A Multiple Lender Approach to Understanding Supply and Search in

... brokerage firms, among them Morgan Stanley and A. G. Edwards. Because the market prices were so obscure, the government says, the employees could rip off their own firms by arranging for the firms to overpay when they borrowed shares…. The S.E.C., which also filed civil fraud allegations, says the a ...

... brokerage firms, among them Morgan Stanley and A. G. Edwards. Because the market prices were so obscure, the government says, the employees could rip off their own firms by arranging for the firms to overpay when they borrowed shares…. The S.E.C., which also filed civil fraud allegations, says the a ...

Global Markets: Prime Brokerage

... Our smart order router CORE @ CIBC lets you efficiently access all markets trading Canadian equities ...

... Our smart order router CORE @ CIBC lets you efficiently access all markets trading Canadian equities ...

Mexican_Financial_Market

... Are vehicles to finance real estate, which provide periodic payments (rent income) and also give the possibility of capital gains (appreciation). Defined in Article 223 and 224 of Income Tax Law (LISR): FIBRAS are trusts that are focused in the acquisition or construction of real estate which is set ...

... Are vehicles to finance real estate, which provide periodic payments (rent income) and also give the possibility of capital gains (appreciation). Defined in Article 223 and 224 of Income Tax Law (LISR): FIBRAS are trusts that are focused in the acquisition or construction of real estate which is set ...

FocusPoint - NN Investment Partners

... been set at 100; their ensuing performances are tracked in relation to the 1972 base point. For example, a 1% return for a given asset class in the first year would put it at 101 while a 5% loss would put it at 95. ...

... been set at 100; their ensuing performances are tracked in relation to the 1972 base point. For example, a 1% return for a given asset class in the first year would put it at 101 while a 5% loss would put it at 95. ...

UDR, Inc. - Barchart.com

... We have acted as counsel to UDR, Inc., a Maryland corporation (the “Company”), in connection with the issuance and sale by the Company of $300,000,000 aggregate principal amount of the Company’s 4.000% Medium-Term Notes, Series A, due 2025 (the “Medium-Term Notes”, or the “Notes”) issued pursuant to ...

... We have acted as counsel to UDR, Inc., a Maryland corporation (the “Company”), in connection with the issuance and sale by the Company of $300,000,000 aggregate principal amount of the Company’s 4.000% Medium-Term Notes, Series A, due 2025 (the “Medium-Term Notes”, or the “Notes”) issued pursuant to ...

Securities markets regulators in transition

... Market and its authority extends to the securities markets, insurance market, savings and lending organisations, microfinance organisations, private pension funds and credit history offices. The main tasks of the Commission are to ensure transparency and efficiency of the financial sector through th ...

... Market and its authority extends to the securities markets, insurance market, savings and lending organisations, microfinance organisations, private pension funds and credit history offices. The main tasks of the Commission are to ensure transparency and efficiency of the financial sector through th ...

Listing Conditions Scientific Research Based

... Demonstrate ability to attract funds from sophisticated investors ...

... Demonstrate ability to attract funds from sophisticated investors ...

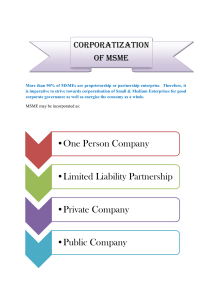

One Person Company •Limited Liability Partnership •Private

... A limited liability partnership can at best be described as a hybrid between a company and partnership that provides the benefit of limited liability but allows its members the flexibility of organising their internal structure as a partnership based on a ...

... A limited liability partnership can at best be described as a hybrid between a company and partnership that provides the benefit of limited liability but allows its members the flexibility of organising their internal structure as a partnership based on a ...

Topic 1. Introduction to financial derivatives

... securities held by FIs may not be paid in full. The examples of credit event include delay, reducing or missing of bond’s coupon and/or principal. Firm-specific credit risk – the risk of default of the borrowing firm associated with the specific types of project risk taken by that firm. ...

... securities held by FIs may not be paid in full. The examples of credit event include delay, reducing or missing of bond’s coupon and/or principal. Firm-specific credit risk – the risk of default of the borrowing firm associated with the specific types of project risk taken by that firm. ...

chapter 2 - CSUN.edu

... Accounting information is also relevant to business decisions because it confirms or corrects prior expectations. Financial statements both help predict future events and confirm or correct prior expectations about the financial health of the company. In order to be relevant accounting information ...

... Accounting information is also relevant to business decisions because it confirms or corrects prior expectations. Financial statements both help predict future events and confirm or correct prior expectations about the financial health of the company. In order to be relevant accounting information ...

primary dealership in ghana

... market, calculated as total market activity divided by the number of PDs. For example, if there are 10 PDs, each would have a proportional market share of 10%. Regulatory Authorities - MOF and Financial Regulators of the different operators in the financial market i.e. BOG, SEC, GSE and NIC. Repo or ...

... market, calculated as total market activity divided by the number of PDs. For example, if there are 10 PDs, each would have a proportional market share of 10%. Regulatory Authorities - MOF and Financial Regulators of the different operators in the financial market i.e. BOG, SEC, GSE and NIC. Repo or ...

preferred securities - Janney Montgomery Scott LLC

... a small portion have floating coupons which vary at a spread over some index, usually LIBOR. Some preferreds will begin their lives with a fixed coupon and convert into a floating coupon at some specified date. Over time, market interest rates may increase or decrease, harming or benefiting an issue ...

... a small portion have floating coupons which vary at a spread over some index, usually LIBOR. Some preferreds will begin their lives with a fixed coupon and convert into a floating coupon at some specified date. Over time, market interest rates may increase or decrease, harming or benefiting an issue ...

The 8th Cumbre Financiera Mexicana April 9th, 2013

... FIBRAs, a vehicle that is quite similar to a REIT in the US, represent an attractive investment option to gain exposure to Mexico’s increasingly attractive real estate sector. FIB RAs, as well as other listed real estate vehicles, offer investors the opportunity to capitalize on Mexico’s strong macr ...

... FIBRAs, a vehicle that is quite similar to a REIT in the US, represent an attractive investment option to gain exposure to Mexico’s increasingly attractive real estate sector. FIB RAs, as well as other listed real estate vehicles, offer investors the opportunity to capitalize on Mexico’s strong macr ...

Document

... Several potential disadvantages include the following: 1. Fair value may not be readily obtainable for some assets or liabilities resulting in subjectivity. (continued) ...

... Several potential disadvantages include the following: 1. Fair value may not be readily obtainable for some assets or liabilities resulting in subjectivity. (continued) ...

CHAPTER 21 - MONEY AND BANKING

... The stability of the value of money in the global marketplace is important because if the value of money is not stable, other countries will not accept that money in trade. In other words, if the marketplace believes your money will not be valuable to use, the market will not accept your money as pa ...

... The stability of the value of money in the global marketplace is important because if the value of money is not stable, other countries will not accept that money in trade. In other words, if the marketplace believes your money will not be valuable to use, the market will not accept your money as pa ...

How do Interest Rates Work - Wealthcare Securities Pvt. Ltd.

... Banks, governments and other large financial institutions need cash and they are willing to pay for it. ...

... Banks, governments and other large financial institutions need cash and they are willing to pay for it. ...

this instrument and any securities issuable pursuant hereto have not

... instrument and to perform its obligations hereunder. This instrument constitutes valid and binding obligation of the Investor, enforceable in accordance with its terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of credit ...

... instrument and to perform its obligations hereunder. This instrument constitutes valid and binding obligation of the Investor, enforceable in accordance with its terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of credit ...

Handelsbanken Shanghai

... A forward contract is the easiest way of covering exchange risk because it locks in the exchange rate. This strategy mitigates one of the problems that customer experience when importing or exporting in foreign currency In order to carry out a FX forward the customer need to advise the agent ban ...

... A forward contract is the easiest way of covering exchange risk because it locks in the exchange rate. This strategy mitigates one of the problems that customer experience when importing or exporting in foreign currency In order to carry out a FX forward the customer need to advise the agent ban ...

University of Rochester Medical Center Eastman Institute for Oral

... Once you apply and are approved for your private student loan, the lender will request that the School of Medicine and Dentistry Financial Aid Office “certify” the loan. The certification will include the amount of loan funds you are eligible for, and the timing of the disbursements. The fall semest ...

... Once you apply and are approved for your private student loan, the lender will request that the School of Medicine and Dentistry Financial Aid Office “certify” the loan. The certification will include the amount of loan funds you are eligible for, and the timing of the disbursements. The fall semest ...

Mr. Llyod Chingambo - United Nations Economic Commission for

... MARKET DEVELOPMENT Lloyd Chingambo Seventh African Development Forum Addis Ababa. Ethiopia October 15, 2010 ...

... MARKET DEVELOPMENT Lloyd Chingambo Seventh African Development Forum Addis Ababa. Ethiopia October 15, 2010 ...

Read full ASX announcement – pdf

... be quoted under section 1019B of the Corporations Act at the time that we request that the +securities be quoted. We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. We ...

... be quoted under section 1019B of the Corporations Act at the time that we request that the +securities be quoted. We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. We ...

Why negative interest rates are not a solution for

... In essence, the central banks of these economies charge the commercial banks for reserve deposits held at the central bank, although in some cases only a part of these balances are subject to negative interest rates (or penalty charges). The conventional motivations for the policy are twofold: first ...

... In essence, the central banks of these economies charge the commercial banks for reserve deposits held at the central bank, although in some cases only a part of these balances are subject to negative interest rates (or penalty charges). The conventional motivations for the policy are twofold: first ...

Slide 1

... •Long run: Over time, the company would hopefully invest the cash in more productive assets, or pay it out to shareholders. Both of these actions would increase EVA. ...

... •Long run: Over time, the company would hopefully invest the cash in more productive assets, or pay it out to shareholders. Both of these actions would increase EVA. ...

Budget to Save—The Balance Sheet

... 8. When an item is consumed, it does not increase the total value of assets owned. When money is borrowed to purchase consumable items, liabilities increase. If total assets remain the same while total liabilities increase, net worth decreases. 9. A house is a wealth-creating asset when it appreci ...

... 8. When an item is consumed, it does not increase the total value of assets owned. When money is borrowed to purchase consumable items, liabilities increase. If total assets remain the same while total liabilities increase, net worth decreases. 9. A house is a wealth-creating asset when it appreci ...