FREE Sample Here - We can offer most test bank and

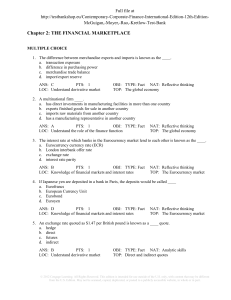

... 40. With semistrong-form market efficiency, no investor can expect to earn excess returns based on an investment strategy using any ____ information. a. past market price b. market value c. publicly available d. private ANS: C PTS: 1 OBJ: TYPE: Fact LOC: Understand the role of the finance function ...

... 40. With semistrong-form market efficiency, no investor can expect to earn excess returns based on an investment strategy using any ____ information. a. past market price b. market value c. publicly available d. private ANS: C PTS: 1 OBJ: TYPE: Fact LOC: Understand the role of the finance function ...

DSM Resource Acquisition and Market Transformation: Two

... addressed by the utility. Second, both involve attempts to influence the market-oriented behavior of other participants in energy efficiency markets. And third, at least when practiced successfully, both lead to the diffusion of energy efficiency measures and practices, and thus eventually to reduct ...

... addressed by the utility. Second, both involve attempts to influence the market-oriented behavior of other participants in energy efficiency markets. And third, at least when practiced successfully, both lead to the diffusion of energy efficiency measures and practices, and thus eventually to reduct ...

The Term Structure of the Risk-Return Tradeoff

... bonds and stocks, real interest rates, and risk shift over time in predictable ways. Furthermore, these shifts tend to persist over long periods of time. Starting at least with the pioneering work of Samuelson (1969) and Merton (1969, 1971, 1973) on portfolio choice, financial economists have argued ...

... bonds and stocks, real interest rates, and risk shift over time in predictable ways. Furthermore, these shifts tend to persist over long periods of time. Starting at least with the pioneering work of Samuelson (1969) and Merton (1969, 1971, 1973) on portfolio choice, financial economists have argued ...

DOMTrader

... • DOM Triggered Stop orders behave like stop orders, but are not triggered until the bid/ask quantity falls below the order’s trigger quantity (DOM threshold). These orders must be enabled by CQG and by you in Smart Orders Trading Preferences. You can change the default in Limit & Stop Orders Prefer ...

... • DOM Triggered Stop orders behave like stop orders, but are not triggered until the bid/ask quantity falls below the order’s trigger quantity (DOM threshold). These orders must be enabled by CQG and by you in Smart Orders Trading Preferences. You can change the default in Limit & Stop Orders Prefer ...

Total Return Swap

... All swaps and “non-standard options” between financial institutions have to be “registered” with an exchange or with “other market organizers” such as CETIP (reg. 2873) ...

... All swaps and “non-standard options” between financial institutions have to be “registered” with an exchange or with “other market organizers” such as CETIP (reg. 2873) ...

Sponsors Address - UWI St. Augustine

... Ladies and gentlemen in order to restore confidence we must promote the principles of trust, clarity, equity, transparency and good governance. You may recall a couple years ago when food price inflation was rampant that there were allegations of price gouging on the part of “middle men”. I made the ...

... Ladies and gentlemen in order to restore confidence we must promote the principles of trust, clarity, equity, transparency and good governance. You may recall a couple years ago when food price inflation was rampant that there were allegations of price gouging on the part of “middle men”. I made the ...

PDF

... In essence we are interested in instances where the actions of one party (Alpha) results in unwanted costs being visited on another party (Beta). In this context, social costs are those falling beyond the boundary of the decision-making unit that is responsible for those costs • • • This notion of c ...

... In essence we are interested in instances where the actions of one party (Alpha) results in unwanted costs being visited on another party (Beta). In this context, social costs are those falling beyond the boundary of the decision-making unit that is responsible for those costs • • • This notion of c ...

Risk management through introduction of futures contracts in tea

... the stock index is the underlying asset, crude oil basket futures, where a specified basket of oil prices is the underlying asset ...

... the stock index is the underlying asset, crude oil basket futures, where a specified basket of oil prices is the underlying asset ...

Liquidity Risk and Asset Pricing

... trading a security may be costly because the traders on the other side may have private information. ...

... trading a security may be costly because the traders on the other side may have private information. ...

Chapter 2 The Financial Markets and Interest Rates

... • Opportunity Cost — Rate of return on next best investment alternative to the investor • Standard Deviation — Dispersion or variability around the mean, or average of the rate of return in the financial markets • Maturity Premium — Additional return required by investors in long-term securities to ...

... • Opportunity Cost — Rate of return on next best investment alternative to the investor • Standard Deviation — Dispersion or variability around the mean, or average of the rate of return in the financial markets • Maturity Premium — Additional return required by investors in long-term securities to ...

Stock Markets

... market with the advent of a common currency, the Euro • Growth has recently strengthened in the U.K., Canada, Japan, and Pacific Basin countries • International stock markets allow investors to diversify by holding stocks issued by corporations in foreign countries • International diversification ca ...

... market with the advent of a common currency, the Euro • Growth has recently strengthened in the U.K., Canada, Japan, and Pacific Basin countries • International stock markets allow investors to diversify by holding stocks issued by corporations in foreign countries • International diversification ca ...

How Do Canadian Banks That Deal in Foreign Exchange Hedge

... functions, financial institutions will generally have a higher tolerance for risk than their customers. Shoughton and Zechner (1999) and D’Souza and Lai (2002) show that a decentralized capital-allocation function can reduce the overall risk of a financial institution that has business lines with co ...

... functions, financial institutions will generally have a higher tolerance for risk than their customers. Shoughton and Zechner (1999) and D’Souza and Lai (2002) show that a decentralized capital-allocation function can reduce the overall risk of a financial institution that has business lines with co ...

An approach on how to trade in commodities market

... beyond shares, bonds and real estate, commodities emerged as an alternative tool and one of the best option across the globe. Till some years ago, this wouldn't have made sense. For retail investors, they could have done very little to actually invest in commodities beyond gold and silver however th ...

... beyond shares, bonds and real estate, commodities emerged as an alternative tool and one of the best option across the globe. Till some years ago, this wouldn't have made sense. For retail investors, they could have done very little to actually invest in commodities beyond gold and silver however th ...

VectorVest ProTrader

... In Day Trading mode, the performance of each search will be analyzed as if you were day-trading. Each night, the search is run, and the next day the Derby simulates buying all stocks from that search and selling them at the close of the same day. It then compiles these results for you into a summary ...

... In Day Trading mode, the performance of each search will be analyzed as if you were day-trading. Each night, the search is run, and the next day the Derby simulates buying all stocks from that search and selling them at the close of the same day. It then compiles these results for you into a summary ...

Full text - Высшая школа экономики

... possibility for to hedge their price risk and hence help producers improve performance of their businesses. Speculators themselves, however, have no effect on fundamental conditions and commodity price. This point of view was predominant before the commodity price boom of 2000s. Many economists attr ...

... possibility for to hedge their price risk and hence help producers improve performance of their businesses. Speculators themselves, however, have no effect on fundamental conditions and commodity price. This point of view was predominant before the commodity price boom of 2000s. Many economists attr ...

The Market Microstructure Approach to Foreign Exchange: Looking

... (1988) forcefully makes the case for this pragmatic approach: “economists cannot just rely on assumption and hypotheses about how speculators and other market agents may operate in theory, but should examine how they work in practice, by first-hand study of such markets.” This strategy paralleled th ...

... (1988) forcefully makes the case for this pragmatic approach: “economists cannot just rely on assumption and hypotheses about how speculators and other market agents may operate in theory, but should examine how they work in practice, by first-hand study of such markets.” This strategy paralleled th ...

The Causal Effects of Short-Selling Bans

... discontinuities in short-selling activity are up to 20% (40%) of the mean (median) shortselling activity for all short-eligible firms in Hong Kong. Despite this, we find that these short-selling bans have no effect on stock prices or market quality. Stock returns, volatility, bid-ask spreads, and c ...

... discontinuities in short-selling activity are up to 20% (40%) of the mean (median) shortselling activity for all short-eligible firms in Hong Kong. Despite this, we find that these short-selling bans have no effect on stock prices or market quality. Stock returns, volatility, bid-ask spreads, and c ...

Full article text

... by Merton who characterized the self-fulfilling prophecy as an initially incorrect definition of a situation triggering new actions which then verify the initial false conception. In a recent questionnaire survey of foreign exchange professionals in Germany, Menkhoff argues that chartism may be seen ...

... by Merton who characterized the self-fulfilling prophecy as an initially incorrect definition of a situation triggering new actions which then verify the initial false conception. In a recent questionnaire survey of foreign exchange professionals in Germany, Menkhoff argues that chartism may be seen ...

Predatory Conduct - College of William & Mary

... so he will always price low if he is low cost. • Since the incumbent will only price high if he is a high cost firm, if PE sees high price, he assumes high cost and enters. • However, incumbent may try to masquerade as a low cost firm, so if PE sees a low price, he knows the incumbent could be bluff ...

... so he will always price low if he is low cost. • Since the incumbent will only price high if he is a high cost firm, if PE sees high price, he assumes high cost and enters. • However, incumbent may try to masquerade as a low cost firm, so if PE sees a low price, he knows the incumbent could be bluff ...

Adverse Selection and Competitive Market Making

... trade. Traders, who are willing to pay this premium (discount) in order to execute a trade immediately, demand liquidity.2 A trader may desire to transact immediately because she has some private information about the future value of the security or because she wants to optimally re-balance her port ...

... trade. Traders, who are willing to pay this premium (discount) in order to execute a trade immediately, demand liquidity.2 A trader may desire to transact immediately because she has some private information about the future value of the security or because she wants to optimally re-balance her port ...

Stock prices volatility and trading volume

... Gebka and Wohar (2013) analyzed the causality between past trading volume and index returns in the Pacific Basin countries. Their OLS results indicate no causal link between trading volume and returns. Nevertheless, the quantile regression method reveals strong nonlinear causality, positive for high ...

... Gebka and Wohar (2013) analyzed the causality between past trading volume and index returns in the Pacific Basin countries. Their OLS results indicate no causal link between trading volume and returns. Nevertheless, the quantile regression method reveals strong nonlinear causality, positive for high ...

Informed Trading in Parallel Auction and Dealer Markets

... better able to identify informed traders. Gramming, Schiereck, and Theissen (2001) examine the relation of degree of trader anonymity and the probability of informed trading on the two parallel markets at the Frankfurt Stock Exchange. Both these studies are based on the concept that the non-anonymo ...

... better able to identify informed traders. Gramming, Schiereck, and Theissen (2001) examine the relation of degree of trader anonymity and the probability of informed trading on the two parallel markets at the Frankfurt Stock Exchange. Both these studies are based on the concept that the non-anonymo ...

Using Prediction Markets to Track Information Flows

... undergraduate major or aptitude test scores) and more interest in either investing or poker (as ...

... undergraduate major or aptitude test scores) and more interest in either investing or poker (as ...

English - Seed System

... Type of trader : (circle): farmer-producer; produce store, other___________________________ Distinguishing grain from seed. There may be many ways traders may help manage grain to be used as seed—either consciously or not. All of the features below help grain to become potential seed—so understandin ...

... Type of trader : (circle): farmer-producer; produce store, other___________________________ Distinguishing grain from seed. There may be many ways traders may help manage grain to be used as seed—either consciously or not. All of the features below help grain to become potential seed—so understandin ...

Multimarket Trading and Market Liquidity Author(s): Bhagwan

... fourth markets" in some stocks. Also, there often exist active markets in derivative securities, such as futures and options. An investor with private information about a stock could trade, for example, on one or more exchanges on which the stock is listed, while simultaneously trading in off-the-ex ...

... fourth markets" in some stocks. Also, there often exist active markets in derivative securities, such as futures and options. An investor with private information about a stock could trade, for example, on one or more exchanges on which the stock is listed, while simultaneously trading in off-the-ex ...