RTF - OTC Markets

... quarterly; and (c) an equity component. The debentures will be issued in Series 1 through 5 with a 10 year maturity date. Each debenture will offer a guaranteed return of principal feature made possible through the purchase of U.S. zero coupon bonds and/or guaranteed investment contracts. Each deben ...

... quarterly; and (c) an equity component. The debentures will be issued in Series 1 through 5 with a 10 year maturity date. Each debenture will offer a guaranteed return of principal feature made possible through the purchase of U.S. zero coupon bonds and/or guaranteed investment contracts. Each deben ...

Brookfield Business Partners LP (Form: 6-K, Received: 10

... Diverse asset base. Existing portfolio comprises 22 municipal systems with coverage of more than 17 million people, as well as 4 industrial water treatment systems with "take-or-pay" contracts. ...

... Diverse asset base. Existing portfolio comprises 22 municipal systems with coverage of more than 17 million people, as well as 4 industrial water treatment systems with "take-or-pay" contracts. ...

ING to sell 33 million shares in NN Group

... capital generated in excess of NN Group’s capital ambition is expected to be returned to shareholders unless it can be used for any other appropriate corporate purposes, including investments in value creating corporate opportunities. NN Group is committed to distributing excess capital in a form wh ...

... capital generated in excess of NN Group’s capital ambition is expected to be returned to shareholders unless it can be used for any other appropriate corporate purposes, including investments in value creating corporate opportunities. NN Group is committed to distributing excess capital in a form wh ...

Word - corporate

... announced that its Board of Directors has expanded the Company’s stock repurchase program by $50 million to $150 million. As of the close of business today and since the inception of the stock repurchase program, the Company has repurchased approximately $86.2 million of common stock. The Company’s ...

... announced that its Board of Directors has expanded the Company’s stock repurchase program by $50 million to $150 million. As of the close of business today and since the inception of the stock repurchase program, the Company has repurchased approximately $86.2 million of common stock. The Company’s ...

Lecture 1

... via an efficient payment system Provides for the efficient flow of funds from saving to investment via financial markets and financial institutions Provides contracts for managing risk such as insurance, futures, and options Copyright© 2003 John Wiley and Sons, Inc. ...

... via an efficient payment system Provides for the efficient flow of funds from saving to investment via financial markets and financial institutions Provides contracts for managing risk such as insurance, futures, and options Copyright© 2003 John Wiley and Sons, Inc. ...

ACCOUNTS OF BANKING COMPANIES

... and represents temporary loans to Bill Brokers and other banks . If the loan is given for one day, it is called ‘money at call’ and if the loan cannot be called back on demand and will require at least a notice of three days for calling back , it is called ‘ money at short notice ’ . It also include ...

... and represents temporary loans to Bill Brokers and other banks . If the loan is given for one day, it is called ‘money at call’ and if the loan cannot be called back on demand and will require at least a notice of three days for calling back , it is called ‘ money at short notice ’ . It also include ...

united states securities and exchange commission - corporate

... On April 26, 2017, Advanced Micro Devices, Inc. (the “Company”) held its 2017 Annual Meeting of Stockholders (the “Annual Meeting”). At the Annual Meeting, the Company’s stockholders voted on the following six proposals, each of which is described in detail in the Company’s definitive proxy statemen ...

... On April 26, 2017, Advanced Micro Devices, Inc. (the “Company”) held its 2017 Annual Meeting of Stockholders (the “Annual Meeting”). At the Annual Meeting, the Company’s stockholders voted on the following six proposals, each of which is described in detail in the Company’s definitive proxy statemen ...

companhia de bebidas das américas-ambev

... 08012.003805/2004-1, whereby, among other decisions, AmBev was fined in the amount of R$352 million. Although CADE has not made available up to now its written opinion, AmBev states the following: ...

... 08012.003805/2004-1, whereby, among other decisions, AmBev was fined in the amount of R$352 million. Although CADE has not made available up to now its written opinion, AmBev states the following: ...

ABA Discussion Paper - American Bankers Association

... Requirement to File Financial Statements with a Regulatory Agency Many bankers are concerned that the requirement to file Call Reports essentially qualifies a bank, by default, to be a PBE and, thus, disqualifies it from the private company reporting privileges. For example, Criterion B states a com ...

... Requirement to File Financial Statements with a Regulatory Agency Many bankers are concerned that the requirement to file Call Reports essentially qualifies a bank, by default, to be a PBE and, thus, disqualifies it from the private company reporting privileges. For example, Criterion B states a com ...

Comments on “Risk Allocation, Debt Fueled Expansion and Financial Crisis,” Beaudry

... In these circumstances, the market price of MBS reflect’s buyers’ belief that most securities that are offered for sale are low quality (fire-sale price). The true value of the average MBS may in fact be much higher. This is the hold-to-maturity price. The adverse selection problem then aggregates f ...

... In these circumstances, the market price of MBS reflect’s buyers’ belief that most securities that are offered for sale are low quality (fire-sale price). The true value of the average MBS may in fact be much higher. This is the hold-to-maturity price. The adverse selection problem then aggregates f ...

Spring 2017 Bursar Payment Worksheet

... TMS Account #__________________________ Spring Semester Budget Amount: _________________ *See enclosed Methods of Payment Sheet For Payment Instructions, then Enter Your Method Here: ___Check Enclosed Credit Card Confirmation No.____________________ E-Check Conf. # ______________ REQUIRED SIGNATURE: ...

... TMS Account #__________________________ Spring Semester Budget Amount: _________________ *See enclosed Methods of Payment Sheet For Payment Instructions, then Enter Your Method Here: ___Check Enclosed Credit Card Confirmation No.____________________ E-Check Conf. # ______________ REQUIRED SIGNATURE: ...

Chapter 22

... asset or liability’s value to small changes in interest rates % in the market val ue of a security D R /(1 R) The duration gap is a measure of overall interest rate risk exposure for an FI To find the duration of the total portfolio of assets (DA) (or liabilities (DL)) for an FI First deter ...

... asset or liability’s value to small changes in interest rates % in the market val ue of a security D R /(1 R) The duration gap is a measure of overall interest rate risk exposure for an FI To find the duration of the total portfolio of assets (DA) (or liabilities (DL)) for an FI First deter ...

Money Laundering in Securities Markets

... employee of a U.S. broker-dealer shutdown by regulators for fraudulent practices. The few securities that traded through the account are subject of various Securities Exchange Commission (S.E.C.) hearings and criminal investigations. Figure 1 shows only one month’s transactions, however it is repres ...

... employee of a U.S. broker-dealer shutdown by regulators for fraudulent practices. The few securities that traded through the account are subject of various Securities Exchange Commission (S.E.C.) hearings and criminal investigations. Figure 1 shows only one month’s transactions, however it is repres ...

Bank Capital

... corporations; these borrowings are called: 1, discount loans/advances 预支款 (from the Fed), 2, fed funds (from other banks), interbank offshore dollar deposits (from other banks), 3, repurchase agreements, a.k.a. (also known as), “repos” from other banks and companies, ...

... corporations; these borrowings are called: 1, discount loans/advances 预支款 (from the Fed), 2, fed funds (from other banks), interbank offshore dollar deposits (from other banks), 3, repurchase agreements, a.k.a. (also known as), “repos” from other banks and companies, ...

Declaration of Appropriateness for Listing by a J

... Exchange and is a company that is suitable for listing on such market. (2) An initial listing applicant conducts business fairly and in good faith. (3) The corporate governance and internal management structure of an initial listing applicant is appropriately developed in accordance with corporate s ...

... Exchange and is a company that is suitable for listing on such market. (2) An initial listing applicant conducts business fairly and in good faith. (3) The corporate governance and internal management structure of an initial listing applicant is appropriately developed in accordance with corporate s ...

Rating Funding Agreement-Backed Securities Programs

... could be disrupted, for example, when interest rates decline and the durations of certain assets shorten, which often occurs with collateralized mortgage obligations (CMOs). To compensate, an insurer may fund a floating-rate FA with fixed-rate assets and then “swap” the resulting fixed payments for ...

... could be disrupted, for example, when interest rates decline and the durations of certain assets shorten, which often occurs with collateralized mortgage obligations (CMOs). To compensate, an insurer may fund a floating-rate FA with fixed-rate assets and then “swap” the resulting fixed payments for ...

NOTICE OF MATERIAL EVENT UNDER SEC RULE 15c2

... There is no assurance that the new rating will be maintained for any given period of time or that they will not be lowered or withdrawn entirely if, in the judgement of the applicable rating agency, circumstances so warrant. The Issuer has not undertaken any responsibility to oppose any proposed r ...

... There is no assurance that the new rating will be maintained for any given period of time or that they will not be lowered or withdrawn entirely if, in the judgement of the applicable rating agency, circumstances so warrant. The Issuer has not undertaken any responsibility to oppose any proposed r ...

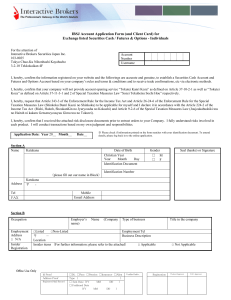

IBSJ Account Application Form (and Client Card) for Exchange listed

... I am obligated to accept all executions that are consistent with the instructions specified in my orders. Although we believe our failure rate is among the lowest in the industry, any system may fail at one time or another, often by reason of forces beyond human control. IB is not liable for system ...

... I am obligated to accept all executions that are consistent with the instructions specified in my orders. Although we believe our failure rate is among the lowest in the industry, any system may fail at one time or another, often by reason of forces beyond human control. IB is not liable for system ...

CHAPTER 12

... Trading securities are current assets by definition. Individual held-to-maturity and available-for-sale securities are either current or noncurrent depending on when they are expected to be sold. It’s not necessary that a company report individual amounts for the three categories of investments – he ...

... Trading securities are current assets by definition. Individual held-to-maturity and available-for-sale securities are either current or noncurrent depending on when they are expected to be sold. It’s not necessary that a company report individual amounts for the three categories of investments – he ...

No Slide Title

... the IPO. Company officers must not “hype” their stock during this time. • The waiting period is after the registration statement is filed, but before the SEC approves it. A simple ad can be published during this time, and indications of interest are gathered, but no sales can be made. • The SEC may ...

... the IPO. Company officers must not “hype” their stock during this time. • The waiting period is after the registration statement is filed, but before the SEC approves it. A simple ad can be published during this time, and indications of interest are gathered, but no sales can be made. • The SEC may ...

ppt

... RECTIFICATION: DEBIT SALES WITH 4500/-, CREDIT SUSPENCE WITH 4500/-, CREDIT RENT WITH 4500/-, DEBIT SUSPENCE WITH 4500/-. ...

... RECTIFICATION: DEBIT SALES WITH 4500/-, CREDIT SUSPENCE WITH 4500/-, CREDIT RENT WITH 4500/-, DEBIT SUSPENCE WITH 4500/-. ...

Chapter 5

... PD; (t, X(t)) is the recovery rate (1 – LGD); (t,T,X(t)) is the liquidity premium; is a stock market bubble factor; and S(t,X(t)) is the liquidating dividend on equity in the event of bond default. ...

... PD; (t, X(t)) is the recovery rate (1 – LGD); (t,T,X(t)) is the liquidity premium; is a stock market bubble factor; and S(t,X(t)) is the liquidating dividend on equity in the event of bond default. ...

Global liquidity: where do we stand?

... International Conference. The topic of this conference is very special to the BIS. We have paid close attention to global liquidity in the past few years and have contributed to recent international efforts to understand it better, including those of the 2011 CGFS Working Group chaired by Jean-Pierr ...

... International Conference. The topic of this conference is very special to the BIS. We have paid close attention to global liquidity in the past few years and have contributed to recent international efforts to understand it better, including those of the 2011 CGFS Working Group chaired by Jean-Pierr ...

Federal Reserve Rule Regarding Capital

... The Fed has decided, as proposed, to retain in the final rule the standard that voting common stock should be the dominant form of a BHC’s Tier 1 capital. The final rule continues to caution that excessive non-voting elements generally will be reallocated to Tier 2 capital. Pooled issuances generall ...

... The Fed has decided, as proposed, to retain in the final rule the standard that voting common stock should be the dominant form of a BHC’s Tier 1 capital. The final rule continues to caution that excessive non-voting elements generally will be reallocated to Tier 2 capital. Pooled issuances generall ...

chapter 7

... Under RA-I, the Lender will provide a loan to the borrower based on the concept of Qard al- Hasan. The borrower will pledge its securities as collateral for the loan granted. However, in the event where the borrower fails to repay the loan on maturity date, the lender has the right to sell the pledg ...

... Under RA-I, the Lender will provide a loan to the borrower based on the concept of Qard al- Hasan. The borrower will pledge its securities as collateral for the loan granted. However, in the event where the borrower fails to repay the loan on maturity date, the lender has the right to sell the pledg ...