ANSWER - We can offer most test bank and solution manual you need.

... a. The most important difference between spot markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than ...

... a. The most important difference between spot markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than ...

ANSWER: True - We can offer most test bank and solution manual

... a. The most important difference between spot markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than ...

... a. The most important difference between spot markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than ...

Lecture 8

... Global Firms and Stock Markets Global companies are turning to foreign stock markets to raise capital. They are attracted to foreign stock markets because of the potential ability to raise large amounts of capital (and more than they could at home). The United States is a favorite market for doing ...

... Global Firms and Stock Markets Global companies are turning to foreign stock markets to raise capital. They are attracted to foreign stock markets because of the potential ability to raise large amounts of capital (and more than they could at home). The United States is a favorite market for doing ...

Are Stocks Expensive? - Zevin Asset Management

... S&P 500 index is trading near a level where each dollar of earnings expected in less than two years costs a little over $14.50. However, even this analysis is just the beginning; the value of a stock today is based on the earnings for the next few years and all the earnings stretching as far into t ...

... S&P 500 index is trading near a level where each dollar of earnings expected in less than two years costs a little over $14.50. However, even this analysis is just the beginning; the value of a stock today is based on the earnings for the next few years and all the earnings stretching as far into t ...

Dr. Edward Yardeni, Chief Economist

... 34% above fair value. Immediately after the crash, stocks were about 10% undervalued. They were consistently undervalued from 1993 through 1995. Of course, theoretically, stock prices are equal to the present discounted value of future earnings (adjusted for risk), not just 12-month forward earnings ...

... 34% above fair value. Immediately after the crash, stocks were about 10% undervalued. They were consistently undervalued from 1993 through 1995. Of course, theoretically, stock prices are equal to the present discounted value of future earnings (adjusted for risk), not just 12-month forward earnings ...

Exchange rate volatility and stock market returns:

... exceed 17%, at most, for Japan. In contrast to Kim and Roubini, I find that the price of oil and the federal fund rate play a trivial role in explaining output fluctuations. Moreover, the results suggest a number of conclusions: fiscal policy has a greater impact than monetary policy on output fluct ...

... exceed 17%, at most, for Japan. In contrast to Kim and Roubini, I find that the price of oil and the federal fund rate play a trivial role in explaining output fluctuations. Moreover, the results suggest a number of conclusions: fiscal policy has a greater impact than monetary policy on output fluct ...

Opportunities for Corporate Finance in Latin American Capital Markets

... Latin American equity markets also absorbed new issues of common stock. The strong performance of these equity markets was due to the capital market reforms that five countries have put into effect. The commodities boom helped but was NOT the only reason for the rally. ...

... Latin American equity markets also absorbed new issues of common stock. The strong performance of these equity markets was due to the capital market reforms that five countries have put into effect. The commodities boom helped but was NOT the only reason for the rally. ...

Legal Forms of Organization

... Members and interests,Articles of organization Managers, officers, members not personally liable Most organize for tax purposes as partnership No limitation to membership, more than one class ...

... Members and interests,Articles of organization Managers, officers, members not personally liable Most organize for tax purposes as partnership No limitation to membership, more than one class ...

download

... When applied to futures and forex, it focuses on the overall state of the economy, interest rates, production, earnings, and management. When analyzing a stock, futures contract, or currency using fundamental analysis there are two basic approaches one can use; bottom up analysis and top down analys ...

... When applied to futures and forex, it focuses on the overall state of the economy, interest rates, production, earnings, and management. When analyzing a stock, futures contract, or currency using fundamental analysis there are two basic approaches one can use; bottom up analysis and top down analys ...

Q1 2009 Market Commentary (Excerpt)

... Against the backdrop of this “reality”, the rate of worsening of the economy is slowing, and in anticipation of eventual economic recovery, the institutions, hedge funds and large market speculators are looking to pump in money into all areas of the financial market and are lifting prices of all ass ...

... Against the backdrop of this “reality”, the rate of worsening of the economy is slowing, and in anticipation of eventual economic recovery, the institutions, hedge funds and large market speculators are looking to pump in money into all areas of the financial market and are lifting prices of all ass ...

Martial law`s end may spur foreign flows

... Thailand remains a top destination for Japanese investment, Mr Prinn says. ...

... Thailand remains a top destination for Japanese investment, Mr Prinn says. ...

Document

... internal control, thus leading to greater accountability and better profit margins. • Good CG practices can pave the way for possible future growth, diversification, or a sale, including the ability to attract equity investors – nationally and from abroad – as well as reduce the cost of loans/credit ...

... internal control, thus leading to greater accountability and better profit margins. • Good CG practices can pave the way for possible future growth, diversification, or a sale, including the ability to attract equity investors – nationally and from abroad – as well as reduce the cost of loans/credit ...

Shanghai-Hong Kong Stock Connect to Commence

... The Securities and Futures Commission (SFC) and the China Securities Regulatory Commission (CSRC) announced on 10 November 2014 that Shanghai-Hong Kong Stock Connect, the pilot programme to allow mutual trading access between the Shanghai and Hong Kong stock markets, will start operating on 17 Novem ...

... The Securities and Futures Commission (SFC) and the China Securities Regulatory Commission (CSRC) announced on 10 November 2014 that Shanghai-Hong Kong Stock Connect, the pilot programme to allow mutual trading access between the Shanghai and Hong Kong stock markets, will start operating on 17 Novem ...

Regulation 10(5)

... If, frequently traded, volume weighted average market price for a period of 60 trading days preceding the date of issuance of this notice as traded on the stock exchange where the maximum volume of trading in the shares of the TC are recorded during such period. ...

... If, frequently traded, volume weighted average market price for a period of 60 trading days preceding the date of issuance of this notice as traded on the stock exchange where the maximum volume of trading in the shares of the TC are recorded during such period. ...

Glossary - Investment 2020

... An investor who believes that the price of a security or the overall market will decline so he/she sells hoping to buy them back at a lower price at a later date. ...

... An investor who believes that the price of a security or the overall market will decline so he/she sells hoping to buy them back at a lower price at a later date. ...

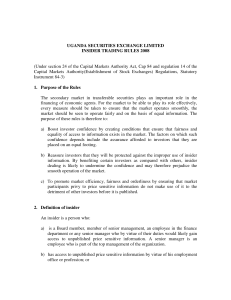

USE Insider Trading Rules-2009

... d) has access to unpublished price sensitive information from any of the persons mentioned in (a) or (b) above; e) all corporations, partnerships, trusts or other entities owned or controlled by any of the above persons. 3) Definition of price sensitive information Information is deemed to be price ...

... d) has access to unpublished price sensitive information from any of the persons mentioned in (a) or (b) above; e) all corporations, partnerships, trusts or other entities owned or controlled by any of the above persons. 3) Definition of price sensitive information Information is deemed to be price ...

Enron Episode - Buy, buy, buy

... buck the trend. But in the case of Enron, there may have been more to it than that. Enron was always making deals, buying smaller companies to help it expand. Every deal needs an investment banker. And almost every analyst's firm had an investment-banking division that stood to make millions of do ...

... buck the trend. But in the case of Enron, there may have been more to it than that. Enron was always making deals, buying smaller companies to help it expand. Every deal needs an investment banker. And almost every analyst's firm had an investment-banking division that stood to make millions of do ...

CAMRI Global Perspectives On a Swing and a Prayer: Are Financial

... The history of the relationship Perhaps Paul Samuelson, the Nobel Prize winning economist, said it best that the US stock market predicted 10 of the past 6 recessions. Obviously stock prices have been more volatile than the broad behavior of GDP. But a glance at Chart 3 sugge ...

... The history of the relationship Perhaps Paul Samuelson, the Nobel Prize winning economist, said it best that the US stock market predicted 10 of the past 6 recessions. Obviously stock prices have been more volatile than the broad behavior of GDP. But a glance at Chart 3 sugge ...

Bulgarian Academy of Sciences Economic Research Institute

... Capital market impact on the Bulgarian economy in post crisis period • During 2013, the market value of listed companies on the main market reached BGN 8.7 billion, and on the alternative segment - about BGN 2.1 billion. At the end of 2013, shares of the stock exchange were trading at levels of BGN ...

... Capital market impact on the Bulgarian economy in post crisis period • During 2013, the market value of listed companies on the main market reached BGN 8.7 billion, and on the alternative segment - about BGN 2.1 billion. At the end of 2013, shares of the stock exchange were trading at levels of BGN ...

Fourth PPT File

... burst and stocks fell into a severe bear market. • All of the developed countries’ markets fell by at least 50 percent: from March 2000 through October 2002. ...

... burst and stocks fell into a severe bear market. • All of the developed countries’ markets fell by at least 50 percent: from March 2000 through October 2002. ...

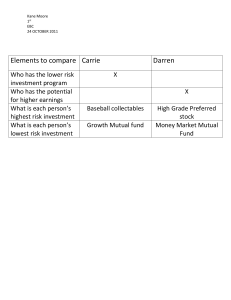

Investments and Their Characteristics

... A bond is an investment in which an investor (called a bondholder) ____________ money to a company or governmental body, called the bond issuer. The issuer borrows the funds for a defined period of ____________________ (maturity date) at a fixed interest rate. The issuer must pay both the __________ ...

... A bond is an investment in which an investor (called a bondholder) ____________ money to a company or governmental body, called the bond issuer. The issuer borrows the funds for a defined period of ____________________ (maturity date) at a fixed interest rate. The issuer must pay both the __________ ...

The Great Depression - What Crashed and Why?

... The world market left its mark on the American economy in other ways. Congress had set tariffs, or taxes on imported products. The tariffs made it very hard for other countries to sell their goods in the U.S. With the loss of American sales, European nations struggled to pay their war debt. They str ...

... The world market left its mark on the American economy in other ways. Congress had set tariffs, or taxes on imported products. The tariffs made it very hard for other countries to sell their goods in the U.S. With the loss of American sales, European nations struggled to pay their war debt. They str ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.