Daniel Drew - The Hudson River Valley Institute

... In 1866, Drew, James Fisk, and Jay Gould wreaked havoc on the stock market. They issued fraudulent stock to the public which led to the demand for regulation of railroads and securities. After Fisk and Gould took a major hit from a failed attempt to take advantage of the gold market, they drove down ...

... In 1866, Drew, James Fisk, and Jay Gould wreaked havoc on the stock market. They issued fraudulent stock to the public which led to the demand for regulation of railroads and securities. After Fisk and Gould took a major hit from a failed attempt to take advantage of the gold market, they drove down ...

Fact Sheet: The New Morningstar Style Box™ Methodology

... The Morningstar Style BoxTM was introduced in 1992 and quickly gained favor within the investment community. For the first time, individual and professional investors had a way to quickly understand the investment positioning of a mutual fund. By providing an easy-to-understand visual representation ...

... The Morningstar Style BoxTM was introduced in 1992 and quickly gained favor within the investment community. For the first time, individual and professional investors had a way to quickly understand the investment positioning of a mutual fund. By providing an easy-to-understand visual representation ...

CEE Trader - Wiener Börse

... Wiener Börse AG provides the new, powerful and easy-to-use trading front-end, CEE Trader, to the members of the Vienna Stock Exchange and its partner exchanges. Banks and brokers can use this tool for multi-market trading on the stock exchanges of Budapest, Ljubljana, Prague and V ienna. The new s ...

... Wiener Börse AG provides the new, powerful and easy-to-use trading front-end, CEE Trader, to the members of the Vienna Stock Exchange and its partner exchanges. Banks and brokers can use this tool for multi-market trading on the stock exchanges of Budapest, Ljubljana, Prague and V ienna. The new s ...

JBWere SMA Listed Fixed Income Portfolio

... Lower brokerage With SMAs, share trades are consolidated, which means the brokerage is spread across a number of investors. So you may pay lower brokerage costs than you would pay if trading shares directly. ...

... Lower brokerage With SMAs, share trades are consolidated, which means the brokerage is spread across a number of investors. So you may pay lower brokerage costs than you would pay if trading shares directly. ...

File: Ch12 Type: Multiple Choice 1. An efficient market is said to

... 19. Investors are attempting to find and exploit information in the stock market. In doing so, these investors help improve the efficiency. What is the best explanation of this paradox? a) It is becoming more and more difficult to beat the market. b) Academic studies confirm that markets are very e ...

... 19. Investors are attempting to find and exploit information in the stock market. In doing so, these investors help improve the efficiency. What is the best explanation of this paradox? a) It is becoming more and more difficult to beat the market. b) Academic studies confirm that markets are very e ...

Student Handbook - Unit Trust Corporation

... The daily newspapers (Trinidad Guardian, Newsday and Trinidad Express) give details on the prices of stocks currently being traded on the Trinidad & Tobago Stock Exchange. The price paid for any stock will be the closing price of the last trading day ...

... The daily newspapers (Trinidad Guardian, Newsday and Trinidad Express) give details on the prices of stocks currently being traded on the Trinidad & Tobago Stock Exchange. The price paid for any stock will be the closing price of the last trading day ...

FORM 8-K - corporate

... As the Company’s share price has grown, the dollar value of these share-based grants has increased significantly. For instance, the closing price of the Company’s common stock rose from $17.36 per share on June 20, 2005 (the date these share-based grant amounts were originally approved by the Board) ...

... As the Company’s share price has grown, the dollar value of these share-based grants has increased significantly. For instance, the closing price of the Company’s common stock rose from $17.36 per share on June 20, 2005 (the date these share-based grant amounts were originally approved by the Board) ...

Key Investor Information Franklin Global Aggregate Investment

... The prospectus and the financial reports refer to all sub-funds of Franklin Templeton Investment Funds. All sub-funds of Franklin Templeton Investment Funds have segregated assets and liabilities. As a result, each sub-fund is operated independently from each other. · You may switch into shares of ...

... The prospectus and the financial reports refer to all sub-funds of Franklin Templeton Investment Funds. All sub-funds of Franklin Templeton Investment Funds have segregated assets and liabilities. As a result, each sub-fund is operated independently from each other. · You may switch into shares of ...

Silvercrest Asset Management Group Inc. (Form: D

... Irrevocably appointing each of the Secretary of the SEC and, the Securities Administrator or other legally designated officer of the State in which the Issuer maintains its principal place of business and any State in which this notice is filed, as its agents for service of process, and agreeing tha ...

... Irrevocably appointing each of the Secretary of the SEC and, the Securities Administrator or other legally designated officer of the State in which the Issuer maintains its principal place of business and any State in which this notice is filed, as its agents for service of process, and agreeing tha ...

comcast corporation

... Pursuant to General Instruction E of Form S-8, this registration statement on Form S-8 (this “Registration Statement”) is being filed in order to register an additional 37,500,000 shares of the Registrant’s Class A Common Stock, par value $0.01 per share, which are securities of the same class and r ...

... Pursuant to General Instruction E of Form S-8, this registration statement on Form S-8 (this “Registration Statement”) is being filed in order to register an additional 37,500,000 shares of the Registrant’s Class A Common Stock, par value $0.01 per share, which are securities of the same class and r ...

Lecture 8

... markets are growing at a rapid pace. • From 1994 to 2001, international bonds rose from $600 billion to $7.0 trillion. • From 1990 to 2000, international equity offerings rose from $20 billion to $315 billion. • From 1990 to 2002, cross border bank loans rose from $3.6 billion to $9.5 billion. ...

... markets are growing at a rapid pace. • From 1994 to 2001, international bonds rose from $600 billion to $7.0 trillion. • From 1990 to 2000, international equity offerings rose from $20 billion to $315 billion. • From 1990 to 2002, cross border bank loans rose from $3.6 billion to $9.5 billion. ...

Emerging Market Repo

... Delivery can be effected in one of three ways: Outright delivery through separate agents, safekeeping and triparty. In most cases delivery is versus payment but in many local market funds move separate from bonds. In an outright delivery Morgan Stanley moves securities to the customer's account at ...

... Delivery can be effected in one of three ways: Outright delivery through separate agents, safekeeping and triparty. In most cases delivery is versus payment but in many local market funds move separate from bonds. In an outright delivery Morgan Stanley moves securities to the customer's account at ...

Fact Sheet: The Morningstar Style Box™

... Morningstar’s equity style methodology uses a “building block,” holdings-based approach that is consistent with Morningstar’s fundamental approach to investing. Style is first determined at the stock level and then those attributes are “rolled up” to determine the overall investment style of a fund ...

... Morningstar’s equity style methodology uses a “building block,” holdings-based approach that is consistent with Morningstar’s fundamental approach to investing. Style is first determined at the stock level and then those attributes are “rolled up” to determine the overall investment style of a fund ...

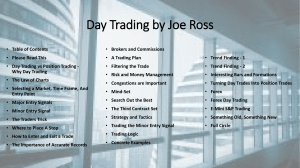

Stock Trading Using Analytics - American Institute of Science

... for each of the stocks. There are various methods such as current market price calculation, moving averages and channel breakouts for trend following. Previous studies has compared the different trend following strategies such as momentum, channel, dual moving average crossover and time series momen ...

... for each of the stocks. There are various methods such as current market price calculation, moving averages and channel breakouts for trend following. Previous studies has compared the different trend following strategies such as momentum, channel, dual moving average crossover and time series momen ...

Full Article

... audit committee of the Chinese company, Renren, which was a heavily anticipated U.S. IPO. Also, a Morgan Stanley analyst wrote: ―Longtop’s stock price has been very volatile in recent days amid fraud allegations that management has denied. Our analysis of margins and cash flow gives us confidence in ...

... audit committee of the Chinese company, Renren, which was a heavily anticipated U.S. IPO. Also, a Morgan Stanley analyst wrote: ―Longtop’s stock price has been very volatile in recent days amid fraud allegations that management has denied. Our analysis of margins and cash flow gives us confidence in ...

NATIONAL FINANCIAL SERVICES LLC STATEMENT OF

... The Company is a registered broker-dealer with the Securities and Exchange Commission (“SEC”) and is a member of the Financial Industry Regulatory Authority (“FINRA”). The Company is licensed to transact on the NYSE Euronext and various national and regional stock and option exchanges. The Company p ...

... The Company is a registered broker-dealer with the Securities and Exchange Commission (“SEC”) and is a member of the Financial Industry Regulatory Authority (“FINRA”). The Company is licensed to transact on the NYSE Euronext and various national and regional stock and option exchanges. The Company p ...

Glossary of the Capital Market

... The part of a firm that is responsible for post-trade activities. Depending upon the organisational structure of the firm, the back office can be a single department or multiple units (such as documentation, risk management, accounting or settlements). Some firms have combined a portion of these res ...

... The part of a firm that is responsible for post-trade activities. Depending upon the organisational structure of the firm, the back office can be a single department or multiple units (such as documentation, risk management, accounting or settlements). Some firms have combined a portion of these res ...

primary dealership in ghana

... In 1996, Bank of Ghana (BOG) introduced a system of Primary Dealers (PDs) in the Government Securities (G-Secs) Market which was intended to enhance the ability of BOG to achieve efficient funding of the Government of Ghana’s (GOG) Public Sector Borrowing Requirement (PSBR) through the development o ...

... In 1996, Bank of Ghana (BOG) introduced a system of Primary Dealers (PDs) in the Government Securities (G-Secs) Market which was intended to enhance the ability of BOG to achieve efficient funding of the Government of Ghana’s (GOG) Public Sector Borrowing Requirement (PSBR) through the development o ...

Technical Analysis on Selected Stocks of Energy Sector

... think technical analysis is a tool, which is effective for shortterm investing. The study on technical analysis of selected companies based on Stratified sampling technique is significant as it helps in understanding the intrinsic value of shares and to know whether the shares are undervalued or ove ...

... think technical analysis is a tool, which is effective for shortterm investing. The study on technical analysis of selected companies based on Stratified sampling technique is significant as it helps in understanding the intrinsic value of shares and to know whether the shares are undervalued or ove ...

November 2010 Economic Update - GLS Financial Consultants, Inc.

... Representative’s Broker/Dealer. This information should not be construed as investment advice. The Dow Jones Industrial Average is a priceweighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-thecounter common stocks trad ...

... Representative’s Broker/Dealer. This information should not be construed as investment advice. The Dow Jones Industrial Average is a priceweighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-thecounter common stocks trad ...

On Chinese Government`s Stock Market Rescue Efforts in 2015

... As a result, many people have been able to make even riskier bets than the official rules allowed. The borrowed money flooded into the Chinese stock market between June 2014 and June 2015, helping to push stock prices up 150 percent. During this period, the amount of officially sanctioned margin tra ...

... As a result, many people have been able to make even riskier bets than the official rules allowed. The borrowed money flooded into the Chinese stock market between June 2014 and June 2015, helping to push stock prices up 150 percent. During this period, the amount of officially sanctioned margin tra ...

File: ch01, Chapter 1: The Nature of Investments

... a) Investors can access information on companies and markets very easily. b) Investors can place stock market orders quickly and inexpensively. c) Individual investors now have access to information previously available only to institutional investors. d) Investors have much higher returns today bec ...

... a) Investors can access information on companies and markets very easily. b) Investors can place stock market orders quickly and inexpensively. c) Individual investors now have access to information previously available only to institutional investors. d) Investors have much higher returns today bec ...

Regulatory Filings Refresher

... compliance professionals. Even so, it is important to note that the U.S. Securities and Exchange Commission (“SEC” or “Commission”) has been giving them more attention of late. In September, for example, the Commission charged more than 30 individuals, investment firms, and publicly traded companies ...

... compliance professionals. Even so, it is important to note that the U.S. Securities and Exchange Commission (“SEC” or “Commission”) has been giving them more attention of late. In September, for example, the Commission charged more than 30 individuals, investment firms, and publicly traded companies ...

Section 9.3 Buying and Selling Stocks

... The Efficient Market Theory In the efficient market theory, the argument is that stock price movements are purely random. This theory declares that: All investors have considered all of the available information on a stock as they make their decisions. It is impossible for an investor to outperf ...

... The Efficient Market Theory In the efficient market theory, the argument is that stock price movements are purely random. This theory declares that: All investors have considered all of the available information on a stock as they make their decisions. It is impossible for an investor to outperf ...