View PDF - Diversified Trust

... The next piece of the puzzle is the corporate profit margin which is defined as net income divided by revenues. The outlook for margins is a fascinating topic that is hotly debated by financial professionals. From the mid 1940’s through 2000, margins were relatively stable at around 6%. Then, from 2 ...

... The next piece of the puzzle is the corporate profit margin which is defined as net income divided by revenues. The outlook for margins is a fascinating topic that is hotly debated by financial professionals. From the mid 1940’s through 2000, margins were relatively stable at around 6%. Then, from 2 ...

Fluctuations of Equity Share Price of the Selected Banks in

... Fluctuations of Equity Share Price of the Selected Banks in Oman regarding its helpfulness, the measure has become a progressively popular technical indicator because of its own means. The study summarises its most imperative finding that money flow appears to predict a cross-sectional variation in ...

... Fluctuations of Equity Share Price of the Selected Banks in Oman regarding its helpfulness, the measure has become a progressively popular technical indicator because of its own means. The study summarises its most imperative finding that money flow appears to predict a cross-sectional variation in ...

relevant aspects of management of banks investment activities on

... WSPÓŁPRACA EUROPEJSKA NR 1(1) 2015 / EUROPEAN COOPERATION Vol. 1(1) 2015 ...

... WSPÓŁPRACA EUROPEJSKA NR 1(1) 2015 / EUROPEAN COOPERATION Vol. 1(1) 2015 ...

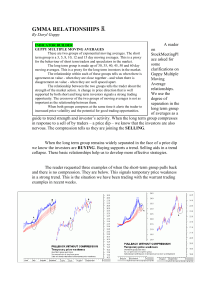

gmma relationships

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

Returns and How They Get That Way

... In the late 1990s, stock prices exploded upward, along with the number of people buying them. And as long as stock prices rose, the new investors felt they knew all they had to about where equity returns came from: They came from rising prices. And surely you could depend on prices to rise. What was ...

... In the late 1990s, stock prices exploded upward, along with the number of people buying them. And as long as stock prices rose, the new investors felt they knew all they had to about where equity returns came from: They came from rising prices. And surely you could depend on prices to rise. What was ...

SMG-Training-Dallas-2011 - Texas Council on Economic

... Gains and Losses occur when stock is sold. Until then its performance is recorded in the Unrealized Gains and Losses section of Account Holdings. ...

... Gains and Losses occur when stock is sold. Until then its performance is recorded in the Unrealized Gains and Losses section of Account Holdings. ...

Individually managed funds - The Community Foundation of Greater

... investment manager(s) will be allowed to choose the degree of concentration in various regions, industries and issues. With the exception of U.S. Government securities, the securities of a single fixed income issue shall not represent more than 15% of the total portfolio market value. If price appre ...

... investment manager(s) will be allowed to choose the degree of concentration in various regions, industries and issues. With the exception of U.S. Government securities, the securities of a single fixed income issue shall not represent more than 15% of the total portfolio market value. If price appre ...

Format pdf

... within Article 49(2)(a) to (d) (high net worth companies, unincorporated associations, etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). This communication is for informational purposes only and it does not constitute an offer of, or a solicitation t ...

... within Article 49(2)(a) to (d) (high net worth companies, unincorporated associations, etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). This communication is for informational purposes only and it does not constitute an offer of, or a solicitation t ...

IPSA - Santiago Exchange

... This fact sheet is intended for general information only and is not an investment recommendation. It is the intention of the Santiago Stock Exchange to provide accurate and truthful information as of the date specified; however, no assurance or guarantee can be given as to the accuracy, timeliness o ...

... This fact sheet is intended for general information only and is not an investment recommendation. It is the intention of the Santiago Stock Exchange to provide accurate and truthful information as of the date specified; however, no assurance or guarantee can be given as to the accuracy, timeliness o ...

Lecture 9 Financial Exchanges

... Allocate capital efficiently. Provide liquidity for owners of companies. Create information that is useful to guide decisions. ...

... Allocate capital efficiently. Provide liquidity for owners of companies. Create information that is useful to guide decisions. ...

Financial markets in popular culture

... Analysis of financial markets See Statistical analysis of financial markets, statistical finance Much effort has gone into the study of financial markets and how prices vary with time. Charles Dow, one of the founders of Dow Jones & Company and The Wall Street Journal, enunciated a set of ideas on t ...

... Analysis of financial markets See Statistical analysis of financial markets, statistical finance Much effort has gone into the study of financial markets and how prices vary with time. Charles Dow, one of the founders of Dow Jones & Company and The Wall Street Journal, enunciated a set of ideas on t ...

Shopping - MBA6113-Technology

... "algorithmic" or "black-box" trading, in which computer programs decide when to buy and sell securities. Hedge funds such as SAC Capital Advisors, D.E. Shaw & Co. and Renaissance Technologies have been using computers in their investment strategies for years. These days, a variety of new computer st ...

... "algorithmic" or "black-box" trading, in which computer programs decide when to buy and sell securities. Hedge funds such as SAC Capital Advisors, D.E. Shaw & Co. and Renaissance Technologies have been using computers in their investment strategies for years. These days, a variety of new computer st ...

Securities Trading Policy

... a disposal of securities of Rift Valley that is the result of a secured lender exercising their rights, for example, under a margin lending arrangement. [Policy terms on providing shares as security required] the exercise (but not the sale of securities following exercise) of an option or a right un ...

... a disposal of securities of Rift Valley that is the result of a secured lender exercising their rights, for example, under a margin lending arrangement. [Policy terms on providing shares as security required] the exercise (but not the sale of securities following exercise) of an option or a right un ...

ch9_IM_1E

... Theoretically, when a firm announces a stock-split, the number of shares doubles (if 2-to-1 stock split) and the market value per share drops by half. Empirically, we have observed a small increase in market value of the stock after the announcement of a stock-split. This can be explained by the inf ...

... Theoretically, when a firm announces a stock-split, the number of shares doubles (if 2-to-1 stock split) and the market value per share drops by half. Empirically, we have observed a small increase in market value of the stock after the announcement of a stock-split. This can be explained by the inf ...

Dividend Policy

... Theoretically, when a firm announces a stock-split, the number of shares doubles (if 2-to-1 stock split) and the market value per share drops by half. Empirically, we have observed a small increase in market value of the stock after the announcement of a stock-split. This can be explained by the inf ...

... Theoretically, when a firm announces a stock-split, the number of shares doubles (if 2-to-1 stock split) and the market value per share drops by half. Empirically, we have observed a small increase in market value of the stock after the announcement of a stock-split. This can be explained by the inf ...

Webtrader Business Terms For Securities Trading

... Orders, which are entered into the order book, and trades, which has been merged automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on ...

... Orders, which are entered into the order book, and trades, which has been merged automatically in or entered into the Trading Platform, must reflect the relevant Securities current market value and represent actual orders and trades. The “current market value” of a trade is the price which based on ...

Extraordinary General Meeting 2004

... A Registration Statement relating to these securities will be filed with the Securities and Exchange Commission. These securities may not be sold nor offers to buy be accepted prior to the time the Registration Statement becomes effective. This communication shall not constitute an offer to buy nor ...

... A Registration Statement relating to these securities will be filed with the Securities and Exchange Commission. These securities may not be sold nor offers to buy be accepted prior to the time the Registration Statement becomes effective. This communication shall not constitute an offer to buy nor ...

Personal Strategy Balanced Portfolio

... of risks in proportion to the amount it invests in stocks, bonds, and money market securities. The principal risks of investing in this fund are summarized as follows: Active management risks The investment adviser’s judgments about the attractiveness, value, or potential appreciation of the fund’s ...

... of risks in proportion to the amount it invests in stocks, bonds, and money market securities. The principal risks of investing in this fund are summarized as follows: Active management risks The investment adviser’s judgments about the attractiveness, value, or potential appreciation of the fund’s ...

PSX Investor Guide

... Company (CDC). We shall talk in detail about CDC subsequently. The essential attribute of a market-based tradable investment is that one can sell the investment and get cash for it quickly. ...

... Company (CDC). We shall talk in detail about CDC subsequently. The essential attribute of a market-based tradable investment is that one can sell the investment and get cash for it quickly. ...

OCA - Federation of European Securities Exchanges

... The case-by case-approach • Historically, derivative exchanges have benefited from the CFTC’s no-action letter regime • No retail investor protection concerns A new multilateral approach? • The SEC’s expected concept paper will focus on mutual recognition of rules (not standardisation). • Will the E ...

... The case-by case-approach • Historically, derivative exchanges have benefited from the CFTC’s no-action letter regime • No retail investor protection concerns A new multilateral approach? • The SEC’s expected concept paper will focus on mutual recognition of rules (not standardisation). • Will the E ...

wsfs financial corp form 8-k

... Board of Directors has declared a quarterly cash dividend of $.08 per share. This dividend represents an increase of $0.01, or 14% over the previous quarterly dividend. This dividend is to be paid on June 2, 2006, to shareholders of record as of May 12, 2006. WSFS Financial Corporation is a $3.0 bil ...

... Board of Directors has declared a quarterly cash dividend of $.08 per share. This dividend represents an increase of $0.01, or 14% over the previous quarterly dividend. This dividend is to be paid on June 2, 2006, to shareholders of record as of May 12, 2006. WSFS Financial Corporation is a $3.0 bil ...

Advanced Accounting by Hoyle et al, 6th Edition

... Held for sale in the short term. Unrealized holding gains and losses are included in earnings (net income). ...

... Held for sale in the short term. Unrealized holding gains and losses are included in earnings (net income). ...

Shining a light

... areas and explore “opportunities to take better advantage of EPA data that may be relevant”. However, the SEC did not heed these or other calls, including a 2007 petition filed by investor and environmental coalition Ceres on climate change. That is, until recently. In January 2009, the 400-member S ...

... areas and explore “opportunities to take better advantage of EPA data that may be relevant”. However, the SEC did not heed these or other calls, including a 2007 petition filed by investor and environmental coalition Ceres on climate change. That is, until recently. In January 2009, the 400-member S ...

The Effect of Stock Market Situation on Investment among Iranian

... Investment Decisions in Mexican firms” concluded that separation of ownership encouraged investment decisions and cash flow had a positive effect on the firm investment decisions. Aldridge et al (2011) in their research titled “Corporate Governance and Financial Constraints on Firm Investment Decisi ...

... Investment Decisions in Mexican firms” concluded that separation of ownership encouraged investment decisions and cash flow had a positive effect on the firm investment decisions. Aldridge et al (2011) in their research titled “Corporate Governance and Financial Constraints on Firm Investment Decisi ...

Prudential Jennison Mid Cap Growth A LW

... The investment seeks long-term capital appreciation. The fund normally invests at least 80% of its investable assets in equity and equity-related securities of medium-sized companies with the potential for above-average growth. The fund's investable assets will be less than its total assets to the e ...

... The investment seeks long-term capital appreciation. The fund normally invests at least 80% of its investable assets in equity and equity-related securities of medium-sized companies with the potential for above-average growth. The fund's investable assets will be less than its total assets to the e ...