Review of the Market Events of May 6, 2010

... have been proposed. However, IIROC believes that these recommendations cannot be dealt with in isolation but rather must be reviewed together in order to more effectively address the issues identified by the events of May 6. 1. The trading on May 6 demonstrated that aberrant or volatile trading in o ...

... have been proposed. However, IIROC believes that these recommendations cannot be dealt with in isolation but rather must be reviewed together in order to more effectively address the issues identified by the events of May 6. 1. The trading on May 6 demonstrated that aberrant or volatile trading in o ...

The principles of HOW PEOPLE MAKE

... Cost of fixing transmission = $600 A. Blue book value is $6500 if transmission works, $5700 if it doesn’t ...

... Cost of fixing transmission = $600 A. Blue book value is $6500 if transmission works, $5700 if it doesn’t ...

Financial Market Shocks and the Macroeconomy

... to issues that relate to market microstructure, i.e., studies of stock market liquidity and insider trading (viz. Holden and Subrahmanyam, 1996, and Leland, 1992). In this ...

... to issues that relate to market microstructure, i.e., studies of stock market liquidity and insider trading (viz. Holden and Subrahmanyam, 1996, and Leland, 1992). In this ...

Durability, Re-trading and Market Performance

... particularly transparent: shares earned a common probabilistic yield, or “dividend,” each period, and this structure was common public information. Although this transparency was thought to argue strongly for observing rational expectation equilibrium 5 , that state emerged reliably only after multi ...

... particularly transparent: shares earned a common probabilistic yield, or “dividend,” each period, and this structure was common public information. Although this transparency was thought to argue strongly for observing rational expectation equilibrium 5 , that state emerged reliably only after multi ...

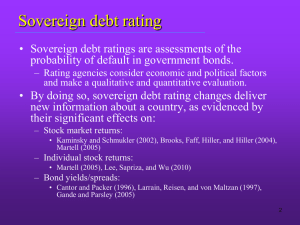

Sovereign Debt Rating and Stock Liquidity around the World

... • We study the impact of sovereign rating changes on stock liquidity for 40 countries for 1990-2009. • Our findings show that sovereign rating changes have a significant and robust impact on stock liquidity. – The impact is nonlinear and asymmetric and varies across stocks and countries. – In a cros ...

... • We study the impact of sovereign rating changes on stock liquidity for 40 countries for 1990-2009. • Our findings show that sovereign rating changes have a significant and robust impact on stock liquidity. – The impact is nonlinear and asymmetric and varies across stocks and countries. – In a cros ...

Food price spikes and strategic interactions

... of decision making means that traders cannot be certain that government will actually do this. Nor can traders be certain of who will be allowed to buy the grain from government if and when it does import, or at what price. These unknowns are major sources of risk and potential financial loss for tr ...

... of decision making means that traders cannot be certain that government will actually do this. Nor can traders be certain of who will be allowed to buy the grain from government if and when it does import, or at what price. These unknowns are major sources of risk and potential financial loss for tr ...

Methodology of Exchange Design

... – Algorithmic complexity can make sensible participation difficult and should be minimized ...

... – Algorithmic complexity can make sensible participation difficult and should be minimized ...

“Communicating with Many Tongues: FOMC Speeches and U.S.

... • The fact that news agencies tend to filter speeches also suggests that individuals might likewise filter the information in speeches. • News agency filtering of speeches is evidence that not all speeches are alike. • Maybe we should turn the problem around. We can look at dates of individual commu ...

... • The fact that news agencies tend to filter speeches also suggests that individuals might likewise filter the information in speeches. • News agency filtering of speeches is evidence that not all speeches are alike. • Maybe we should turn the problem around. We can look at dates of individual commu ...

Equity Trading by Institutional Investors: To Cross or Not

... because the price is set independently of order size. There may, however, be an “implicit” price impact if the existence of a large crossing order is known to participants in the primary market. There is also an implicit price impact due to the removal of crossing orders from the primary market, whi ...

... because the price is set independently of order size. There may, however, be an “implicit” price impact if the existence of a large crossing order is known to participants in the primary market. There is also an implicit price impact due to the removal of crossing orders from the primary market, whi ...

An Economic and Game Theory Approach to the Legalisation of

... The South African government has a stockpile of rhino horn. It is of interest to consider if this stockpile could be used to manipulate the market for rhino horn in order to deter poachers and save the rhino population. Since the stockpile is larger than what it is believed illegal poachers have at ...

... The South African government has a stockpile of rhino horn. It is of interest to consider if this stockpile could be used to manipulate the market for rhino horn in order to deter poachers and save the rhino population. Since the stockpile is larger than what it is believed illegal poachers have at ...

TRANSFER PRICE

... PROS: some coordination, little gray trade, some adaptation CONS: not locally adapted ...

... PROS: some coordination, little gray trade, some adaptation CONS: not locally adapted ...

Earnings Release

... captured by the dispersion observed between analysts’ predictions [Abarbanell, Lanen and Verrechia (1995)]. Finally, an alternative method presented by Maddala and Nimalendran (1995) is the non-observed component approach that uses earnings surprises as a non-observed explicative variable in differe ...

... captured by the dispersion observed between analysts’ predictions [Abarbanell, Lanen and Verrechia (1995)]. Finally, an alternative method presented by Maddala and Nimalendran (1995) is the non-observed component approach that uses earnings surprises as a non-observed explicative variable in differe ...

MARKET SEGMENTATION AND THE COST OF CAPITAL IN

... seven months prior to) and post (four to 34 months after) liberalization. They separate the 9-month period (six months prior to three months after) 'during' liberalization to account for the revaluation effect. Using a cross-sectional time-series model for a sample of EMs, they do not find statistic ...

... seven months prior to) and post (four to 34 months after) liberalization. They separate the 9-month period (six months prior to three months after) 'during' liberalization to account for the revaluation effect. Using a cross-sectional time-series model for a sample of EMs, they do not find statistic ...

Chapter 5

... B = B[t, T, i, (t, X(t)), (t, X(t)), (t,T,X(t)), , S(t,X(t))] Equity Prices: = [ t, T, i, (t, X(t)), , S(t,X(t))] where t is the current period; T is the bond’s time to maturity; i is the stochastic defaultfree interest rate process; (t, X(t)) is the default intensity process, i.e., the ri ...

... B = B[t, T, i, (t, X(t)), (t, X(t)), (t,T,X(t)), , S(t,X(t))] Equity Prices: = [ t, T, i, (t, X(t)), , S(t,X(t))] where t is the current period; T is the bond’s time to maturity; i is the stochastic defaultfree interest rate process; (t, X(t)) is the default intensity process, i.e., the ri ...

Collect the Biggest Dividends In Stock Market History

... dividend was financed through debt. That’s always a warning sign for any dividend, but it was especially problematic in this case. That’s because this dividend amounted to $9 a share. The dividend equaled 60% of the share price, based on the declaration day price of $16 a share. That’s right: Palm i ...

... dividend was financed through debt. That’s always a warning sign for any dividend, but it was especially problematic in this case. That’s because this dividend amounted to $9 a share. The dividend equaled 60% of the share price, based on the declaration day price of $16 a share. That’s right: Palm i ...

CME Group customer forum

... because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures and a swap position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a porti ...

... because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures and a swap position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a porti ...

primary dealership in ghana

... Primary Dealer System - A system whereby qualified and approved institutions are given exclusive rights to purchase all securities issued for resale and, in which, they support secondary market activity. Primary Markets - The market in which new securities are issued either by government, BOG or by ...

... Primary Dealer System - A system whereby qualified and approved institutions are given exclusive rights to purchase all securities issued for resale and, in which, they support secondary market activity. Primary Markets - The market in which new securities are issued either by government, BOG or by ...

Pre-open phase

... Limit orders are at limit price and market orders are at the discovered equilibrium price. In a situation where no equilibrium price is discovered in the pre-open session, all market orders are moved to normal market at previous day’s close price or adjusted close price / base price following price ...

... Limit orders are at limit price and market orders are at the discovered equilibrium price. In a situation where no equilibrium price is discovered in the pre-open session, all market orders are moved to normal market at previous day’s close price or adjusted close price / base price following price ...

Chapter 12

... transaction that is possessed by some market participants but not all. Asymmetric information is a situation in which either the buyer or the seller has private information. How does a market with asymmetric information work? Is the market outcome efficient? ...

... transaction that is possessed by some market participants but not all. Asymmetric information is a situation in which either the buyer or the seller has private information. How does a market with asymmetric information work? Is the market outcome efficient? ...

The value creation through Mergers and Acquisitions on bidder

... statistically significant influence on CAARs over the 41-day event window. In the second step, we examine the cross-border versus the domestic M&As. According to the results, cross-border events have a positive significant return during the whole event window, while M&As do not increase the sharehol ...

... statistically significant influence on CAARs over the 41-day event window. In the second step, we examine the cross-border versus the domestic M&As. According to the results, cross-border events have a positive significant return during the whole event window, while M&As do not increase the sharehol ...

Combinatorial Information Market Design - Robin Hanson

... When compared to official Hewlett-Packard forecasts of printer sales, internal corporate markets were more accurate 6 out of 8 times, even though the official forecasts where made after the markets closed and with knowledge of the market prices (Chen and Plott, 1998). Play money markets predicted th ...

... When compared to official Hewlett-Packard forecasts of printer sales, internal corporate markets were more accurate 6 out of 8 times, even though the official forecasts where made after the markets closed and with knowledge of the market prices (Chen and Plott, 1998). Play money markets predicted th ...

Principles of Economics

... situation in which a firm assumes that other firms will match its price reductions but will not follow price increases. The optimal strategy in such a situation is frequently to leave the price at the current level and to rely on nonprice competition rather than price competition. The model explai ...

... situation in which a firm assumes that other firms will match its price reductions but will not follow price increases. The optimal strategy in such a situation is frequently to leave the price at the current level and to rely on nonprice competition rather than price competition. The model explai ...

Sample pages 1 PDF

... corresponding net returns. Since returns are smaller in magnitude over shorter periods, we can expect returns and log returns to be similar for daily returns, less similar for yearly returns, and not necessarily similar for longer periods ...

... corresponding net returns. Since returns are smaller in magnitude over shorter periods, we can expect returns and log returns to be similar for daily returns, less similar for yearly returns, and not necessarily similar for longer periods ...

Experimental Approach to Business Strategy 45-922

... The prisoner’s dilemma illustrates why games reach outcomes in which all players are worse off than they would be in one of the other outcomes. Notice that in a competitive equilibrium is a single the potential trading surplus is used up by the traders. It is impossible to make one or more players b ...

... The prisoner’s dilemma illustrates why games reach outcomes in which all players are worse off than they would be in one of the other outcomes. Notice that in a competitive equilibrium is a single the potential trading surplus is used up by the traders. It is impossible to make one or more players b ...

PowerPoint Presentation - University of Notre Dame

... In a significant number of situations, individuals are charged different amounts for the same good (car purchases). Yet we would expect there to be a single price in a competitive market. Why? IF everyone knew the rate (price) that others were trading, why would they every pay more than others were ...

... In a significant number of situations, individuals are charged different amounts for the same good (car purchases). Yet we would expect there to be a single price in a competitive market. Why? IF everyone knew the rate (price) that others were trading, why would they every pay more than others were ...