* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download ch13-1

International monetary systems wikipedia , lookup

Futures exchange wikipedia , lookup

Patriot Act, Title III, Subtitle A wikipedia , lookup

Fixed exchange-rate system wikipedia , lookup

Money laundering wikipedia , lookup

Financial crisis wikipedia , lookup

Exchange rate wikipedia , lookup

Money market fund wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Currency intervention wikipedia , lookup

Virtual currency law in the United States wikipedia , lookup

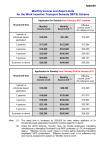

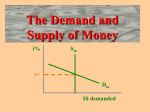

Chapter 13 Chapter 13-1 Short-Run Economic Fluctuation What is money? Money is any asset that can easily be used to purchase goods and services. Currency in circulation is cash held by the public. Checkable bank deposits are bank accounts on which people can write checks. The money supply is the total value of financial assets in the economy that are considered money. Roles of money A medium of exchange is an asset that individuals acquire for the purpose of trading rather than for their own consumption. A store of value is a means of holding purchasing power over time. A unit of account is a measure used to set prices and make economic calculations. The Definition and Functions of Money • Money is a highly liquid financial asset. – Liquid – easily changeable into another good or asset. • Money serves as: – A medium of exchange. – A unit of account. – A store of wealth. Money as a Medium of Exchange • Money facilitates exchange by reducing the cost of trading. • Without money, we would have to barter. Money As a Medium of Exchange • Money does not have to have any inherent value to function as a medium of exchange. • All that is necessary is that everyone believes that other people will exchange it for their goods. Money as a Unit of Account • Money is used as a common denominator to measure the relative values of goods and services. • Without money, we would have to measure the value of goods and services in terms of other goods and services. • Money is a useful unit of account only if its value relative to the average of all other prices doesn’t change too quickly. Money as a Store of Value • Money is a financial asset that can be used to store wealth (income that you have saved and not consumed). • As a store of wealth, money pays no interest, but is perfectly liquid. • Money’s usefulness as a store of wealth depends on how will it maintains its value. Types of money Commodity money is a good used as a medium of exchange that has other uses. A commodity-backed money is a medium of exchange with no intrinsic value whose ultimate value is guaranteed by a promise that it can be converted into valuable goods. Fiat money is a medium of exchange whose value derives entirely from its official status as a means of payment. Measuring the Money Supply A monetary aggregate is an overall measure of the money supply. Near-moneys are financial assets that can’t be directly used as a medium of exchange but can readily be converted into cash or checkable bank deposits. M1 = $1,368.4 (billions of dollars), June 2005 The Federal Reserve uses three definitions of the money supply: M1, M2, and M3. M1 is equally split between currency in circulation and checkable bank deposits M2 = $6,510.0 (billions of dollars), June 2005 • The Federal Reserve uses three definitions of the money supply: M1, M2, and M3. M2 has a much broader definition: it includes M1, plus a range of other deposits and deposit-like assets, making it about three times as large. Credit Cards • Is the Credit Card in your wallet Money? – It is accepted everywhere(Medium of exchange) – You get a bill (Unit of Account)