Slide 1

... Client Order-Book Online System (COBOS) – internet - based application for secure access to the BSE Trading System (Xetra ) in real time that allows BSEmembers' clients to enter orders and to make transactions after receipt of confirmation from their broker. (March 2003) ...

... Client Order-Book Online System (COBOS) – internet - based application for secure access to the BSE Trading System (Xetra ) in real time that allows BSEmembers' clients to enter orders and to make transactions after receipt of confirmation from their broker. (March 2003) ...

Data Mining BS/MS Project

... VAR1 – if a stock’s average true range (average max-min) is greater than the stock’s moving average (average of end-of-day prices) VAR3 – if a stock’s end-of-day price is greater than the 50-day moving average VAR4 – if a stock’s end-of-day price divided by the daily range (max-min) is > 0.5 VAR5 – ...

... VAR1 – if a stock’s average true range (average max-min) is greater than the stock’s moving average (average of end-of-day prices) VAR3 – if a stock’s end-of-day price is greater than the 50-day moving average VAR4 – if a stock’s end-of-day price divided by the daily range (max-min) is > 0.5 VAR5 – ...

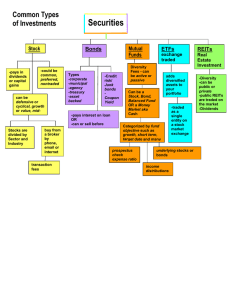

Securities

... composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading price. Very similar to Mutual Funds with these exceptions – ...

... composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading price. Very similar to Mutual Funds with these exceptions – ...

Chapter 2.3

... 2. Shares of stock that a company can sell are known as __________________________ shares. The number of shares of stock a company can sell is listed in the company _____________________. Stocks that have been sold in the marketplace are known as ___________________ shares. Issued shares held by inv ...

... 2. Shares of stock that a company can sell are known as __________________________ shares. The number of shares of stock a company can sell is listed in the company _____________________. Stocks that have been sold in the marketplace are known as ___________________ shares. Issued shares held by inv ...

Name

... 1. When buying or selling stock on the New York Stock Exchange, who would execute your trade and how could you be assured that there will always be someone willing to buy if you are willing to sell or sell if you are willing to buy? ...

... 1. When buying or selling stock on the New York Stock Exchange, who would execute your trade and how could you be assured that there will always be someone willing to buy if you are willing to sell or sell if you are willing to buy? ...

Investing Options

... • Common stock – shares or units of ownership in a public corporation – Most basic form of ownership – One vote per share owned to determine company’s board of directors ...

... • Common stock – shares or units of ownership in a public corporation – Most basic form of ownership – One vote per share owned to determine company’s board of directors ...

Review Sheet - Jefferson Elementary School

... Which Stock’s closing price showed the most change from the previous day? ...

... Which Stock’s closing price showed the most change from the previous day? ...

Stock PPT - Issaquah Connect

... Important: beware from stocks with “weird” or no financial information new startups or private gone public ...

... Important: beware from stocks with “weird” or no financial information new startups or private gone public ...

Chapter 2

... • Inefficient stock market: A market in which stock prices do not reflect all public information that is available to investors. • Stock selections by an investor may beat the market. Copyright © 2009 Pearson Education Canada ...

... • Inefficient stock market: A market in which stock prices do not reflect all public information that is available to investors. • Stock selections by an investor may beat the market. Copyright © 2009 Pearson Education Canada ...

Securities Markets

... issuers to sell new securities over time after filing a single registration Private placement means new securities are sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

... issuers to sell new securities over time after filing a single registration Private placement means new securities are sold directly to investors, bypassing the open market ◦ Registration not required ◦ Can be cheaper and faster for issuer ◦ Can lead to higher costs, restrictions ...

Dowload as PDF

... FBC has one of Israel's leading Capital Markets practices. The Capital Markets team provides counsel on international and local public offerings, private placements, controlling shareholder transactions and issues relating to corporate governance, and ongoing reporting and filing requirements under ...

... FBC has one of Israel's leading Capital Markets practices. The Capital Markets team provides counsel on international and local public offerings, private placements, controlling shareholder transactions and issues relating to corporate governance, and ongoing reporting and filing requirements under ...

File

... Many speculators saw opportunities to get rich quick. Many speculators borrowed money to buy stock. This is called BUYING ON MARGIN Buying on Margin can be risky – if prices decline (below original value), investors still owe money they borrowed, but the stocks are worthless. Speculators who were “b ...

... Many speculators saw opportunities to get rich quick. Many speculators borrowed money to buy stock. This is called BUYING ON MARGIN Buying on Margin can be risky – if prices decline (below original value), investors still owe money they borrowed, but the stocks are worthless. Speculators who were “b ...

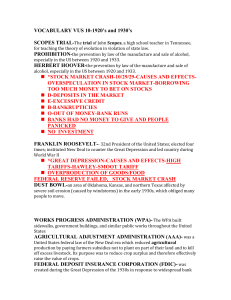

VOCABULARY VUS 10-1920`s and 1930`s SCOPES TRIAL

... sidewalks, government buildings, and similar public works throughout the United States AGRICULTURAL ADJUSTMENT ADMINISTRATION (AAA)- was a United States federal law of the New Deal era which reduced agricultural production by paying farmers subsidies not to plant on part of their land and to kill of ...

... sidewalks, government buildings, and similar public works throughout the United States AGRICULTURAL ADJUSTMENT ADMINISTRATION (AAA)- was a United States federal law of the New Deal era which reduced agricultural production by paying farmers subsidies not to plant on part of their land and to kill of ...

stock market project

... must pick one or two stocks in the New York Stock Exchange (NYSE) to track. • At the end of the trimester you will be asked to turn in your tracking sheet, graph your stock and answer several questions on a worksheet. ...

... must pick one or two stocks in the New York Stock Exchange (NYSE) to track. • At the end of the trimester you will be asked to turn in your tracking sheet, graph your stock and answer several questions on a worksheet. ...

IMPORTANT TERMS 1. Accession Tax – 2. Active Market – 3

... This is a tax which is levied on gifts and inherited property. This tax is not a liability on the donor. This tax is levied on the recipient. ...

... This is a tax which is levied on gifts and inherited property. This tax is not a liability on the donor. This tax is levied on the recipient. ...

Document

... A Suggested Model for the Determinants of Bid-Ask Spread: Evidence from Amman Stock Exchange (ASE). Abstract This study aimed at suggesting a model for the main determinants of the bid-ask spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period ...

... A Suggested Model for the Determinants of Bid-Ask Spread: Evidence from Amman Stock Exchange (ASE). Abstract This study aimed at suggesting a model for the main determinants of the bid-ask spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period ...

ECONOMICS CHAPTER 3

... BUSINESS GROWTH AND EXPANSION • BUSINESS GROWTH • There are two BASIC ways businesses grow: • 1. Growth through investment: – Income statement p. 69 – Net Income + depreciation = cash flow – Those $ may be reinvested back into the company. ...

... BUSINESS GROWTH AND EXPANSION • BUSINESS GROWTH • There are two BASIC ways businesses grow: • 1. Growth through investment: – Income statement p. 69 – Net Income + depreciation = cash flow – Those $ may be reinvested back into the company. ...

Electrode Placement for Chest Leads, V1 to V6

... Debtor: Entity issuing the bond. Creditor: Entity purchasing the bond. • The greater the company’s financial strength, the easier it is for the company to issue bonds. • Bonds are infrequently seen in the sport industry, but examples do exist. – For example, the New York Yankees and the New Jersey N ...

... Debtor: Entity issuing the bond. Creditor: Entity purchasing the bond. • The greater the company’s financial strength, the easier it is for the company to issue bonds. • Bonds are infrequently seen in the sport industry, but examples do exist. – For example, the New York Yankees and the New Jersey N ...

File

... NASDAQ is a virtual market called an “over the counter (OTC) market. It has no central location or floor brokers. Trading is done through a computer and telecommunications network of dealers. These market makers provide continuous bids and ask prices within a prescribed percentage spread for shares ...

... NASDAQ is a virtual market called an “over the counter (OTC) market. It has no central location or floor brokers. Trading is done through a computer and telecommunications network of dealers. These market makers provide continuous bids and ask prices within a prescribed percentage spread for shares ...

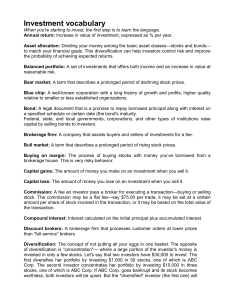

Investment vocabulary

... Bear market: A term that describes a prolonged period of declining stock prices. Blue chip: A well-known corporation with a long history of growth and profits; higher quality relative to smaller or less established organizations. Bond: A legal document that is a promise to repay borrowed principal a ...

... Bear market: A term that describes a prolonged period of declining stock prices. Blue chip: A well-known corporation with a long history of growth and profits; higher quality relative to smaller or less established organizations. Bond: A legal document that is a promise to repay borrowed principal a ...

STOCKS

... Job seekers line up to register at a City of Miami job fair in Miami, Tuesday, Jan. 26, 2010. Florida's unemployment rate hit 11.8 percent, the highest in Florida in almost 35 years. Nearly 1,087,000 workers were searching for a paycheck in ...

... Job seekers line up to register at a City of Miami job fair in Miami, Tuesday, Jan. 26, 2010. Florida's unemployment rate hit 11.8 percent, the highest in Florida in almost 35 years. Nearly 1,087,000 workers were searching for a paycheck in ...

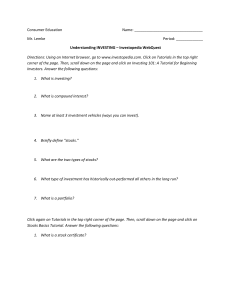

Unit 5 - Understanding Investing WebQuest

... Click again on Tutorials in the top right corner of the page. Then, scroll down on the page and click on Stocks Basics Tutorial. Answer the following questions: 1. What is a stock certificate? ...

... Click again on Tutorials in the top right corner of the page. Then, scroll down on the page and click on Stocks Basics Tutorial. Answer the following questions: 1. What is a stock certificate? ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.