Prezentacja programu PowerPoint

... WDM is Central and Eastern Europe’s leading microcap investment bank and investment manager. It has been listed on the Warsaw Stock Exchange since 2007. WDM has taken 50 companies public on the Warsaw Stock Exchange since 2007. It has raised over $150,000,000 in private equity, venture capital and p ...

... WDM is Central and Eastern Europe’s leading microcap investment bank and investment manager. It has been listed on the Warsaw Stock Exchange since 2007. WDM has taken 50 companies public on the Warsaw Stock Exchange since 2007. It has raised over $150,000,000 in private equity, venture capital and p ...

What is a stock?

... record keeping within that corporation are maintained at a high level. There have been notable exceptions, but generally record keeping of publicly quoted companies has been shown to be better than that of private companies. ...

... record keeping within that corporation are maintained at a high level. There have been notable exceptions, but generally record keeping of publicly quoted companies has been shown to be better than that of private companies. ...

Fin432_gj_ch6

... substantial price appreciation, usually due to some special situation such as a new product – Companies lack sustained track record of business and financial success – Earnings may be uncertain or highly unstable – Potential for substantial price appreciation – Stock price subject to wide swings up ...

... substantial price appreciation, usually due to some special situation such as a new product – Companies lack sustained track record of business and financial success – Earnings may be uncertain or highly unstable – Potential for substantial price appreciation – Stock price subject to wide swings up ...

put title here - Terry FitzPatrick: Reporting, Training, Media

... Street because he was always looking out for number one and not really thinking so much about the companies. That's what people say. I think he was also interested in building up the value of some companies, but he was a manipulator." ...

... Street because he was always looking out for number one and not really thinking so much about the companies. That's what people say. I think he was also interested in building up the value of some companies, but he was a manipulator." ...

Contents Stock Market Indicators Measuring market bredth Sample

... Most analysts prefer the A/D ratio as an indicator, because it is more amenable to comparisons than the A-D line. The A/D ratio has an absolute value that does not vary in function of the number of components being analyzed – it remains constant, regardless of the number of stocks under considerati ...

... Most analysts prefer the A/D ratio as an indicator, because it is more amenable to comparisons than the A-D line. The A/D ratio has an absolute value that does not vary in function of the number of components being analyzed – it remains constant, regardless of the number of stocks under considerati ...

Tender Offer Statement Amendment 6

... (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons) CALCULATION OF FILING FEE Transaction Valuation* ...

... (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons) CALCULATION OF FILING FEE Transaction Valuation* ...

Introduction to Business

... prices and sell them at lower wholesale prices. Metals and gems can fluctuate greatly in value. ...

... prices and sell them at lower wholesale prices. Metals and gems can fluctuate greatly in value. ...

CASE STUDY 4 USING A COMMSEC MARGIN LOAN TO

... Jenny & Lee both decided to invest into 5 stocks that their research identified as having a high and consistent historical dividend yield, as well as growth potential in the medium term, for a period of 6 months. At the end of the 6 month period, Jenny and Lee could reassess the future growth perfor ...

... Jenny & Lee both decided to invest into 5 stocks that their research identified as having a high and consistent historical dividend yield, as well as growth potential in the medium term, for a period of 6 months. At the end of the 6 month period, Jenny and Lee could reassess the future growth perfor ...

Circular 2018/2 Duty to report securities transactions Duty to

... specified in the regulatory and technical implementing standards (RTS 22) for Article 26 of Regulation (EU) No 600/2014 of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Regulation (EU) No 648/2012 (MiFIR). Natural persons are identified in ...

... specified in the regulatory and technical implementing standards (RTS 22) for Article 26 of Regulation (EU) No 600/2014 of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Regulation (EU) No 648/2012 (MiFIR). Natural persons are identified in ...

JBWere SMA Growth Portfolio

... Lower brokerage With SMAs, share trades are consolidated, which means the brokerage is spread across a number of investors. So you may pay lower brokerage costs than you would pay if trading shares directly. ...

... Lower brokerage With SMAs, share trades are consolidated, which means the brokerage is spread across a number of investors. So you may pay lower brokerage costs than you would pay if trading shares directly. ...

ETFs: A Call for Greater Transparency and Consistent

... exposure is achieved by a swap, then to address systemic and investor concerns, the following features must be incorporated. First, any counterparty exposure must be wholly offset with high quality collateral. Second, the swap structure should follow best practices as outlined in the section below t ...

... exposure is achieved by a swap, then to address systemic and investor concerns, the following features must be incorporated. First, any counterparty exposure must be wholly offset with high quality collateral. Second, the swap structure should follow best practices as outlined in the section below t ...

Brokerage Accounts, Transferring Stocks, and Handling Bonds

... documents being submitted (the original stock certificate and/or the stock transfer form) bear a Medallion Signature Guarantee from a financial institution such as a bank, credit union, or brokerage firm that participates in the Medallion Signature Guarantee Program. A Medallion Signature Guarantee ...

... documents being submitted (the original stock certificate and/or the stock transfer form) bear a Medallion Signature Guarantee from a financial institution such as a bank, credit union, or brokerage firm that participates in the Medallion Signature Guarantee Program. A Medallion Signature Guarantee ...

Understanding premiums and discounts in ETFs

... Trading restrictions in certain markets, such as China’s stockmarkets, could also lead to a difference between the market price and NAV of ETFs. For example, a large number of stocks were suspended from trading in the mainland A-share market in early August, hindering redemptions of ETFs in primary ...

... Trading restrictions in certain markets, such as China’s stockmarkets, could also lead to a difference between the market price and NAV of ETFs. For example, a large number of stocks were suspended from trading in the mainland A-share market in early August, hindering redemptions of ETFs in primary ...

Chapter 1, Answer to Questions

... 1. An investment is any asset into which funds can be placed with the expectation of preserving or increasing value and earning a positive rate of return. An investment can be a security or a property. Individuals invest because an investment has the potential to preserve or increase value and to ea ...

... 1. An investment is any asset into which funds can be placed with the expectation of preserving or increasing value and earning a positive rate of return. An investment can be a security or a property. Individuals invest because an investment has the potential to preserve or increase value and to ea ...

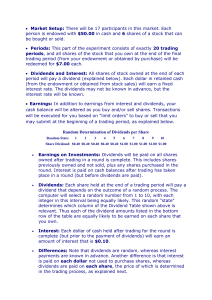

Experimental Instructions

... Example: Suppose that the only bids submitted in a round are 60 cents for one share and 20 for another, and the only asks are 10 for one share and 40 for another. The clearing price cannot be above 40, since there would be 2 shares offered for sale, but only 1 share that buyers are willing to purc ...

... Example: Suppose that the only bids submitted in a round are 60 cents for one share and 20 for another, and the only asks are 10 for one share and 40 for another. The clearing price cannot be above 40, since there would be 2 shares offered for sale, but only 1 share that buyers are willing to purc ...

7. Which of the following statements regarding money

... Answer: Stock splits do not affect total value of equity or the individual other than the number of shares outstanding and the par value. Difficulty: moderate ...

... Answer: Stock splits do not affect total value of equity or the individual other than the number of shares outstanding and the par value. Difficulty: moderate ...

L4 bond1 - people.bath.ac.uk

... When the buyer buys the bond between two coupon payments, he must compensate the seller for the interest for the coupon interest earned since the last coupon Accrued interest = C(n1/n2), where n1 is the number of days from the last coupon payment, and n2 is the number of days in the year ...

... When the buyer buys the bond between two coupon payments, he must compensate the seller for the interest for the coupon interest earned since the last coupon Accrued interest = C(n1/n2), where n1 is the number of days from the last coupon payment, and n2 is the number of days in the year ...

Causative Factors of Downturn in Growth and Performance of Stock

... organizational values and standards. According to one analyst, efficiency and effectiveness is the only way to attract the attention of stock holders. It is a common belief that normally public companies follow the well management standards and procedure rather than that of the private companies. Th ...

... organizational values and standards. According to one analyst, efficiency and effectiveness is the only way to attract the attention of stock holders. It is a common belief that normally public companies follow the well management standards and procedure rather than that of the private companies. Th ...

Enron Fraud Paper - Matt Pugh's ePortfolio

... investments to its SPE’s to prevent Enron from a loss on the fair value. These SPE’s were used to manage the risk and because they’re a pass through entity they have lower taxes, lower financing costs and they have off-balance sheet financing which can outweigh the cost of establishing the SPE. Last ...

... investments to its SPE’s to prevent Enron from a loss on the fair value. These SPE’s were used to manage the risk and because they’re a pass through entity they have lower taxes, lower financing costs and they have off-balance sheet financing which can outweigh the cost of establishing the SPE. Last ...

Important Notice of Trading China A Shares and A

... contingency such as when HKEx loses all its communication lines with SSE or SZSE, etc and customers should still bear the settlement obligations if the orders are matched and executed. The Bank has the rights to forward the client’s identity to HKEx which may on-forward to SSE or SZSE for surveillan ...

... contingency such as when HKEx loses all its communication lines with SSE or SZSE, etc and customers should still bear the settlement obligations if the orders are matched and executed. The Bank has the rights to forward the client’s identity to HKEx which may on-forward to SSE or SZSE for surveillan ...

Stock market crashes, productivity boom busts

... since the 1930s, as well as the establishment of federal deposit insurance in 1934, may be the most important factors in reducing the severity of recessions in the post World War II era, whether or not preceded by a stock market crash. ...

... since the 1930s, as well as the establishment of federal deposit insurance in 1934, may be the most important factors in reducing the severity of recessions in the post World War II era, whether or not preceded by a stock market crash. ...

Stock Market Crashes, Productivity Boom Busts and Recessions

... since the 1930s, as well as the establishment of federal deposit insurance in 1934, may be the most important factors in reducing the severity of recessions in the post World War II era, whether or not preceded by a stock market crash. ...

... since the 1930s, as well as the establishment of federal deposit insurance in 1934, may be the most important factors in reducing the severity of recessions in the post World War II era, whether or not preceded by a stock market crash. ...

Identify the right investments

... opt for the Alternative Investment Market (AIM), which means that (in most cases) companies listed on AIM carry higher risk than those listed on the main stock market. For the investor, the drawback to investing in AIM stocks is their lack of liquidity. Market makers will constantly quote buy and se ...

... opt for the Alternative Investment Market (AIM), which means that (in most cases) companies listed on AIM carry higher risk than those listed on the main stock market. For the investor, the drawback to investing in AIM stocks is their lack of liquidity. Market makers will constantly quote buy and se ...