CALLWAVE INC - Barchart.com

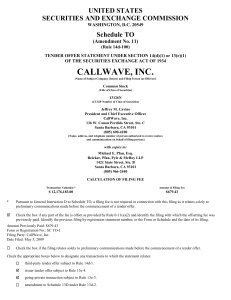

... CallWave Announces Extension of Tender Offer by One (1) Day to 12 a.m. (midnight) EDT on June 5, 2009 and Results of Tender Offer as of June 4, 2009 SAN FRANCISCO – June 5, 2009 – CallWave, Inc. (NASDAQ: CALL), a leading global provider of Internet, mobile and Web-based collaboration software soluti ...

... CallWave Announces Extension of Tender Offer by One (1) Day to 12 a.m. (midnight) EDT on June 5, 2009 and Results of Tender Offer as of June 4, 2009 SAN FRANCISCO – June 5, 2009 – CallWave, Inc. (NASDAQ: CALL), a leading global provider of Internet, mobile and Web-based collaboration software soluti ...

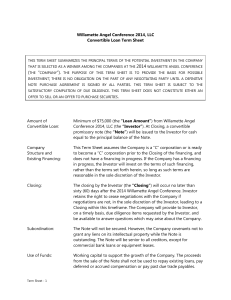

2014 WAC term sheet v2 (00537204).DOCX

... Company shall pay the Investor, within thirty (30) days following the closing of such acquisition, an amount determined as follows: 1.5X the original principal balance of the Note for an acquisition closed within twelve (12) months of Note repayment; 1.0X the original principal balance of the Note f ...

... Company shall pay the Investor, within thirty (30) days following the closing of such acquisition, an amount determined as follows: 1.5X the original principal balance of the Note for an acquisition closed within twelve (12) months of Note repayment; 1.0X the original principal balance of the Note f ...

US Treasury Market US Treasury Market

... This research report has been prepared and issued by MLPF&S and/or one or more of its non-U.S. affiliates. MLPF&S is the distributor of this research report in the U.S. and accepts full responsibility for research reports of its non-U.S. affiliates distributed in the U.S. Any U.S. person receiving t ...

... This research report has been prepared and issued by MLPF&S and/or one or more of its non-U.S. affiliates. MLPF&S is the distributor of this research report in the U.S. and accepts full responsibility for research reports of its non-U.S. affiliates distributed in the U.S. Any U.S. person receiving t ...

guide to acquiring startup financing

... A FINANCING PACKAGE In an ideal world, you would have one funding source. But reality for most businesses is that multiple funding sources are necessary. Consider the following example for financing a craft brewery. You have $50,000 in stock and personal savings. Fifty thousand dollars is a nice sta ...

... A FINANCING PACKAGE In an ideal world, you would have one funding source. But reality for most businesses is that multiple funding sources are necessary. Consider the following example for financing a craft brewery. You have $50,000 in stock and personal savings. Fifty thousand dollars is a nice sta ...

Acquisition of Sectoral Balance Sheet Data

... All instruments and records acknowledging claims to the residual value of companies / corporations, after the claims of all creditors have been met are categorized as shares and other equity. There are several types of shares, including common stock, preferred stock, treasury stock, and dual class s ...

... All instruments and records acknowledging claims to the residual value of companies / corporations, after the claims of all creditors have been met are categorized as shares and other equity. There are several types of shares, including common stock, preferred stock, treasury stock, and dual class s ...

DOC - ESW Group

... convertible promissory notes (“Notes”) in the aggregate principal amount of $1,400,000 to Black Family Partners LP, John J. Hannan, Orchard Investments, LLC and Richard Ressler (each individually a “Senior Secured Lender” and collectively the “Senior Secured Lenders”), pursuant to a note subscriptio ...

... convertible promissory notes (“Notes”) in the aggregate principal amount of $1,400,000 to Black Family Partners LP, John J. Hannan, Orchard Investments, LLC and Richard Ressler (each individually a “Senior Secured Lender” and collectively the “Senior Secured Lenders”), pursuant to a note subscriptio ...

30DC, INC. (Form: SC 13D/A, Received: 01/08/2016

... all performances or services remaining to be rendered by Consultant under this Agreement and Client will remain liable for all remaining payments due under this Agreement. 5. Exclusivity; Performance; Confidentiality. The services of Consultant hereunder shall not be exclusive, and Consultant and it ...

... all performances or services remaining to be rendered by Consultant under this Agreement and Client will remain liable for all remaining payments due under this Agreement. 5. Exclusivity; Performance; Confidentiality. The services of Consultant hereunder shall not be exclusive, and Consultant and it ...

DOC - Investor Relations

... company reported just under $200 million in capital deployment in the quarter and since, at a weighted average going-in cash yield of approximately 9.6%. Summarizing the company’s recent advances, Mr. Stapley added, “We are running ahead of plan in nearly every key metric we track. FFO and FAD grew ...

... company reported just under $200 million in capital deployment in the quarter and since, at a weighted average going-in cash yield of approximately 9.6%. Summarizing the company’s recent advances, Mr. Stapley added, “We are running ahead of plan in nearly every key metric we track. FFO and FAD grew ...

Shares

... This includes both the original and new shares issued. Retained Profits – these are the cumulative undistributed profits - owned by shareholders but retained by company N.B. Retained Profits do not equate to cash - cash may already have been used to fund the business (as working capital or to ob ...

... This includes both the original and new shares issued. Retained Profits – these are the cumulative undistributed profits - owned by shareholders but retained by company N.B. Retained Profits do not equate to cash - cash may already have been used to fund the business (as working capital or to ob ...

Form SC 13G/A WILLIAMS SONOMA INC

... of Another Person: No persons other than the persons filing this Schedule 13G have an economic interest in the securities reported on which relates to more than five percent of the class of securities. Securities reported on this Schedule 13G as being beneficially owned by M&MC and PI consist of sec ...

... of Another Person: No persons other than the persons filing this Schedule 13G have an economic interest in the securities reported on which relates to more than five percent of the class of securities. Securities reported on this Schedule 13G as being beneficially owned by M&MC and PI consist of sec ...

main market-related risks

... Befimmo adopts a responsible approach under which it has, for many years, aimed to take the necessary measures to reduce the environmental impact of the activities it controls and directly influences, such as, for its renovation and/or building projects, site checks, and for the operational portfoli ...

... Befimmo adopts a responsible approach under which it has, for many years, aimed to take the necessary measures to reduce the environmental impact of the activities it controls and directly influences, such as, for its renovation and/or building projects, site checks, and for the operational portfoli ...

Securities Law for Non-Securities Lawyers by Amy Bowerman Freed

... Definition of Tender Offer. The Williams Act was passed in 1968 to protect shareholders in the course of takeovers and tender offers by granting the SEC and the courts the power to manage problems that arise. The Act does not, however, define what constitutes a “tender offer.” This has allowed the S ...

... Definition of Tender Offer. The Williams Act was passed in 1968 to protect shareholders in the course of takeovers and tender offers by granting the SEC and the courts the power to manage problems that arise. The Act does not, however, define what constitutes a “tender offer.” This has allowed the S ...

Bancroft - NYU School of Law

... Corporate Structure: Suited for businesses that need to raise great amounts of capital from sources outside of management. Don’t require SRs to know each other, permits investment w/out risk of personal liability (the most you can lose is the money you have invested), provides steady base of capital ...

... Corporate Structure: Suited for businesses that need to raise great amounts of capital from sources outside of management. Don’t require SRs to know each other, permits investment w/out risk of personal liability (the most you can lose is the money you have invested), provides steady base of capital ...

g4g capital corp. (formerly g4g resources ltd

... 2. Basis of preparation – Statement of Compliance These unaudited condensed interim financial statements have been prepared in accordance with interim standards under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and in accord ...

... 2. Basis of preparation – Statement of Compliance These unaudited condensed interim financial statements have been prepared in accordance with interim standards under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and in accord ...

Portfolio rebalancing is the process of bringing the different asset

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

... Portfolios are adjusted if and when a particular asset class deviates from its target allocation by more than a certain amount—say plus or minus five percentage points. So if, for example, the target for large-cap stocks was 60%, but a market rise caused that share to climb above 65%, stocks would ...

commentary - Jones Day

... 11 For purposes of the Seven Firms and Nine Firms letters, “foreign securities” are (i) securities issued by issuers not organized under U.S. law (including depositary receipts issued by U.S. banks that were initially offered and sold outside the U.S. under Regulation S) where the transaction is no ...

... 11 For purposes of the Seven Firms and Nine Firms letters, “foreign securities” are (i) securities issued by issuers not organized under U.S. law (including depositary receipts issued by U.S. banks that were initially offered and sold outside the U.S. under Regulation S) where the transaction is no ...

Dermira, Inc. (Form: SC 13D, Received: 10/17/2014

... No.333-198410) in connection with its initial public offering of 7,812,500 shares of Common Stock of the Issuer (the “IPO”) was declared effective. The closing of the IPO took place on October 8, 2014, and at such closing ATP IV purchased an aggregate of 220,000 shares of Common Stock at the IPO pri ...

... No.333-198410) in connection with its initial public offering of 7,812,500 shares of Common Stock of the Issuer (the “IPO”) was declared effective. The closing of the IPO took place on October 8, 2014, and at such closing ATP IV purchased an aggregate of 220,000 shares of Common Stock at the IPO pri ...

Liabilities

... payment will be made may not be identified definitely but the existence of the liability is certain a. Acceptances Payable c. Estimated Liabilities b. Liabilities under trust receipts d. Accrued expenses payable 10. Cash dividends that have been declared but not yet paid as the balance sheet date. a ...

... payment will be made may not be identified definitely but the existence of the liability is certain a. Acceptances Payable c. Estimated Liabilities b. Liabilities under trust receipts d. Accrued expenses payable 10. Cash dividends that have been declared but not yet paid as the balance sheet date. a ...

Ch_2

... minus long-term debt financing) Equity (Dividends plus repurchase of equity minus new equity financing) ...

... minus long-term debt financing) Equity (Dividends plus repurchase of equity minus new equity financing) ...

united states securities and exchange commission - corporate

... of Merger with HPE Enterprise Services TYSONS, Va., March 27, 2017—CSC (NYSE: CSC) today announced that shareholders have voted to approve the company’s proposed merger with the Enterprise Services business of Hewlett Packard Enterprise (NYSE: HPE). The proposed merger, which was announced in late M ...

... of Merger with HPE Enterprise Services TYSONS, Va., March 27, 2017—CSC (NYSE: CSC) today announced that shareholders have voted to approve the company’s proposed merger with the Enterprise Services business of Hewlett Packard Enterprise (NYSE: HPE). The proposed merger, which was announced in late M ...

I Overview of Market System

... general investors excluding specified investors, etc. in accordance with the Financial Instruments and Exchange Act and the regulations of TSE. Investors that can buy stocks at TOKYO PRO Market are called "specified investors, etc. (namely "professional investors")" and mainly classified into specif ...

... general investors excluding specified investors, etc. in accordance with the Financial Instruments and Exchange Act and the regulations of TSE. Investors that can buy stocks at TOKYO PRO Market are called "specified investors, etc. (namely "professional investors")" and mainly classified into specif ...

Outcomes of de minimis Guarantee Scheme

... In the case of the other 46% of entrepreneurs (who had relevant collateral), de minimis guarantee enabled them to earmark their collateral for other purposes, e.g. another credit, thanks to which they obtained an opportunity to intensify business operations. This is one of the most significant outco ...

... In the case of the other 46% of entrepreneurs (who had relevant collateral), de minimis guarantee enabled them to earmark their collateral for other purposes, e.g. another credit, thanks to which they obtained an opportunity to intensify business operations. This is one of the most significant outco ...

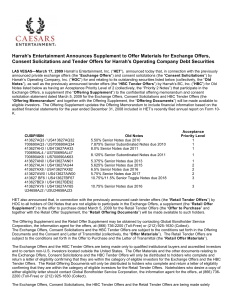

Harrah`s Entertainment Announces Supplement to Offer Materials for

... This release includes “forward-looking statements.” You can identify these statements by the fact that they do not relate strictly to historical or current facts. These statements contain words such as “may,” “will,” “project,” “might,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” ...

... This release includes “forward-looking statements.” You can identify these statements by the fact that they do not relate strictly to historical or current facts. These statements contain words such as “may,” “will,” “project,” “might,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” ...

How can I sell my Share Certificates? - Trop-X

... I have share certificates, how can I sell them? In most cases when companies sell you their shares, they will issue you with a certificate that represents your ownership in that company. As a shareholder you can go on to sell your shares in one of two ways: Firstly you can search for someone who is ...

... I have share certificates, how can I sell them? In most cases when companies sell you their shares, they will issue you with a certificate that represents your ownership in that company. As a shareholder you can go on to sell your shares in one of two ways: Firstly you can search for someone who is ...

FMDQ OTC Plc - Association of Issuing Houses of Nigeria

... Since 2005, corporate organisations as well as individuals have been granted membership following the adoption of the Association’s new constitution ...

... Since 2005, corporate organisations as well as individuals have been granted membership following the adoption of the Association’s new constitution ...