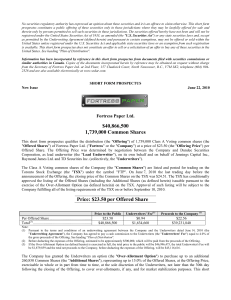

No securities regulatory authority has expressed an opinion about

... estimates and forecasts about its business and the industry and markets in which it operates. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Assumptions underlying the Company's expectations regardi ...

... estimates and forecasts about its business and the industry and markets in which it operates. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Assumptions underlying the Company's expectations regardi ...

Chapter 13 PowerPoint Presentation

... the amount of the obligation. These creditors are completely protected by the pledged property. ...

... the amount of the obligation. These creditors are completely protected by the pledged property. ...

Form: 11-K, Received: 06/25/2013 17:25:37

... If a participant qualifies for a hardship withdrawal, they can withdraw from their tax-deferred account (including catch-up contribution). The funds available under the non-hardship distributions must be withdrawn first before the tax-deferred funds can be withdrawn. Under present Internal Revenue ...

... If a participant qualifies for a hardship withdrawal, they can withdraw from their tax-deferred account (including catch-up contribution). The funds available under the non-hardship distributions must be withdrawn first before the tax-deferred funds can be withdrawn. Under present Internal Revenue ...

working capital - McGraw Hill Higher Education

... the bank commits to a multi-year agreement, in return it will charge a commitment fee. This is a fee charged by the bank on the unused portion of a line of credit. Most bank loans have a duration of a few months and are designed to cover short-term working capital needs such as a seasonal increa ...

... the bank commits to a multi-year agreement, in return it will charge a commitment fee. This is a fee charged by the bank on the unused portion of a line of credit. Most bank loans have a duration of a few months and are designed to cover short-term working capital needs such as a seasonal increa ...

The Distribution of Subsidized Agricultural Credit

... not all of which are readily observable. Several of these include possession of title, other forms of collateral, farm size (see below), the existence of financial institutions in a given region, and alternative institutions Ð such as co-operatives Ð that facilitate access. If it can be established ...

... not all of which are readily observable. Several of these include possession of title, other forms of collateral, farm size (see below), the existence of financial institutions in a given region, and alternative institutions Ð such as co-operatives Ð that facilitate access. If it can be established ...

Introduction to Accounting

... • Payment of dividends or capital to owners • Repayment of creditors Investing • Purchase of assets • Amounts invested in other entities (debt or equity) ...

... • Payment of dividends or capital to owners • Repayment of creditors Investing • Purchase of assets • Amounts invested in other entities (debt or equity) ...

An Introduction to Hedge Fund Strategies

... the manager to choose net-long or net-short (positive beta or negative beta) market exposure, while still focussing primarily on stock-selection opportunities. It has the disadvantage, from the perspective of the final investor that, it is no longer clear how the hedge fund allocation affects overal ...

... the manager to choose net-long or net-short (positive beta or negative beta) market exposure, while still focussing primarily on stock-selection opportunities. It has the disadvantage, from the perspective of the final investor that, it is no longer clear how the hedge fund allocation affects overal ...

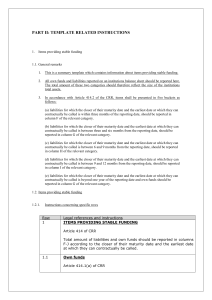

Annex VI

... issued or guaranteed by BIS, IMF, EC, or MDBs Total securities with a 0% risk weight issued or guaranteed by BIS, IMF, EC, or MDBs, which institutions identify themselves as ‘extremely high liquidity and credit quality’ as referred to in Article 404, should be reported in columns F-J according to th ...

... issued or guaranteed by BIS, IMF, EC, or MDBs Total securities with a 0% risk weight issued or guaranteed by BIS, IMF, EC, or MDBs, which institutions identify themselves as ‘extremely high liquidity and credit quality’ as referred to in Article 404, should be reported in columns F-J according to th ...

Notice of the Ministry of Labor and Social Security and China

... 8. The original copy and photocopy of the effective identity certificate documents of the handling agent; and 9. Other materials that shall be provided as required by the China Clearing Corporation. Article 5 A trustee shall, when filling in the Application Form for Registration of Securities Accoun ...

... 8. The original copy and photocopy of the effective identity certificate documents of the handling agent; and 9. Other materials that shall be provided as required by the China Clearing Corporation. Article 5 A trustee shall, when filling in the Application Form for Registration of Securities Accoun ...

CHAPTER 7

... the nature of securities, the method of their distribution and trading, and obligations to disclose information as to their riskiness, in order that investors may make informed purchase decisions. While the chapter clearly focuses on shares of a corporation, students must bear in mind that “securiti ...

... the nature of securities, the method of their distribution and trading, and obligations to disclose information as to their riskiness, in order that investors may make informed purchase decisions. While the chapter clearly focuses on shares of a corporation, students must bear in mind that “securiti ...

Supervision of Credit Rating Agencies: The Role of Credit Rating

... the securities) of an enterprise and/or legal entity. In some jurisdictions, like the United States, CRAs are expressly excluded from prospectus liability (s.11 liability). It is possible that CRAs will be held liable in the Netherlands for prospectus liability (through s.6:194 of the Dutch Civil Co ...

... the securities) of an enterprise and/or legal entity. In some jurisdictions, like the United States, CRAs are expressly excluded from prospectus liability (s.11 liability). It is possible that CRAs will be held liable in the Netherlands for prospectus liability (through s.6:194 of the Dutch Civil Co ...

Taylor Economics Chapter 29 Test Bank

... net worth, and the various methods that banks may employ to protect themselves from this type of outcome. Banks run a risk of negative net worth if the value of their assets declines. The value of assets can decline because of an unexpectedly high number of defaults on loans, or if interest rates ri ...

... net worth, and the various methods that banks may employ to protect themselves from this type of outcome. Banks run a risk of negative net worth if the value of their assets declines. The value of assets can decline because of an unexpectedly high number of defaults on loans, or if interest rates ri ...

Filed by The Dow Chemical Company Pursuant to Rule 425 under

... forward-looking statements, including the failure to consummate the proposed transaction or to make or take any filing or other action required to consummate such transaction on a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions th ...

... forward-looking statements, including the failure to consummate the proposed transaction or to make or take any filing or other action required to consummate such transaction on a timely matter or at all, are not guarantees of future results and are subject to risks, uncertainties and assumptions th ...

Bonds

... 2. the length of time until the amounts are received, 3. the market rate of interest. The features of a bond (callable, convertible, etc) affect the market rate of the bond. A corporation only makes journal entries when it issues or buys back bonds, and when bondholders convert bonds into common sto ...

... 2. the length of time until the amounts are received, 3. the market rate of interest. The features of a bond (callable, convertible, etc) affect the market rate of the bond. A corporation only makes journal entries when it issues or buys back bonds, and when bondholders convert bonds into common sto ...

Cobalt Power Group Inc. is a publicly traded Canadian exploration

... content of this News Release. WARNING: The Company relies on litigation protection for “forward looking" statements. Actual results could differ materially from those described in the news release as a result of numerous factors, some of which are outside the control of the Company. This news releas ...

... content of this News Release. WARNING: The Company relies on litigation protection for “forward looking" statements. Actual results could differ materially from those described in the news release as a result of numerous factors, some of which are outside the control of the Company. This news releas ...

SOUTHWEST AIRLINES CO

... You should carefully review the information included elsewhere and incorporated by reference in this prospectus supplement and the accompanying prospectus and should particularly consider the following matters. This prospectus supplement, the accompanying prospectus, and the documents we incorporate ...

... You should carefully review the information included elsewhere and incorporated by reference in this prospectus supplement and the accompanying prospectus and should particularly consider the following matters. This prospectus supplement, the accompanying prospectus, and the documents we incorporate ...

GEORGE MASON UNIVERSITY

... assets in a form that avoids exposure to the risks associated with medium to long-term debt and equity investments. ...

... assets in a form that avoids exposure to the risks associated with medium to long-term debt and equity investments. ...

Squeeze-out – Sell-out a significant reform to come.

... Linklaters LLP is a limited liability partnership registered in England and Wales with registered number OC326345. It is a law firm authorised and regulated by the Solicitors Regulation Authority. The term partner in relation to Linklaters LLP is used to refer to a member of Linklaters LLP or an emp ...

... Linklaters LLP is a limited liability partnership registered in England and Wales with registered number OC326345. It is a law firm authorised and regulated by the Solicitors Regulation Authority. The term partner in relation to Linklaters LLP is used to refer to a member of Linklaters LLP or an emp ...

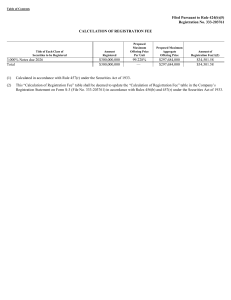

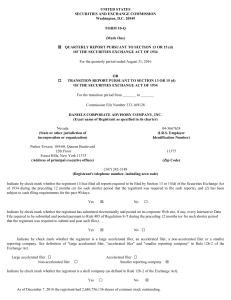

Daniels Corporate Advisory Company, Inc. (Form: 10

... The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at ...

... The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at ...

T1.1 Chapter Outline - U of L Class Index

... Secondary Market - trading of securities subsequent to the initial sale - enables the transfer of ownership • auction market - TSE • dealer market - ‘over the counter (OTC) ‘ ...

... Secondary Market - trading of securities subsequent to the initial sale - enables the transfer of ownership • auction market - TSE • dealer market - ‘over the counter (OTC) ‘ ...

glossary

... b) Harder to transfer ownership. c) Reduced legal liability for investors. d) Most common form of organization. Ans: c Response A: Corporations generally have higher taxes than partnerships and proprietorships because corporate income is taxed twice, once at the corporate level and once at the indiv ...

... b) Harder to transfer ownership. c) Reduced legal liability for investors. d) Most common form of organization. Ans: c Response A: Corporations generally have higher taxes than partnerships and proprietorships because corporate income is taxed twice, once at the corporate level and once at the indiv ...

NORTH AMERICAN PALLADIUM LTD (Form: 6-K

... consecutive trading days immediately prior to date of issuance of each tranche (converted into US dollars). The exercise price of Warrants issued in connection with the Additional Notes cannot be less than the weighted average trading price of the Common Shares on the TSX for the five consecutive tr ...

... consecutive trading days immediately prior to date of issuance of each tranche (converted into US dollars). The exercise price of Warrants issued in connection with the Additional Notes cannot be less than the weighted average trading price of the Common Shares on the TSX for the five consecutive tr ...

Double Diamond Investors - Fuqua School of Business

... • Used multi-factor model from the insample periods to forecast the out-ofsample periods for each variable Double Diamond ...

... • Used multi-factor model from the insample periods to forecast the out-ofsample periods for each variable Double Diamond ...

Procedure for Submission of Information and Reports to Closed

... timeframes set out herein shall be processed within no more than three (3) business days of the date of receipt of said documents from the Trading Member. ...

... timeframes set out herein shall be processed within no more than three (3) business days of the date of receipt of said documents from the Trading Member. ...