The Stock Market Game

... The NASDAQ is the largest electronic stock market in the US. When it began trading in 1971, it was the world’s first electronic marketplace. Transactions take place on a virtual platform. Investors at remote locations all over the world buy and sell shares on a virtual platform. Both the NASDAQ and ...

... The NASDAQ is the largest electronic stock market in the US. When it began trading in 1971, it was the world’s first electronic marketplace. Transactions take place on a virtual platform. Investors at remote locations all over the world buy and sell shares on a virtual platform. Both the NASDAQ and ...

Selecting the appropriate structure

... A business entity with one owner is called an incorporation. ...

... A business entity with one owner is called an incorporation. ...

Stocks

... IPO occurs when a private company sells stocks to the public for the first time. Company needs to file with SEC (Securities Exchange Commission) to go public ...

... IPO occurs when a private company sells stocks to the public for the first time. Company needs to file with SEC (Securities Exchange Commission) to go public ...

Waiting can be a winning strategy

... then invest in a distressed environment in order to gain a profit when – and if – the stock recovers. That is why value investing doesn’t suit all types of investors. Some like to put all their spare cash in the stock market. Another example of Amundi’s long-term view and strategy of waiting it out ...

... then invest in a distressed environment in order to gain a profit when – and if – the stock recovers. That is why value investing doesn’t suit all types of investors. Some like to put all their spare cash in the stock market. Another example of Amundi’s long-term view and strategy of waiting it out ...

File - BSC Economics

... d) All of the above 15) Banks providing depositors with checking accounts that enable them to pay their bills easily is known as a) Liquidity services. b) Asset transformation. c) Risk sharing. d) Transaction costs. 16) Monetary policy is chiefly concerned with a) How much money businesses earn. b) ...

... d) All of the above 15) Banks providing depositors with checking accounts that enable them to pay their bills easily is known as a) Liquidity services. b) Asset transformation. c) Risk sharing. d) Transaction costs. 16) Monetary policy is chiefly concerned with a) How much money businesses earn. b) ...

Stock Market Game Workshop

... 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, around the world. ...

... 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, around the world. ...

Chapter 9 Sources of Capital

... (oil, gold, etc.) based on the current price, but not getting the item until a “future” time The hope is that by the time you receive the ...

... (oil, gold, etc.) based on the current price, but not getting the item until a “future” time The hope is that by the time you receive the ...

of 6 CIRCULAR CIR/CFD/POLICYCELL/1/2015 April 13, 2015

... acquirer will apply for and use separate Acquisition Windows during the tendering period. If one acquirer chooses to use acquisition window of one Stock Exchange having nationwide trading terminal, it would not be mandatory for the other acquirer to choose the same Stock Exchange. ...

... acquirer will apply for and use separate Acquisition Windows during the tendering period. If one acquirer chooses to use acquisition window of one Stock Exchange having nationwide trading terminal, it would not be mandatory for the other acquirer to choose the same Stock Exchange. ...

Scenario of the Primary Capital Market in India

... responsible for the continuing gloom and its likely future outlook. Some suggestions have been made for its long term growth and development which revolve around policies of Securities and Exchange Board of India (SEBI) relating to free pricing (resulting into greedy overpricing of equity issuances) ...

... responsible for the continuing gloom and its likely future outlook. Some suggestions have been made for its long term growth and development which revolve around policies of Securities and Exchange Board of India (SEBI) relating to free pricing (resulting into greedy overpricing of equity issuances) ...

Economic Background to the Great Depression

... such short supply, it also appeared that businesses would be unable to get enough money to operate and that the whole British economy might come to a standstill. The U.S. government was concerned over Britain’s financial plight. To help ease Britain’s problem, the U.S. Federal Reserve System agreed ...

... such short supply, it also appeared that businesses would be unable to get enough money to operate and that the whole British economy might come to a standstill. The U.S. government was concerned over Britain’s financial plight. To help ease Britain’s problem, the U.S. Federal Reserve System agreed ...

chapter two - Sigma Capital

... a) The nominal shares offered to the public shall not be less than 30% of the total company shares. b) The subscribers to the offered shares should not be less than l50 subscribers, even if they are non-Egyptians. In case the trading of company shares results in the reduction of the number of shareh ...

... a) The nominal shares offered to the public shall not be less than 30% of the total company shares. b) The subscribers to the offered shares should not be less than l50 subscribers, even if they are non-Egyptians. In case the trading of company shares results in the reduction of the number of shareh ...

Practice Test

... bought a total of 110 cows a year ago, with the expectation of a 20 percent annual return on their money. [I]nitially, there were 63 investors who agreed to finance the purchase of a cow—which the company then cares for—in return for a piece of the company’s profits.18 ...

... bought a total of 110 cows a year ago, with the expectation of a 20 percent annual return on their money. [I]nitially, there were 63 investors who agreed to finance the purchase of a cow—which the company then cares for—in return for a piece of the company’s profits.18 ...

Is it time to change SOX? Solongo Batbaatar MA0N0228

... SOX impact on Market Efficiency • In 2002, the market value of the Wilshire 5000 for all public companies in US, stood at $10.5 trillion. • By April 2007, the value of the Wilshire 5000 was 14.5 trillion ...

... SOX impact on Market Efficiency • In 2002, the market value of the Wilshire 5000 for all public companies in US, stood at $10.5 trillion. • By April 2007, the value of the Wilshire 5000 was 14.5 trillion ...

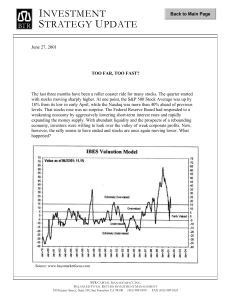

INVESTMENT STRATEGY UPDATE

... evolution of the Internet will continue bringing major change to our daily lives -- only differently than was originally envisioned by stock market bubble investors, the dot-com entrepreneurs, and the venture capitalists who backed them. Regarding valuations, we are well aware that the stock market ...

... evolution of the Internet will continue bringing major change to our daily lives -- only differently than was originally envisioned by stock market bubble investors, the dot-com entrepreneurs, and the venture capitalists who backed them. Regarding valuations, we are well aware that the stock market ...

FOR IMMEDIATE RELEASE What do stock markets tell us about

... Recent research by academics at the Cass Business School, the Bank of England and City University Hong Kong uses data for more than 40 markets observed over 30 years to show that average returns of up to 12% per annum are available to those allocating assets across international stock markets. The a ...

... Recent research by academics at the Cass Business School, the Bank of England and City University Hong Kong uses data for more than 40 markets observed over 30 years to show that average returns of up to 12% per annum are available to those allocating assets across international stock markets. The a ...

TOTAL NUMBER OF SHARES AND VOTING RIGHTS The

... The total number of shares and voting rights of Forthnet S.A. on 13.06.2017, which is the date of the invitation to Ordinary General Meeting of Shareholders to be held on the 5th of July 2017, amounts to one hundred and ten million ninety seven thousand one hundred eighty five (110,097,185). It is n ...

... The total number of shares and voting rights of Forthnet S.A. on 13.06.2017, which is the date of the invitation to Ordinary General Meeting of Shareholders to be held on the 5th of July 2017, amounts to one hundred and ten million ninety seven thousand one hundred eighty five (110,097,185). It is n ...

The Great Depression

... started to wise up, lots of people sold stock quickly, the prices went down fast, and almost everybody lost money. ...

... started to wise up, lots of people sold stock quickly, the prices went down fast, and almost everybody lost money. ...

How the Stock Market Works

... A share is one of the equal parts into which the stock of a corporation is divided. Each share of stock entitles its owner to a proportionate amount of the corporation annual profit in the form of a dividend. The company must publish financial statements showing the exact condition of the business e ...

... A share is one of the equal parts into which the stock of a corporation is divided. Each share of stock entitles its owner to a proportionate amount of the corporation annual profit in the form of a dividend. The company must publish financial statements showing the exact condition of the business e ...

What Caused the Wall Street Crash of 1929?

... speculative bubble. – Shares kept rising and people felt they would continue to do so. The problem was that stock prices became divorced from the real potential earnings of the share prices. Prices were not being driven by economic fundamentals but the optimism / exuberance of investors. The average ...

... speculative bubble. – Shares kept rising and people felt they would continue to do so. The problem was that stock prices became divorced from the real potential earnings of the share prices. Prices were not being driven by economic fundamentals but the optimism / exuberance of investors. The average ...

Agenda 3/9/10

... in 1928, he cleared the way for Herbert Hoover to head the Republican ticket. 2. The Democrats chose Alfred E. Smith , an Irish American from New York’s Lower East Side, and the first ever Roman Catholic nominated for president. 3. Prohibition was a major issue in the 1928 ...

... in 1928, he cleared the way for Herbert Hoover to head the Republican ticket. 2. The Democrats chose Alfred E. Smith , an Irish American from New York’s Lower East Side, and the first ever Roman Catholic nominated for president. 3. Prohibition was a major issue in the 1928 ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.