Alexey Nikolaevich Chubinov,

... covers only guarantees issued in compliance with the Russian legislation. According to article 368 of the Civil Code of the Russian Federation bank guarantee can be issued only by credit and insurance companies. Credit organizations according to FZ from 02.12.1990 No. 395-1 “On banks and bank activi ...

... covers only guarantees issued in compliance with the Russian legislation. According to article 368 of the Civil Code of the Russian Federation bank guarantee can be issued only by credit and insurance companies. Credit organizations according to FZ from 02.12.1990 No. 395-1 “On banks and bank activi ...

Use of Derivatives for Debt Management and Domestic Debt Market

... of such instruments. Derivative instruments contribute to overall market efficiency and liquidity. These benefits include the ability for market participants to hedge positions effectively, the ability to trade in and out of markets at any time, continuous price updates and market intelligence throu ...

... of such instruments. Derivative instruments contribute to overall market efficiency and liquidity. These benefits include the ability for market participants to hedge positions effectively, the ability to trade in and out of markets at any time, continuous price updates and market intelligence throu ...

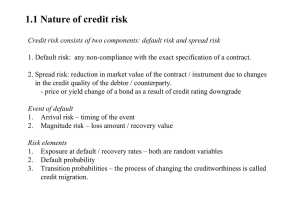

Default risk and spread risk

... The correlation between default risks of different borrowers is generally low (that is, low joint default frequency), though it can be significant for related companies, and smaller companies within the same domestic industry sector. ...

... The correlation between default risks of different borrowers is generally low (that is, low joint default frequency), though it can be significant for related companies, and smaller companies within the same domestic industry sector. ...

Annex 1 SECURITIES AND FUTURES (STOCK MARKET LISTING

... "applicant" means a corporation which has made an application under section 3; "application" means an application made under section 3 and all documents in support of or in connection with the application including any replacement of or amendment or supplement to such application and the filing obli ...

... "applicant" means a corporation which has made an application under section 3; "application" means an application made under section 3 and all documents in support of or in connection with the application including any replacement of or amendment or supplement to such application and the filing obli ...

The Financial CHOICE Act

... consists of noncumulative perpetual preferred stock. In addition, banking organizations that can treat certain trust preferred securities as tier 1 capital under the banking agencies’ existing capital rules will be permitted to include such securities in the definition of “tangible equity.” For cred ...

... consists of noncumulative perpetual preferred stock. In addition, banking organizations that can treat certain trust preferred securities as tier 1 capital under the banking agencies’ existing capital rules will be permitted to include such securities in the definition of “tangible equity.” For cred ...

Fixed Account / Fixed Interest Account

... 3 Moody’s Investors Service’s Financial Strength Rating is an opinion of the ability of insurance companies to repay punctually senior policyholder claims and obligations. The Aa3 rating is the fourth highest rating on this 21-step scale, and indicates that the company offers excellent financial sec ...

... 3 Moody’s Investors Service’s Financial Strength Rating is an opinion of the ability of insurance companies to repay punctually senior policyholder claims and obligations. The Aa3 rating is the fourth highest rating on this 21-step scale, and indicates that the company offers excellent financial sec ...

Addressing Issuer Concerns

... 11. Mr. Jose Antonio Ocampo stressed the importance of GDP-indexed bonds as a counter-cyclical policy instrument. He pointed out that financial markets have been pushing developing countries into pro-cyclical policies. Mr. Ocampo promoted the idea of Multilateral Development Banks (MDBs) as market m ...

... 11. Mr. Jose Antonio Ocampo stressed the importance of GDP-indexed bonds as a counter-cyclical policy instrument. He pointed out that financial markets have been pushing developing countries into pro-cyclical policies. Mr. Ocampo promoted the idea of Multilateral Development Banks (MDBs) as market m ...

The Balance Sheet: Assets, Debts and Equity

... include utility bills, car payments and mortgages. Like assets, some of these liabilities are short-term (e.g., utility bills) and others are long-term (e.g., the portion of your mortgage not due over the next 12 months). The difference between your assets and liabilities is your net worth, which is ...

... include utility bills, car payments and mortgages. Like assets, some of these liabilities are short-term (e.g., utility bills) and others are long-term (e.g., the portion of your mortgage not due over the next 12 months). The difference between your assets and liabilities is your net worth, which is ...

Century Park Pictures Corporation

... The Company has no operating activities, no cash on hand, no profit and operates a business plan with inherent risk. Because of these factors, our auditors have issued an audit opinion for the Company which includes a statement describing our going concern status. This means, in our auditor's opinio ...

... The Company has no operating activities, no cash on hand, no profit and operates a business plan with inherent risk. Because of these factors, our auditors have issued an audit opinion for the Company which includes a statement describing our going concern status. This means, in our auditor's opinio ...

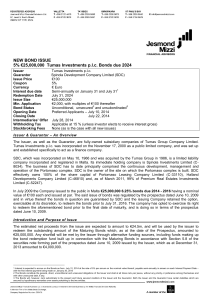

NEW BOND ISSUE 5% €25000000 Tumas Investments plc Bonds

... The Bonds shall constitute the general, direct, unconditional and unsecured obligations of the Issuer and shall be guaranteed in respect of both the principal amount and the interest due under said Bonds by the Guarantor. This means that bondholders will rank pari passu (equally) with the other unse ...

... The Bonds shall constitute the general, direct, unconditional and unsecured obligations of the Issuer and shall be guaranteed in respect of both the principal amount and the interest due under said Bonds by the Guarantor. This means that bondholders will rank pari passu (equally) with the other unse ...

Crises management - Banque centrale du Luxembourg

... Crises management measures vary according to their different nature ranging from re-capitalisation measures, which have been historically considered as being outside of the scope of central banks, to the channelling of private sector funds to institutions under distress. As concerns central bank inv ...

... Crises management measures vary according to their different nature ranging from re-capitalisation measures, which have been historically considered as being outside of the scope of central banks, to the channelling of private sector funds to institutions under distress. As concerns central bank inv ...

As filed with the Securities and Exchange Commission on June 29

... in a timely manner and has made or will make all changes required by the IRS in order to qualify the plan under ERISA. Item 9. (a) ...

... in a timely manner and has made or will make all changes required by the IRS in order to qualify the plan under ERISA. Item 9. (a) ...

Corporate Bond www.AssignmentPoint.com A corporate bond is a

... Corporate bonds are divided into two main categories High Grade (also called Investment Grade) and High Yield (also called Non-Investment Grade, Speculative Grade, or Junk Bonds) according to their credit rating. Bonds rated AAA, AA, A, and BBB are High Grade, while bonds rated BB and below are High ...

... Corporate bonds are divided into two main categories High Grade (also called Investment Grade) and High Yield (also called Non-Investment Grade, Speculative Grade, or Junk Bonds) according to their credit rating. Bonds rated AAA, AA, A, and BBB are High Grade, while bonds rated BB and below are High ...

DuPont System of Analysis

... ROE = Net Profit Margin x Total Asset Turnover x Financial Leverage Multiplier i. Financial Leverage Multiplier, or “Equity Multiplier” as some call it, is really a debt ratio ii. More assets financed with debt mean less assets financed with equity, so higher this number is, the greater the use ...

... ROE = Net Profit Margin x Total Asset Turnover x Financial Leverage Multiplier i. Financial Leverage Multiplier, or “Equity Multiplier” as some call it, is really a debt ratio ii. More assets financed with debt mean less assets financed with equity, so higher this number is, the greater the use ...

Cash flows from operating activities

... Cash inflows from investing activities normally arise from selling fixed assets, investments, and intangible assets. Cash outflows from investing activities normally include payments to acquire fixed assets, investments, and intangible assets. Cash inflows from financing activities normally arise fr ...

... Cash inflows from investing activities normally arise from selling fixed assets, investments, and intangible assets. Cash outflows from investing activities normally include payments to acquire fixed assets, investments, and intangible assets. Cash inflows from financing activities normally arise fr ...

Insights 1213_Berman.indd

... same kinds of restrictions that would be required in the case of a Section 4(a)(2) offering by the issuer itself.17 Under Section 2(a)(11) of the Securities Act, any person who has “purchased from an issuer with a view to, or offers or sells for an issuer in connection with, the distribution of any ...

... same kinds of restrictions that would be required in the case of a Section 4(a)(2) offering by the issuer itself.17 Under Section 2(a)(11) of the Securities Act, any person who has “purchased from an issuer with a view to, or offers or sells for an issuer in connection with, the distribution of any ...

AVEO Announces $17 Million Private Placement CAMBRIDGE

... warrant to purchase one share of AVEO’s common stock. The warrants will have an exercise price of $1.00 per share and will be exercisable for a period of five years from the date of issuance. The closing of the financing is expected to take place on or about May 18, 2016, and is subject to standard ...

... warrant to purchase one share of AVEO’s common stock. The warrants will have an exercise price of $1.00 per share and will be exercisable for a period of five years from the date of issuance. The closing of the financing is expected to take place on or about May 18, 2016, and is subject to standard ...

investors encourage the development of a uk municipal bond market

... with short-dated maturities. Taking steps to expand companies’ access to suitable financing options is a crucial part of ensuring that long-term investment is sustainable and sound. As part of this, The Investment Association is supportive of the development of a strong municipal bond market in the ...

... with short-dated maturities. Taking steps to expand companies’ access to suitable financing options is a crucial part of ensuring that long-term investment is sustainable and sound. As part of this, The Investment Association is supportive of the development of a strong municipal bond market in the ...

1 - JustAnswer

... 33. At June 1, 2008, Delgado reported retained earnings of $35,000. The company had no dividends during June. At June 30, 2008, the company will report retained earnings of a. $35,000. b. $42,000. c. $38,400. d. $31,600. 34. A current asset is a. the last asset purchased by a business. b. an asset w ...

... 33. At June 1, 2008, Delgado reported retained earnings of $35,000. The company had no dividends during June. At June 30, 2008, the company will report retained earnings of a. $35,000. b. $42,000. c. $38,400. d. $31,600. 34. A current asset is a. the last asset purchased by a business. b. an asset w ...

Webtrader Business Terms For Securities Trading

... Orders, which are entered into the order book, and trades, which has been merged automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on ...

... Orders, which are entered into the order book, and trades, which has been merged automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on ...

FA2: Module 9 Tangible and intangible capital assets

... c. Decommissioning obligations Definition: Legal or constructive (expectation by outsiders) obligation associated with the retirement of a tangible long-lived asset that the entity is required to settle. The PV of obligation (using pre-tax riskadjusted rate) is estimated, if it can be done with rea ...

... c. Decommissioning obligations Definition: Legal or constructive (expectation by outsiders) obligation associated with the retirement of a tangible long-lived asset that the entity is required to settle. The PV of obligation (using pre-tax riskadjusted rate) is estimated, if it can be done with rea ...

Implications of Proposed Bank Capital Regulations for Investors in

... Over time, we expect that banks will replace most outstanding TruPS with DRD-eligible preferred stock. However, the substitution of preferred stock for TruPS will be neither dollar-fordollar nor simultaneous. Initially, we expect that many banks will redeem TruPS at par between now and early 2013 by ...

... Over time, we expect that banks will replace most outstanding TruPS with DRD-eligible preferred stock. However, the substitution of preferred stock for TruPS will be neither dollar-fordollar nor simultaneous. Initially, we expect that many banks will redeem TruPS at par between now and early 2013 by ...

Filed by Time Warner Inc. Pursuant to Rule 425 under the Securities

... 2015, which was filed with the SEC on February 25, 2016, its proxy statement for the 2016 Annual Meeting, which was filed with the SEC on April 29, 2016, and the definitive proxy statement for the Special Meeting of Stockholders of Time Warner, which was filed with the SEC on January 9, 2017. To the ...

... 2015, which was filed with the SEC on February 25, 2016, its proxy statement for the 2016 Annual Meeting, which was filed with the SEC on April 29, 2016, and the definitive proxy statement for the Special Meeting of Stockholders of Time Warner, which was filed with the SEC on January 9, 2017. To the ...