Risk, Cost of Capital, and Capital Budgeting

... return is the Cost of Equity Capital: R i RF βi ( R M RF ) Example: Suppose the stock of Stansfield Enterprises, a publisher of PowerPoint presentations, has a beta of 2.5. The firm is 100 percent equity financed. Assume a risk-free rate of 5 percent and a market risk premium of 10 percent. Wh ...

... return is the Cost of Equity Capital: R i RF βi ( R M RF ) Example: Suppose the stock of Stansfield Enterprises, a publisher of PowerPoint presentations, has a beta of 2.5. The firm is 100 percent equity financed. Assume a risk-free rate of 5 percent and a market risk premium of 10 percent. Wh ...

Chapter 2 Securities Markets and Transactions

... • The goal is to fill all buy orders at the lowest price and to fill all the sell orders at the highest price with supply and demand determining the price. • The actual auction takes place at the post where the particular security trades. • Members interested in purchasing a given security negotiate ...

... • The goal is to fill all buy orders at the lowest price and to fill all the sell orders at the highest price with supply and demand determining the price. • The actual auction takes place at the post where the particular security trades. • Members interested in purchasing a given security negotiate ...

No Registration Opinions (2015 Update)

... opinions being given are based, as to factual matters, on representations of the issuer and certificates of its officers. Each opinion letter also contemplates that the Purchase Agreement includes covenants by the issuer to limit future offers of the same or similar securities and, in the case of Ru ...

... opinions being given are based, as to factual matters, on representations of the issuer and certificates of its officers. Each opinion letter also contemplates that the Purchase Agreement includes covenants by the issuer to limit future offers of the same or similar securities and, in the case of Ru ...

us securities and exchange commission - corporate

... On the Second Amendment Effective Date the Applicable Percentages shall be determined based upon the Applicable Ratings specified in the certificate delivered pursuant to Subpart 3.3 of the Second Amendment. Thereafter, each change in the Applicable Percentages resulting from a publicly announced ch ...

... On the Second Amendment Effective Date the Applicable Percentages shall be determined based upon the Applicable Ratings specified in the certificate delivered pursuant to Subpart 3.3 of the Second Amendment. Thereafter, each change in the Applicable Percentages resulting from a publicly announced ch ...

Grupo Supervielle SA

... Closing of the transaction is subject to the prior satisfaction of the conditions contained in the offer, and the closing will be announced as soon as it occurs. The price offered and accepted totals Ps. 46,500,000, and will be paid on the actual date of the closing of the transaction. As of Decembe ...

... Closing of the transaction is subject to the prior satisfaction of the conditions contained in the offer, and the closing will be announced as soon as it occurs. The price offered and accepted totals Ps. 46,500,000, and will be paid on the actual date of the closing of the transaction. As of Decembe ...

GLAXOSMITHKLINE PLC (Form: 6-K, Received: 02/23/2017 11:33:29)

... Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor Name GlaxoSmithKline plc LEI 5493000HZTVUYLO1D793 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and ( ...

... Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor Name GlaxoSmithKline plc LEI 5493000HZTVUYLO1D793 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and ( ...

Notice Concerning Debt Financing

... 1. Amounts are rounded down to the nearest million yen. Accordingly, adding or subtracting the above interest-bearing liabilities amounts, it is not always equal to the total amount or the amount of increase or decrease. 2. “Short-term borrowing” means a borrowing lasting within one year from the dr ...

... 1. Amounts are rounded down to the nearest million yen. Accordingly, adding or subtracting the above interest-bearing liabilities amounts, it is not always equal to the total amount or the amount of increase or decrease. 2. “Short-term borrowing” means a borrowing lasting within one year from the dr ...

Worksheet on buying on margin and selling short. Buying on Margin

... ___________________________________________ $3,000 Stock | $1,200 Debt ...

... ___________________________________________ $3,000 Stock | $1,200 Debt ...

19 PART II - PRICING IN PUBLIC ISSUE Pricing. 28. (1) An issuer

... coupon rate in case of convertible debt instruments. Face value of equity shares. 31. (1) Subject to the provisions of the Companies Act, 1956, the Act and these regulations, an issuer making an initial public offer may determine the face value of the equity shares in the following manner: (a) if th ...

... coupon rate in case of convertible debt instruments. Face value of equity shares. 31. (1) Subject to the provisions of the Companies Act, 1956, the Act and these regulations, an issuer making an initial public offer may determine the face value of the equity shares in the following manner: (a) if th ...

Global Financial Capital Fund June 2017

... payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the fund invests, may mean that the fund may not be able to sell those securities at their true value. These risks increase where the fund invests in high yie ...

... payments nor is the solvency of the issuers guaranteed. Market conditions, such as a decrease in market liquidity for the securities in which the fund invests, may mean that the fund may not be able to sell those securities at their true value. These risks increase where the fund invests in high yie ...

Bonus Assignment solution

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

Dr. Onada OO

... current assets instead of short term loans to finance broadcasting company current assets. But, intermittent capital finance with short term loans can be used for fluctuating needs of the company. The company can use short term finance to pay for peak seasons requirements before the end of the payme ...

... current assets instead of short term loans to finance broadcasting company current assets. But, intermittent capital finance with short term loans can be used for fluctuating needs of the company. The company can use short term finance to pay for peak seasons requirements before the end of the payme ...

Remuneration Payment

... belonging to those foreign investors who were shareholders of CVRD at the time that these securities were issued in 1997, either as holders of American Depositary Receipts (ADRs) or through shares purchased in Brazilian equity markets, according to the norms of Resolution 1,287/87, Annex IV. CVRD wi ...

... belonging to those foreign investors who were shareholders of CVRD at the time that these securities were issued in 1997, either as holders of American Depositary Receipts (ADRs) or through shares purchased in Brazilian equity markets, according to the norms of Resolution 1,287/87, Annex IV. CVRD wi ...

Yield Curve Targeting

... officials argued that superior U.S. credit justified somewhat lower rates. Two and a half per cent was close to the rate previously set by the market. It was an even rate, not a "hat size" like 2 3/8% or 2 5/8%. One Treasury official later justified the rate as consistent with the yields required fo ...

... officials argued that superior U.S. credit justified somewhat lower rates. Two and a half per cent was close to the rate previously set by the market. It was an even rate, not a "hat size" like 2 3/8% or 2 5/8%. One Treasury official later justified the rate as consistent with the yields required fo ...

Press Release NORMA Group AG places shares at an issue price of

... holdings of the existing shareholders to cover overallotments (greenshoe option). The corresponding total issue volume including full overallotments amounts to € 386.4 million. Before deduction of IPO expenses, NORMA Group will receive € 147.0 million from the capital increase. The first day of trad ...

... holdings of the existing shareholders to cover overallotments (greenshoe option). The corresponding total issue volume including full overallotments amounts to € 386.4 million. Before deduction of IPO expenses, NORMA Group will receive € 147.0 million from the capital increase. The first day of trad ...

Euronav NV (Form: 6-K, Received: 01/27/2017 16:07:39)

... Euronav's return to shareholders' policy is to distribute 80% of net income over the full financial year. Under Belgian corporate law the final full year dividend must be approved by the Annual General Meeting of Shareholders (AGM) on the basis of the fully audited results of the financial year. The ...

... Euronav's return to shareholders' policy is to distribute 80% of net income over the full financial year. Under Belgian corporate law the final full year dividend must be approved by the Annual General Meeting of Shareholders (AGM) on the basis of the fully audited results of the financial year. The ...

Quiznos Completes Restructuring of Debt and Strengthens Financial

... Quiznos’ financial advisor for the restructuring was Moelis & Company and its legal advisor was Paul, Weiss, Rifkind, Wharton & Garrison L.L.P. Vinson & Elkins L.L.P acted as the company’s financing counsel. The financial advisor for Avenue Capital and certain other lenders was Lazard and the le ...

... Quiznos’ financial advisor for the restructuring was Moelis & Company and its legal advisor was Paul, Weiss, Rifkind, Wharton & Garrison L.L.P. Vinson & Elkins L.L.P acted as the company’s financing counsel. The financial advisor for Avenue Capital and certain other lenders was Lazard and the le ...

Form 604 Notice of change of interests of

... The persons who have become associates (2) of, ceased to be associates of, or have changed the nature of their association (9) with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN/ARSN (if applicable) ...

... The persons who have become associates (2) of, ceased to be associates of, or have changed the nature of their association (9) with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN/ARSN (if applicable) ...

Policy for Securities Trading

... (i) recommend that a third party Trade in the Issuer’s Securities; or (ii) convey such MNPI to an unauthorized third party. Such actions constitute “tipping.” Tipping is prohibited regardless of whether or not the Employee or Family Member who provides the tip receives any monetary or other benefit. ...

... (i) recommend that a third party Trade in the Issuer’s Securities; or (ii) convey such MNPI to an unauthorized third party. Such actions constitute “tipping.” Tipping is prohibited regardless of whether or not the Employee or Family Member who provides the tip receives any monetary or other benefit. ...

Hedging Instruments available to Mrs. Jane

... their short-term transactions like making payments, recovering receivables. On the other hand, the strategically hedging is chosen by the firms who have to make long period transactions. Moreover, there are some firms, which use a passive hedging policy, which means that the firm does not, takes int ...

... their short-term transactions like making payments, recovering receivables. On the other hand, the strategically hedging is chosen by the firms who have to make long period transactions. Moreover, there are some firms, which use a passive hedging policy, which means that the firm does not, takes int ...

form 8-k current report - corporate

... forward-looking statements, which statements are indicated by the words “may,” “will,” “plans,” “intends,” “believes,” “expects,” “anticipates,” “potential,” “could,” “would,” “should,” and similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties, and other ...

... forward-looking statements, which statements are indicated by the words “may,” “will,” “plans,” “intends,” “believes,” “expects,” “anticipates,” “potential,” “could,” “would,” “should,” and similar expressions. Such forward-looking statements involve known and unknown risks, uncertainties, and other ...

Chapter 1: An Introduction to Corporate Finance

... on an equity index plus or minus a spread. For example, first an investor could enter into an interest rate swap to convert fixed rate bond payments into payments that vary with a float rate, such as LIBOR. Then, the investor could enter a total return swap, paying LIBOR and receiving the total retu ...

... on an equity index plus or minus a spread. For example, first an investor could enter into an interest rate swap to convert fixed rate bond payments into payments that vary with a float rate, such as LIBOR. Then, the investor could enter a total return swap, paying LIBOR and receiving the total retu ...

defining “security”

... 3. Reasonable expectations of investing public a. NOTE: in Reves Court said that public expectations could lead to defining something as a security even if it would not be under an economic analysis. 4. Are there other factors to reduce risk? a. Is there another Federal Regulatory Regime? EX: ERISA, ...

... 3. Reasonable expectations of investing public a. NOTE: in Reves Court said that public expectations could lead to defining something as a security even if it would not be under an economic analysis. 4. Are there other factors to reduce risk? a. Is there another Federal Regulatory Regime? EX: ERISA, ...

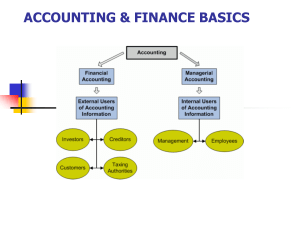

WIS ACCOUNTING BASICS

... With respect to Events No. 1 and 2, it is clear that only the balance sheet and statement of cash flows are affected. There is no effect on the income statement. Furthermore, you can see that Event No. 1 increases assets and equity and that the cash inflow is defined as a financing activity. Event N ...

... With respect to Events No. 1 and 2, it is clear that only the balance sheet and statement of cash flows are affected. There is no effect on the income statement. Furthermore, you can see that Event No. 1 increases assets and equity and that the cash inflow is defined as a financing activity. Event N ...

INVERNESS MEDICAL INNOVATIONS INC (Form: S-8

... Form S-4, as amended (File No. 333-67392), by filing this Post-Effective Amendment No. 1 on Form S-8 relating to the sale of (i) up to 799,456 shares of common stock, par value $0.001 per share, of the Company (the "Innovations Common Stock") issuable upon the exercise of stock options granted under ...

... Form S-4, as amended (File No. 333-67392), by filing this Post-Effective Amendment No. 1 on Form S-8 relating to the sale of (i) up to 799,456 shares of common stock, par value $0.001 per share, of the Company (the "Innovations Common Stock") issuable upon the exercise of stock options granted under ...