9.2 How to invest in corporations

... Common stock holders have the right to vote on important corporate decisions. They normally have one vote for each share that they own. ...

... Common stock holders have the right to vote on important corporate decisions. They normally have one vote for each share that they own. ...

Markets

... • Describe, briefly, the bond and derivatives markets. • Discuss the factors behind rapid change in the securities markets ...

... • Describe, briefly, the bond and derivatives markets. • Discuss the factors behind rapid change in the securities markets ...

Warsaw, 3 January 2005

... of the Ordinance of the Council of Ministers dated October 16, 2001, the Management Board of ComputerLand Spółka Akcyjna, Warsaw, Al. Jerozolimskie 180, hereby informs of the Resolution of the National Depository for Securities on the assimilation of series P, R and O shares. With reference to stock ...

... of the Ordinance of the Council of Ministers dated October 16, 2001, the Management Board of ComputerLand Spółka Akcyjna, Warsaw, Al. Jerozolimskie 180, hereby informs of the Resolution of the National Depository for Securities on the assimilation of series P, R and O shares. With reference to stock ...

How to Make Millions in the Stock Market

... them up. The following lesson may give you an idea of how difficult it is to time the stock market. You will be given the chance to make decisions about investing in stocks at various times over the last 80 years. Even if you know some history of the U.S. stock market, you will likely still find it ...

... them up. The following lesson may give you an idea of how difficult it is to time the stock market. You will be given the chance to make decisions about investing in stocks at various times over the last 80 years. Even if you know some history of the U.S. stock market, you will likely still find it ...

The Great Depression PPT

... started to wise up, lots of people sold stock quickly, the prices went down fast, and almost everybody lost money. ...

... started to wise up, lots of people sold stock quickly, the prices went down fast, and almost everybody lost money. ...

The Stock Exchange Corner

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

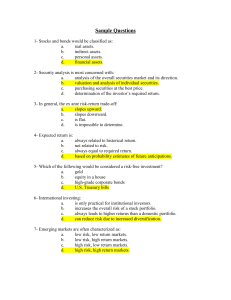

Sample Questions - U of L Class Index

... 36- Dividend reinvestment plans: a. enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporatio ...

... 36- Dividend reinvestment plans: a. enable investors to earn money market rates on their dividend income. b. enable investors to directly purchase shares from corporations, thereby eliminating brokerage commissions. c. are provided by full-service brokerage houses only. d. are provided by corporatio ...

Stock Market Crash - Fern Creek US History

... • People bought a lot of stock on the hope it would climb in value • Buying on the margin- buying stock on credit with high interest that can be paid if you sell for profit • Worked for a while, couldn’t last, no real value ...

... • People bought a lot of stock on the hope it would climb in value • Buying on the margin- buying stock on credit with high interest that can be paid if you sell for profit • Worked for a while, couldn’t last, no real value ...

Investing

... you own a share of stock, you own a piece of the company When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

... you own a share of stock, you own a piece of the company When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

Dhaka Stock Exchange

... I/we hereby declare that I/we have already placed the concerned securities, along with the relevant irrevocable sale/dispose of order with my/our above named stock-broker (document enclosed) for execution at prevailing market price, and that I/we shall submit details of the proposed sell/transfer of ...

... I/we hereby declare that I/we have already placed the concerned securities, along with the relevant irrevocable sale/dispose of order with my/our above named stock-broker (document enclosed) for execution at prevailing market price, and that I/we shall submit details of the proposed sell/transfer of ...

stock split - cloudfront.net

... • Company can vote to do stock split , where each single share is split into more shares. • This can bring the price of a single stock down, so that more people can afford to invest ...

... • Company can vote to do stock split , where each single share is split into more shares. • This can bring the price of a single stock down, so that more people can afford to invest ...

Pros and Cons of Capital Market

... set of investors and paying back to another set of investors. Eventually, following may be witnessed in a Ponzi scheme:The promoter vanishes, taking all the remaining investment money; The scheme collapses as the promoter starts having problems paying the promised returns . Pyramid Scheme:- The orga ...

... set of investors and paying back to another set of investors. Eventually, following may be witnessed in a Ponzi scheme:The promoter vanishes, taking all the remaining investment money; The scheme collapses as the promoter starts having problems paying the promised returns . Pyramid Scheme:- The orga ...

DailyNewsTSIK

... A team of four Briarwood Elementary School students took eighth place in the fall 2006 statewide Take Stock in Kentucky investment competition. More than 300 teams from across the state competed in the fall Take Stock in Kentucky competition in which teams of students research Kentucky companies, ma ...

... A team of four Briarwood Elementary School students took eighth place in the fall 2006 statewide Take Stock in Kentucky investment competition. More than 300 teams from across the state competed in the fall Take Stock in Kentucky competition in which teams of students research Kentucky companies, ma ...

Stock Market Tycoons

... 1. Your teacher will let you know who your stock partner will be for this project. 2. Meet with your partner to discuss several companies that you will be interested in finding out more about in the next few days. 3. At home talk to your family about companies and consider possible investments to ma ...

... 1. Your teacher will let you know who your stock partner will be for this project. 2. Meet with your partner to discuss several companies that you will be interested in finding out more about in the next few days. 3. At home talk to your family about companies and consider possible investments to ma ...

Ch 14 Problems - U of L Class Index

... 1- Suppose today is January 1, 2007; MAM Industries issued a 20-year bond with a 9% coupon and a $1,000 face value, payable on January 1, 2027. The bond now sells for $915. Use this bond to determine the firm’s after-tax cost of debt. Assume a 34% tax rate. (6.6%) 2- MAM Industries just declared a d ...

... 1- Suppose today is January 1, 2007; MAM Industries issued a 20-year bond with a 9% coupon and a $1,000 face value, payable on January 1, 2027. The bond now sells for $915. Use this bond to determine the firm’s after-tax cost of debt. Assume a 34% tax rate. (6.6%) 2- MAM Industries just declared a d ...

Demutualizing African Stock Exchanges

... By Sam Mensah SEM International Associates Limited, Ghana ...

... By Sam Mensah SEM International Associates Limited, Ghana ...

Double Double - Dana Investment Advisors

... it bottomed in late 2002. Then in the mid 2000’s, the Fed assured us that housing prices were not overvalued. So is the stock market in or approaching a bubble status? According to FactSet, the S&P 500 is now trading at 17.5 times the last 12 months earnings up from 16.5 times a year ago. The 10 yea ...

... it bottomed in late 2002. Then in the mid 2000’s, the Fed assured us that housing prices were not overvalued. So is the stock market in or approaching a bubble status? According to FactSet, the S&P 500 is now trading at 17.5 times the last 12 months earnings up from 16.5 times a year ago. The 10 yea ...

Just 14 Stocks Have Created 20% of All Stock Market Gains Since

... research piece, contains many companies that have been around for years, but also sports four tech companies, albeit one has been around since 1911. ALSO READ: 7 Dirt Cheap S&P 500 Value Stocks for Massive Upside Potential for 2017 and 2018 In a remarkable and striking similarity, all the companies ...

... research piece, contains many companies that have been around for years, but also sports four tech companies, albeit one has been around since 1911. ALSO READ: 7 Dirt Cheap S&P 500 Value Stocks for Massive Upside Potential for 2017 and 2018 In a remarkable and striking similarity, all the companies ...

rainbow trading corporation spyglass trading. lp

... • Little to no additional margin required • Risk needs to be low to be effective ...

... • Little to no additional margin required • Risk needs to be low to be effective ...

November 2013 - Dana Investment Advisors

... and Twitter) and business media stocks (LinkedIn). Activity is also heating up with 3D printing stocks. These are not recommendations, but merely examples, and they are very volatile. This market will continue to advance as long as interest rates are low and the Fed keeps buying bonds. That will be ...

... and Twitter) and business media stocks (LinkedIn). Activity is also heating up with 3D printing stocks. These are not recommendations, but merely examples, and they are very volatile. This market will continue to advance as long as interest rates are low and the Fed keeps buying bonds. That will be ...

Investing

... When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

... When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

i̇mkb at a glance

... * Value date of outright purchases and sales transactions vary between 0-90 days for government debt securities, 0-30 days for other securities, while the beginning value date of repo/reverse repo transactions vary between 0-7 days. ** Value date for outright purchases and sales transactions of Fore ...

... * Value date of outright purchases and sales transactions vary between 0-90 days for government debt securities, 0-30 days for other securities, while the beginning value date of repo/reverse repo transactions vary between 0-7 days. ** Value date for outright purchases and sales transactions of Fore ...

September 2015: (Not) - Dana Investment Advisors

... recession ended in June of 2009. The stock market actually bottomed out in March of that year. The stock market leads. It is very smart. Since that time one of the Fed’s objectives was to drive down interest rates to make money attractive to business so they would borrow and create jobs. Another obj ...

... recession ended in June of 2009. The stock market actually bottomed out in March of that year. The stock market leads. It is very smart. Since that time one of the Fed’s objectives was to drive down interest rates to make money attractive to business so they would borrow and create jobs. Another obj ...

Regional Equity Market Integration in South America

... and sellers interact with one another in a diverse market. Nonetheless, there are challenges to the integration process. These include: a lack of free flow of capital among the three countries, jurisdiction-related differences among the domestic markets, technical issues in the sophistication level ...

... and sellers interact with one another in a diverse market. Nonetheless, there are challenges to the integration process. These include: a lack of free flow of capital among the three countries, jurisdiction-related differences among the domestic markets, technical issues in the sophistication level ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.