FAIRPOINT COMMUNICATIONS INC (Form: 425

... involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events or developments to differ materially from those expressed or implied by these forward-looking statements. Such factors include those risks described from time to time in FairPoint’s ...

... involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events or developments to differ materially from those expressed or implied by these forward-looking statements. Such factors include those risks described from time to time in FairPoint’s ...

Unconstrained fixed income: generating consistent returns

... cushion of a high running yield to absorb any losses from defaults. Similarly the yield cushion will help absorb bond price losses during the journey to maturity, so we believe investors will typically at least break-even51in the short-term. At Russell Investments we have a specific focus on 1-5 yea ...

... cushion of a high running yield to absorb any losses from defaults. Similarly the yield cushion will help absorb bond price losses during the journey to maturity, so we believe investors will typically at least break-even51in the short-term. At Russell Investments we have a specific focus on 1-5 yea ...

Internationalization of Stock Markets: Potential Problems for United

... It is not surprising that little attention has been paid to the potential problems faced by United States shareholders as a result of foreign listings and stock offerings by their corporations. This is a consequence of the market-oriented paradigm in which many in the United States view the securiti ...

... It is not surprising that little attention has been paid to the potential problems faced by United States shareholders as a result of foreign listings and stock offerings by their corporations. This is a consequence of the market-oriented paradigm in which many in the United States view the securiti ...

rule change

... deletions from the immediately preceding filing. The purpose of Exhibit 4 is to permit the staff to identify immediately the changes made from the text of the rule with which it has been working. The self-regulatory organization may choose to attach as Exhibit 5 proposed changes to rule text in plac ...

... deletions from the immediately preceding filing. The purpose of Exhibit 4 is to permit the staff to identify immediately the changes made from the text of the rule with which it has been working. The self-regulatory organization may choose to attach as Exhibit 5 proposed changes to rule text in plac ...

Repurchase agreements and the law

... amendment to the bankruptcy code to exempt repo collateral from automatic stay. The chief argument for an exemption for repo collateral, as well as collateral used in derivatives transactions, was that a ...

... amendment to the bankruptcy code to exempt repo collateral from automatic stay. The chief argument for an exemption for repo collateral, as well as collateral used in derivatives transactions, was that a ...

Thrivent Investment Management Inc. Statement of Financial

... related to an entity’s assessment of its ability to continue as a going concern. The standard requires that management evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the entity’s ability to continue as a going concern within one year ...

... related to an entity’s assessment of its ability to continue as a going concern. The standard requires that management evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the entity’s ability to continue as a going concern within one year ...

NewsRelease - Lydall Inc.

... economy and other future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “ ...

... economy and other future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “ ...

In the Matters of DELAWARE MANAGEMENT COMPANY, INC

... sale of investment company shares, as in the case before us, at the cost of sacrificing the best executions on portfolio transactions, the ultimate effect of such trades is to increase the cost of securities purchased by investment companies and reduce the amount the investment companies receive for ...

... sale of investment company shares, as in the case before us, at the cost of sacrificing the best executions on portfolio transactions, the ultimate effect of such trades is to increase the cost of securities purchased by investment companies and reduce the amount the investment companies receive for ...

The case for a European public credit rating agency

... banks are also in this category, as they can make financial gains, but also incur losses like any other bank, and therefore have to be careful as far as their balance sheet is concerned. As a consequence they are not allowed to buy what are known as 'junk bonds'. Who provides ratings The main rating ...

... banks are also in this category, as they can make financial gains, but also incur losses like any other bank, and therefore have to be careful as far as their balance sheet is concerned. As a consequence they are not allowed to buy what are known as 'junk bonds'. Who provides ratings The main rating ...

Financial Market Failures and Systemic Risk

... The Lira was an early example of the new mood among currency traders. In the early 90's, after the Italian government had lifted capital controls and decided to join the narrow-band ERM, international investors were attracted by a high-inflation, high-yielding country, promising future convergence. ...

... The Lira was an early example of the new mood among currency traders. In the early 90's, after the Italian government had lifted capital controls and decided to join the narrow-band ERM, international investors were attracted by a high-inflation, high-yielding country, promising future convergence. ...

View PDF Version - Freegold Ventures Limited

... This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the Offering, including its expected timing of completion, the receipt of required regulatory approvals and the use of net proceeds therefrom. Often, but not always, forward- ...

... This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the Offering, including its expected timing of completion, the receipt of required regulatory approvals and the use of net proceeds therefrom. Often, but not always, forward- ...

Introducing the benefits of the capital markets to small and medium

... the company issues the instruments for sale, or through the secondary market. Access to the secondary market trading will be through the network of Members who are approved by the Exchange and who have access to the trading platform. ...

... the company issues the instruments for sale, or through the secondary market. Access to the secondary market trading will be through the network of Members who are approved by the Exchange and who have access to the trading platform. ...

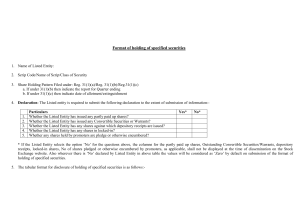

Format of holding of specified securities Name of Listed Entity: Scrip

... Details of the shareholders acting as persons in Concert including their Shareholding (No. and %): Details of Shares which remain unclaimed may be given hear along with details such as number of shareholders, outstanding shares held in demat/unclaimed suspense account, voting rights which are frozen ...

... Details of the shareholders acting as persons in Concert including their Shareholding (No. and %): Details of Shares which remain unclaimed may be given hear along with details such as number of shareholders, outstanding shares held in demat/unclaimed suspense account, voting rights which are frozen ...

CR 37/2014 Title: Capital Increase and Private Offering of Shares to

... The Management Board of Integer.pl SA with its registered office in Cracow ("Issuer") informs that on 14 April 2014 the Issuer's Management Board adopted Resolution No. 1 on the increase of the Company's share capital through the issue of series L shares while excluding subscription rights of the ex ...

... The Management Board of Integer.pl SA with its registered office in Cracow ("Issuer") informs that on 14 April 2014 the Issuer's Management Board adopted Resolution No. 1 on the increase of the Company's share capital through the issue of series L shares while excluding subscription rights of the ex ...

XXV Asamblea Annual de ASSAL XV Conferencia sobre

... indirect, special, consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even if AMB is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any such information. The credit ratings, financial repor ...

... indirect, special, consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even if AMB is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any such information. The credit ratings, financial repor ...

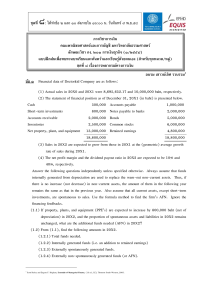

อบรม เชาวน์เลิศ รวบรวม1 ข้อ ๑ Financial data of Doctorkid Company

... ข้อ ๓ Suppose a firm makes the following policy changes. If the change means that external, nonspontaneous financial requirements (AFN) will increase, indicate this by a (+); indicate a decrease by a (-); and indicate indeterminate or no effect by a (0). Think in terms of the immediate, short-run ef ...

... ข้อ ๓ Suppose a firm makes the following policy changes. If the change means that external, nonspontaneous financial requirements (AFN) will increase, indicate this by a (+); indicate a decrease by a (-); and indicate indeterminate or no effect by a (0). Think in terms of the immediate, short-run ef ...

Business 3 Template

... information and credit reports and its confidentiality. E. The company’s database management plan, systems, devices, equipment and software to be Used, update mechanism, security measures, and the protection of its database. F. The organizational structure of the company. G. Budget estimates for the ...

... information and credit reports and its confidentiality. E. The company’s database management plan, systems, devices, equipment and software to be Used, update mechanism, security measures, and the protection of its database. F. The organizational structure of the company. G. Budget estimates for the ...

Securities Trading Floor Monthly Reports (April

... 3- Audited financial information including profit and loss statement, balance sheet and statement of cash flows for the last financial year. Investors should pay much emphasis in evaluating annual reports; Management: Know the people in charge. Are they technically qualified ? Are the directors well ...

... 3- Audited financial information including profit and loss statement, balance sheet and statement of cash flows for the last financial year. Investors should pay much emphasis in evaluating annual reports; Management: Know the people in charge. Are they technically qualified ? Are the directors well ...

Financial Report - Charles Darwin University

... University Foundation Trust in respect of the liabilities incurred as trustee and, to the extent that the Company has incurred any liabilities in its capacity as trustee, that right is recorded in the Statement of Financial Position of the Company. Based on the valuation of the assets in the Stateme ...

... University Foundation Trust in respect of the liabilities incurred as trustee and, to the extent that the Company has incurred any liabilities in its capacity as trustee, that right is recorded in the Statement of Financial Position of the Company. Based on the valuation of the assets in the Stateme ...

ING Group Inaugural AT1 Roadshow (PDF 0,4 Mb)

... Application has been made to list the Capital Securities on the Global Exchange Market of the Irish Stock Exchange and the Capital Securities will be governed by, and construed in accordance with the laws of New York, except for subordination provisions and waiver of set-off provisions which shall b ...

... Application has been made to list the Capital Securities on the Global Exchange Market of the Irish Stock Exchange and the Capital Securities will be governed by, and construed in accordance with the laws of New York, except for subordination provisions and waiver of set-off provisions which shall b ...

nextera energy, inc. - corporate

... NEE. NEECH will add the net proceeds from the sale of the Debentures to its general funds. NEECH expects to use its general funds to repay, at maturity, $600 million principal amount of its Series E Debentures due June 1, 2017 and $650 million principal amount of its Series F Debentures due Septembe ...

... NEE. NEECH will add the net proceeds from the sale of the Debentures to its general funds. NEECH expects to use its general funds to repay, at maturity, $600 million principal amount of its Series E Debentures due June 1, 2017 and $650 million principal amount of its Series F Debentures due Septembe ...

download

... difference between cash on hand and the purchase price. A method of financing in which a company issues shares of its stock and receives money in return. Define Firms Cost of Capital The return expected by investors for the capital they supply to fund all the assets acquired and managed by the firm. ...

... difference between cash on hand and the purchase price. A method of financing in which a company issues shares of its stock and receives money in return. Define Firms Cost of Capital The return expected by investors for the capital they supply to fund all the assets acquired and managed by the firm. ...

Diapositiva 1

... level 2, in the narrower criterion of ‘total consideration’ − this approach has an impact on competition between trading venues, to the extent that reference to the traded instruments’ price puts established and more ...

... level 2, in the narrower criterion of ‘total consideration’ − this approach has an impact on competition between trading venues, to the extent that reference to the traded instruments’ price puts established and more ...

Broker-Dealer Trading Activities

... customer orders in listed or OTC securities must carefully evaluate the extent to which this order flow would be afforded better terms if executed in a market or with a market maker offering price improvement opportunities. In conducting the requisite evaluation of its internal order handling proced ...

... customer orders in listed or OTC securities must carefully evaluate the extent to which this order flow would be afforded better terms if executed in a market or with a market maker offering price improvement opportunities. In conducting the requisite evaluation of its internal order handling proced ...

Public Deposit by NBFC(Cont…)

... Chit Fund business But does not include any institution whose principal business is that of agriculture activity Industrial activity sale/purchase/construction of immovable property ...

... Chit Fund business But does not include any institution whose principal business is that of agriculture activity Industrial activity sale/purchase/construction of immovable property ...