Reasons to Include ESG Factors in Security Selection

... Companies that treat employees well can have an impressive track record. A 2009 study indicated that companies with practices deemed “ethical management” outperformed their peers over two decades. Workplace diversity may also positively impact financial results of public companies.3 ...

... Companies that treat employees well can have an impressive track record. A 2009 study indicated that companies with practices deemed “ethical management” outperformed their peers over two decades. Workplace diversity may also positively impact financial results of public companies.3 ...

Intercontinental Exchange, Inc. (Form: 4, Received: 03/14

... the totals listed on this Form 4. The total number of shares of common stock was adjusted by five shares to account for a rounding error and the stock split. The common stock number referred in Table I is an aggregate number and represents 24,480 shares of common stock and 3,845 ...

... the totals listed on this Form 4. The total number of shares of common stock was adjusted by five shares to account for a rounding error and the stock split. The common stock number referred in Table I is an aggregate number and represents 24,480 shares of common stock and 3,845 ...

HK`s formula for developing public confidence in exchanges

... today (June 3) shared with participants of an international forum in Beijing Hong Kong's formula for successfully building public confidence in stock exchanges, which is crucial to the development of exchanges. Speaking at the World Federation of Exchanges Forum for Developing Markets, Mr Ma said th ...

... today (June 3) shared with participants of an international forum in Beijing Hong Kong's formula for successfully building public confidence in stock exchanges, which is crucial to the development of exchanges. Speaking at the World Federation of Exchanges Forum for Developing Markets, Mr Ma said th ...

Chapter 10

... Leverage is the use of debt to attempt to increase the return earned on the equity investment of the owners. What are the advantages and disadvantages of using leverage when financing a business? Leverage is attractive because any profits earned from investing borrowed money, above the cost of bo ...

... Leverage is the use of debt to attempt to increase the return earned on the equity investment of the owners. What are the advantages and disadvantages of using leverage when financing a business? Leverage is attractive because any profits earned from investing borrowed money, above the cost of bo ...

Advantages and disadvantages of investing in the Stock

... A rights issue is an invitation to existing shareholders to purchase additional new shares in the company. More specifically, this type of issue gives existing shareholders securities called "rights", which, well, give the shareholders the right to purchase new shares at a discount to the market pr ...

... A rights issue is an invitation to existing shareholders to purchase additional new shares in the company. More specifically, this type of issue gives existing shareholders securities called "rights", which, well, give the shareholders the right to purchase new shares at a discount to the market pr ...

(the “Stock Exchange”) take no responsi

... Subject to the Conditions, the CBBCs have been terminated and the listing of the CBBCs shall be withdrawn after the close of business on the MCE Date. The relevant Issuer will pay to each holder of the CBBCs the Residual Value (if any). The Residual Value (if any) will be paid in accordance with the ...

... Subject to the Conditions, the CBBCs have been terminated and the listing of the CBBCs shall be withdrawn after the close of business on the MCE Date. The relevant Issuer will pay to each holder of the CBBCs the Residual Value (if any). The Residual Value (if any) will be paid in accordance with the ...

New rules on collateral for securities in repurchase agreements

... On March 5, 2002 the Central Bank of Iceland announced plans to change which securities qualify for repurchase agreements. The main principle of the rules is that bonds will be usable as collateral for repurchase agreements, if they fulfil the following conditions: 1. Bonds shall be issued denominat ...

... On March 5, 2002 the Central Bank of Iceland announced plans to change which securities qualify for repurchase agreements. The main principle of the rules is that bonds will be usable as collateral for repurchase agreements, if they fulfil the following conditions: 1. Bonds shall be issued denominat ...

(the “Stock Exchange”) take no responsi

... Subject to the Conditions, the CBBCs have been terminated and the listing of the CBBCs shall be withdrawn after the close of business on the MCE Date. The relevant Issuer will pay to each holder of the CBBCs the Residual Value (if any). The Residual Value (if any) will be paid in accordance with the ...

... Subject to the Conditions, the CBBCs have been terminated and the listing of the CBBCs shall be withdrawn after the close of business on the MCE Date. The relevant Issuer will pay to each holder of the CBBCs the Residual Value (if any). The Residual Value (if any) will be paid in accordance with the ...

Snap Inc (Form: 4, Received: 03/09/2017 21:25:20)

... ( 3) Each share of Class C Common Stock is convertible at any time into one share of Class B Common Stock at the option of the reporting person or upon the transfer of such share of Class C Common Stock, other than a Permitted Transfer (as defined in the Issuer's certificate of incorporation then i ...

... ( 3) Each share of Class C Common Stock is convertible at any time into one share of Class B Common Stock at the option of the reporting person or upon the transfer of such share of Class C Common Stock, other than a Permitted Transfer (as defined in the Issuer's certificate of incorporation then i ...

In Rescue to Stabilize Lending, U.S. Takes Over Mortgage Finance

... the former chairman of TIAA-CREF, the huge pension fund for teachers that also offers mutual funds, will take over Fannie Mae and succeed Daniel H. Mudd. At Freddie Mac, David M. Moffett, currently a senior adviser at the Carlyle Group private equity firm, succeeds Richard F. Syron. Mr. Mudd and Mr. ...

... the former chairman of TIAA-CREF, the huge pension fund for teachers that also offers mutual funds, will take over Fannie Mae and succeed Daniel H. Mudd. At Freddie Mac, David M. Moffett, currently a senior adviser at the Carlyle Group private equity firm, succeeds Richard F. Syron. Mr. Mudd and Mr. ...

Glossary - Southern Company

... A measurement of electricity equal to 1,000 kilowatts and typically used when describing large amounts of generating capacity. ...

... A measurement of electricity equal to 1,000 kilowatts and typically used when describing large amounts of generating capacity. ...

offensive selling – selling into strength

... Sharp Pullback and Fast Recovery to New Highs 1. Stock breaks sharply to its 10-week moving average line in one to three weeks, and then quickly rebounds to new highs in one to three weeks 2. The pullback typically occurs on relatively heavy volume, and the price action on the way down may be severe ...

... Sharp Pullback and Fast Recovery to New Highs 1. Stock breaks sharply to its 10-week moving average line in one to three weeks, and then quickly rebounds to new highs in one to three weeks 2. The pullback typically occurs on relatively heavy volume, and the price action on the way down may be severe ...

IPSA - Santiago Exchange

... Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct ...

... Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct ...

Block 3 - Webcourses

... Short-term notes payable - used to borrow cash or purchase asset and due within one year Unearned revenue - Business receives cash before services or products are provided to customers. CPLTD Amount of long-term debt principal payable within the next 12 months Sales Tax Payable - sales taxes collect ...

... Short-term notes payable - used to borrow cash or purchase asset and due within one year Unearned revenue - Business receives cash before services or products are provided to customers. CPLTD Amount of long-term debt principal payable within the next 12 months Sales Tax Payable - sales taxes collect ...

Financial Markets

... The prices of stocks in the index are multiplied by their respective number of shares outstanding They are added up in order to arrive at a figure equal to the aggregate market value for that day This figure is then divided by the corresponding figure of the day the index was started The res ...

... The prices of stocks in the index are multiplied by their respective number of shares outstanding They are added up in order to arrive at a figure equal to the aggregate market value for that day This figure is then divided by the corresponding figure of the day the index was started The res ...

Chapter 18 Notes

... income. These bonds have full financial backing and credit of the government. Corporate bonds are more risky and challenging, however they may produce You may be able to sell your bond at either a discount or a premium, if you decide to sell your bond before its maturity date. ...

... income. These bonds have full financial backing and credit of the government. Corporate bonds are more risky and challenging, however they may produce You may be able to sell your bond at either a discount or a premium, if you decide to sell your bond before its maturity date. ...

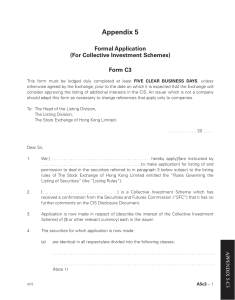

Appendix 5

... Formal Application (For Collective Investment Schemes) Form C3 This form must be lodged duly completed at least FIVE CLEAR BUSINESS DAYS, unless otherwise agreed by the Exchange, prior to the date on which it is expected that the Exchange will consider approving the listing of additional interests i ...

... Formal Application (For Collective Investment Schemes) Form C3 This form must be lodged duly completed at least FIVE CLEAR BUSINESS DAYS, unless otherwise agreed by the Exchange, prior to the date on which it is expected that the Exchange will consider approving the listing of additional interests i ...

The Scope of Business Today - University of Hawaii at Hilo

... is defined as the total value of goods and services produced within a territory during a specified period regardless of ownership ...

... is defined as the total value of goods and services produced within a territory during a specified period regardless of ownership ...

The Great Depression (1929-40)

... • While the overall economy boomed in the 1920s, the wealth created by the boom flowed to only a small %... • half of American families lived in poverty ...

... • While the overall economy boomed in the 1920s, the wealth created by the boom flowed to only a small %... • half of American families lived in poverty ...

Networks in Finance and Economics

... •EVERY BANK must DEPOSIT to NATIONAL CENTRAL BANK the 2% of all deposits and debts issued in the last two years. This reserves are supposed to help in the case of liquidity shocks •2% value fluctuates in time and it is recomputed every month. Banks sell and buy liquidity to adjust their liquidity ne ...

... •EVERY BANK must DEPOSIT to NATIONAL CENTRAL BANK the 2% of all deposits and debts issued in the last two years. This reserves are supposed to help in the case of liquidity shocks •2% value fluctuates in time and it is recomputed every month. Banks sell and buy liquidity to adjust their liquidity ne ...

PPT - Sabrient Systems

... "As an investment advisor for more than 40 years, I have seen, tested and used numerous research tools, and I've watched a host of analysts and firms come and go. However, Sabrient's models have worked extremely well for me.... So, for an investor who seeks to improve 'hit' rate and investment retur ...

... "As an investment advisor for more than 40 years, I have seen, tested and used numerous research tools, and I've watched a host of analysts and firms come and go. However, Sabrient's models have worked extremely well for me.... So, for an investor who seeks to improve 'hit' rate and investment retur ...

Bettapharma, an Investment Project of China Everbright Limited

... About China Everbright Limited China Everbright Limited (“CEL”, stock code: 165.HK), established in Hong Kong in 1997, persistently pursues its “Macro Asset Management” strategy with specific focuses on cross-border asset management and investment businesses. CEL manages a portfolio of private equi ...

... About China Everbright Limited China Everbright Limited (“CEL”, stock code: 165.HK), established in Hong Kong in 1997, persistently pursues its “Macro Asset Management” strategy with specific focuses on cross-border asset management and investment businesses. CEL manages a portfolio of private equi ...

Spectra7 Opens on TSX as Canada`s New Semiconductor Company

... resolution and signal fidelity to consumer and wireless infrastructure products, rang the Toronto Stock Exchange opening bell today and began trading under the symbol “SEV”. The event was broadcast live on Business News Network (“BNN”), Canada’s only all business and financial news channel, and was ...

... resolution and signal fidelity to consumer and wireless infrastructure products, rang the Toronto Stock Exchange opening bell today and began trading under the symbol “SEV”. The event was broadcast live on Business News Network (“BNN”), Canada’s only all business and financial news channel, and was ...

NTX - New Europe Blue Chip Index

... INDEX DESCRIPTION New Europe Blue Chip Index (NTX) is a free float weighted price index made up of the top blue chip stocks (ranked by freefloat adjusted market capitalisation) traded on stock exchanges in Central, Eastern and South-Eastern Europe and Austria. The index is calculated in EUR and diss ...

... INDEX DESCRIPTION New Europe Blue Chip Index (NTX) is a free float weighted price index made up of the top blue chip stocks (ranked by freefloat adjusted market capitalisation) traded on stock exchanges in Central, Eastern and South-Eastern Europe and Austria. The index is calculated in EUR and diss ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.