INTRODUCTION TO

... of Fund schemes create conflict of interest. Henceforth, AMCs shall not enter into any revenue sharing arrangement with the underlying funds in any manner and shall not receive any revenue by whatever means from the underlying fund. These guidelines set by the SEBI will lead to greater transparenc ...

... of Fund schemes create conflict of interest. Henceforth, AMCs shall not enter into any revenue sharing arrangement with the underlying funds in any manner and shall not receive any revenue by whatever means from the underlying fund. These guidelines set by the SEBI will lead to greater transparenc ...

fec2010abstracts - Lupcon Center for Business Research

... resources allocation processes , and the dominance of exploitation learning. Internet banking attracts a special worldwide attention because of its benefits to both banks and customers. Banking sector started to use the internet not only as an innovative payment method and to increase customer conve ...

... resources allocation processes , and the dominance of exploitation learning. Internet banking attracts a special worldwide attention because of its benefits to both banks and customers. Banking sector started to use the internet not only as an innovative payment method and to increase customer conve ...

Prezentacja programu PowerPoint

... The company’s mission is to develop the extraordinary medical and health care potential of the derivatives of the NHAC MIC-1 stem cells first isolated and cultured at Wroclaw University. MIC-1 stem cells are harvested from the antlers of the Polish red deer, one of the most rapidly regenerating of a ...

... The company’s mission is to develop the extraordinary medical and health care potential of the derivatives of the NHAC MIC-1 stem cells first isolated and cultured at Wroclaw University. MIC-1 stem cells are harvested from the antlers of the Polish red deer, one of the most rapidly regenerating of a ...

What`s Going On In Britain? – By Sandi Weaver

... What’s next? Britain needs to invoke Article 50 to formally start the EU extrication process. Some have speculated that day may never come. There seems to be confusion on which British politicians will step up to lead the country out, now that Brexit has passed. The economic price, now increasingly ...

... What’s next? Britain needs to invoke Article 50 to formally start the EU extrication process. Some have speculated that day may never come. There seems to be confusion on which British politicians will step up to lead the country out, now that Brexit has passed. The economic price, now increasingly ...

The more things change...

... now paid (at least if you are a government) to borrow money rather than save it. (Never mind the small irony that central banks are an extension of the very governments themselves whose debt is being bought back). We now have a strange situation globally where something in the order of $5-7 trillion ...

... now paid (at least if you are a government) to borrow money rather than save it. (Never mind the small irony that central banks are an extension of the very governments themselves whose debt is being bought back). We now have a strange situation globally where something in the order of $5-7 trillion ...

Interest Rate Parity

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

View as DOCX (4b/2) 22 KB

... relatively quickly and easily by allowing members of the public to buy shares. It should be noted that not all Public Limited Companies (PLC's) are listed on a stock exchange, this is because the conditions for listing are relatively stringent and therefore onerous on the business. The differences b ...

... relatively quickly and easily by allowing members of the public to buy shares. It should be noted that not all Public Limited Companies (PLC's) are listed on a stock exchange, this is because the conditions for listing are relatively stringent and therefore onerous on the business. The differences b ...

Investments - GEOCITIES.ws

... Auction markets with centralized order flow Dealership function: can be competitive or assigned by the exchange (specialists or registered traders) Securities: stock, futures contracts, options, and to a lesser extent, bonds Examples: TSE, ME, NYSE, AMEX ...

... Auction markets with centralized order flow Dealership function: can be competitive or assigned by the exchange (specialists or registered traders) Securities: stock, futures contracts, options, and to a lesser extent, bonds Examples: TSE, ME, NYSE, AMEX ...

Foundation Medicine, Inc.

... Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each price within the ranges set forth in this footnote. This is a non-qualified portion of an option granted on March 7, 2013 that vested 25% on January 2, 2014 and then vests in equal quarterl ...

... Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each price within the ranges set forth in this footnote. This is a non-qualified portion of an option granted on March 7, 2013 that vested 25% on January 2, 2014 and then vests in equal quarterl ...

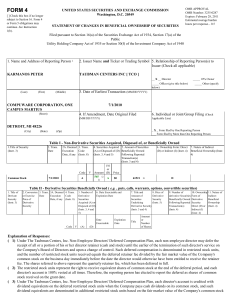

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

Thoughts for Investors - Alex. Brown | Raymond James

... First, to help explain the investment philosophy that guides the author’s approach to portfolio management. Second, to remind readers of important behavioral skills that the author believes are necessary to help them become successful investors. The author welcomes comments and criticisms, especiall ...

... First, to help explain the investment philosophy that guides the author’s approach to portfolio management. Second, to remind readers of important behavioral skills that the author believes are necessary to help them become successful investors. The author welcomes comments and criticisms, especiall ...

PROFIT WARNING

... the Group’s financial results for 1H 2017, which are expected to be published in August 2017. Shareholders and potential investors should exercise caution when dealing in the securities of the Company. On behalf of the Board New Ray Medicine International Holding Limited ...

... the Group’s financial results for 1H 2017, which are expected to be published in August 2017. Shareholders and potential investors should exercise caution when dealing in the securities of the Company. On behalf of the Board New Ray Medicine International Holding Limited ...

COMMON STOCK VALUATION (Dividend Models) A company can

... Relevant costs are also called differential costs. Making correct decisions is one of the most important tasks of a successful manager. Every decision involves a choice between at least two alternatives. The decision process may be complicated by volumes of data, irrelevant data, incomplete informat ...

... Relevant costs are also called differential costs. Making correct decisions is one of the most important tasks of a successful manager. Every decision involves a choice between at least two alternatives. The decision process may be complicated by volumes of data, irrelevant data, incomplete informat ...

FINA 351 – Managerial Finance, Ch. 10 (Ref 10c)

... Suppose you wait until the day after the public announcement to buy your shares. The stock price stays around $50 for weeks and you make no extraordinary return. In this case, did you violate insider trading rules? ...

... Suppose you wait until the day after the public announcement to buy your shares. The stock price stays around $50 for weeks and you make no extraordinary return. In this case, did you violate insider trading rules? ...

Security Analysis and Portfolio Management

... any kind of financial transaction refers to financial market. Financial market is a platform where buyers and sellers are involved in sale and purchase of financial products like shares, mutual funds, bonds and so on. ...

... any kind of financial transaction refers to financial market. Financial market is a platform where buyers and sellers are involved in sale and purchase of financial products like shares, mutual funds, bonds and so on. ...

DIRECTIONS - Seizert Capital Partners

... to endorse any strategy and is provided for informational purposes only. It is not an offer to sell, or a solicitation for the offer to purchase, a security in any jurisdiction where such an offer, solicitation or sale would be unlawful. An investment in accordance with a Seizert Capital Partners st ...

... to endorse any strategy and is provided for informational purposes only. It is not an offer to sell, or a solicitation for the offer to purchase, a security in any jurisdiction where such an offer, solicitation or sale would be unlawful. An investment in accordance with a Seizert Capital Partners st ...

File

... Why Did the Market Crash? Interestingly, economists that have later examined the fundamentals from the 1920s believe there was not a stock market bubble ready to burst by 1929. In fact, most of the stock values had merely tracked the rise in expected dividend payments. The economy was expanding rapi ...

... Why Did the Market Crash? Interestingly, economists that have later examined the fundamentals from the 1920s believe there was not a stock market bubble ready to burst by 1929. In fact, most of the stock values had merely tracked the rise in expected dividend payments. The economy was expanding rapi ...

New Media Announces Pricing of Public Offering of Common Stock

... New Media Announces Pricing of Public Offering of Common Stock NEW YORK, N.Y. November 18, 2016 – New Media Investment Group Inc. (“New Media” or the “Company”, NYSE: NEWM) announced today that it priced its public offering of 7,500,000 shares of its common stock for gross proceeds of approximately ...

... New Media Announces Pricing of Public Offering of Common Stock NEW YORK, N.Y. November 18, 2016 – New Media Investment Group Inc. (“New Media” or the “Company”, NYSE: NEWM) announced today that it priced its public offering of 7,500,000 shares of its common stock for gross proceeds of approximately ...

Plumbers and Visionaries

... structures in the EU. But the appeal of the book is wider. Anyone entering the securities business today will find that its 352 pages will give them the history of the plumbing companies – often in minute (even excessive) detail – skilfully interwoven with the political, economic, financial and tech ...

... structures in the EU. But the appeal of the book is wider. Anyone entering the securities business today will find that its 352 pages will give them the history of the plumbing companies – often in minute (even excessive) detail – skilfully interwoven with the political, economic, financial and tech ...

Stock prices and economic growth

... of stock prices: dividends or earnings and the factor by which future dividends or earnings must be multiplied in order to obtain the present value. The latter is better known as the discount factor. From this fundamental perspective, stock prices tend to contain information about future economic gr ...

... of stock prices: dividends or earnings and the factor by which future dividends or earnings must be multiplied in order to obtain the present value. The latter is better known as the discount factor. From this fundamental perspective, stock prices tend to contain information about future economic gr ...

Loss Avoidance - Raymond James

... The sunk cost fallacy can have a disastrous impact for your investments. People often make decisions trying vainly to prevent wasting their earlier investment of time and money. They pin their hopes on a chance of breaking even at some point, even though the downside risk has increased beyond accept ...

... The sunk cost fallacy can have a disastrous impact for your investments. People often make decisions trying vainly to prevent wasting their earlier investment of time and money. They pin their hopes on a chance of breaking even at some point, even though the downside risk has increased beyond accept ...

exercises_1_soln

... Problem 1) As accounts manager in your company, you classify 75% of your customers as "good credit" and the rest as "risky credit" depending on their credit rating. Customers in the "risky" category allow their accounts to go overdue 50% of the time on average, whereas those in the "good" category a ...

... Problem 1) As accounts manager in your company, you classify 75% of your customers as "good credit" and the rest as "risky credit" depending on their credit rating. Customers in the "risky" category allow their accounts to go overdue 50% of the time on average, whereas those in the "good" category a ...

... A U.S. federal agency established by the Commodity Futures Trading Commission Act of 1974. It ensures the open and efficient operation of the futures market. The CFTC protects investors from abusive trade practices, manipulation, and fraud. The CFTC ensures that the markets are liquid and that both ...

price sensitive information announcement pursuant to

... This announcement is made by Zhongyu Gas Holdings Limited (the “Company” and together with its subsidiaries, the “Group”) pursuant to Rule 17.10 of the Rules Governing the Listing of Securities (“GEM Listing Rules”) on the Growth Enterprise Market (“GEM”) of The Stock Exchange of Hong Kong Limited ( ...

... This announcement is made by Zhongyu Gas Holdings Limited (the “Company” and together with its subsidiaries, the “Group”) pursuant to Rule 17.10 of the Rules Governing the Listing of Securities (“GEM Listing Rules”) on the Growth Enterprise Market (“GEM”) of The Stock Exchange of Hong Kong Limited ( ...

... Warehouse shopping clubs like Costco, Sam's and BJ's have been around for a while, but after watching a CNBC special on the history and operations of Costco, I was genuinely impressed and convinced that a Costco membership deserves strong consideration. The show highlighted co-founder and former CEO ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.