any important price in the economy, or relaxing some significant liquidity constraint, that would increase agg ...

... The Liquidity Trap and the Domestic Bond Market In its most general sense, a liquidity trap is a situation where the central bank can expand the monetary base indefinitely without affecting any important price in the economy, or relaxing some significant liquidity constraint, that would increase agg ...

Working paper 09-12

... exchange rate liberalisation of the early 1990s. A study by Mwenda in 1993 looked at the impact on the effectiveness of monetary policy of switching to indirect monetary policy instruments, with a special focus on growth and variability in broad money and in inflation. The study finds out that the ...

... exchange rate liberalisation of the early 1990s. A study by Mwenda in 1993 looked at the impact on the effectiveness of monetary policy of switching to indirect monetary policy instruments, with a special focus on growth and variability in broad money and in inflation. The study finds out that the ...

Exchange-Rate Targeting Advantages

... 1. Targets M3 and later M0 2. Problems of M as monetary indicator Japan 1. Forecasts M2 + CDs 2. Innovation and deregulation makes less useful as monetary indicator 3. High money growth 1987-1989: “bubble economy,” then tight money policy Germany and Switzerland 1. Not monetarist rigid rule 2. Targe ...

... 1. Targets M3 and later M0 2. Problems of M as monetary indicator Japan 1. Forecasts M2 + CDs 2. Innovation and deregulation makes less useful as monetary indicator 3. High money growth 1987-1989: “bubble economy,” then tight money policy Germany and Switzerland 1. Not monetarist rigid rule 2. Targe ...

Fixed Exchange Rates

... • Perfect capital mobility if residents of one country can buy any desired assets with very low commissions and fees, interest rates would be tightly linked. If rf increases, the demand for foreign securities increases, which raises r relative to rf. • Any event a country tends to change r relative ...

... • Perfect capital mobility if residents of one country can buy any desired assets with very low commissions and fees, interest rates would be tightly linked. If rf increases, the demand for foreign securities increases, which raises r relative to rf. • Any event a country tends to change r relative ...

Mankiw: Brief Principles of Macroeconomics, Second Edition

... • Real exchange rates show the value of a product in both countries. • Real exchange rates will determine who will export and who will import a product under free trade. • Suppose a TV monitor sells for $100 in the US and for ¥5000 in Japan. If the exchange rate between $ and ¥ is ¥100=$1, then the ...

... • Real exchange rates show the value of a product in both countries. • Real exchange rates will determine who will export and who will import a product under free trade. • Suppose a TV monitor sells for $100 in the US and for ¥5000 in Japan. If the exchange rate between $ and ¥ is ¥100=$1, then the ...

I (r) - Homework Market

... World economy (NOT the national economy) decides the real interest rate National economy’s S and I may no longer be equal Can lend capital abroad Can borrow capital from abroad Supply = demand in national economy determined by both [1] World real interest rate [2] Real exchange rate ...

... World economy (NOT the national economy) decides the real interest rate National economy’s S and I may no longer be equal Can lend capital abroad Can borrow capital from abroad Supply = demand in national economy determined by both [1] World real interest rate [2] Real exchange rate ...